Retail Open Position Online - Forex Tools

The informer displays the current market sentiment. Data on the ratio of Forex trading positions are collected from several brokers.

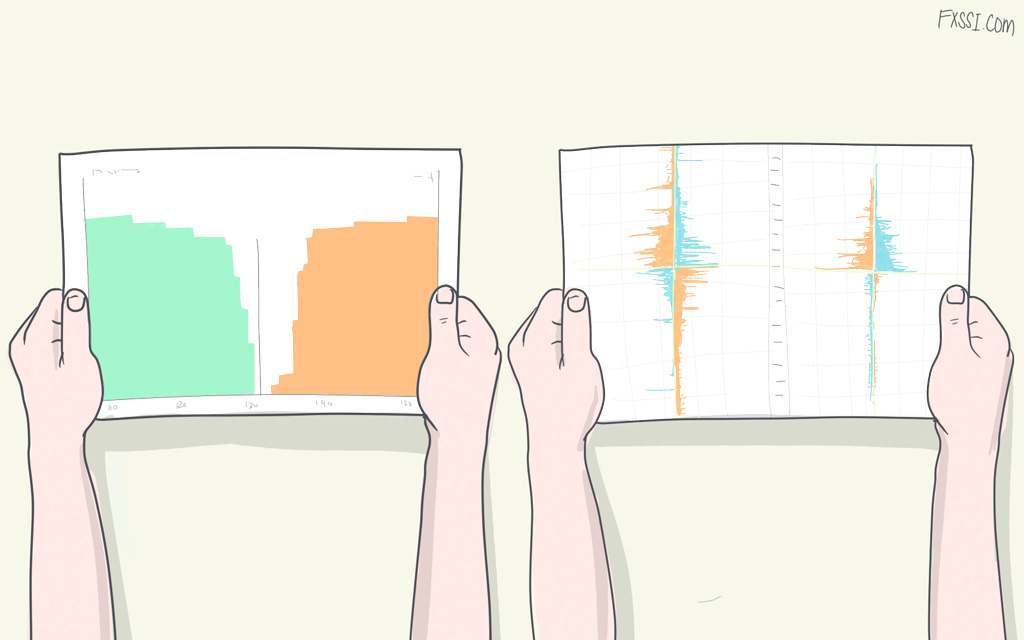

Analyze open positions of traders not only as of the present moment, but also in the form of a chart.

In this article, we would like to tell you a few words about the open positions of traders and describe basic principles of their analysis. Besides, we’re going to show you our proprietary and easy-to-use tools (online services) for the analysis of the Forex open position ratios.

The service represents an aggregator that accumulates data coming from various brokers. It can be used to analyze open positions of traders online not only as of the present moment, but also in its dynamics (you can view the history of the indicator’s changes over several previous months). In addition, the tool can be configured for displaying data both from one and several brokers at once. If you understand what we’re talking about, you can turn to learn the tools immediately.

What are the Open Positions of Traders in the Forex Market?

Example of ratio of positions

The term “open interest” (or “open positions”) is a percentage value showing the current difference between the number of traders opened trades to Buy and Sell a currency. At that, already closed trades don’t affect the indicator readings.

Positions of Forex traders are an excellent indicator of the market sentiment that enables looking at the market from a market maker’s point of view.

Most brokers tend to provide data on the open positions of traders in Forex, while aspiring to win the loyalty of their clients. However, it’s not easy and convenient to analyze, much less to compare data from a dozen of various websites, for an end-user. This is where the idea of developing a single tool to analyze the ratio of short and long positions opened with all brokers comes from.

How Can I Analyze the Ratio of Short and Long Positions?

First of all, don’t rush to open trades. First, study the data displayed on the chart, watch them for some time, until you find out some regularities in the price behavior. We can give you an advice on what you should pay your attention to in order to shorten the time taken for searching the patterns:

