What is Slippage in Forex

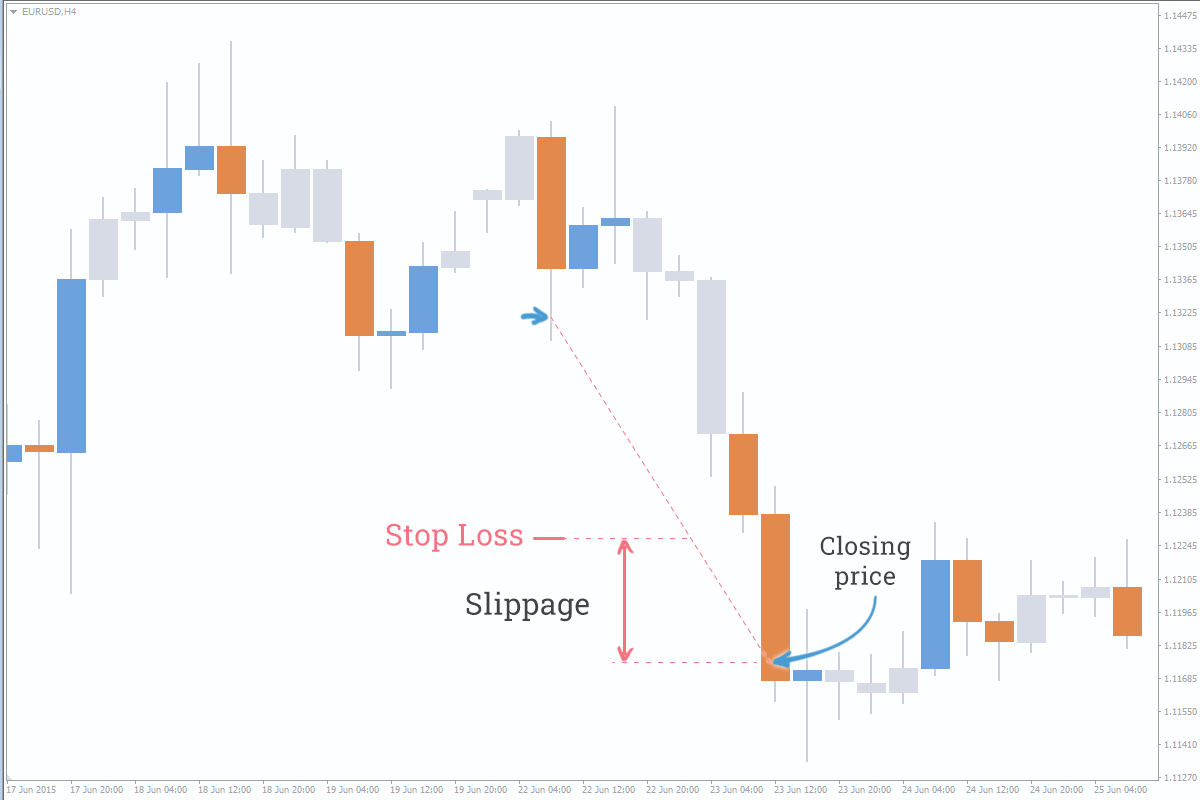

Slippage in Forex is execution of a trade at the price different from that requested by a trader. It is calculated as the difference between the expected execution price of a trade and the price at which this trade was actually executed.

Slippage can be either positive (additional profit) or negative (additional loss).

Slippage most often occurs with increased amplitude (volatility) of the market movement.

In practice, slippage looks like this: you set Stop Loss at the level where your loss will be equal to $20, but the volatility increases at the time of closing a trade and the price “slips”, thereby closing your trade at a loss of $22 instead of $20.

Is Slippage Good or Bad?

The above mentioned suggests that you might think slippage is very bad, because it brings additional losses.

In principle, most novice traders think that, so they try to find a broker “without a slippage”.

However, are they doing the right thing? You need to understand the nature of slippage to find it out:

Imagine that at some point there are nobody left in the market but traders willing to buy (and you are one of them).When each new seller can see this situation, they will offer higher and higher prices, but they won’t be able to satisfy the needs of all buyers.

Such sellers will take their turns satisfying the demand of buyers; when it’s your turn, the price might change significantly. Therefore, your order will be executed at the price worse than the requested one.

That is the nature of the market where these situations are impossible to avoid.

Slippage is the norm!

Accordingly, brokers offering trading conditions “without slippage” are a bit cunning, because such conditions cannot really exist.

Btw, if you are looking to upgrade your terminal with pro indicators and different utilities you can browse from variety of resources available at FXSSI Product manager.