Stereotypes of the Market Crowd Behavior

Bob spends a lot of time sitting in front of his computer every day trying to profit from exchange rate fluctuations. Let's take a look at one of the typical days when Bob tried to earn a profit.

He thinks he is an advanced trader since he has read a ton of articles and books on trading. He has even developed his own trading strategy based on the acquired knowledge.

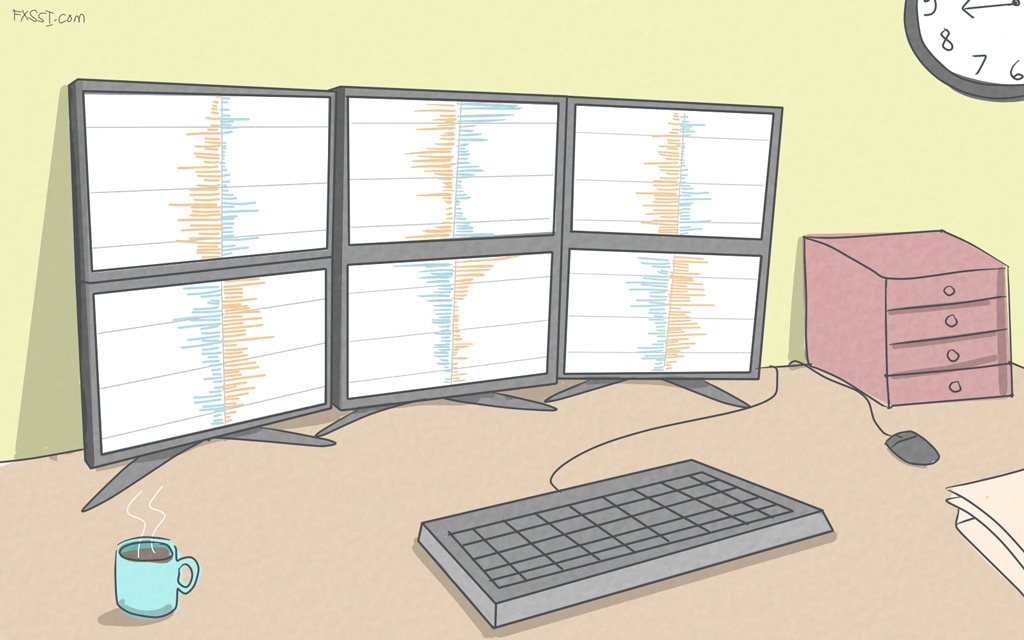

The first thing Bob does after turning on his computer is launch a trading terminal. There are many currency charts opened there – he flicks through them searching for any trading signal.

Unfortunately, his first attempt to find a market entry point has failed.

"But I've already opened the terminal anyways!" says Bob. "I need to open a trade". After setting the task Bob begins to monitor signals more carefully…

When he discovers a signal that doesn’t really exist, he opens a Buy trade and writes down his thoughts in his trading journal since he considers himself to be a serious trader:

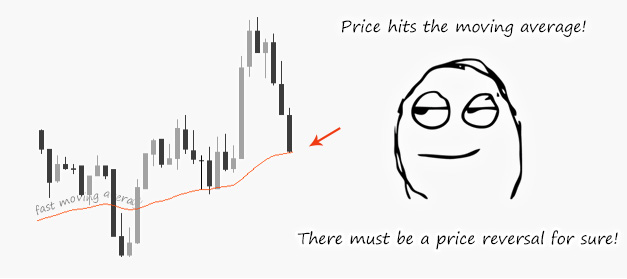

"I’ve bought the EURUSD pair by following a signal: at first the price plunged down and then it hit the moving average, which indicates a price reversal". And he added a corresponding picture:

The next step for Bob is to think about how to take profit and not to actually miss it… "Well… why don’t I just set the take-profit?" So, wthout further consideration he places a Take-Profit order about 20 points away from the current price.

But what about the stop-loss? Bob usually doesn't set stop-losses, since he's always in front of his computer and closes all trades manually.

So, his trade has been opened without the stop-loss and the price doesn't seem to move in any particular direction.

"While the market is inactive, I’d better go and play some shooting game," says Bob.

After half an hour he remembers that it's time to check the terminal… Looking at the screen, he sees that the price has dropped by another 50 points and now he's got a floating loss at $50 on his account.

