Sentiment Analysis in Forex and the Indicators Required

Sentiment analysis in Forex evaluates whether traders are net short or net long within a particular Forex currency pair.

It's a key tool that Forex traders can use to understand how participants in the market are positioned and therefore make decisions based on what they might be required to do next.

Sentiment analysis is a forward-looking tool often used by contrarian traders to go long or short, in the opposite direction to the crowd. The contrarian viewpoint is that, if a particular Forex market is for example net long, then the only way price can go from here is down as those longs inevitably sell to close out their positions.

While it’s important to understand the three types of Forex market analysis available, sentiment analysis is often an underestimated addition to a trader’s arsenal. By using sentiment analysis in your trading, you can give yourself an edge over those using technical or fundamental analysis alone.

Indicators Required for Sentiment Analysis

Now that you have an understanding of what Forex sentiment analysis is, let's take a look at some of the best sentiment indicators available.

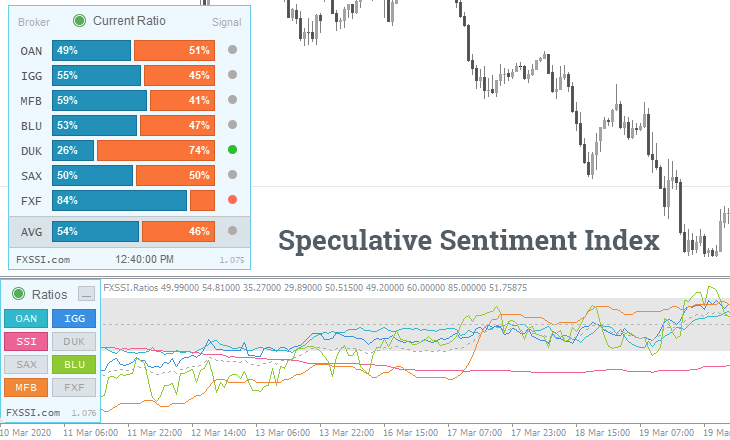

Speculative Sentiment Index (SSI)

The most popular sentiment tool is the proprietary, FXSSI speculative sentiment index indicator.

This particular SSI indicator displays a ratio of buyers and sellers for any Forex currency pair you select. It’s the most widely used and understood indicator in Forex sentiment analysis and gives us an idea of how a market is positioned overall.

The SSI is viewed as a contrarian indicator, used to help traders take the opposite side of the crowd. Remember above when we talked about if a market is net long, then the only place for it to go is down as they inevitably close out their positions?

Using this knowledge, you’re able to use the SSI indicator to help trade against the crowd and position yourself to take advantage of potentially massive, impending market moves before they happen.

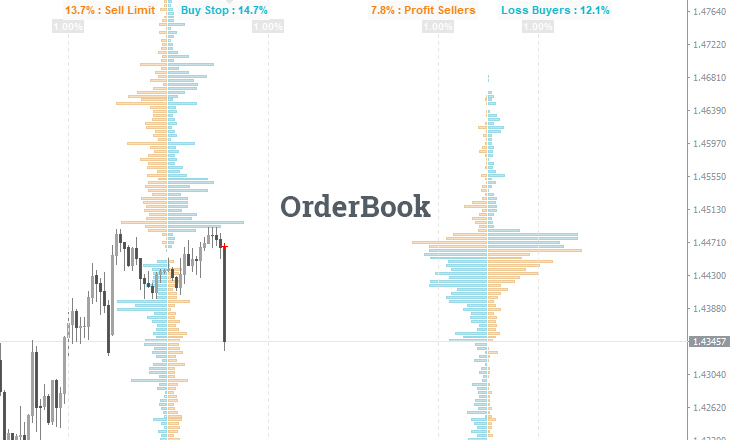

Order Book

The second sentiment analysis tool in our list is the based on broker clients positions order book indicator.

The Forex order book indicator allows traders to view price levels where there are accumulations of stop loss orders. It clearly highlights on the chart, where the largest numbers of stop orders are sitting and gives you an edge when planning entry and exit levels.

Unlike a stock exchange where all trading volume goes through a centralized server, the Forex market’s decentralized nature makes viewing an order book more complex. While you’re not getting an entire market view, you are receiving a representative sample size that statistically can be used to make trading decisions.

