All Types of Money Management in Forex

Let's start this article by asking this question: “How much money can you afford to lose as a result of your next trade?”

If your answer is one of the following ones – 2% of deposit, 30 points or $16, then you should still read this article, since you can find something new in it.

What is Money Management in Forex?

When we think about our trading, we always imagine winning trades and continuous growth of deposit, but we never remember a very important nuance – losses. As you know, losses are inevitable in trading. Any experienced trader can tell you that it’s normal to have losses and the best thing we can do is try to limit their size. That's why money management was invented.

Money management (MM) is a strategy for managing the size of trades made on a trader’s account. Simply put, money management determines the lot size which your next trade should be opened with. MM is generally used in order to achieve a smooth growth of deposit and thereby limit losses as much as possible. Obviously, money management cannot affect the success rate of trades, but it can significantly reduce the potential losses in case of a series of losing trades.

However, it’s just a theory. So what do we have in practice? The answer is that most traders mainly focus on searching for entry and exit points and attribute a secondary role to money management. In principle, they do it right, because money management is not able to convert a losing strategy into a winning one, but if you manage to make money, effective and excellent money management will be indispensable for you.

Let's consider the most popular methods of money management and try to choose the most effective one:

- Fixed lot.

- Fixed percentage of deposit.

- Step-by-step lot size increase.

- Martingale.

- Anti-martingale.

- Semi-martingale.

Fixed Lot

Probably, it’s the easiest and most popular (not to be confused with the best one) MM method.

Probably, it’s the easiest and most popular (not to be confused with the best one) MM method.

The point is a simple one: we need to select a fixed volume for our positions. All subsequent trades we’re going to open will have precisely this volume, regardless of the size of Stop Loss and Take Profit. Learn more details in the table on the right side.

The nice thing about this method is that it is simple, user-friendly, and good for any novice trader.

The disadvantage of this money management method may include a complete lack of any money management.

Besides, when your deposit has been increased, you will enter the market with too small lot, thereby losing the potential of your trading strategy. However, this method is more than enough for most traders, because it doesn’t usually come to the “growth of their deposits”. That is the sad statistics.

Fixed percentage of deposit

This method is a bit more interesting. Each time you open a trade, you customize lot size in such a way that you will lose a certain percentage of deposit in case of making a losing trade. The size of Stop Loss must be necessarily taken into account when calculating the lot size.

This method is a bit more interesting. Each time you open a trade, you customize lot size in such a way that you will lose a certain percentage of deposit in case of making a losing trade. The size of Stop Loss must be necessarily taken into account when calculating the lot size.

Speaking of Stop Losses , here at FXSSI we use StopLossCLusters indicator to determine the best levels of SL and TP placement.

Traders usually agree to lose 1-2% of their deposits during a conservative trading and up to 10% during an aggressive trading.

The good thing about a fixed percentage is that it takes into account growth of deposit, as well as “cushions” drawdown as a result of a series of losing trades.

However, it has disadvantages. For example, if the number of winning and losing trades is equal, the account suffers a loss. It can be clearly seen in the example above. In addition, the majority of traders don’t much like this method, because they constantly have to calculate a trade’s lot size, which is often about 0.7645 lot. You will agree that it is a lot easier to round it to 0.8 and not make things hard for yourself.

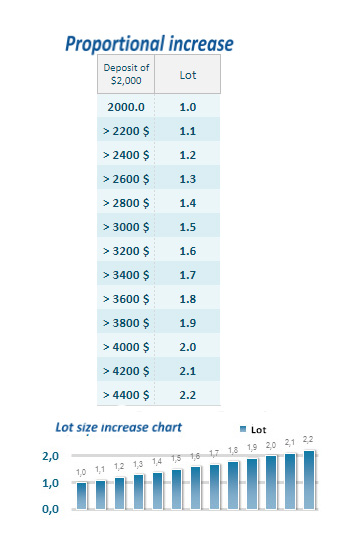

Step-by-step Lot Size Increase

It fixes errors/removes difficulties of the previous two methods. The core of the method can be easier explained through an example. Assume that you have a deposit of $10,000, and the initial lot size as from which you’re going to trade is 1. Each time you make $2,000, you should increase the lot size, for example, by 0.2 lot. Accordingly, when your deposit grows to $12,000, you’ll enter the market with the lot size of 1.2; when your deposit equals $14,000, you’ll enter with 1.4 lot, etc.

It fixes errors/removes difficulties of the previous two methods. The core of the method can be easier explained through an example. Assume that you have a deposit of $10,000, and the initial lot size as from which you’re going to trade is 1. Each time you make $2,000, you should increase the lot size, for example, by 0.2 lot. Accordingly, when your deposit grows to $12,000, you’ll enter the market with the lot size of 1.2; when your deposit equals $14,000, you’ll enter with 1.4 lot, etc.

The lot size can also be proportionally reduced in case of decrease in your deposit.

This method is simple and user-friendly and doesn’t require any mathematical calculations; in addition, it takes into account deposit growth.

