Swing Trading Vs Scalping: Which is Your Trading Style?

The trading style you adopt in forex plays a huge role in how frustrated or stressed out you would be on your forex trading journey.

Of the four major forex trading styles, scalping and swing trading represent the opposite ends of the spectrum.

In this article, you’ll learn everything you need to know about each trading style and what they entail. You’ll also learn how to choose the one that works best for you. But if you’re in a hurry, here’s a comparison table that explores the differences between scalping and swing trading.

| Swing Trading | Scalping | |

|---|---|---|

| Trade Holding Period | Most trades end in days. But some last for months, depending on how long the trend lasts | A few seconds or minutes |

| Number of Trades | Only a few | As many opportunities as there are within a trading day. Usually tens or hundreds |

| Trading Strategy | Strict adherence to trends using forex trading tools and market structures. | No need to pursue any trading strategy |

| Timeframe | Daily to weekly | From 1-minute to 5-minute |

| Profit | Huge profits over few trades | Little profits over many trades |

| Tracking | Just enough to make an analysis and ensure that trades are going in the expected direction. | Requires constant tracking and monitoring |

| Stress Level | Moderate | High |

| Suitability | Suitable for traders of all trading skills. Also great for traders who have other jobs. | Only for advanced traders and full-time forex traders |

| Decision Making | Takes place after adequate analysis | Quick |

| Broker Choice | Any kind of broker, depending on trader’s preferences | Must be brokers with minimal spreads. |

| Trader Traits | Patience | Quick decision-making, focus |

What is Scalping in Forex?

Scalping is a trading style that involves making daily quick trades that last from seconds to minutes.

Characteristics of Scalping

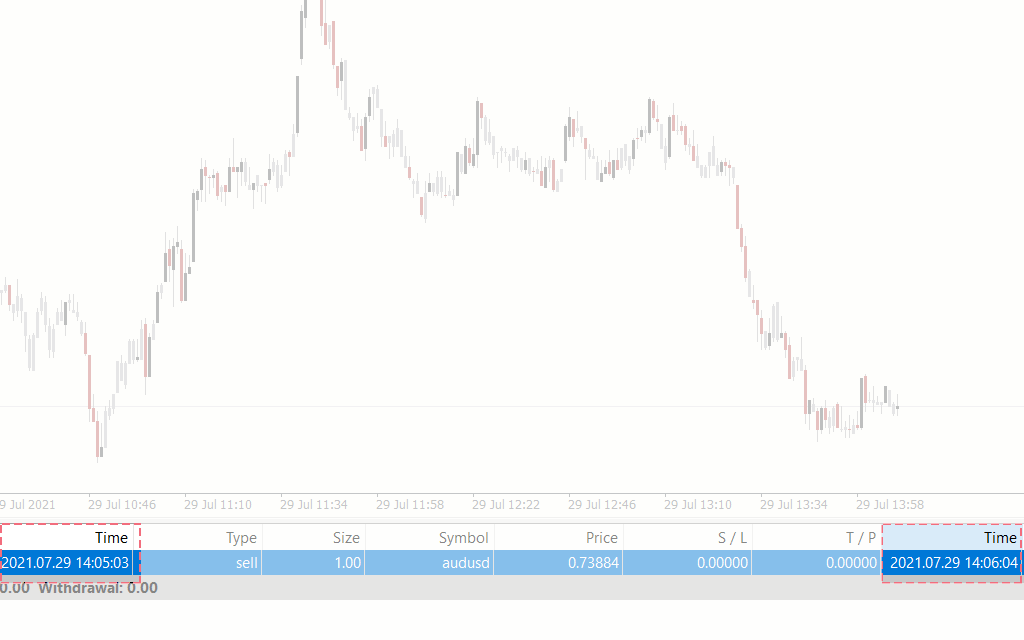

This is what a scalp trade might look like:

These are some of the attributes that forex scalping entails:

- Those that adopt this trading style are scalpers, and they often spend a lot of time monitoring forex charts, scouting for trade opportunities.

- Since trades last for only short periods, the profit is also minimal. Scalpers close trades with as little as 1 pip to 15 pips profit on their trades. But when they gather these little wins over tens and even hundreds of trades, they may end up having a significantly profitable day.

- Scalping does not involve large risks.

- Scalping , however, involves quick trades, with traders not necessarily following a particular trading strategy. Scalpers make trades that go either way regardless of the major trend of the market, since they wouldn’t be in the trade for long.

- Scalpers trade the smallest timeframes, such as the 1-minute and 5-minute charts, sometimes they even use the tick charts.

- Scalpers make use of brokers with low spreads, so that they can execute a lot of trades quickly.

- Scalpers are often traders who can concentrate on the charts for long periods of time and, actually, have the time to do this. They need to be able to handle stress, make quick decisions and act under pressure.

