Simple Inside Bar Trading Strategy

Are you a technical trader? In this article, you will understand a result-oriented candlestick pattern trading method known as the inside bar trading strategy.

If you apply technical analysis then mostly the charts are made up of candlestick charts. Though technical indicators are applied extensively, candlestick patterns play a vital role in providing successful trading signals. In other words, you will see significant trading results if you combine technical indicators with candlestick patterns.

Most forex traders look continuously for profitable day trading or swing trading strategies. However, they fail to specialize in understanding a trading strategy thoroughly. They move from one trading system to other in the quest of finding a better trading system.

The most significant factor of this inside bar trading strategy is the small stop loss. It has low risk against a high reward. In this article we will discuss the identification of the inside bar pattern. And also understand the entry and exit methods specifically.

What are the components of the Inside Bar Pattern?

The inside bar candlestick pattern is a 2 candle pattern. It consists of a first candle which engulfs the second candle. The opening price of the first candlestick is higher than the second candlestick. Similarly, the closing price of the first candle is lower than the second candle.

The first candle is also known as the Mother candle. In simple terms the Mother candlestick engulfs the second candle stick completely.

A bullish inside bar pattern forms when the first candle is a bearish candle and the second candle is bullish. Similarly, in a bearish inside bar candlestick pattern the first candle is bullish while the second candle is bearish.

The important criteria of this pattern are the opening and closing prices of the first candle known as the Preceding candle or Mother Candle. As a deciding factor, the first candle must completely engulf the second candle.

How To Identify The Inside Bar Candlestick Pattern?

Identification of this candle pattern is pretty simple and easy. If you understand bullish and bearish engulfing candle pattern then you can spot it right away. Visually, the body of both candles helps you identify the pattern.

Infact, even the engulfing is very small you should consider the pattern. It is not necessary for the second candle to be engulfed with a comparatively larger Mother candle. All it matters is that you could visually confirm the engulfing.

Also, the pattern is opposite to the outside bar candlestick pattern.

To make it easier to spot inside and outside bar patterns in MetaTrader 4, you can use a handy indicator available for download here. This indicator will assist you in identifying these important forex patterns for your trading strategy.

How to trade the Inside Bar candle Pattern?

You can spot the inside bar pattern in uptrend and downtrend market conditions. Similarly, the pattern occurs as a reversal pattern and continuation pattern. However, you can get significant results if you trade as a continuation pattern.