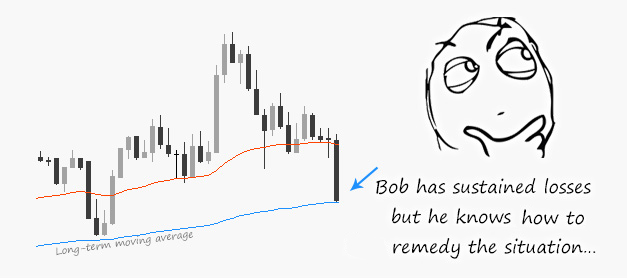

Bob is wondering: "How is that possible? I have never seen anything like this in my life! The price will definitely not keep moving down since it has hit the long-term moving average this time. And it’s a 100% guaranteed reversal!" Then he buys the same amount of currency, i.e. he doubles up his position against the impulse.

After another half an hour, the price has slightly bounced off, and Bob's floating loss has turned into a small profit. Inspired by the feeling that everything seems to be going according to his plan, he finally decides to set the stop-loss (to protect himself against losses) at the weekly low level.

As soon as he does this, some strange things start to unfold in the market…

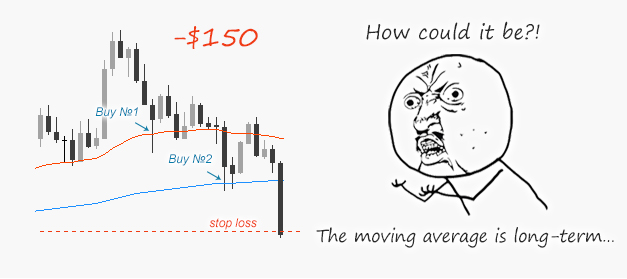

The price starts to rapidly move up and down, eventually making Bob’s Stop-Loss order trigger at a loss of $150. Bob sits there wide-eyed asking himself a question: "How could it be?! The moving average is long-term…"

This is what happened to Bob.

Perhaps, some of you have recognized yourself in Bob’s behavior or you might have experienced this firsthand some time ago.

The moral of the story is simple, though: there are behavioral stereotypes in trading that made it possible to come up with a "portrait" of Bob.

Now let's move onto a bit more serious topic and take a look at the basic stereotypes of the market crowd behavior.

We will take into account the behavior that affects the market directly, for example: opening a trade, placing a Buy Limit order, etc. We won't look at various psychological aspects and poor money management.

Prior to writing this article, we've conducted some research that helped us gather the data provided below.

So, let’s start.

Stereotypes of the Market Crowd Behavior

1. Most Trades are Opened Against an Impulse

In other words, these are the trades that are opened against a trend or attempts to catch a reversal.

We will not dwell on the problem of trend identification. In fact, one can notice that when the price continues to move in one direction for a long time, there are many people willing to open their trades against this movement. Most of them don’t believe that the price will keep moving in the same direction, since it has already moved a rather considerable distance up or down.

