Some Techniques to Reduce and Control Drawdown

Drawdowns happen to everyone all the time. They are as much a part of trading as profits and order execution.

That’s why you never hear about eliminating them. Rather, it’s always about how to reduce a drawdown in Forex.

The foundation of every trade is a setup. And each setup should always contain four core elements:

- Entry.

- Profit Target.

- Stop Loss.

- Total Capital Risked/Trade Size.

Here is a key point to take away: In Forex, the maximum drawdown should never exceed the distance between the entry and the stop loss, less any slippage and commissions.

This holds true for trades on any timeframe.

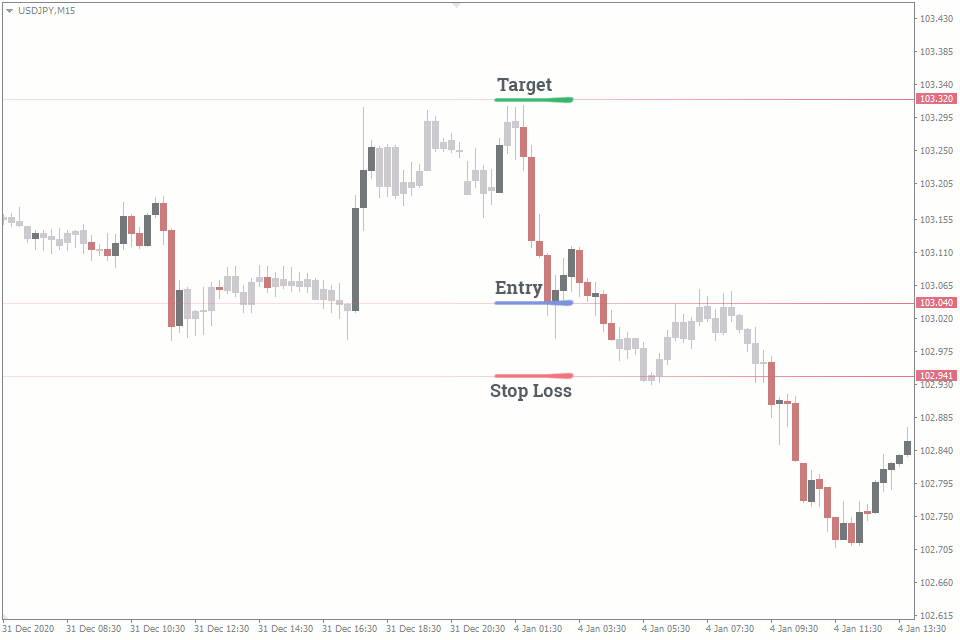

Let’s use the following chart as an example.

Let's say you are trading the USD/JPY Forex currency pair by going bullish with a long position. The entrance is $103.04. Set your target at recent highs at $103.32 and a stop at $102.94.

The distance between $103.04 and $102.94 is $0.10, or 0.097% loss. Now, let's say you are using 500x leverage and investing $1000 in a trade. The total potential loss would be $1,000 x 0.00097 x 500 = ~$485.

Here are a few ways to reduce your drawdown in Forex:

- Reduce your leverage or trade size.

- Limit your position size relative to your total account size.

- Set max loss amounts for a day, week, and month.

- Place stop-loss orders or contingent stop-loss orders immediately after entering the trade.

- Move your stop-loss levels closer to your entries.

- Diversify your trades across uncorrelated Forex pairs.

This list is by no means comprehensive, but it covers many key elements to reduce your drawdown.

How to get out of the drawdown

As much as we do to prepare to reduce drawdowns in Forex, they will happen. The second half of the battle is managing them once they begin. The simplest and easiest way to stop a drawdown is to close out your positions.

Let’s say the trade setup is still valid, but you don’t like the total potential risk. You can always exit part of the position to reduce your total drawdown.

Another option is to add a position that works in the opposite direction, like a hedge. For example, if you're long the US Dollar versus the Japanese Yen, you can hedge that by going long the Swiss Franc versus the US Dollar.

Whichever method you choose to reduce your drawdown depends on your skill and comfort level in trading Forex.

Psychology behind drawdowns

For most of us, our trades will go negative at some point. It’s rare to pick off the exact top or bottom.

When you create a rigid trading structure with clear entries, exits, stops, and risk management, drawdowns become part of your everyday life. You stop fighting them and start managing them.

In fact, most of us only think of drawdowns for one of two reasons: we risked too much on the trade, or we didn’t define our stop loss. You can reduce your drawdown at any time using one of the strategies listed.

Drawdowns require a sort of meditative acceptance where you acknowledge them as a part of your trading. Only then can you begin to manage them.