Forex Sentiment - Overview

The Forex Sentiment tool is essential for traders who practice sentiment analysis. It provides data on the buyer-to-seller ratio for different currency pairs and gathers information from various sources.

This tool not only reflects the collective mindset of traders but also provides actionable trading signals, making it an indispensable asset for both novice and experienced traders.

This tool is very flexible. By analyzing the data and integrating it into your strategy, you can get signals, guidance for trade direction, or confirmation for your trading setups.

Before you begin trading with the FX Sentiment tool, here are some important articles you should read:

- SSI in Forex Trading – Everything You Need to Know;

- Order Book Guide – (Series of five articles);

- Does the Ratio of Open Positions Work?

- 3 Strategies for Analyzing the Ratio of Open Positions;

- Sentiment Strategy: Beginner’s Guide;

- Stereotypes of the Market Crowd Behavior.

How to read Forex Sentiment

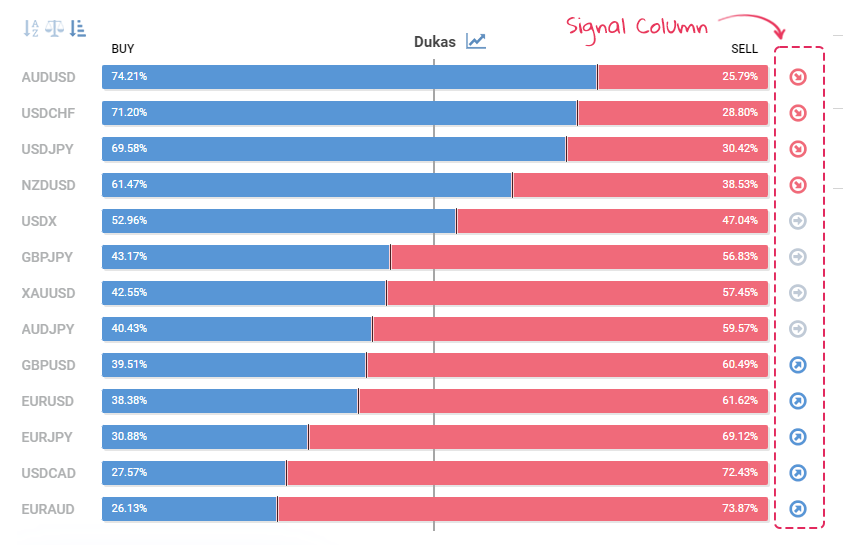

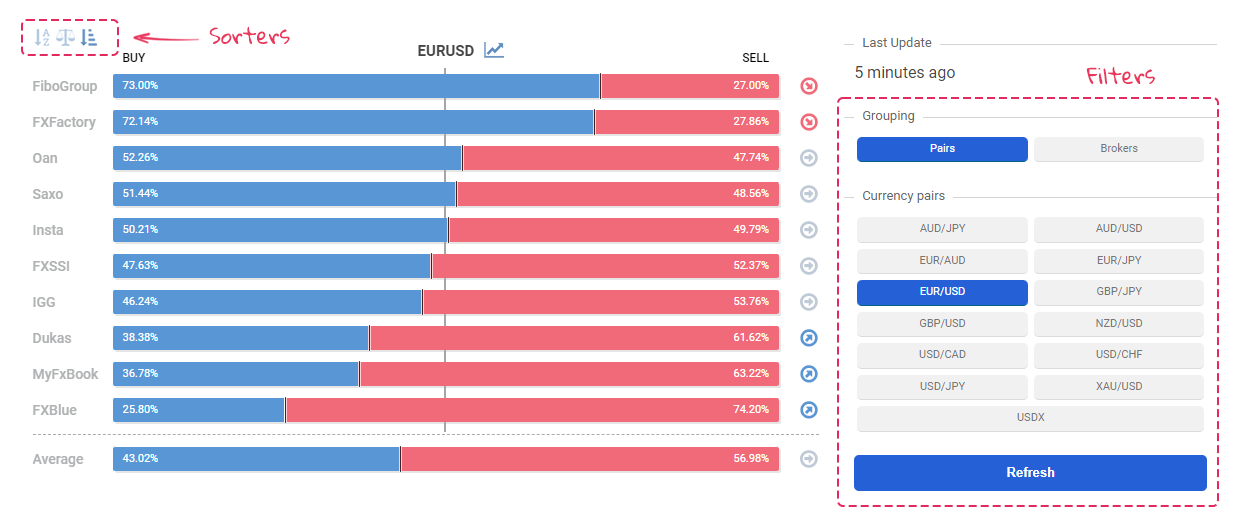

The histogram bars on the tool show a percentage that reflects the difference between the number of buying and selling trades. Importantly, trades that are already closed do not influence the indicator’s readings.

