Do You Need a Trading Diary?

A trading journal is one of the most important tools for every forex trader. Your trading diary gives you a clear view of your performances in your past trades.

It is a record that contains everything about your trades, from your trades entries and exits to the strategies you used. And with that knowledge, you can analyze your past errors and learn to avoid them in your future trades.

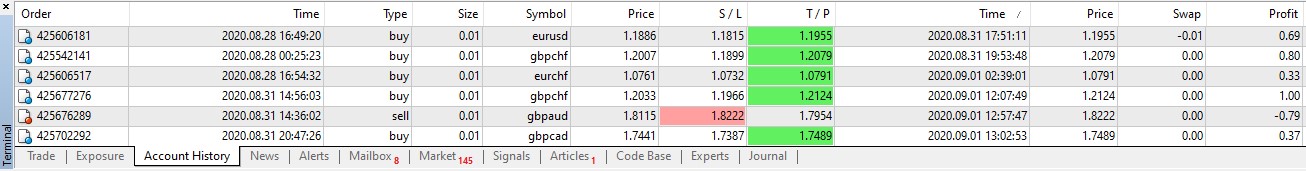

It is easy to think a trading journal is nothing more than a record of past trade entries and exits. Perhaps your broker already does that for you. But your trade record, as displayed on your broker’s trading platform, isn’t enough to give you some necessary bits of information. Moreover, you’ll soon get to why a proper forex trading diary contains more than trade entries and exits.

Advantages Of Keeping A Trading Journal

As you’ll soon see, the advantages of keeping a trading journal are more than its disadvantages. But you should weigh the pros and cons before you decide to use a trading diary.

Here are the things you stand to gain from keeping a proper trading journal.

Historical perspective

Keeping a record of your past trades gives you a historical perspective. From this record, you can analyze how frequently you traded and how many of those trades were profitable.

Your journal also reveals which currency pairs gave you the most success and which ones cost you money. You may then decide how to reduce the risks you place on your least profitable currency pairs or find another way to cut down the losses.

Prune out recurring errors

When you keep a trading diary for a while, you'll start noticing patterns in the way you have been trading. These patterns could be good or bad. When the patterns are good, you try to keep up with them. And when the patterns are bad, you try to eliminate the cause.

Choose and confirm your best strategy

When you keep a trading diary over time, it would give you a vivid view of how reliable your strategies are. It shows you how well you have profited from your strategies and how much you have lost. It also reveals how your strategy performed in market trends and other market conditions. Another insight your trading journal gives is your performance when you set your stop losses too loose or too tight.

Having these bits of information helps you know if your strategy needs tweaking or a complete replacement.

Emotional trading error reduction

One of the most destructive habits of many forex traders is that they make trades from emotions. This is common among novice traders. What this means is that they make trades without getting convincing confirmations from their strategies to do so.

An example is you lowering your stop losses when market price nears them, hoping the price would reverse and go your way. This manner of trading could be disastrous to your account.

The common cause of emotional trading is the lack of confidence in your trading strategy. But a trading journal helps you build your trading confidence by giving you reasons to stick with your strategy. These reasons are often in the form of statistical evidence of your performance in past trades.

Disadvantages Of Keeping A Trading diary

These are the cons of keeping a forex trading journal:

- Requires a lot of dedication. Keeping a trading diary could be stressful and require more dedication than you can imagine. Learning to trade forex is stressful enough. Adding the stress of keeping a journal could be too much for some.

- Useless when you don't know how to analyze it. A trading diary is more than a record of your lost or gained pips. There are some other bits of information you can hope to extract from it. But it would be completely useless if you didn’t know how to analyze the data and draw the right conclusions from your trading journal. You would be better off sticking to your trade history on your broker’s trading platform.

How To Keep A Trading diary

Your trading journal has to have every necessary bit of information from which you may draw the right conclusions.

There are two types of trading journals: the excel documents and trading diary software applications. The advantage of using a software package is that it provides tools, graphs, and tips to help improve your trade. You wouldn’t always have much to do with the journal software. But these software applications are not free.

An excel document trading diary, however, does not provide the tools that its software counterpart provides. This makes it very hard and stressful to draw reasonable conclusions from it, especially if it doesn’t contain the right information. But unlike journal software, excel files are free.

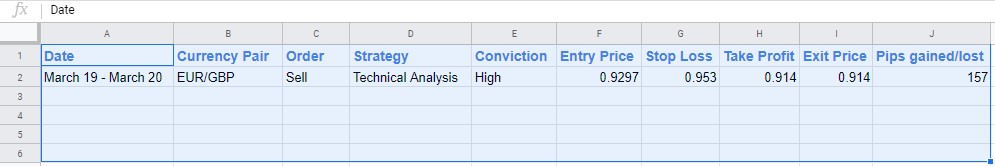

The image below is an example of a basic forex trading journal in an excel format.

What Should Be In Your Trading Journal?

This section is majorly for those who are keeping an excel document trading journal. Many trading diary software programs already have some of these contents.

The basic content

There are some basic bits of information that should be in every trading journal. Some of them are your entry and exit prices for every trade, the currency pair you traded, and the date of the trades. Typically, your broker should provide these details on their trading platform. The MT4 trading platform, for example, provides your trade history and still allows you to export it in an excel file format.

Here’s how to export your account history to an excel file format on the MT4 trading platform:

- Launch your MT4 trading platform.

- Navigate to the terminal section, which is often on the bottom of the window. If your terminal section is not visible, click the “view” tab on the top left corner of your screen. Then select “terminal” on the menu that follows.

- Select the “Account history” tab you’ll find at the bottom of your terminal.

- Move your cursor to anywhere within the terminal section and right-click. Select the “save as report” option that comes after.

- The default file extension after the filename of the file is “.html”. Change this to “.xls”, which is the file extension for excel documents.

- Change the “save as type” option from “HTML files” to “all files”.

- Click the save button. That is all.

The extra content

These are the bits you will not find on your trading platform. You may need to create columns for them in your newly exported excel file.

- The overall market outlook of any currency you are trading. Before trading the GBPUSD pair, for example, check and record the strength of the US dollar against other currencies. This shows you a bigger picture of how strong the USD is before you buy or sell.

- Your conviction for every trade you make. Rate the convictions for each trade entry depending on how well the trades fit your trade entry guidelines. This way, you can measure your performances on trades where you had varying levels of conviction. So if you find out that your low conviction trades end up in too many losses, you’ll either ignore future low conviction trades or learn to manage them better.

- Emotions before trades. And this is often a good practice for beginner traders as well.

- Different sections for different strategies. It makes it easy to see which strategies are offering the best returns. And if you have just one trading strategy, dedicate one sheet of an excel document to one currency pair. Doing this helps you know which currency pairs yield the most success with your strategy.

- The timeframe you're trading on. This extra bit of information reveals how each timeframe you trade affects their trades.

You may not need all of these in your trading journal. The ultimate decision is yours. You may choose to ignore any you don’t believe would improve your trading.

Conclusion

In the end, keeping a trading journal is not enough without doing a regular review of your records. Only then can you analyze your errors and successes, draw conclusions from them, and adapt to improve your trading. After all, that is the entire essence of keeping a trading journal.

Finally, keeping a trading diary may not be for everyone, despite its many advantages. For instance, those who aren’t full-time traders may not have the time to fill up their journals after every trade. So, you should consider the pros and cons before making your decision.

And if you’re still not sure if trading journals are for you, you may give it a trial. You don’t have to go through the stress of creating a spreadsheet. Some trading diary software packages offer free trials. By then, you should know for sure if you need a trading journal.