Difference Between Classic Order Book and Extended Order Book

Have you ever wanted to see what other participants are doing in the market? Where are they buying? Where are they selling?

This data can be incredibly powerful and whilst stock and cryptocurrency traders take this data for granted, due to the forex market’s decentralised nature, it has generally not been available in this market until now.

FXSSI’s Extended Orderbook indicator is an incredibly powerful tool that not only lets you see the limit orders of other participants, but also lets you see stop orders and existing positions – even stock and crypto traders don’t get this info!

Read on as we look at a classic order book, our Extended Orderbook indicator, the difference between the two market views and the advantages and disadvantages of each.

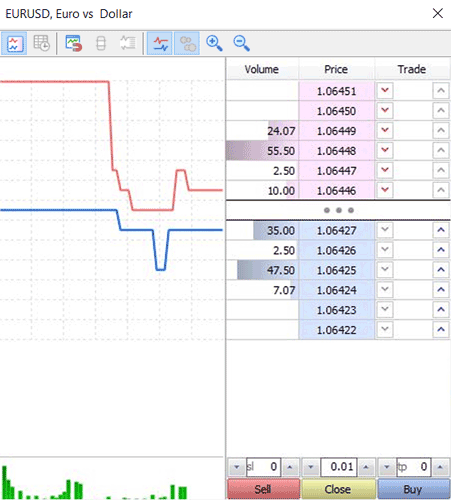

Classic Order Book

A classic order book is built from limit orders around the current price – that is liquidity in the market. It shows you where you can buy and sell and with how much volume in real time.

In less liquid markets, like stocks and crypto, this is the essential info as you can see how much slippage you’re going to take if you buy at market vs a limit order. This allows you to make more educated decisions about entering and exiting your trade or even what direction the market would move in the event of a large market buy or sell being placed.

Even in a more liquid market like forex where you can generally get filled pretty close to the last price, this info would be very useful and especially if you are trading size. The problem is the data has just never been available for forex due to its decentralised nature – eg. there is no central exchange that handles all the orders for EURUSD.

To get aggregated orderbook data for the entire market would require a globally coordinated reporting regime which is not likely to happen any time soon and would no doubt come with more trade stifling regulations.

The next best thing: exit polls

Estimates of election results derived from pre-polling can be wildly inaccurate.

At the aggregate level they tend to be pretty reliable, but sub sections of the estimate that failed to account for certain factors, over accounted for others and can throw entire results off as we saw with both Brexit and the 2016 US election.

A much more reliable election indicator is exit polls – this is polling a representative sample of people who have already voted about how they actually did vote. This is similar to measuring inflation in economics, we survey and report inflation expectations which tend to be highly correlated to actual inflation measurements, but are rarely identical.

The best data of course is actual data, not an adjusted estimate.

Extended Orderbook – A representative sample

FXSSI’s Extended Orderbook indicator for MT4 is similar to exit polls in that the indicator is based on a representative sample of market participants. It is also similar to exit polls in that the data is not updated in real time – the indicator updates every 5-20m.

Though this is not perfect and we’d of course prefer to have real-time data covering the entire market, our indicator really is the next best thing. It can be an incredibly powerful tool when it comes to supercharging your trading strategy and performance results.

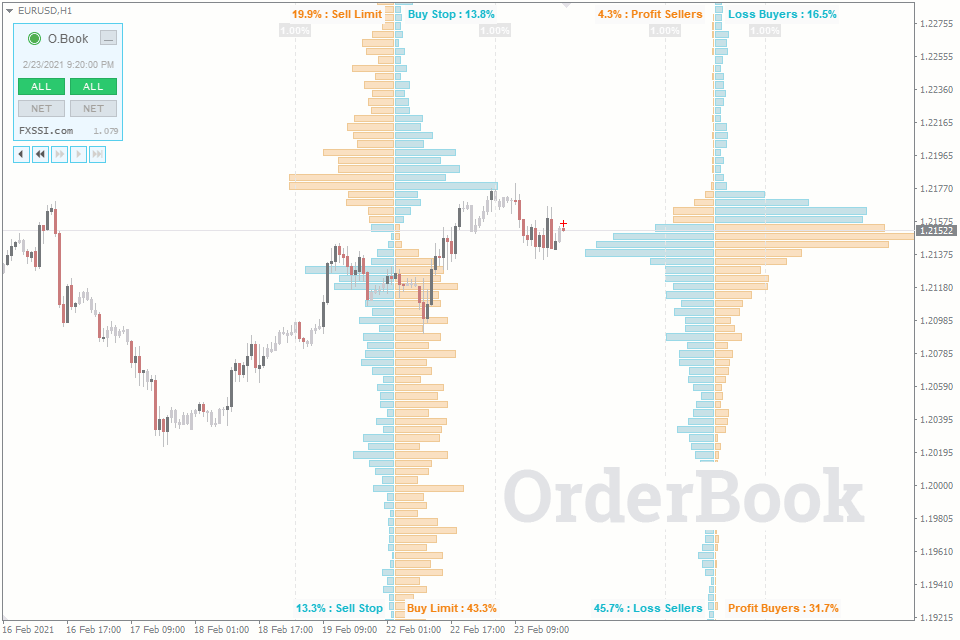

Extended Orderbook – See the market in 8D

A classic orderbook is made up solely of limit orders – buy limits below price and sell limits above the current price. This is extremely valuable data, but it’s only two pieces of the pie.

