How to Trade Like a Big Players Do

In this article we will discuss trading strategies that helps traders to trade like big players do.

Though there are many trading strategies and techniques to trade the forex markets, many of them are based on common indicators. Moving averages, MACD, RSI are some of the familiar indicators of retails forex traders. In fact most of the trading strategies are based on some kind of oscillators or moving averages.

However, this may not be the case of big players like the banks or financial institutions. The big players do not use these indicators to enter and exit the market. As such when 90 percent of the retail traders fail to materialize the market movements, the big players in the market make substantial profits.

So it is essential for the retail forex trader to understand and operate in the same manner as big players do. Let us explore some of the tools that can help the forex trader to look at the markets in a different perspective.

Finding the Market Sentiment

Forex market has only two sides buy side and sell side. It is essential to understand the direction where most of the market players are aligned and to trade accordingly. First of all how do we understand and find out this information.

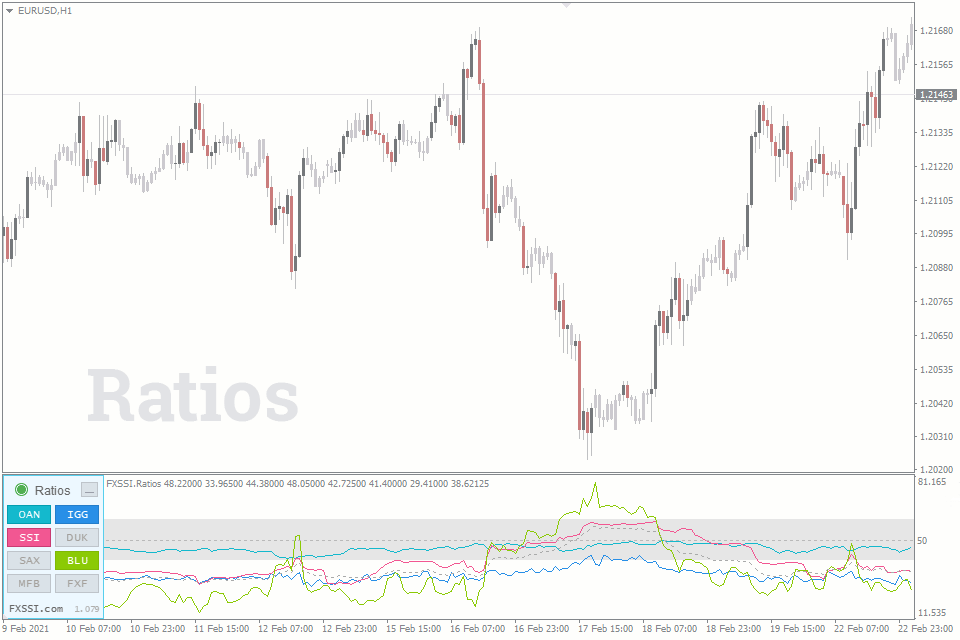

The SSI or the market sentiment indicator does this job perfectly. The SSI indicator shows the ratios of buyers to sellers for a given currency pair. It shows this by displaying the percentage of buyers and sellers. So, forex traders can identify and understand whether forex retail traders are mostly in the buy side or sell side.

In order to trade like big players do, it is important to understand the market sentiment of the global market players not only a particular broker’s buyer’s and sellers’ sentiment . The Ratios indicator is another amazing tool. This indicator shows the ratio of the buyer’s and seller’s position as a chart.

This indicator collects market data from various source including forex brokers and data aggregators. As a result, it provides a much better view of the market sentiment. Using this indicator we can understand the percentage of traders in buy side and sell side of each data source separately.

Taking an average of all the data sources provides an excellent view of the buyers and sellers currently operating in the market.

Now, we are able to identify the market bias using the above indicator. We will now use the next indicator to locate the open positions and the pending orders of the market participants.

