Why Do Most Traders Fail?

Forex trading is an exciting and potentially lucrative endeavor. But while the path to success is relatively straightforward, that doesn’t mean it is easy.

There are many reasons to trade Forex. However, as with most rewarding pursuits it requires effort, patience, and time. Sadly, the truth is that the majority of retail traders fail to achieve success.

However, this shouldn’t deter anyone from setting out on the path to becoming a successful trader and, if anything should incentivize you to work even harder to become one of those successful traders.

In terms of achieving success, one of the most effective methods is to learn from the mistakes of traders who didn’t make the grade. In this article, we are going to discuss why most traders fail and explore ways to overcome these issues and improve your chances of achieving success.

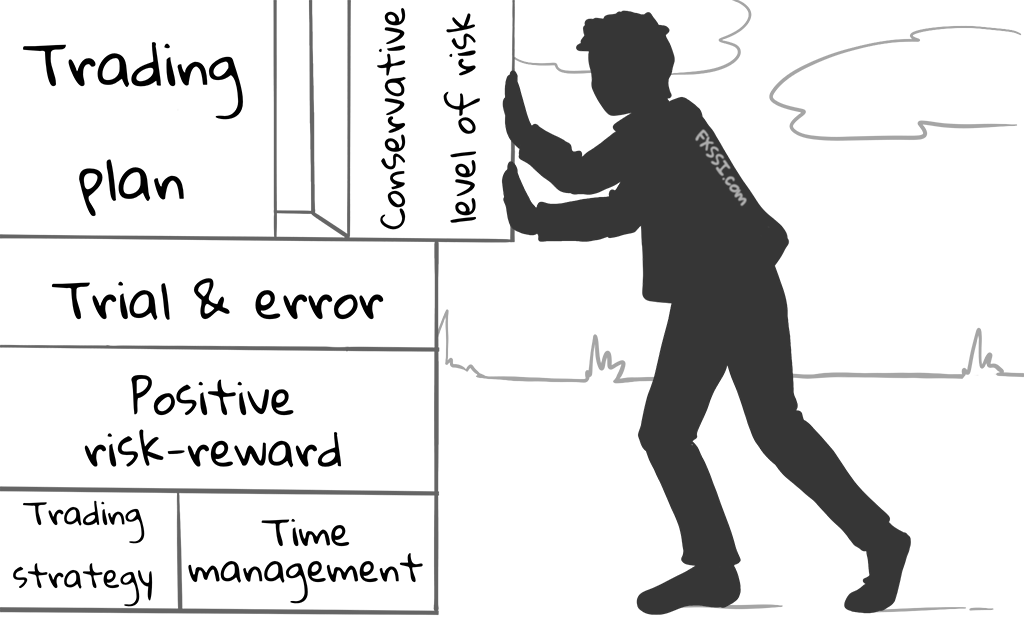

1. Not Having A Trading Plan

The phrase “fail to plan, plan to fail” is very appropriate when it comes to trading as one of the biggest causes of failure is the lack of having a trading plan. For some traders, not having a plan reflects a lack of trading education, for others, it reflects a lack of discipline and effort.

Having a trading plan is a crucial part of achieving and maintaining success in trading. A trading plan sets out the exact criteria for taking a trade, including the setup and the correct conditions for taking a trade.

An effective trading plan will also outline key trade management details such as position size, stop loss, and target placement as well as any special considerations such as how to deal with news releases or re-entering a trade.

Given the highly stressful and fast-paced environment of live trading, having a trading plan is vital to avoid over-trading and taking emotional trades, which can both lead to unnecessary losses. One of the biggest risk factors with emotional trading is FOMO trading.

2. Strategy Hopping

Another reason why do traders fail is the constant changing between strategies. The situation might sound familiar. Spend time learning or developing a new strategy, test it to establish its effectiveness, employ it for a short period. But then become frustrated by a drawdown and so change strategy and start the process all over again.

The issue here is that the majority of new traders don’t give their chosen trading strategy long enough time to prove itself in live trading conditions.

Every strategy suffers a drawdown and even if your backtest results look incredibly promising, live results will always vary slightly.

The key thing is to spend enough time monitoring the strategy to learn if any adjustments can be made (such as widening stop loss or increasing/decreasing target or improving entry technique) to improve the strategy.

If after these adjustments are made and monitored, the strategy is still not performing then you can move on. Doing so prematurely, however, invites an endless cycle of strategy hopping which wastes a lot of time and damages confidence.

3. Trading too aggressively

This is a mistake that nearly all new traders are guilty of. Some learn from it and improve while others sadly sabotage their careers with it.

The logic appears fairly sound at first glance: trade with large position size and winning trades will bring in big returns, allowing you to grow your account. However, what’s being missed here is the impact that disproportional position sizing can have on your account.

For example, at 5 percent per trade, it takes only 20 consecutive losing trades to blow up an account. On the other hand, at 1percent per trade, it takes 100 consecutive losing trades to blow an account. This gives you much more breathing space, especially as you are just starting.

If you are looking for more tips on how to reduce drawdown, be sure to read this simple and helpful article.

4. Focusing on hit rate over positive risk-reward

Trading aggressively usually goes hand in hand with traders focusing on strategies with high hit rates. A quick google search will throw up hundreds (if not more) of strategies boasting 80% and 90% hit rates.

However, it is entirely possible to have an 80% hit rate and still lose money. In the same way that it's possible to have a very low hit rate and still make money. The secret here is learning to focus on positive risk-reward instead of hit rate.

Risk-reward refers to the ratio of the amount made on winning trades versus the amount lost on losing trades. If your strategy makes more on winners than it loses on losers, this is a positive risk-reward strategy.

Many strategies with high hit rates have inverse risk-reward ratios where they lose more than they gain. Typically, strategies with a reward of 2 or 3 times risk stand a much higher likelihood of delivering long-term success.

For example, if you have a strategy that wins 5% and loses 1% with a hit rate of 60% this means over 100 trades the strategy could well deliver -10%. Whereas if you have a strategy that loses 1% and wins 2% with a hit rate of just 40%, over 100 trades this strategy could well deliver 20%.

The Good News

Fortunately, none of the issues discussed above are so dire that they cannot be rectified.

However, it is vital to constantly monitor your trading and your performance to make sure that you are:

- sticking to your trading plan, that your strategy is performing how it should;

- that you are targeting;

- and that you are keeping a conservative level of risk in your positioning sizing.

If you can stick to these principles over time, you can hopefully count yourself one of the successful traders who survive the tricky learning process and avoid falling foul of these top mistakes. For more helpful tips on how to become a successful trader, you can check out this handy guide.