How to analyze market sentiment with Ratios tool

The main crowd indicator is open positions ratio.

Open positions ratio is a percentage value showing the current difference between the number of traders, which have opened Long and Short positions. At that, already closed trades don’t affect the indicator’s value.

This indicator shows the sentiment of individual traders for a long and short certain currency pair in forex. According to the fact that “the crowd is usually wrong” we should open our trades in the direction opposite to the crowd’s direction.

Basic ratio strategy

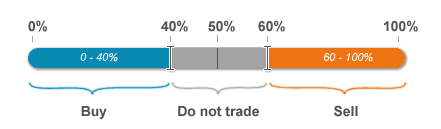

Here are the rules of basic trading strategy based on buy and sell ratio:

Basically, we should open a long position on a currency, when more than 60% of traders sell the currency. As you probably guessed, we should open a short position on a currency, when more than 60% of traders buy the currency.

When the ratio is close to the value of 50%, we should not trade.

Ratios tool

Ratios tool shows the historical buy/sell ratio from different brokers.

You can see that this tool has two panels. The top panel is a candlestick chart, and the bottom panel is a ratio chart. You can customize a layout of this tool. For example, you can disable some brokers or select different timeframes.

We analyze ratio from different brokers to diversify risks. We should look for the majority of brokers showing unidirectional signals.

We can see a good signal to open a long trade on the picture above.

Buy the way, every ratio line shown on the chart represents a percentage of buyers, while a percentage of sellers can be calculated by the following formula: 100% – percentage of buyers = percentage of sellers.

The dotted black line is an average ratio. You can use it as a usual ratio, but with a shortened signal width (sell, when the average ratio is more than 53%, and buy, when the average ratio is less than 47%).

Efficiency of ratio signal

We can tell you from our own experience that not all brokers provide equally efficient signals. We carried out a study and obtained the following results:

The table above shows efficiency of the ratio signals from different brokers and currency pairs. Employ this information to give a preference, when not all of the brokers give unidirectional signals.

Please consider that using only the ratio long vs short Forex signal to enter the market produces no more than 53-57% of profitable trades (in case a stop loss is equal to a take profit).