Order Book Trading

An Order Book gives traders valuable insight into the market. When you trade on an exchange, whether it be Stocks, Futures or Cryptocurrencies, all of these exchanges provide an order book.

You can see the Buy and Sell Limit Orders from other members of the exchange. The Bid and Offer prices being quoted originate from those Limit Orders. Investors can use Order Book analysis trading strategies with this data.

As other traders submit Market Orders, they are executed by the Limit Orders at the top of the book. As orders sweep the book, the spot price will adjust as does the entire Order Book.

Unfortunately, the retail Forex trading industry is lacking this great feature. MetaTrader 4, the platform used by most traders, does not offer a Forex Order Book. Moreover, most Forex brokers provide an aggregated feed to their clients and show just a few price levels from the Order Book.

Being able to view the Depth of Market doesn’t just show price sentiment, but the combined weight behind each price. Order Book Trading assists traders with scalping, identifying Buy and Sell signals and improving the timing of larger orders to prevent slippage.

The ability to factor in details from the Order Book into your trading strategy can give you a valuable edge. You may wonder how you can take advantage of Order Book Trading if popular trading applications lack this feature. Well, at FXSSI, we’ve developed an Order Book Indicator for MT4.

MT4 Forex Order Book Indicator

The Forex Order Book Indicator for MetaTrader 4 that we developed as part of our suite of Forex analysis tools works quite differently to a conventional Order Book, such as ones used on an exchange.

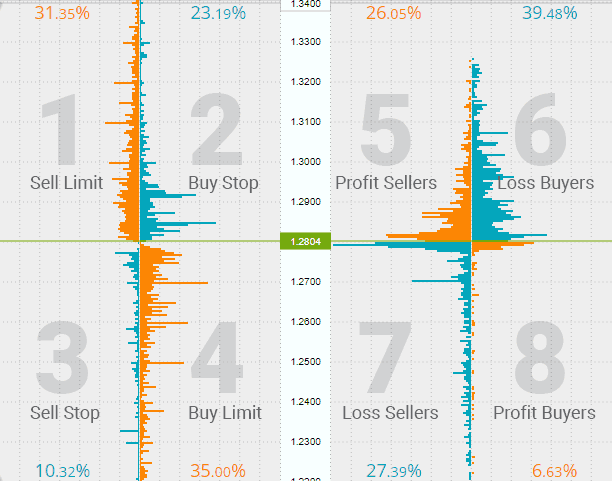

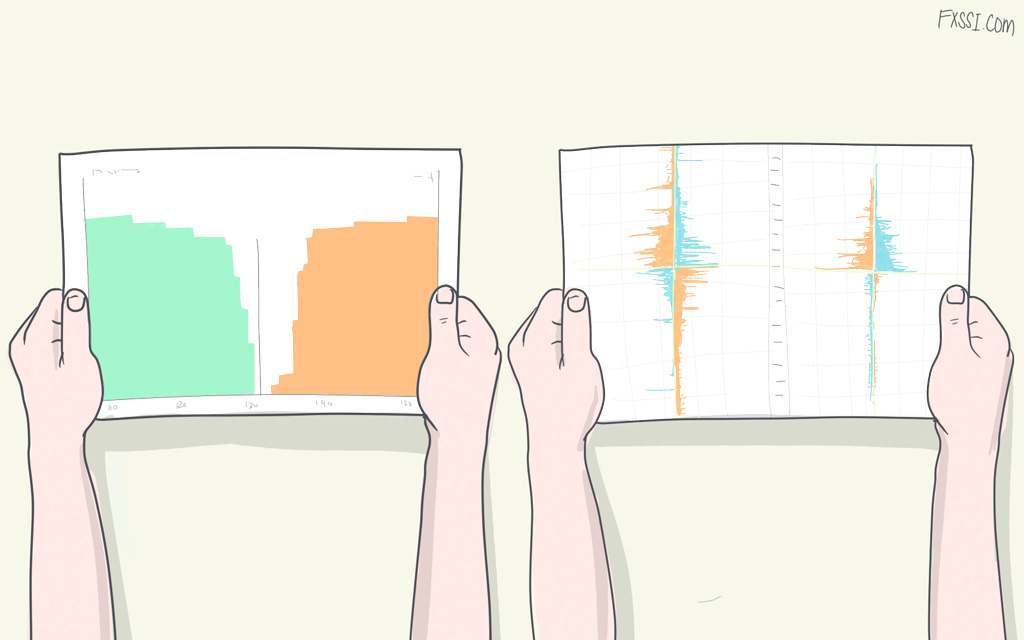

The FXSSI.OrderBook indicator is split into two histograms. In the histogram on the left-hand side, you will see an Order Book made of not just Limit Orders, but also Stop Orders. In the other histogram on the right-hand side, you can see the open positions of other traders, which is something no exchange could ever show, due to the fact that traders do not hold positions on an exchange.

Now that you understand how our Order Book Analysis tool is different from a conventional exchange Order Book we can move onto how you can gain actionable insight from this indicator.