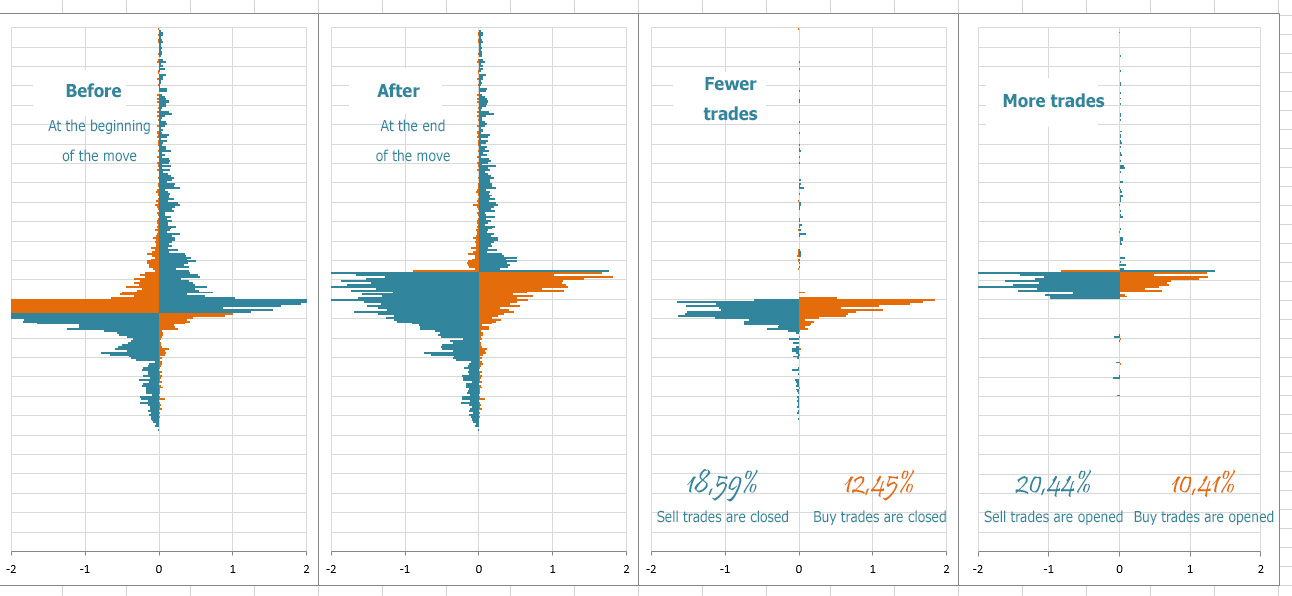

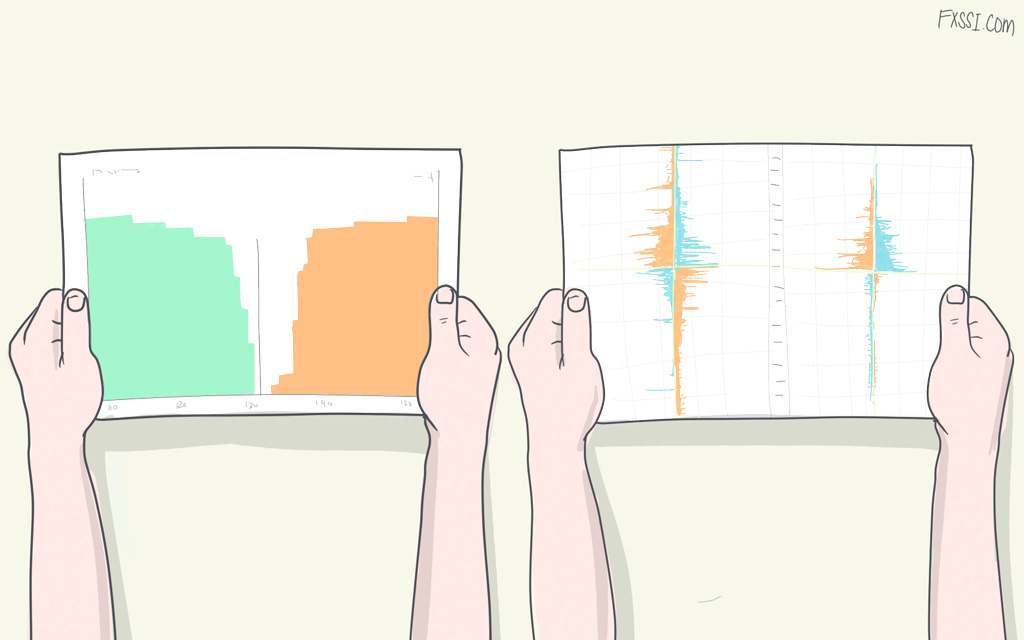

Let's take a look at the following situation:

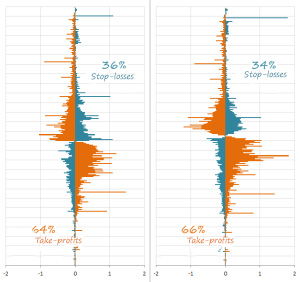

The left side shows us the situation on the market at two certain points in time; and the right side displays the difference between these points. “Fewer trades” stands for those trades that have been closed and “More trades” stands for those that have been opened during this movemenet. The given example clearly shows that a lot more Sell trades than Buy trades have opened during this upward movement.

If we think about the number of trades opened with an existing trend, 60% of trades are opened against a trend and only 40% of the trades are opened following a trend.

Our desire to open trades approximately at these points – near the border of a pattern that doesn’t have an established top – underlies this stereotype.

2. Winning Trades are Closed About 2 Times Faster Than Losing Ones

A normal human fear is the root cause of this stereotype. We’re afraid to incur losses but we happily take profits.

This is the reason why the average time of a winning trade is 1 hour, and a losing trade usually stays open for more than 2 hours.

Another interesting aspect is that at some point in time this kind of behavior will result in the increase of losing trades on the market. You can see for yourself if you take a look at the percentage dynamics of winning traders using this analytical tool. Once you do check it out, you’ll see that the percentage of winning traders rarely exceeds 40% and it usually ranges from 30 to 35 percents.

By the way, the first and the second stereotypes greatly contribute to the superiority in the ratio of open positions that we apply in trading.

3. Stop-Loss is Set Far Less Frequently Than Take-Profit

Most newbie and more experienced traders really "suffer" from not setting stop-losses.