Think of it as if the Forex broker’s order book is a snapshot of the entire market. If 75% of traders in the order book are long in a market, then more than likely the rest of the market is showing similar trading patterns.

Profit Ratio

The third Forex sentiment analysis tool in our list is the Forex trader profit ratio indicator.

The Forex trader profit ratio indicator shows possible points on the chart where a reversal is likely to occur. It’s a leading indicator that gives traders a heads-up as to potential reversal levels in the market, before price starts to move in the opposite direction.

The profit ratio sentiment analysis indicator displays the percentage of traders that are currently holding a profitable position on their account, out of the entire number of positions in the market. An indication of a normal reading would be 25%.

If that seems like a low number of profitable traders, then you’re probably right. But as you’ll see in the performance of sentiment analysis in Forex in the section below, the majority of Forex traders actually must lose, for the minority to profit. That’s just how the market works.

Open Interest

The fourth Forex sentiment indicator in our list is the Forex open interest indicator.

The Forex open interest indicator displays a graph of the total number of open positions, both long and short. It is an indicator that displays the total volume of open orders in the market that it’s applied.

This particular Forex sentiment indicator is a popular choice among traders because the output is a simple line, making it a lot easier to read than the other indicators within this list.

The open interest indicator has a number of settings that you can flick through in order to find the sentiment data that is of most interest to you. Whether you require numbers on the total number of open positions, the total number of active pending orders or the volume of open orders displayed as a total lot size, there’s data for you.

As you can see, it’s a simple yet flexible sentiment analysis indicator.

Commitment of Traders (CoT) Report

While the Commitment of Traders (CoT) report isn’t a sentiment indicator tailored specifically to Forex markets like those listed above, it’s still a useful indicator that you can use to help keep you on the right side of the market.

The CoT report is published by the Commodity Futures Trading Commission (CFTC) every Friday at 3.30 PM Eastern Time. It breaks down and provides an overall snapshot of which types of traders are long or short futures markets, including currencies.

The three types of traders that the CoT report looks at are commercial traders such as hedge funds, non-commercial traders such as large individual professional traders and non-reportable traders which typically shows an indication of the retail trading crowd.

The Performance of Sentiment Analysis in Forex

After going through the indicators you need for sentiment analysis in Forex, there's no doubt that you have one burning question remaining. Does Forex sentiment analysis outperform regular technical analysis based around candlestick and chart patterns?

While this page focuses on the definition of sentiment analysis in Forex, we encourage you to check out our test of whether the ratio of open positions works.

The strategy was to test whether we should sell if sentiment pointed to the market being net long and vice versa. So that is, taking a contrarian position to current Forex market sentiment.

The results were fascinating and in fact showed that the majority of Forex traders must lose, for the minority to profit. Those results may sound scary, but that’s the harsh reality of Forex trading.

Adapt or die and having the ability to correctly conduct sentiment analysis will help you on the path to becoming a consistently profitable Forex trader over the long term.

Sentiment Analysis (Forex) vs Sentiment Analysis (Stock Market)

You always must keep in mind that unlike centralized stock exchanges, Forex markets are highly decentralized. For this reason, you’re unable to gain an overall Forex market sentiment from any other indicator or data point.

If you’re a stock market trader, then you’re able to asses total volume from the one exchange to get the definitive market sentiment.

In Forex however, you’re only gaining a snapshot of the overall market and must think of your data in the same way as a political analyst uses exit poll data from specific polling booths to predict a winner.

But never underestimate the herd mentality of human psyche. If a large percentage of traders on the broker’s book are long, then there is a high probability that they aren’t thinking outside the square and the wider market looks exactly the same.

Humans are predictable and while they may think they aren't, traders are in fact no different.

Final Thoughts on Sentiment Analysis in Forex

Sentiment analysis in Forex is a powerful market analysis technique that is gaining popularity as the power of contrarianism, rather ironically hits the mainstream.

While sentiment analysis will never provide you with a mechanical Forex trading system that has exact entry and exit points, when used in conjunction with traditional technical or fundamental analysis, it can provide you with an otherwise untapped edge.

If you’re interested in Forex sentiment analysis, go through the list of Forex sentiment indicators from FXSSI, subscribe to receive the weekly CoT report and start applying some of these data points to your trading strategy today.