What Is FOMO Trading and How to Stop It Ruining Your Trading?

Trader psychology is a primarily overlooked ingredient in achieving and maintaining trading success. One of the biggest aspects that poses a challenge to traders is FOMO, a term meaning the fear of missing out.

Many new traders believe that finding success in Forex trading, or financial markets trading generally, is simply the product of finding a strategy that works and applying it to the markets consistently.

However, any seasoned trader will tell you that this is a bit of an oversimplification. Perhaps the biggest key to success in trading is developing the correct mindset for success.

What is FOMO?

FOMO refers to a situation where the trader is acting on an emotional impulse rooted in fear and greed. In this scenario the trader typically takes trades they should take or deviates from their plan because they sense an opportunity, typically linked to a ‘gut feeling' and don’t want to let the opportunity pass.

Experienced traders will tell you that trading in this FOMO manner rarely leads to sustainable success. In fact, any successes had when trading in this manner can actually create more harm than good by wrongly reinforcing the view that the traders was ‘right’ to trade in this way.

The bedrock of trading success is formulating a strategy or learning a strategy, developing a trading plan and sticking to that plan in a consistent and disciplined manner. If you’re looking for some other great trading wisdom, make sure to check out this article where an experienced trader shares nine things they wish they’d known when they started trading Forex.

How to understand if you are suffering from FOMO

The simplest way to know if you have FOMO is if you are taking unplanned trades. One of the best examples is entering a trade because price is mobbing strongly after a news release and you feel like you can profit.

Another example is taking a trade which doesn’t meet all of your criteria because you believe the trade will work anyway and you don’t want to miss out.

Trading can be psychologically taxing and one of the key reasons traders use a plan is to avoid taking trades based on emotion and the unpredictable losses which can occur and derail your trading as a result.

How Can FOMO Ruin Your Trading?

The simplest way that FOMO damages your trading is that it disrupts your distribution of results. Let’s say you have learned or developed a strategy and back tested this strategy to gain an idea of the drawdown and profit you can expect over any given time period.

Well, as soon as you start taking unplanned trades, you disrupt these results and risk ruining your returns in the long run. This can happen in very simple, seemingly harmless ways.

FOMO Trading Example

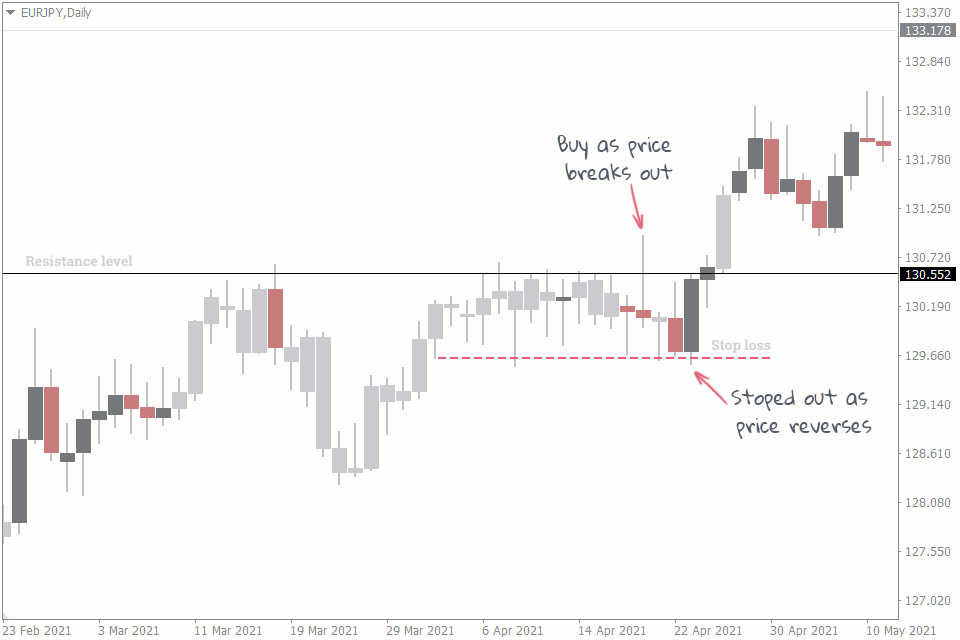

For example, let’s say you have a breakout strategy that states you will enter a trade once a candle closes above your resistance level. Now, let’s say one day you are watching the market.

You see price breaking out above your level but you fear that the move is happening too quickly and if you wait for the candle to close before entering you will already have missed a lot of the move. So, you decide to enter before the close.

However, the initial breakout fades and price reverses and actually closes back under the level, with a bearish reversal candle and then continues to reverse (false breakout and stops you out).

Now, if you had stuck to your plan you wouldn’t have incurred the loss. If you take these types of trades regularly enough, you can turn an otherwise winning trading approach into a losing one.

In the chart above you can see an example of this exact situation. Even more frustratingly you can see that after the initial breakout failed and the FOMO trader was stopped out, the real breakout occurred.

This is where the secondary issue with FOMO trading can occur. Because the FOMO trader took an unplanned trade and failed, they might then refrain from taking the proper trade because they already suffered a loss.

So, you can see, in this scenario, the loss suffered from the FOMO trade would actually have been compounded because having suffered the loss on the FOMO trade they would have missed out on taking the trade they should have originally waited for.

Quick FOMO Test

At this point, you are probably wondering if you are a FOMO trader or not. Now, one rule of thumb here is that if you are questioning whether you are, likely are one! However, if you want to know for certain here is a quick test you can take.

Answer the following questions (yes or no):

- Do you only take planned trades?

- Do you sometimes take trades because you feel you know where the market is headed?

- If you go through a trading session without taking a trade if you feel like you have missed out?

- Would you rather risk being wrong on a trade than not take a trade?

- Do you have difficulty sticking to your trading plan?

So, if you answered yes to at least three of these questions you are a FOMO trader. If you answered yes to two of them, you are at risk of becoming a FOMO trader.

While FOMO trading is a destructive habit in terms of achieving and maintaining trading success, the good news is it is solvable.

Tips for Overcoming FOMO Trading

One of the best ways to prevent FOMO trading is to develop and write out (or print out) a clear, detailed trading plan setting out the exact criteria you need to trade. This removes the emotional impulse to trade when you feel like trading. Check out this trading plan checklist for an easy to follow guide on creating a trading plan.

The next step is to keep a trading journal. Each day keep a note of whether you stuck to your trading plan and how you felt doing so. You will notice that at first it is hard, and you still have the urge to take unplanned trades.

However, as you stick to your plan and keep journaling, you will notice these feelings fade. If you’d like to keep reading, head here For further tips and tricks to help you become a successful trader.