The reason lies in a human psychology again… We don’t know where we should set a stop-loss so that it will not be randomly triggered by price, so we prefer not to set it at all – we act just like Bob who closes all his trades manually.

As you can see, the ratio of stop-losses to take-profits roughly equals 1 to 2, i.e. only 40% of all open trades have stop-losses.

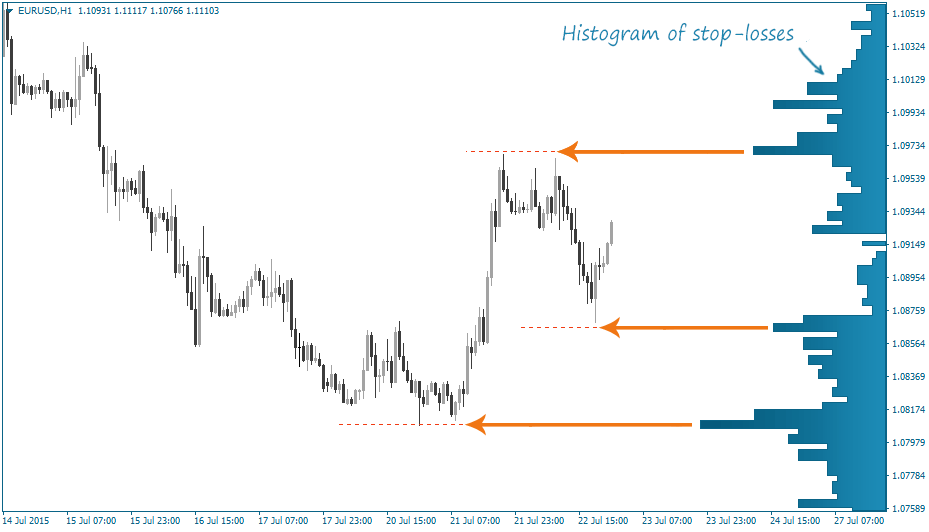

If you look at the chart below, you’ll understand why it equals exactly 40%.

4. Extremes are the Most Popular Levels Where the Market Crowd Sets Their Stop-Losses

You've probably heard that stop-loss should be set above a local high or below a local low. This assertion is usually supported by the idea that if the price does hit a local high/low it will certainly move further.

Of course, there is some logic behind it. However, that was true some time ago when the market resembled a flock without a sheepherd. When the price was approaching the previous peak, growing panic swept through the traders, and the price skyrocketed beyond this peak. This is why the crowd picked up a habit of moving their stop-loss to these high and low levels.

Today, however, the market is controlled by market makers. And such levels with stop-losses are of the greatest interest to them in terms of opening new trades.

Despite the market change, the habit of setting stop-losses at extreme levels remains the same:

Here's an approximate scale of this habit: the density of stop-losses at extreme levels is two times higher than at other price levels. One can see it with the naked eye even in the picture above.

5. 80% of Trades Have Take-Profit

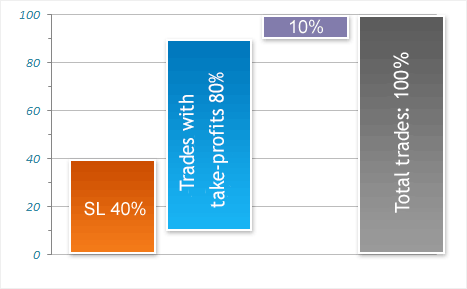

People are more eager to set a take-profit than a stop-loss. We've already tackled the topic of the reasons behind this, so now let's focus on an interesting chart instead:

Here's a short explanation:

- 40% of trades have stop-losses, and 30% of those have take-profits as well;

- 80% of trades have take-profits, and 30% of those have stop-losses as well;

- 10% of trades have neither take-profits nor stop-losses.

This chart displays a general idea, but the real figures might differ.

6. Take-Profit is Set Practically Without Any Reference to Levels

Take-profit is basically set without reference to any price levels. This is due to the fact that the variety of methods for setting take-profits is much wider than for stop-losses.

Of course, we can always find situations where we could see a cluster of take-profits, but their density is going to be much lower compared to stop-losses. The density implies the ratio between average trading volumes at extreme levels and beyond them.

Conclusion: the average mass of traders sets take-profit chaotically without any indication of the "crowd".

7. Most Trades are Opened Almost Randomly

If we study the clusters of trades at particular levels, we’ll notice a certain regularity: the longer the price has stayed at one of these levels, the larger the volumes of open trades at this level. Well, it's kind of obvious. However, this leads to the conclusion that trades are evenly distributed in time. So, there are no common entry points, and everyone enters the market whenever they want.

