Forex Stop Hunting - Not What you Expected

Have you ever experienced an unexpected Forex market spike that took out your stop loss?

Only for the market to immediately reverse back in the opposite direction?

It certainly feels like someone is stop hunting you.

While your stop losses are always being hunted in some way, it’s not by your Forex broker wanting to personally pocket your relatively small trading account.

It’s actually the smart money from large, institutional players such as banks and hedge funds, guiding price into areas where stop loss orders are most likely to have accumulated.

This is done in order to get a large trade volume filled.

If you’re ready to take responsibility for your stop placement and understand how the smart money takes advantage of the retail crowd, then this article is for you.

What is Forex Stop Hunting?

So, if it’s not your broker trying to pocket your trading account, then what is Forex stop hunting?

Forex stop hunting is the liquidation of a large number of stop orders at once, before price moves back in the opposite direction.

It’s a market function in which big players known as the Smart Money, are searching for clusters of stop orders to be able to take sizable, high-volume positions.

Stop hunting is simply the smart money conducting their business at levels where buying and selling can be most easily facilitated.

The Smart Money

The notion of smart money is an interesting concept.

It’s not so much that some players in markets are more intelligent than others, but more about the fact that their size gives them more control.

Smart Money is used to describe big players who are able to use their size to manipulate price in a way that benefits them.

By moving price toward areas where there’s likely to be clusters of stop loss orders just sitting around, big players are able to cleanly build large positions.

Negative Connotations Around Stop Hunting

Stop hunting has such negative connotations within the retail Forex trading realm, but in reality it’s just a lack of understanding around what’s actually happening within markets.

There is no targeting of individual stop loss orders by anyone, especially not from your broker.

Institutional traders are simply looking at charts from a supply/demand viewpoint, in order to determine where the biggest cluster of stop loss orders are sitting.

The smart money is able to profit from the retail crowd’s predictable human behavior within markets.

By changing your mindset from that of a retail trader to an institutional trader, you are able to ride on the coattails of smart money towards profitability.

Can I Take Advantage of Forex Stop Hunting?

As mentioned above, Forex stop hunting doesn’t have to be a negative.

If you’re able to understand how the smart money thinks, then even as a retail trader, you’re able to take advantage.

One of the most common things that Forex education firms portray, is that the more obvious a support/resistance level becomes through multiple touches, the stronger that level becomes.

In reality, this is simply not the case.

All it does is give smart money an opportunity to stop hunt the liquidity sitting just beyond the support/resistance level, taking advantage of retail traders who don’t know how to set their stop loss properly.

So now that you understand why Forex stop hunting occurs, you’re able to identify positions on your chart where you expect clusters of stop loss orders to be sitting and come up with a stop hunting strategy to take advantage.

Think Like the Smart Money Thinks

In order to be able to take advantage of stop hunting, you have to change your mindset to think like the smart money.

We now know that institutional traders are looking to buy at levels where retail traders are going to bunch their stop loss orders.

To be able to get the institutional level volumes they require, they’re going to have to search for liquidity in order to get their position fully filled at a reasonable price.

As we now know that they’ll be searching for liquidity in the form of stop loss orders on the other side of obvious support/resistance levels, we’re able to identify those zones and join the smart money.