Market Participant’s Positions – Order Book

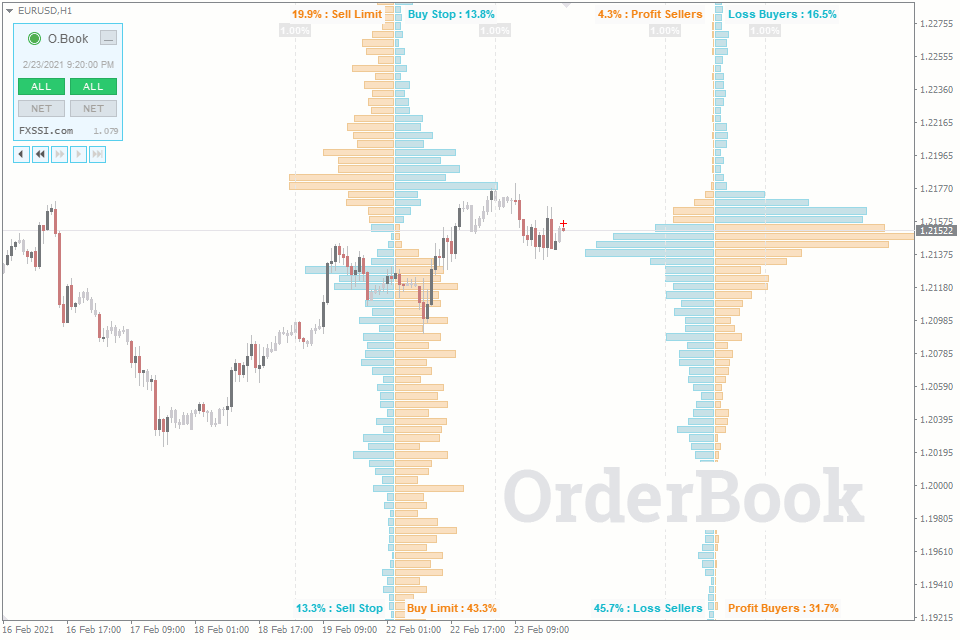

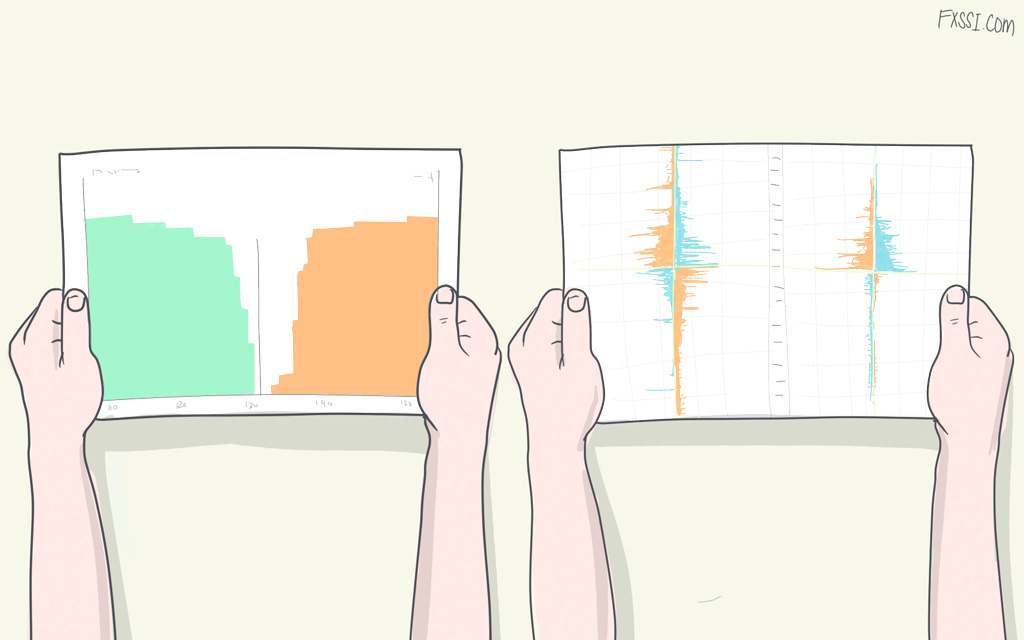

The order book indicator plots a histogram of the open trades and pending orders of market participants. The left-side shows all the pending orders take profits and stop losses. On the other hand, the right-side shows the current open trades.

This amazing information is further supplemented by additional information such as Buy stops, Sell limits, Profit sellers and Loss buyers. In fact order book indicator does not provide trading signals. But, they help the trader in understanding the location of open positions and pending orders that in turn is the best method to identify support and resistances.

Furthermore, traders can identify the clusters where other traders are densely located. It’s important to understand the difference between classic order book and the extended order book to effectively use the features of the extended order book.

So far, we had identified the market bias using SSI or market sentiment indicator and the ratios indicator. Further we can use the order book to identify where other traders have market positions to trade like a big player. Now let’s use another indicator to identify the potential reversal points.

