Is Day Trading Profitable? Basic Steps to Make Day Trading Profitable

There are many ways to approach the forex market. One of them is through day trading. But the question on the minds of many are this: Should you go into day trading? Is day trading profitable?

That’s what we discuss in this article. We also mention some tips on how to take your day trading to the next level.

Is Day Trading Profitable?

Yes. But if we left it there, we would be doing you a great disservice.

Unlike other trading-time plans that give you ample opportunity to re-evaluate and garner some composure while on the trade, day trading requires that you make quick and precise decisions, day after day, that will earn you profit. Understandably, this adds to the burden of approaching your trades with the right mindset.

That notwithstanding, it is possible to be profitable in intraday trading when you have a good combination of the proper trading strategy and the right tools to use. Looking out for variables that could lead to losses and avoiding them can also make your forex day trading profitable.

PS: Day trading is not Scalp trading. Here’s an article that describes the difference between day trading and scalping.

How To Day Trade Profitably

There’s no rocket science to day trading profitably. And although it isn’t simple, it’s possible. Knowing how to day trade profitably comes down to these things:

Find a good strategy

It is very important to have a clear strategy that you want to adopt when taking your trades and adhere to them religiously. Creating such a strategy will help you avoid instances where you have to exit trades abruptly for fear of making further losses or staying too long in a trade when you feel you could make more profit.

Your strategy will help you create certain conditions that must be fulfilled before entering and exiting a trade. When you stick to your own plan, regardless of whatever the trend in the market is at every point in time, your trading is rid of emotions that could deter how profitable your daily trading is.

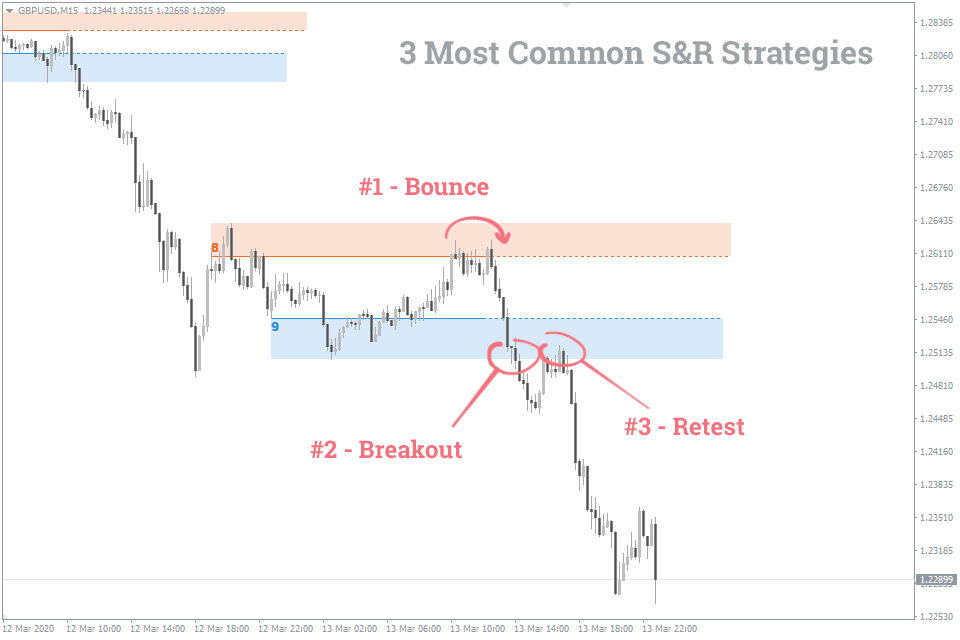

For instance, one trading strategy that has proven itself time and time again is the breakout and retest strategy. It gets even better when you use it with the FXSSI Support and Resistance indicator. This indicator helps you draw support and resistance levels on the chart. There are three major techniques of trading with strong support and resistance levels:

- Rebound (Bounce) from a level.

- Level breakout.

- Retest of the broken level.

Their benefit is that they are quite simple, so even a novice trader can easily use them.

By the way, that isn’t the only day trading strategy that has proven to be profitable. Adopting some of these best day trading strategies can help you achieve the noble “trade-like-a-robot” mantra of many professional forex traders as you journey into being profitable.