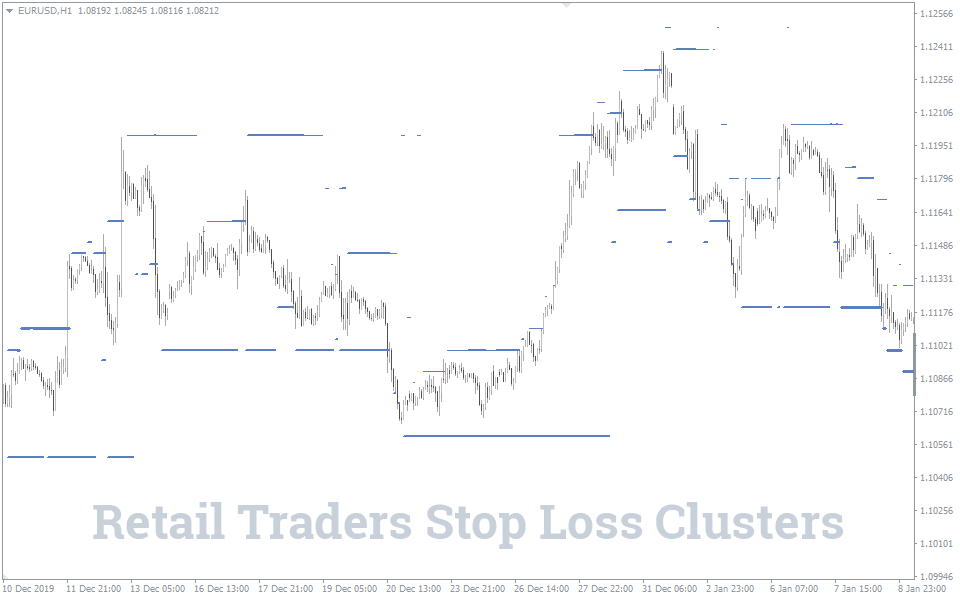

The FXSSI Stop Hunt Indicator (MT4)

To help you identify where stop loss orders are most likely to be clustered, we’ve developed the FXSSI Stop Loss Clusters Indicator for MT4.

This particular Stop Hunt Indicator for MT4, helps identifying where traders will place their stop loss orders.

Anywhere that there’s likely to be a cluster of stop loss orders ripe to be hunted by institutional traders, the indicator displays a thick line, directly onto your MT4 chart.

The thicker the line displayed on your chart, the larger the indicator sees the potential cluster of stop loss orders being placed.

This thickness adds a third dimension of cluster volume to your analysis.

You can also see that these clusters clearly appear above or below obvious areas of support/resistance, such as intermediate swing levels.

When combined with your own technical analysis to identify levels of support/resistance, the FXSSI stop hunt indicator becomes an extremely powerful tool.

To keep things simple, only the two largest potential clusters of stop orders on the chart are displayed – One above resistance and one below support.

Do Forex Brokers Hunt my Stop Loss?

Even after understanding how stop hunting actually works, traders are still going to be skeptical of their Forex brokers.

Put simply though, for most regulated Forex brokers, it’s simply not worth their while to stop hunt their own clients.

The risks of being found out and shamed in today’s socially connected world, far outweigh the benefits of taking a few pips off the small account holders they rely on to survive themselves.

In saying that however, while the majority of stop hunting is a natural function of an efficient market, there are certain things you need to pay attention to when it comes to your broker.

First of all, you must understand how your broker makes money – That is whether they run an A-book or B-book business model.

A-Book Forex Brokers

As A-book Forex brokers often operate as ECN brokers, they don’t actively trade against their clients.

Instead, they pass orders onto liquidity providers and instead take a cut of that trader’s volume in the form of a spread.

They want traders to keep trading high volume so they can keep taking a cut of the spread and, for this reason, they don’t want to stop hunt them to the point they blow up their account.

One way many traders think A-book Forex brokers stop hunt, is by widening their spreads around news.

However, this is most often done simply because the prices quoted from liquidity providers reflect a thinning of the underlying market during these periods of unpredictable price action.

Widening spreads in these situations isn’t stop hunting, it’s just protecting the broker’s business from excessive downside risk.

B-Book Forex Brokers

B-Book Forex brokers on the other hand, is a whole other beast.

Best known by retail traders as market makers, B-book brokers actually do trade against their clients.

They take the opposite side of a client’s trade, which means that if they win, the client loses.

B-Book Forex brokers are often in control of their own price quotes offered to clients and as a result, there’s obviously some level of conflict of interest here.

With their own order book of positions and the ability to control the prices displayed to clients, B-book brokers can technically manipulate prices in order to stop hunt their own clients.

While in 2020 this is rare, if you’re uncomfortable with this conflict of interest, then ensure you’re trading with an A-book Forex broker instead.