Identify Reversal Points

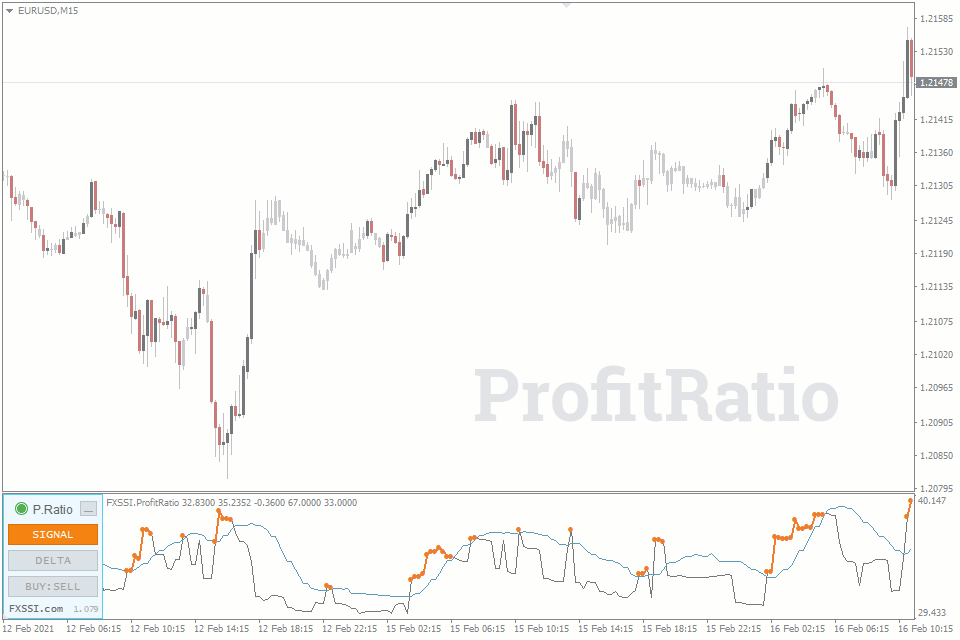

It’s of paramount importance for a trader to identify reversal point for a profitable entry. Most traders struggle to identify this; however the next essential step is to find if the reversal is false. The Profit Ratio indicator applies win / loss ratio to identify the best reversal points.

Once the trader applies this indicator the indicator plots the reversal points before the actual price reversal takes place. This enables the trader with an early entry in the beginning of a new trend. The indicator plots a chart and plots the potential reversal points that acts as best entry point.

We have already discussed how to identify the market sentiment, support and resistance and the open positions and pending orders. Together with them we now have the best entry point. Let’s now discuss the method to identify potential stop loss and take profit targets.

Identify Stop Loss and Take Profit Levels

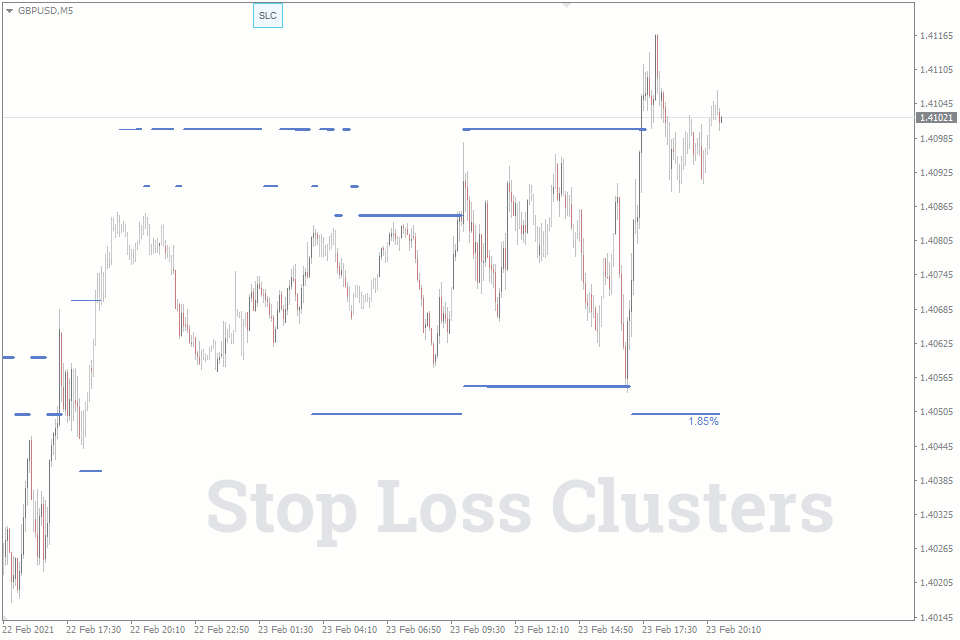

Another important failure of most retails traders is placing the stop loss and take profit levels randomly. Traders should place their stop loss bit far from the stop loss points of other traders. So there will be fewer chances of the positions hitting the stops.

The Stop Loss Clusters (SLC) indicator displays the stop losses levels where most market participants have placed it. The indicator plots these levels in MT4 charts and helps traders to place their stop loss in a better place than most of the other traders.

Stop loss cluster form a best place to book profits too, since many positions are lined at that level. So, the stop loss cluster (SLC) indicator can provide both stop loss and take profit points.

Trading With Indicators – Smart Money Trading

We had discussed the application of above indicators; now let us see how to trade them with Smart Money Trading strategy. As a retail trader if you want to trade like the big boys, then Smart money trading strategies are very effective.

Smart money trading is using the above indicators and trading the opposite of the majority of market participants. To be precise, if most of the traders are bullish we should be bearish and vice versa.

We should enter the market with a buy trade, if most of the market participants are selling. Combining the above indicators allow us to identify the market sentiment, identify their orders, identify best trend reversal points, find their stop loss and take profit levels and trade with the mindset of big boys.

The Bottom Line

Traders can derive best trading results if they combine the above indicators to gain information not available for most other retail traders and apply smart money trading strategies. Moreover, traders can stay opposite to the crowd and trade like the big boys do.