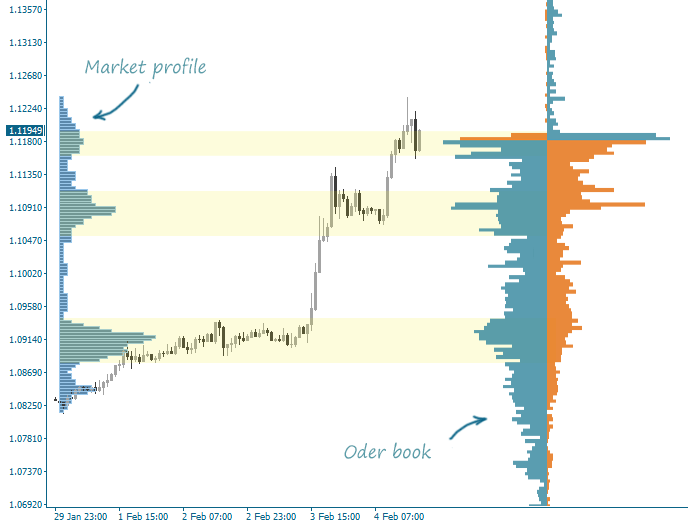

Let's take a look at the following example:

On the left we can see the market profile built on the basis of the time that the price has spent at every price level. The right side of the chart above displays the order book. Take a look at the areas colored in yellow. There are larger trading volumes in these areas both in the market profile and in the order book. And if we look at the chart, we'll see a ranging market in these areas.

Conclusion: many traders trade involuntarily, even when there are no signals, just like Bob from our story. They just want to open a trade, and they will always find a reason to do this. Their motivation might lie in the absence of systematic approach or in a great variety of entry signals of all kinds.

8. On Average One Open Trade Accounts for 3 Pending Orders (Including Stop-Losses And Take-Profits of These Open Trades)

This is the last but equally interesting stereotype in our today's article.

Based on the research data, the number of pending orders is on average three times larger than the amount of open trades.

This makes sense since one trade can have two pending orders – a stop-loss and a take-profit. However, these orders make the ratio of an open trade to pending orders equal to no more than 1:2, but the data suggests that the ratio should be equal 1:3. The fact is that Limit and Buy & Sell Stop orders account for the remaining volume of the pending orders.

If we also take into account the previous stereotypes and the fact that not all trades have a stop-loss and a take-profit, we’ll get the following ratio of pending orders existing in the market:

- Stop-Loss orders – 14%;

- Stop orders – 20%;

- Take-Profit orders – 28%;

- Limit orders – 40%.

Overall, it doesn’t matter to us (who trade against the crowd) what kind of order it actually is – either a Take-Profit or a Limit order – since they are one and the same to the market makers.

How Not to Blend in With the Crowd

But wait! What's the point? The point is that you’ll stop being the "food" for market sharks, if you get rid of these sterotypical patterns. The crowd is the one feeding all the major market players. The less you resemble this crowd, the smaller the chance that you’ll be "eaten" together with this crowd.

If you have recognized yourself in some of the stereotypes above, you’re at risk.

Here are our recommendations on how not to blend in with the crowd:

- Open your trades solely in the direction of a current impulse. Never do anything like this.

- Always set a stop-loss outside of round-numbers and areas of highs & lows. Here's the best technique for setting your stop-losses.

- And as for your take-profit, we'd recommend you to sometimes disregard it. Usually, when we predict the right market direction, the price can keep moving further in this direction for quite some time.

- If you decide to set a take-profit, it's always better to do it inside a cluster of stop-losses – there are usually local extremes in this area. Imagine that all traders are complaining that the price always triggers their Stop-Loss orders, but in your case it will regularly trigger your Take-Profit orders instead. Wouldn't this be awesome? Learn more about this technique here.

- Enter the market only when you really have a signal. Most of our troubles come from opening trades only because we’re sitting in front of our computer and our desire to trade right away. And then we get angry with ourselves for having entered the market.

- Switch your attention from profits to losses. You must ensure that the losses will always be within the limits, close your trades in time, and profits can "take care of themselves".

- And one more thing: enter the market using specifically Limit orders (and not Buy/Sell Stop orders) with pre-set stop-losses and take-profits.

Many of the given recommendations are not new or unknown, but now that you understand the behavior of the market crowd, you are able to sort out other, less useful recommendations.

Of course, blindly following the advice won't guarantee you profits, but at least it will help you avoid losses.