Scalping vs Day Trading - What is the Difference

If you are a forex trader, you probably fall into the category of either scalp trader or day trader. The line that distinguishes the difference between a day trader and a scalp trader is a blurry one.

A day trader is broadly defined as someone who does not carry their trades overnight, thereby confining the endurance of any positions to a single day. On the other hand, a scalper holds positions for a few seconds to several minutes. They are sometimes viewed as day traders as well.

In this article, we will explore the differences between scalping and day trading strategies, as well as the advantages and disadvantages of each technique.

What is Scalping?

There is no dictionary to define what scalping is or is not. However, scalping is generally characterised as a trading technique of placing short duration trades which last anywhere between a few seconds to a few hours.

Scalpers could submit dozens or even hundreds of trades in a single trading session. The profits of the many small trades placed by a scalper are intended to add up to something more substantial over time.

Scalping techniques aim to make incremental gains which can be assessed at the end of the day, week or month.

Scalping Strategies

Because scalpers rely on profiting from short term volatility and momentum, they should align their active trading hours with the best days to trade forex.

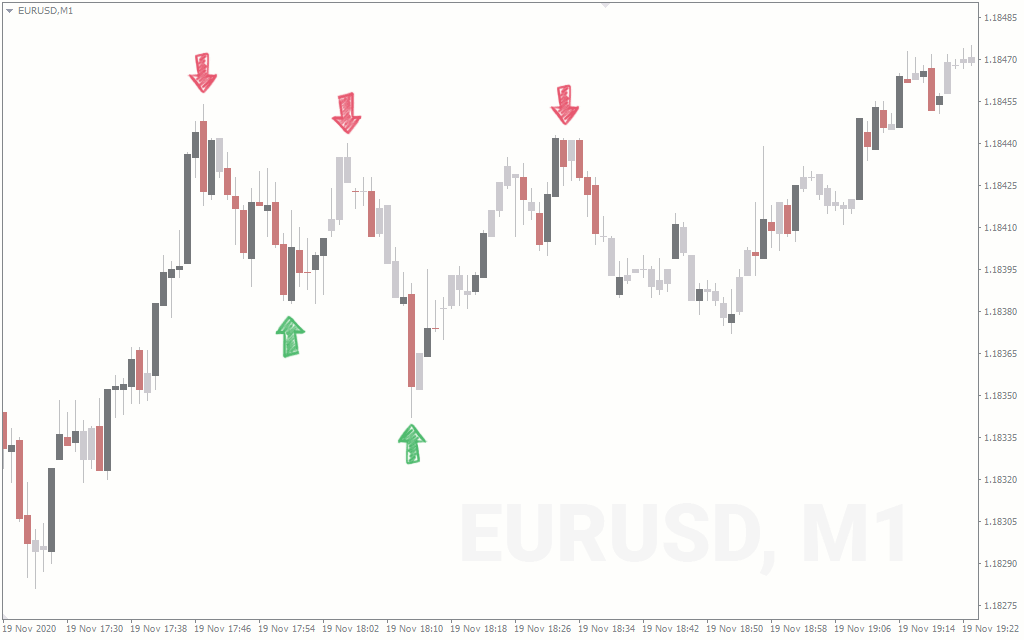

Scalpers trade on low time-frame charts; usually between one-minute and five-minutes. Some scalpers will even use tick charts and order books to see even more granular information about price momentum.

A scalper will attempt to capture just a few pips profit from each trade. A few pips is an easier to achieve price target in comparison to other trading strategies.

Scalping strategies usually rely on momentum and support and resistance indicators. Even if a scalper gets the trend wrong, it’s still possible for them to hit targets when price momentum pulls back or reaches resistance zones.

In fact, there is even a scalping technique which trades the countertrend.

Pros and Cons of Scalping

| Pros | Cons |

|---|---|

| Scalping strategies are less capital intensive because trade sizes are generally very small, often just 0.01 Lots. | In comparison to other trading strategies, scalpers submit many more orders which result in higher trading costs. |

| Because positions are much smaller in size, it means scalpers have less exposure to the market, thus limiting risk. | Since only minimal profits are obtained from each trade, more time needs to be spent actively managing trades. The more trades are placed, the higher the chance of errors occurring. |

| It’s easier to reach targets because smaller price movements in the range of a few pips are likely to happen frequently. | The emotional burden of placing many orders per day can weigh on a trader and take a toll over time. |

| Traders don’t need to spend hours planning and researching every new trade. | There are only a few opportune hours per day for scalping which means your schedule must reflect those occasions. |

What is Day Trading?

