How to Trade the Breakout and Retest Strategy in Forex

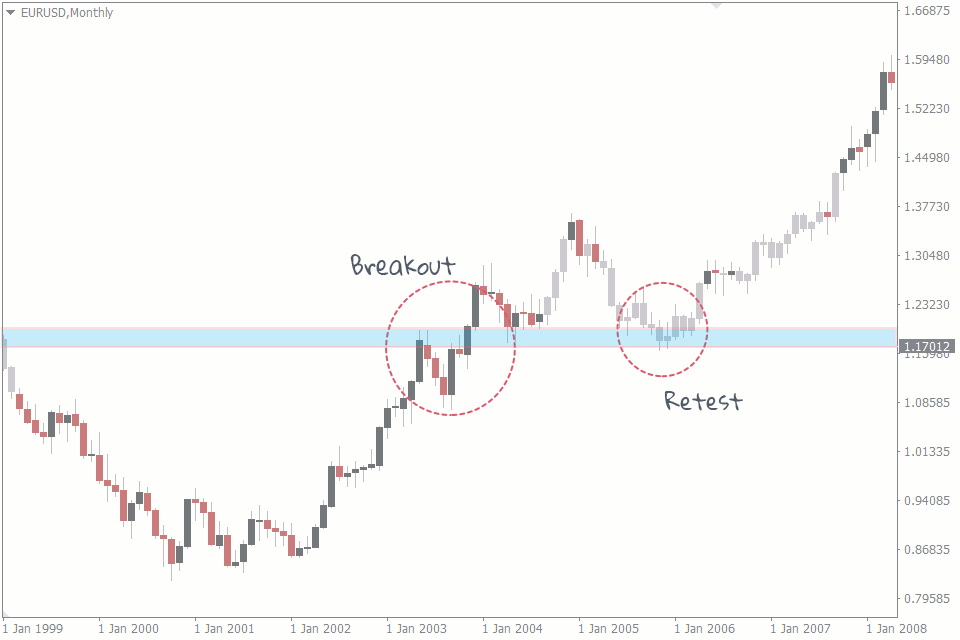

After a price breakout, you could trade the breakout candle or wait for a retest of the breakout level. The first approach is risky. Therefore, in today's article, we're going to take a look at the second one as more efficient.

What the Breakout and Retest Strategy is About

The breakout and retest strategy is the one that many traders adopt when trading forex trendline breakouts or support and resistance levels. The strategy is designed to help forex traders do two main things.

The first is to avoid false breakouts. Many false breakouts start with a string candlestick that breaks out of a level but ends with an immediate candlestick that brings the price back into the level.

Unknowing traders would have traded the first breakout candle and gotten faked out on the next candle. But with the breakout and retest strategy, you wouldn’t even be in the trade at the breakout.

The second thing that the breakout and retest strategy does is that it helps traders confirm a new trend. When the price breaks out from a resistance level and retests it on the other side, for instance, it is a clear signifier that a new support level has formed and a new trend has begun.

How to Trade the Breakout and Retest Strategy

When using the breakout and retest strategy, the first thing to do is to identify and draw your support and resistance levels correctly. You may be easily tricked into false breakouts without marking out your levels properly. You can also rely on this Support and Resistance indicator to help you mark the levels.

The next step is to await breakouts from your drawn levels. And when your breakouts come, resist the urge to make any trade, no matter how far the momentum carries the price before the retracement. If you did this, it would only be a breakout strategy and not a breakout and retest strategy.

When the retracement finally occurs, don’t place your order until a retest happens. There are times when the price falls back into the level it recently broke out from, taking out your stop losses.

When the retest happens, don’t place your order yet. When then do you get to place an order? Place your order after the first candlestick after the retest. This candlestick must confirm the new price direction. This candlestick tells you that the new trend is now on the move, and you can jump on it.

Pros and Cons of the Breakout and Retest Strategy

The breakout and retest strategy is not foolproof. It has its benefits and shortcomings. And knowing them would help you understand how to play to the strength of the strategy while limiting the effects of the weaknesses on your trades.

Pros

- The strategy helps you avoid false breakouts. Most forex traders who fall for the false breakout often make their trades on the first breakout candlestick. But when you use the breakout and retest strategy, you avoid false breakouts and enter a newly established trend.

- The strategy helps you get into a trade at the best positions. The breakout and retest strategy offers you a good position to get into a trade. After the first breakout, many traders chase the breakout by “getting into the trade quickly” before the price goes too far. But what they’re actually doing is getting into the trade at the worst time because they’re either buying at a higher price or selling at a lower price. A typical example is in the chart below.

Cons

- The retest may never come. The retest doesn’t always come, causing traders setting up the breakout and retest strategy to lose out on potentially major moves.

- The retracement is sometimes incomplete. There are also times when the retracement does not return to the level the price broke out from. This situation could confuse traders, as some wait in vain for a complete retracement, while others are confused about the next step. If you find yourself in situations like this, place your order on the first candlestick after the first retracement you see. If that retracement happens to be the only retracement, you would have made a good trade. And if the retest eventually completes, you would still have gotten into the trade at a fair price.

- The retest sometimes gets faked out. This happens when the price returns to the level it broke out from instead of retesting and bouncing off the newly formed level. This is why we recommend that you only enter the trade on the first candlestick after the retest because this candlestick is usually a confirmation that the newly formed level would hold.

Tips on Trading the Breakout and Retest Strategy

You already know enough to trade the breakout and retest strategy if you've made it this far. But before you go, keep these tips at the back of your mind. They’ll help you make the best of the strategy.

- Wait for the first candlestick after the retest. We can’t emphasize this enough. Don’t be in a hurry. Don’t be greedy. Wait for the first candlestick after the retest to confirm your bias before making the trade.

- Practice patience and discipline. Trading the breakout and retest strategy takes a lot of patience and discipline. Because the fear of losing out could overtake you when you see the price racing ahead on the first breakout. This could force you to make rash decisions and enter the trade at the wrong time. But patience and discipline help you wait out the first impulse after the breakout and trade the retest masterfully.

With the forex breakout and retest strategy, you can avoid a lot of false breakouts and still get into trades at good levels.