- The blue bar indicates the percentage of Buy trades,

- The orange bar displays the percentage of Sell trades.

If you look at the signal arrows to the right of the histogram, you can see the contrarian mechanics behind the indicator’s strategy. Let’s explore the logic behind this.

A common belief is that approximately 95-99% of traders lose money in the market, meaning they trade at a loss. Therefore, trading in the opposite direction to the majority of traders could be profitable.

This indicator was specifically designed for a rapid evaluation of the current sentiment among the majority of traders.

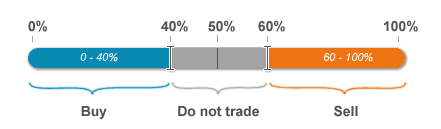

The image above demonstrates the simplest way to analyze using this indicator. If you observe more than 60% of buyers in the market, you should consider a Sell trade. Conversely, if there are 60% of sellers, you should be looking for a Buy trade.

Note that 60% is a flexible threshold and can be adjusted based on your requirements. Lowering this value will result in more signals, though they may be less accurate. Conversely, a higher value will yield fewer signals, but with greater accuracy.

What is the benefit of analyzing several sources of Forex Sentiment?

In this tool, we have aggregated data from multiple sources to enhance the overall effectiveness and potential output.

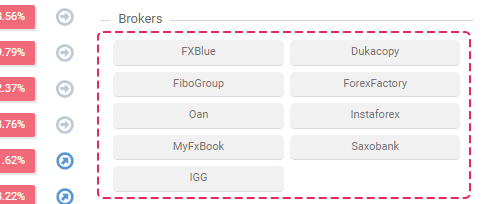

The FX Sentiment tool by FXSSI includes data from the following well-known brokers and services:

- Oanda,

- Ducaksopy,

- IG Group,

- Fibo Group,

- Instaforex,

- MyFxBook,

- FXBlue,

- FXSSI,

- ForexFactory.

Now, let’s get to the main point. By analyzing data from multiple brokers, you reduce the risk of relying on potentially misleading data from a single source. For instance, a large trade at one specific broker could skew the indicator’s readings in a way that doesn’t reflect the whole forex market.

Additionally, your confidence in the data increases when all sources agree, compared to when they are divided, with some indicating to buy and others to sell. This allows you to assess the potential risk of a trade more accurately, based on how many sources confirm your trading setup.

What does the Market Sentiment data actually show?

As we’ve mentioned at the beginning of this article, FX Sentiment shows the percentage of buyers and sellers.

But what kind of buyers and sellers are they?

After all, we know that any trade in Forex involves two participants. If you’re buying, then someone else is selling to you. So, how, in this case, can the ratio of buyers to sellers be any different from 50 to 50?

The thing is that the positions ratio that we are talking about is the ratio among retail traders. That is, the number of commercial and professional participants is excluded from this indicator.

At the beginning of this article, we discussed how FX Sentiment displays the percentage of buyers and sellers.

But who exactly are these buyers and sellers?

After all, we know that any trade in Forex involves two parties: if you’re buying, someone else is selling to you. So, how can the buyer-to-seller ratio differ from 50 to 50?

The key point here is that the ratio we’re referring to is specific to retail traders. This means that the numbers do not include commercial and professional participants; they are excluded from this indicator.

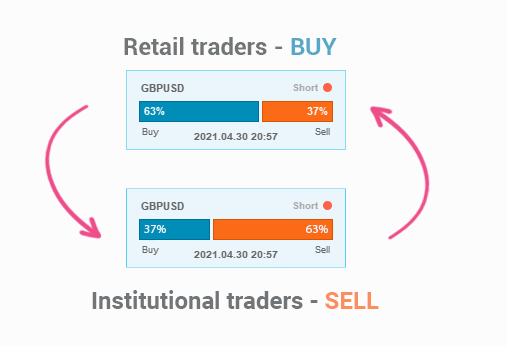

Therefore, FX Sentiment doesn’t just reveal the overall ratio of buyers to sellers; it specifically displays the ratio between retail buyers and retail sellers.