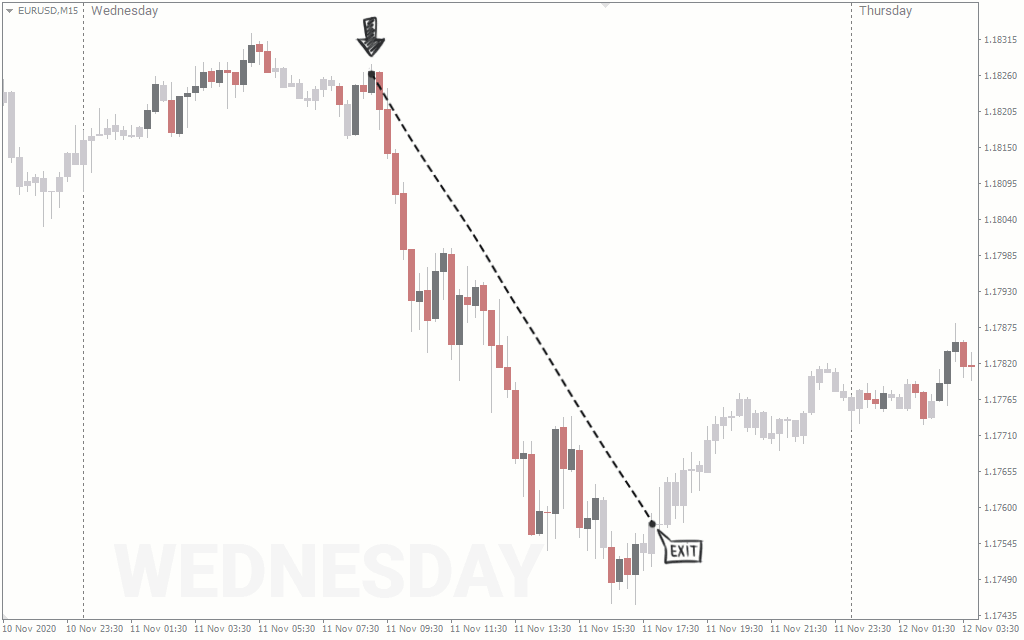

Unlike scalpers who place dozens of trades per day, a day trader would sit on the sidelines, waiting for the best trade setups to manifest. Day traders usually wouldn’t place more than a few trades per day and if there are no suitable opportunities, sometimes, none at all.

Although it depends on how quickly the market reaches their target price, day traders don’t keep their positions open for longer than several hours and always flatten their account before the end of the day to avoid rollover fees and wild volatility.

Day Trading Strategies

It’s not impossible for a currency pair to move as much as one-hundred pips in a single day and day trading strategies seek out those large swings and trends.

Day traders rely on a much wider range of tools to assist with making trading decisions. Some traders spend years searching for the best day trading indicators. There are hundreds of different technical analysis indicators and thousands of different day trading strategies in existence.

In general, a day trader will have strict criteria to determine when to open and close positions and the volume of each order.

One of the hardest parts of day trading is watching positions for hours, and seeing prices gravitate towards the target price only to pull back. After watching this painstaking process occur dozens of times per day, it can be tempting for traders to close a position too early because of the concern the price will continue to recede or not proceed to the intended target.

When day traders fall into this trap, they don’t just leave profits on the table. They may accidentally turn into a scalper which would diminish their earning potential as they ultimately end up being a low frequency and low-profit trader.

Pros and Cons of Day Trading

| Pros | Cons |

|---|---|

| Day trading strategies wait until there is a valid trading opportunity; there are less trade monitoring and management obligations. | Because day trading strategies target distant prices, there is a high chance of failure. |

| Less sensitive to spreads and commissions fees, which allows more flexibility when choosing a broker or trading account. | Because higher levels of drawdown are expected, a larger amount of capital is required to maintain positions. |

| There is time to think and plan before entering any new trade, which helps preserve confidence. | While traders wait for distant targets to be reached, there is a similar chance for drawdown to occur, which is an uncomfortable situation. |

Should you Choose Scalping or Day Trading?

Forex trading is never easy, because even when choosing the trading methodology you will use, you can get caught between the two.

The only way to honestly know whether scalping or day trading is the right method for you, is to test them both out. Consider the pros and cons mentioned in this article and use your trading journal to determine which trading style was most effective for you.

To wrap up, also make sure to try both techniques at different times of the day, because sometimes there are variations of forex strategies for each session.