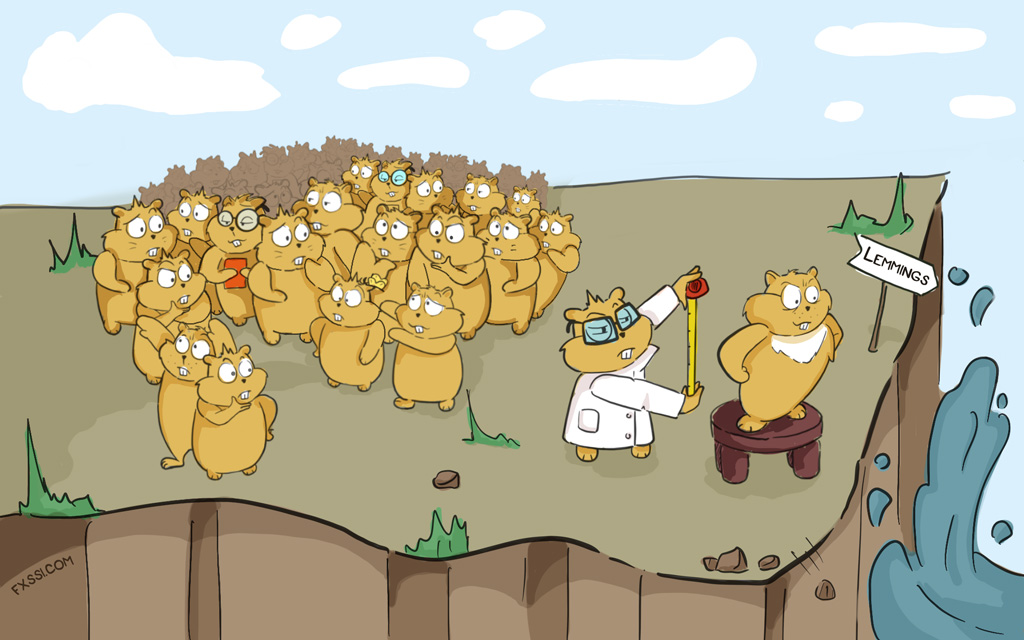

- The following saying is almost the market axiom: “The price always goes against the crowd.” Therefore, you’ll increase your chances of success by an additional percent, if you open your trade “against the crowd”.

- Moreover, our personal experience shows the following thing: if there is a strong trend in the market, most traders open their positions against it. Thus, the statement, which says that when you open a position against the crowd, you open it towards the trend, is true.

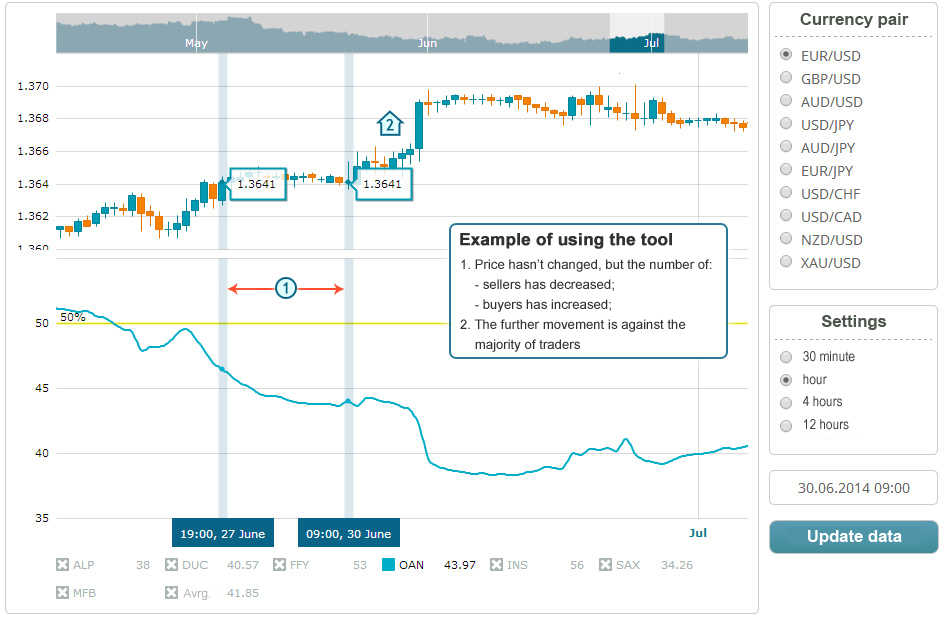

- Sometimes you can see the following market picture on the chart: “passengers have been put on a train” or “extra passengers have been put off a train”. Here is an example of it:

Read also 3 Strategies for Analyzing the Ratio of Open Position in Forex.

Now let’s consider the tools.

How can I use the tools?

Let’s clear up this point: the percentage value of long positions is shown on the chart. Since the total percentage value of short and long positions is equal to 100%, you can easily calculate the percentage value of short positions by subtracting the percentage value of long positions from 100%.

How Can I Calculate an Average Percentage Value?

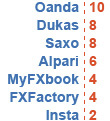

Since every broker has a different trading volume, it would be incorrect to calculate the average percentage value of open trading positions by a simple method of arithmetic mean. For example, the Oanda’s volume of open positions is several times larger than that of the Myfxbook’s.

Every broker is assigned the “weight”, so that you can see the difference in their volumes: the higher is the “weight”, the stronger is its affection on the average percentage value of open positions. The approximate “weight” of every broker is shown on the picture to the right.

Conclusion

The information provided in this article must not be regarded as a reference guide, since there is always an option that the price will go in the opposite direction than that indicated by your signals. The market often looks like a tug-of-war, where five people compete with ten ones.

It would be interesting to hear from you what kind of methods you apply to analyze open positions of traders. We’ll be happy to answer all your questions in the Comments section below.