How do we tell retail traders apart from professional ones? Most sources for client positions on the internet come from brokers and services that work mainly with small retail traders.

It’s generally true that the combined position of big institutional traders mirrors what retail traders are doing. This concept is at the heart of trading based on sentiment ratio.

When you trade against the majority, you’re essentially trading in the same direction as the professional traders. Statistics show that these professional traders are usually more successful than retail traders.

How to trade Forex Sentiment

Features of FXSSI Forex Sentiment tool

The FXSSI Forex Sentiment tool comes packed with a range of features designed to give traders a comprehensive view of the market. In this section, we’ll explore the key functionalities and innovations that set this tool apart, providing users with detailed insights and a more informed trading experience.

Trading Signals. The tool generates signals based on the percentage of buyers and sellers.

A sentiment above 60% buyers indicates a sell signal, while below 40% buyers suggests a buy signal. The range between 40% and 60% is considered neutral, signaling market indecision.

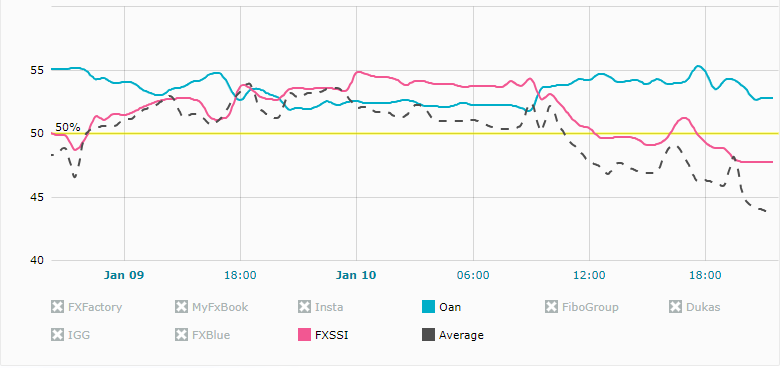

Weighted Average Value: Unlike standard averages, the FXSSI FX Sentiment tool calculates an average value where each broker is assigned a specific weight, ensuring a more accurate and representative market sentiment.

Every source adds a certain amount of influence to the average, as illustrated in the above picture, offering you more dependable data according to our research.

Customizable Sorting Options. You can sort the Forex Sentiment data alphabetically, by source weight, or by value, offering flexibility in data analysis.

USDX Symbol Feature. The USDX symbol has been integrated into the tool, calculated using the original USDX formula that includes the pertinent currencies. This feature is useful for gauging the overall sentiment of the USD, and it can serve as a correlation factor in your trading decisions.

FX Sentiment Charts. Within the interface of this tool, you can access charts of this data by clicking on the chart icon located next to the name of the currency pair.

This action will direct you to the Ratios tool, which displays the same currency pairs and brokers but offers historical charts of the sentiment ratio. This feature allows for an in-depth analysis of past market trends and sentiments.

Forex Sentiment Live Tool Interface

Sort options. The tool offers three options to sort data for more tailored analysis.

- Alphabetical Sorting: This option lets you organize the sources or currency pairs in alphabetical order.

- Sort by Weight or Currency Pair Volume: This filter arranges the data based on the importance or volume of the trades.

- Sentiment Ratio Filtering: This allows you to view the data according to the proportion of buying to selling sentiment, from highest to lowest.

Grouping Function. The tool includes a feature that allows you to switch the view from currency-specific to broker-specific. In Currency mode, you can view all available sources for a specific currency pair. Conversely, in Brokers mode, you have the ability to see sentiment data for all available pairs from a specific broker.

Currency Pairs. Here is the list of available currency pairs for this tool:

- AUD/JPY;

- AUD/USD;

- EUR/AUD;

- EUR/JPY;

- EUR/USD;

- GBP/JPY;

- GBP/USD;

- NZD/USD;

- USD/CAD;

- USD/CHF;

- USD/JPY;

- XAU/USD;

The “Refresh” button on this tool refreshes the data, providing you with the latest information for FX Sentiment indicator.

The FX Sentiment tool is an innovative solution that empowers Forex traders with crucial market insights. Its comprehensive features, ease of use, and real-time data make it an invaluable tool in a trader’s arsenal, helping to navigate the complexities of Forex markets with greater confidence and precision.