How to Set Take-Profit Properly?

If it seems to you that price doesn’t hit your Take-Profit order level intentionally and constantly or you simply don’t know where to set your take-profit, you’re in the right place.

In this article, we’re going to learn at what levels take-profit setting is more effective and highlight certain characteristics of the market "crowd" behavior when setting take-profit.

First, let’s determine what kind of take-profit (TP) can be regarded as properly set.

Theoretically, the take-profit which (in addition to the potential defined in an order) has an additional probability of triggering by various swings, for example, market noise or price false breakouts, can be regarded as properly set.

In other words, TP should be set at the level, which can be randomly touched by price even if you have opened a trade of the wrong direction.

It’s important to understand a number of characteristics of most market participants’ behavior when placing a Take-Profit order.

Tricks of Take-Profit Setting

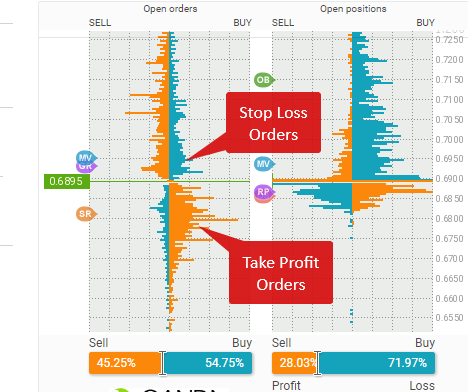

- Unlike stop-losses, take-profits are set by almost all the traders due to a trading psychology. Remember how often you want to forget about stop-losses at all. In the following picture you can see the differecnce between stop loss and take profit orders in amount:

- There is no such a classical idea of where you need to set TP. In most cases, TP is set in accordance with a pattern-based strategy, by an indicator or in a random way at all. If we collect data on the take-profits set by a great number of traders and draw the histogram showing the dependence of a certain price on the volume of Take-Profit Orders opened at the given price, we can see that the volume has been evenly distributed among all the prices on the whole.

Better Levels For Take-Profit Setting

We shall take the approach identical to that used in the article on stop-loss in order to identify the right levels for the take-profit setting.

I remind you that we watched for the areas where many Stop orders had been accumulated and attempted to avoid the areas so that we could set the right stop-loss. As for TP, we’ll make use of the areas of orders accumulation as an opportunity to improve our chance of making a successful trade.

Let’s look at the levels where Stop orders are accumulated (this data were taken from the order-book):

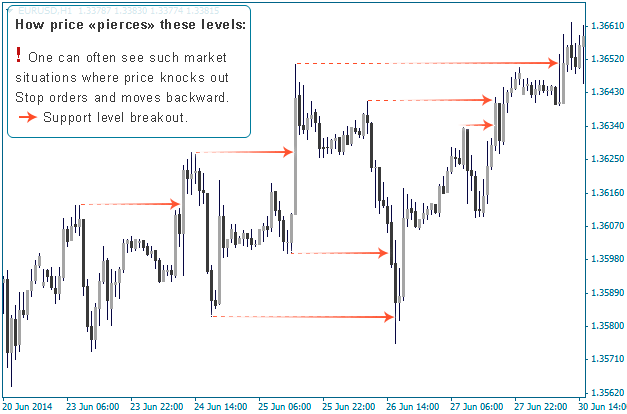

Here is a higher probability of price moving through the areas. So as not to speak without proof, let me provide you with an example of how price "pierces" the levels:

Conclusions:

The rule behind a regular knocking out orders is as follows: the majority must lose so that the minority earns a profit. This is why a strategy of placing orders "against the market crowd" justifies itself.

I dare not call a particular take-profit the wrong, so I’m going to highlight a neutral and the right take-profit:

Neutral TP is a TP set randomly or based on a strategy, but regardless of the levels of orders accumulation and round price levels. In this case, the probability of taking profit equals the quality of a trade.

The right TP is a TP set according to your trading strategy but allowing for the levels of orders accumulation and round price levels. It works fine in practice even if you open a trade of the wrong direction.

We have determined what the right take-profit is. Now let’s learn where to set it.

There cannot be the single right take-profit for a particular trade, since there can be a lot of them depending on the long-term character of your strategy. Ways of setting the right take-profit are shown on the picture to the right:

You can set take-profits, for example, on M30 charts where you should watch for previous price highs & lows or round price levels. The basic message which we want to convey to you in this article is that whatever level your profit target is at (it depends on your strategy), take-profit should be moved towards at the support and resistance levels and round price levels.