- Scalping is only for advanced forex traders. This means that a trader must first understand the basics of forex trading, such as the importance of having a trading plan, what leverage is, and the best leverage to use.

Day trading, or intraday trading, is a trading style that is closer to scalping than other trading styles. Learn the difference between the day trading and scalping, so that you don’t consider yourself a scalper when you’re actually a day trader.

By the way, knowing your trading style helps you answer other forex trading questions you might have, like, what is the best timeframe to trade?

What is Swing Trading in Forex?

Swing trading heavily depends on forex trends. Swing traders try to identify the trend the market is in and make trades within it.

Characteristics of Swing Trading

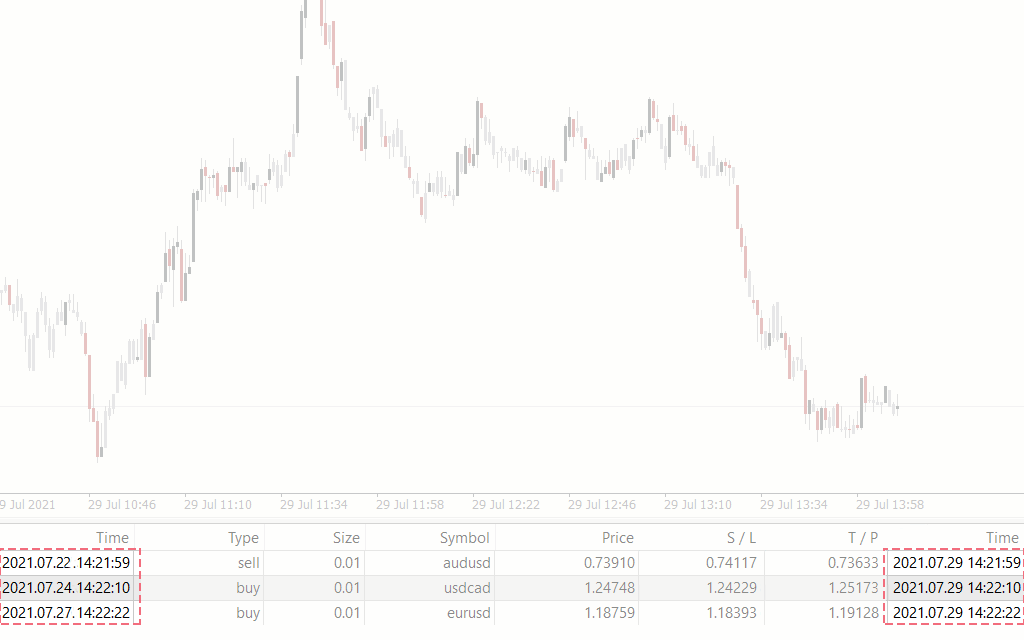

This is what a swing trade might look like:

The following are the key attributes to swing trading:

- Swing trading involves the use of technical analysis tools, such as indicators, Fibonacci tools, trendlines, and support and resistance zones. For instance, they wait for a breakout of consolidation and trade the subsequent trend. It is because of this strict adherence to trends that swing traders are often called trend traders.

By the way, knowing the momentum of the price at every point could become a significant advantage and add enormous value to the arsenal of a swing trader. You can learn how to use the stochastic indicators, some of the best momentum-measuring indicators out there.

- Swing traders often trade timeframes north of the daily timeframe.

- They don’t spend as much time focusing on the chart as scalpers, because most of their trades last for days and some even extend to months. The time they spend on trades depends on how long the trend lasts.

- Because swing trading doesn’t require a lot of uninterrupted attention, traders can get busy with other things, like holding down a full-time job while they trade on the side.

- Finally, patience is a virtue swing traders must possess. They must also have the fortitude to withstand minor trends that go against their major ones.

- Unlike scalping, any trader can practice swing trading.

Choosing Your Trading Style

Swing trading and scalping are not the only trading styles. Other trading styles in forex include position trading and day trading. So, if you feel you aren’t a scalper and swing trading isn’t really your thing, you can check out other forex trading styles to learn what’s best for you.

However, the best way to know for sure is to try out the various trading styles and see what suits your personality. Try to understand what feels more natural to you.

Summary

Knowing your trading style gives you a good sense of how to approach the forex market. Scalping and swing trading are two major forex trading styles. One of the key differences between these two is that scalp trading ends in a matter of seconds or minutes. It never lasts overnight.

Swing trading, on the other hand, could last for days and even for weeks. Although, most end in days.

Because of the short lifespan of scalp trading, scalpers use the smallest timeframes, such as 1-minute and 5-minute ones. But swing traders use larger timeframes, starting from daily and sometimes going on to weekly ones.