Differences Between Day Trading And Swing Trading

There are various trading strategies in forex. Two of the most popular are day trading and swing trading. This article discusses the differences between those two.

Before we delve too far into the differences, let’s give you a quick overview of what each is.

Day trading is the forex trading strategy that involves the opening and closing of trades within a day. The trader who indulges in day trading uses technical analysis on the smaller timeframes to generate trade entries and exits. Most of these trades last from seconds to a few hours within the same trading day.

Swing trading involves identifying long-term trends on the chart over days. Unlike the day trader, the swing traders may hold a trade for as long as weeks. Fundamental and technical analyses on larger timeframes (4-hour and above) are what the swing trader relies on to generate entry and exit positions.

Key Differences Between Swing Trading And Day Trading

Now that you’re up to speed with what swing trading and day trading are, you might have noticed some of the obvious differences between them. In this section, we discuss those obvious differences and some not-so-obvious ones:

Trade Frequency

As a day trader, your primary goal is to make as many pips as you can during a day. You’re not necessarily concerned about the major trend of the currency pair as long as you get trading opportunities. As a result, you would make as many trades as you can within the trading day. You may even open multiple positions on the same currency pair, as long as you get to accumulate your pips.

But as a swing trader, you’re more patient. You don’t need to rush into trades. Your entry positions may not even present themselves for days sometimes. So you are okay with making a few trades per week.

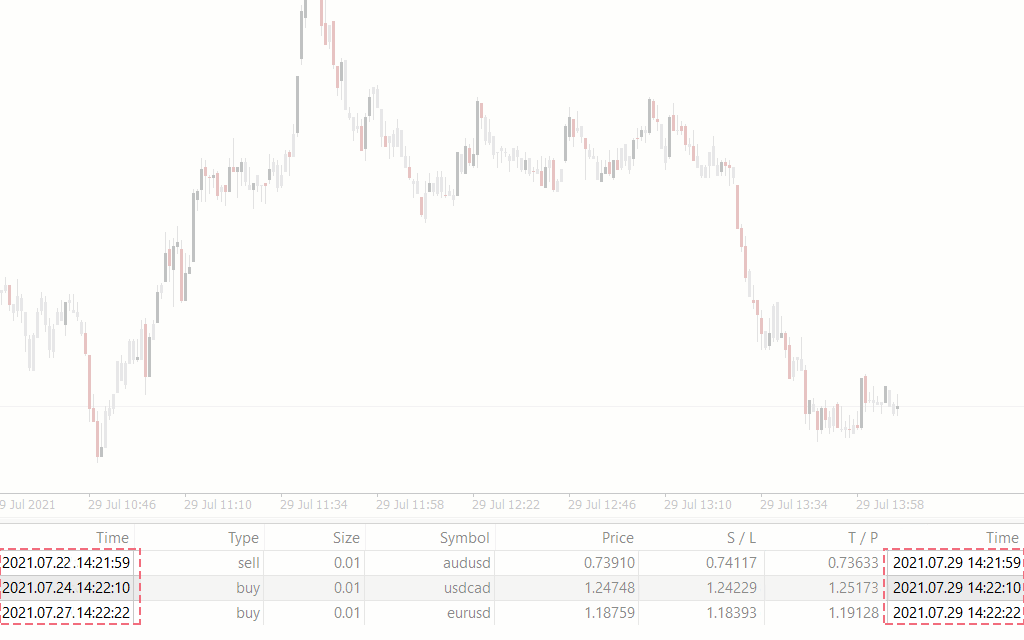

The image above is a sample of the trade frequency of a swing trader. See how the entry dates are days apart from exit dates.

Profitability

One is not more profitable than the other, but the way each generates profit is quite different.

The day trader, for instance, accumulates many small-sized profits from their numerous trades within the trading day. These small profits come as a result of the little distances the price is able to cover within the short time span of a day trader’s trades.

But when the price has days or even weeks to move from its starting point, as it is for swing trades, it is most likely going to cover more grounds. This is how swing traders make their profits.

Swing traders accumulate a small number of large-sized profits, while day traders accumulate numerous small-sized profits.

Risk

Just as it is with profitability, none is riskier than the other. Only that with day trading, you’re in smaller positions and your risks are very small for every single trade. But when you sum up the risk on each trade you make, your total risk may pile up substantially. And because the swing trader holds a position across days, the price has enough time to go as far away against them as possible. As a result, the risks are sizeable for every single loss but few in number because of the lower trade frequency.

Time Consumption

The swing trader does not spend too much time on the chart. Swing trading is originally for traders who don’t have much time to spend analyzing charts. That is why they use the higher timeframes which are slow-moving to analyze their trades. And once they enter a position, the trade can last for days before they hit a take profit or a stop loss, and so close-monitoring of their open trades is not necessary.