Take Advantage of Specialized Day Trading Indicators

There are myriads of day trading tools and indicators that you can take advantage of. In fact, there are various indicators for various purposes.

For instance, the Stop Loss Clusters indicator helps you keep track of your money management. The Order Book indicator gives a wide view of the market from what other traders think about it. And trend trading indicators like Auto Trendlines and Trix Crossover are good for helping you know when to enter positions.

However, you must have first tested any indicator you would be using before throwing it on your chart. A good way to check the performance of an indicator is to back-test it. You can do this by going back in time on your chart to see where your indicator would have called in trade entries and check against what the results were each time a trade was called. You should do this check across several currency pairs too.

You may find these best day trading indicators to be useful when doing your research.

Keep A Trading Diary

This is not talked about often enough. But building a profitable day trading account isn’t only about mastering technical analysis. A huge part of getting better as a day trader is to take a step back to analyze your past trades, see what you did wrong and what you did right, and learn from them. And where can you get such detailed info about your past trades? By keeping a trading journal!

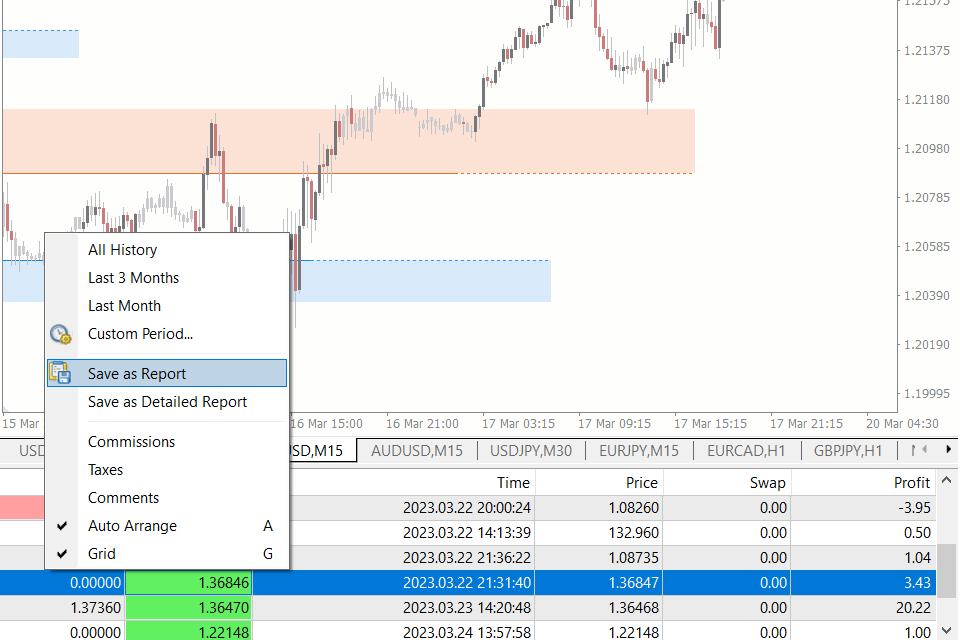

How to create a trade report from the MT4 terminal:

- Select the “Account history” tab you’ll find at the bottom of your terminal.

- Move your cursor to anywhere within the terminal section and right-click.

- Select the “save as report” option that comes after.

- The default file extension after the filename of the file is “.html”. Change this to “.xls”, which is the file extension for excel documents.

- Change the “save as type” option from “HTML files” to “all files”.

- Click the save button.

A trading diary helps you to prune the excesses from your trading strategy by helping you to see what you’re doing that isn’t giving you the best results. And if you use multiple strategies, your trading journal can help you see which of them is most profitable, which needs tweaking, and which needs to be discarded. If, by any chance, there’s a day of the week that you’re most profitable, your trading diary will tell you.

If you need just one reason to keep a trading journal, it’s that it helps you optimize your forex trading.

Master Risk Management

You honestly won’t go far as a day trader if you don’t know proper risk management. If you don’t know when to accept your loss and move on, or take your profit and not get greedy, you’ll end up losing more than you’re gaining.

Conclusion

While the statistics of profitable day traders may not be encouraging, whether or not day trading is profitable largely depends on the trader themselves and their approach to it. We can tell you now that you should take your mind off it being easy. But it is possible.