Its disadvantage is that it will result in different losses as a percentage of deposit when using different Stop Losses; the same applies to different Take Profits.

Martingale

Oh, that's a scary word that novice traders love so much.

Oh, that's a scary word that novice traders love so much.

Why do they love it so much? Well, because the method creates the illusion of a profitable strategy, although the strategy itself is ultimately unprofitable.

The core of the method is as follows: every time you close a trade at a loss, you’ll open the next trade with the same lot size as with the previous trade multiplied by the coefficient (the coefficient usually equals 1.4-2). Thus, if the trade is profitable, it will allow you to make money and win back the loss resulting from the previous one. Read more on how this method works in the table on the right side.

There is a little bit different name, which captures the core of this method very correctly, – the “method of deferred loss”. It means that you will still lose sooner or later, and, as you know, the size of the last losing trade made by the martingale method = 100% of deposit.

Its advantages include a high probability of a successful trade (or a series of successful trades) due to the fact that Stop Losses are not applied.

Its disadvantages are obvious: a high probability of losing the entire deposit.

Anti-martingale

The method is the opposite as compared to the previous one. Every time we make a profit, we should increase the lot size; if we suffer a loss, we should reset the lot size to the initial one.

We mainly expect a super-successful and winning series of trades when using this method. The method has the right to exist, but initial deposit is often simply not enough to wait until this mega-trade is made.

Like the method of martingale, the anti-martingale method doesn’t demonstrate any positive mathematical regularities.

Semi-martingale

Notwithstanding the similarity of its name with the previous two ones, this method has always been the object of interest.

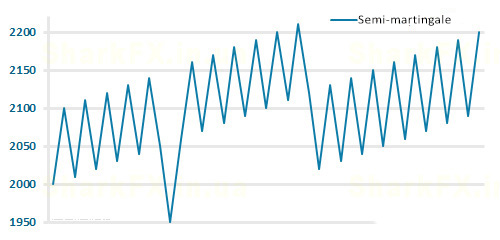

The core of the method is as follows: we increase the lot size by a certain value every time we make a losing trade and reduce it for each winning trade. Read more on this subject in this figure.

What’s interesting about this method is that it “generates” additional money using mathematical regularity.

The following chart illustrates 20 losing trades and 20 winning trades made using the semi-martingale method:

As you can see, 40 trades (Stop Losses and Take Profits being equal) executed based on this method made additional 200 units of money.

Unfortunately, all our attempts to make money by this method failed. It has a weak place – a series of losing/winning trades. If the lot size is about the initial one, you’ll make money. But if comes the time when most of trades are losing, you’ll simply not have enough deposit to open a new trade. The lot size will be too small in case of a winning series that greatly “cuts” profit.

Comparison of Methods

You should start thinking about money management only when you have a tested winning strategy (regularity). Otherwise, you just won't know what fails – a strategy or MM.

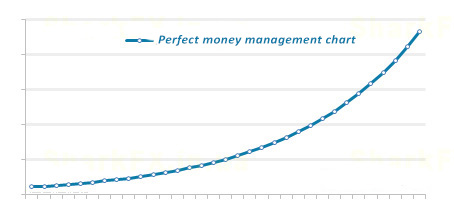

All methods have advantages and disadvantages, but we’re interested in the most stable method of MM. The stable method refers to the thing which is somewhat similar to this chart:

In this case, stability is reflected in the smoothness of the line, and the line’s curve accounts for deposit growth. Accordingly, the type of money management most closely resembling this line will be the best.

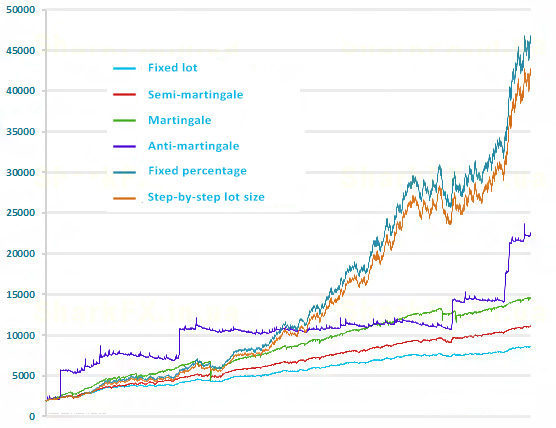

Now let’s try to compare the charts of deposit growth for each method under equal conditions. There are in total 3,000 trades, and success of a trade is 55%.

Comparison of the effectiveness of different money management methods:

What Conclusions can be Drawn?

- The lack of money management (fixed lot size) is OK only in the early stages. If you have a winning strategy, you must select MM.

- All methods that don’t take into account deposit growth will lose potential in the long run.

- All coefficient-based martingales are subject to leap-frogging moves serving as a strong indication of instability.

The choice is rather obvious: if you plan to work long-term, choose a fixed percentage or step-by-step lot size increase. At that, we would recommend you to select the latter, because the fixed percentage bore traders with its calculations; as for the step-by-step lot size increase, you can print out a table and work using it without having to calculate a trade volume.

That’s it! Observe the right money management!