Learn more about the Order Book Indicator for MT4.

How to Use Order Book to Trade

Traders who focus on technical analysis indicators, chart patterns and candlestick formations often completely forget what actually moves markets. It’s supply and demand and the decisions that traders make that influences the market.

The Order Book indicator shows both supply and demand and market sentiment.

As Forex and CFD traders, the prices of the instruments we trade are derived from large exchanges such as CME or CBoT and others. Whales have the most power to move the market, and we can be sure they are not trading with a retail Forex broker like you and I.

The whales can quite easily ruin your week submit their orders on Futures exchanges or buy Options contracts. It makes a lot of sense to follow the activities that happen in these venues, not just follow what our Forex trading peers are doing at retail brokers. Learn more about our thoughts on Order Book vs Futures Volumes in an earlier article. Observing the Futures Market can give insights into where investors expect the price to head in the future.

Certain behaviors and imbalances in the Order Book can be a signal of something important. The book allows us to find support and resistance levels, potential breakouts and a shift in sentiment.

Forex Order Book Signals and Strategies

Here are a few examples of signals and insights that can be generated by using our Pending Orders and Positions Order Book histogram indicator.

Find Support and Resistance Levels

Pending Orders histogram – A group of Buy Limit Orders can be interpreted as a support level. At the same time, a group of Sell Limit Orders can be viewed as a resistance level. You can confirm these levels by plotting a horizontal line on the chart, and you should notice a correlation.

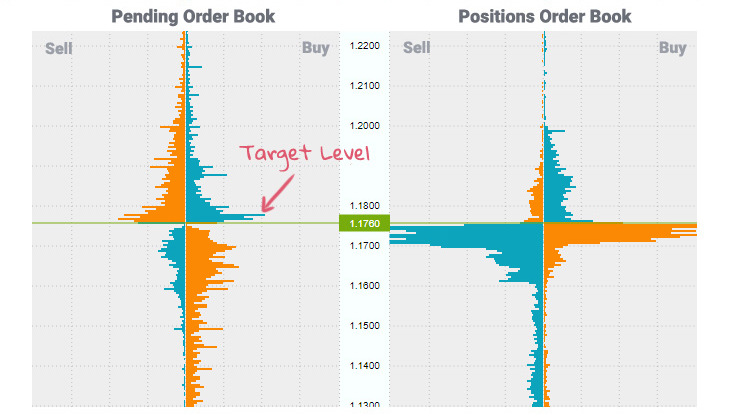

Set Targets where Stop Losses Accumulate

Pending Orders histogram – We’ve noticed a tendency that wherever the majority of traders lay their Stop Losses, the market gravitates towards them and ultimately loses momentum. This indication doesn’t draw any conclusion about the continuation or reversal of the current trend. These clusters can be a good area to exit profitable positions.

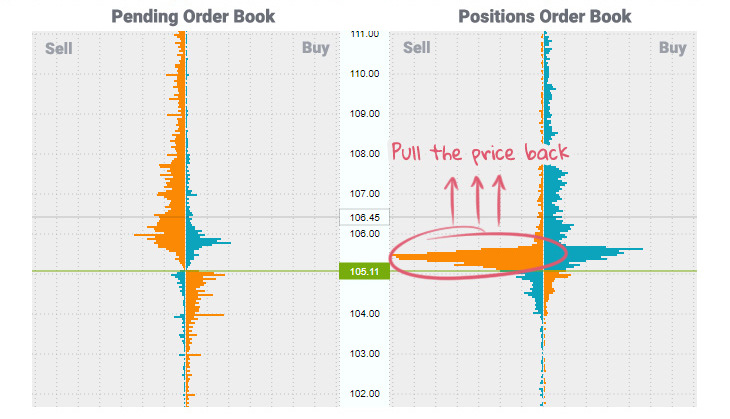

Take Signals when Losing Trades Accumulate

Positions histogram – The Positions histogram allows you to see an overview of open trades. A common symptom of the notorious disposition effect is waiting out unprofitable trades. Traders try to wait out unprofitable positions only to be wiped out. Our observation is that an accumulation of losing sellers will push up the price, and losing buyers will pull the price down.

Expect Reversals when Winning Trades Accumulate

Positions histogram – Rather depressingly, we’ve noticed that whenever a cluster of profitable positions will arise, it’s only ever temporary and the price whipsaws back, turning those profitable trades into losers. If you are able to notice this event, you can do the opposite.

How Reliable is an Order Book Trading Strategy

You may be sold on the idea of using Order Book analysis in your Forex trading strategy. Sadly, it is not the holy grail of market analysis tools. The Order Book can give you precious insights that no other indicator can, yet it cannot be solely relied on. Based on our assessments, the signals created by our Order Book indicator are somewhere between 55% and 60% accurate.

While this figure is net positive, the accuracy can be vastly improved if combined with other techniques. We recommend using it to tip you off about possible opportunities but seek additional validation too. Alternatively, the Order Book can be used as a confirmation tool for other indicators.