This is not the case for day traders, however. Day traders have to be on the chart for as long as possible to be able to catch new trading opportunities as they come.

Timeframe

Because the day trader is looking to quickly get in and out of trades, they resort to smaller timeframes, such as the 1-hour timeframe down to the 15, 5, and 1-minute charts. With these timeframes, the day trader can easily analyze and observe what the currency pair is trying to do within the day.

The swing trader, on the other hand, makes use of timeframes starting from the 4-hour chart. The reason for this is that the swing trader is more interested in the long-term.

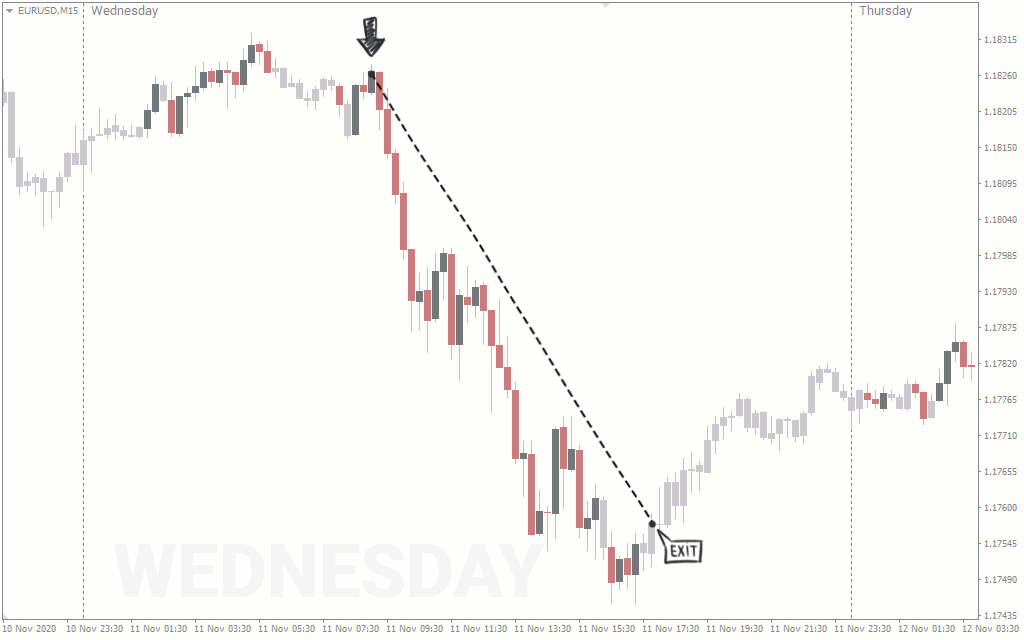

The image above is a typical example of the day trader trading on a lower timeframe.

Attraction to Volatile Pairs

Swing traders are not as attracted to volatile pairs as day traders are. The reason is that a swing trade lasts for days or even weeks, and the swing trader would have made a relatively substantial amount of pips irrespective of the market volatility.

The story is quite different for the day trader, though. Day traders expect to close all their trades within the day, and they expect to have made substantial gains by the end of the trading day. This is why they look for volatile pairs where their trades are going to be over in a short time. Low volatile currency pairs are only going to drag them down, and so they avoid these pairs like a plague.

| Day Trading | Swing Trading | |

|---|---|---|

| Trade Frequency | Many trades per day | Multiple Trades per week |

| Profitability | Many small-sized profits | Few large-sized profits |

| Risk | Small risks accumulate across multiple trades | Larger risks accumulate across few trades |

| Time Consumption | More active time on the charts | Less active time on the charts |

| Timeframe | 1-minute, 5-minute, 15-minute, 1-hour. | 4-hour, daily, weekly, and monthly. |

| Attraction to Volatility | Prefers volatile markets | Not necessarily attracted to volatility. |

Above is a tabular representation of the differences between day trading and swing trading.

So Which is Better? Day Trading Vs Swing Trading?

After all is said and done, the better forex trading strategy between day trading and swing trading is…

None.

Swing trading is not better than day trading, nor is day trading better than swing trading.

The reason for this is that the better one is largely dependent on who’s using the strategy. If you don't have a lot of time to spare on trading, for instance, swing trading may be for you. This way, you can simply analyze the market and make trades within minutes. But if you find that patience is not a virtue you can boast of, maybe you should consider day trading, as you can watch your trades close before your eyes.

And for some traders, the breakneck speed and decisiveness that day trading requires might be too much for them. Swing traders would make a better landing pad for such traders, as they can have hours or even days to ponder on their trades.

Conclusion

Whatever you choose in the end, make sure it is something you’re comfortable with. But if you feel these two trading styles don’t suit you, Scalping is another trading style you may want to check out.

We have articles for you that tell you the differences between scalping and day trading, and the differences between scalping and swing trading. They should help you find which is best for you in no time.