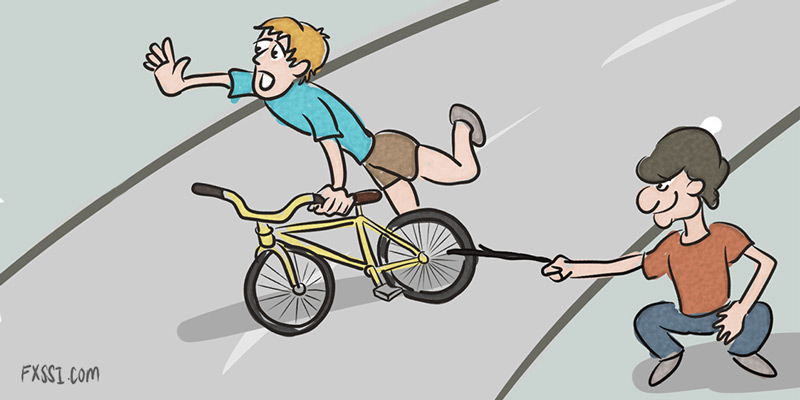

Simple Forex Stop Hunting Strategy

To help you put all of this together, we’ve come up with a simple Forex stop hunting strategy.

This strategy is designed to help traders truly take advantage of how the smart money views markets.

The point of this trading strategy is not to imitate institutional players, but instead follow what they’re doing and never push against the immense power of smart money flows.

Don’t blindly sell a breakout through support – Being first in isn’t an advantage, it’s being dumb money!

Timeframe: M30, H1, D1.

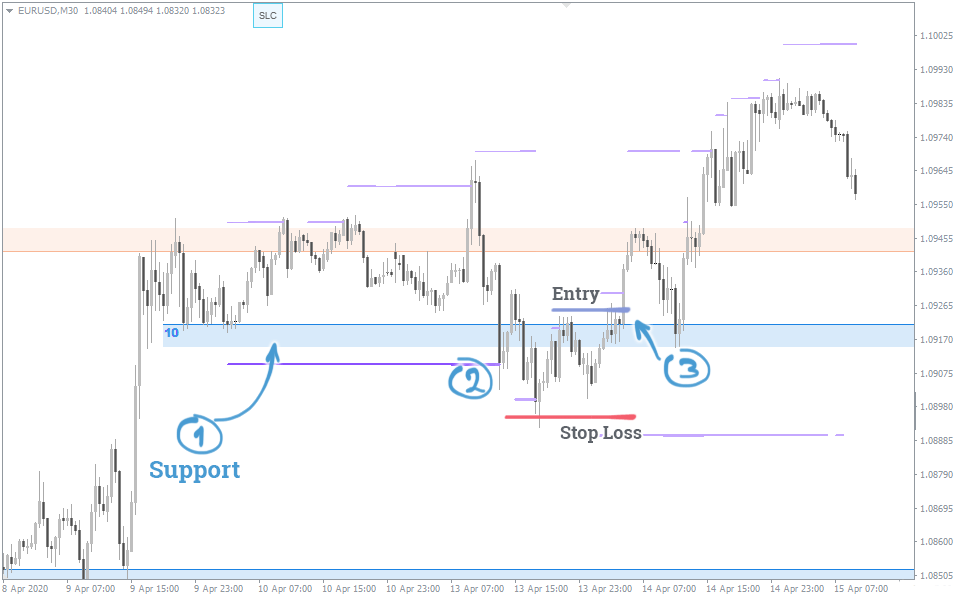

Step 1: Identify a level of obvious support and wait and see if the smart money decides to hunt stops displayed on the Stop Loss Cluster indicator below.

Step 2: Watch for price action that will likely show stop hunting. Look for long wicks into liquidity, followed by an immediate reversal.

Step 3: After identifying that support has in fact held and that fake-out was nothing more than a stop hunt, enter long with a stop back below that low.

Instead of being a dumb money retail trader who blindly sells breakouts, you’re now following the smart money.

You saw the accumulation of a cluster of stops happen right in front of your eyes and you’re riding sizable wake of institutional flow.

The Bottom Line on Forex Stop Hunting

As you can see now, Forex stop hunting certainly does exist.

It’s not a myth after all!

Remember, what you’re seeing is smart money targeting clusters of stops in order to get large orders filled

Not your retail broker setting out to screw you!

Stop blaming your Forex broker for your own poor stop loss placement and start taking advantage of smart money flows, which is in fact what's actually doing the stop hunting.