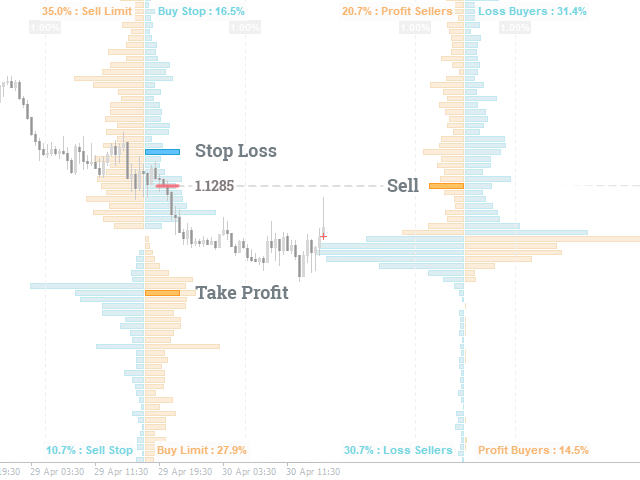

Conversely, FXSSI’s Extended Orderbook indicator for MT4 gives you a full view of all 8 pieces of the pie:

- Buy limits below price/sell limits above price (liquidity).

- Buy stops above price/sell orders below price (stop losses & breakout

- traders).

- Open buys below price/open sells above price (profitable trades).

- Open buys above price/open sells below price (losing positions).

The value of such an array of data should be immediately clear to you, but if not, you should definitely check out our Extended Orderbook for MT4 page for further explanation, illustrations and ideas for incorporating this powerful indicator into your trading strategy.

Our guides to orderbook trading and stop hunting in forex are also highly relevant and essential reading.

Efficient markets require perfect knowledge

In order for markets to be perfectly efficient, all participants in the market would require perfect knowledge of every fundamental and technical aspect driving a market.

Although this is obviously impossible to achieve in reality, you should be at least looking at all the available data and the Extended Orderbook indicator empowers you to do just that.

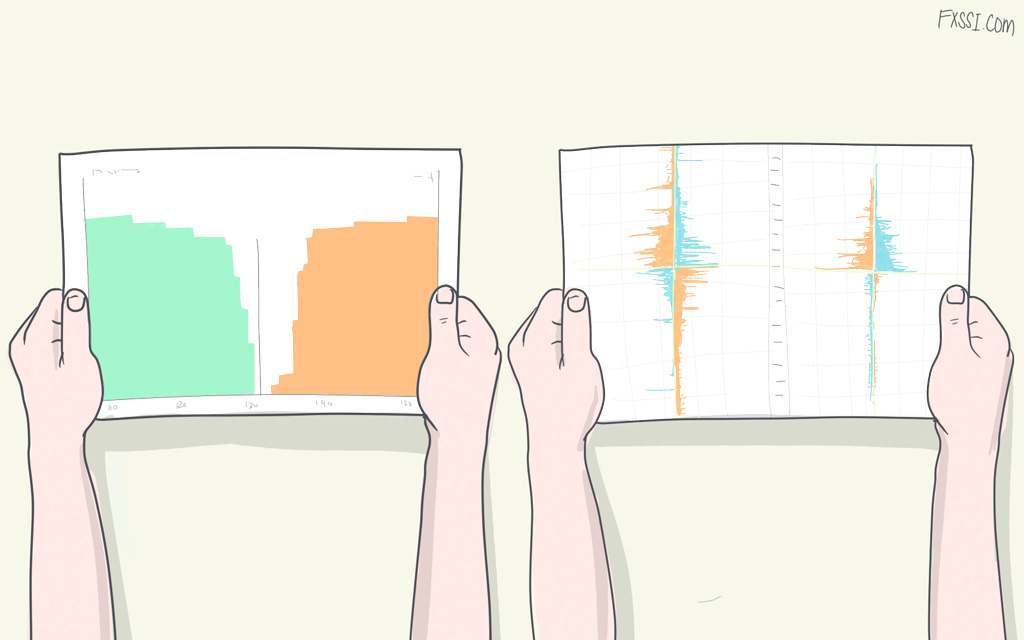

Classic Orderbook vs Extended Orderbook

Still unclear as to how our Extended Orderbook indicator differs from a classic orderbook?

Here’s a handy table which illustrates the key differences of Classic Orderbook vs Extended Orderbook:

| Classic | Extended |

|---|---|

| Is good for short term trading, scalping | For day trading |

| Real time update | Snapshot is made once in 5-20 minutes |

| Shows only Limit Orders | Shows Limit, Stops, Takes and other orders |

Another powerful feature which somewhat makes up for the lack of real time data is the ability to go back in time and look at previous snapshots of the book and how and where the market responded to changes in order flow. All right there in your terminal, seen overlaid on your candles.

The possibilities for honing your edge and improving your trading results with this indicator are truly endless.

Ready to supercharge your trading strategy?

See the power of our Extended Orderbook Indicator and want to implement it in your forex strategy?

FXSSI Pro members get access to this indicator and a host of other powerful proprietary indicators designed by traders, for traders.

Become an FXSSI Pro member today and get the edge you’ve been looking for.