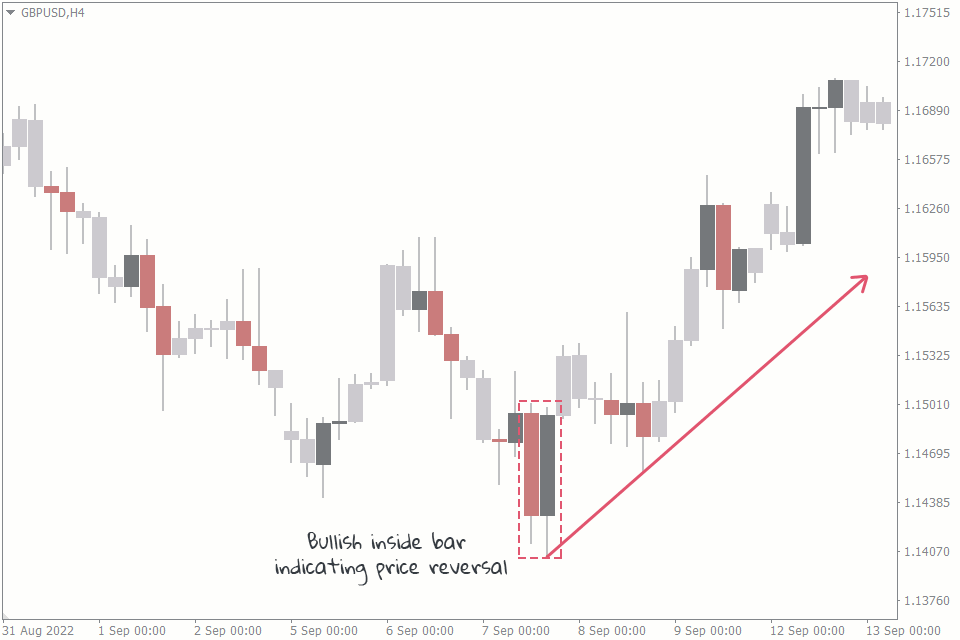

Trading The Reversal Pattern

In the above GBPUSD H4 price chart shows the inside bar candlestick reversal pattern. The price was moving in a downtrend and you can spot two consecutive candles. Here the first candle engulfs the second candle completely. Since the second candle is bullish it suggests a potential price reversal.

Candlestick charts reflect the underlying price action in the market. The second candle shows potential consolidation of the price. In other words, it shows the shift in the market which can be due to various reasons.

However, the most important thing you should note is the price consolidation. So, forex traders should prepare for price movement after the consolidation.

In the above example after the closing of the second candle you could validate the presence of inside bar candlestick pattern. Once the pattern is validated the price indeed reversed its direction and moved upwards.

Similarly, such pattern can be found during an opposite market condition. In that case you can look for potential bearish reversal signal and validate the pattern and trade accordingly.

Such as, during an uptrend if you identify a bearish mother candle and the bullish second candle. The Mother candle should engulf the second candle to validate the inside bar pattern. From here you can look for a potential bearish reversal trading opportunity using this pattern.

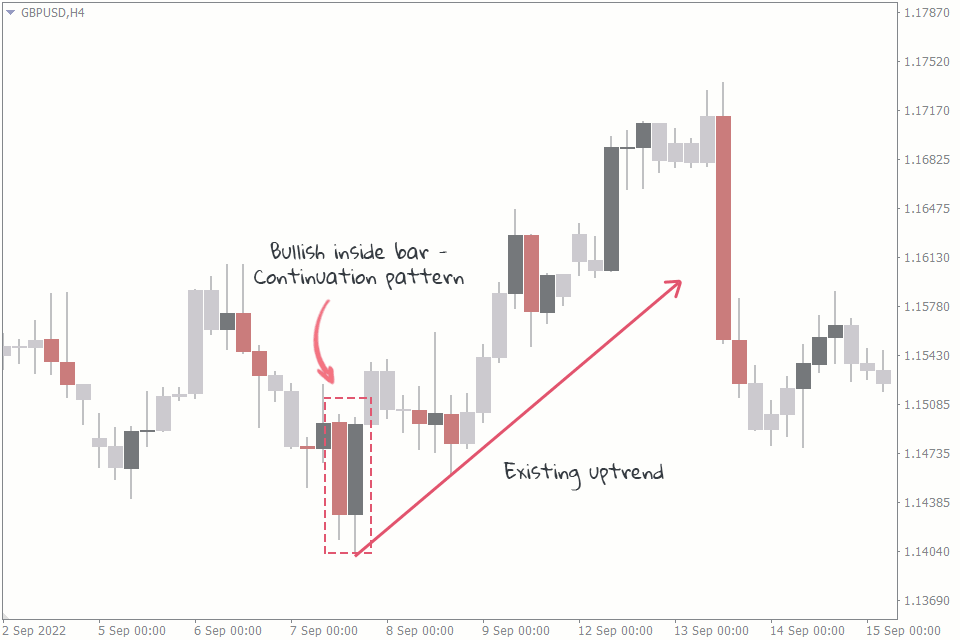

Trading Inside Bar Continuation Pattern

In the above GBPUSD H4, the market is already in an existing uptrend with higher highs and lower lows. You can easily identify the 2 candle inside bar trading pattern during the uptrend. So, the consolidation could potentially due to the pause in the current uptrend.

Once the consolidation is over, you can expect the prices to continue in the trend direction. So, forex technical traders should adopt a trading strategy accordingly. A similar setup could be formed in an existing downtrend which you can interpret accordingly.

Entry and Exit Of The Inside Bar Trading Strategy

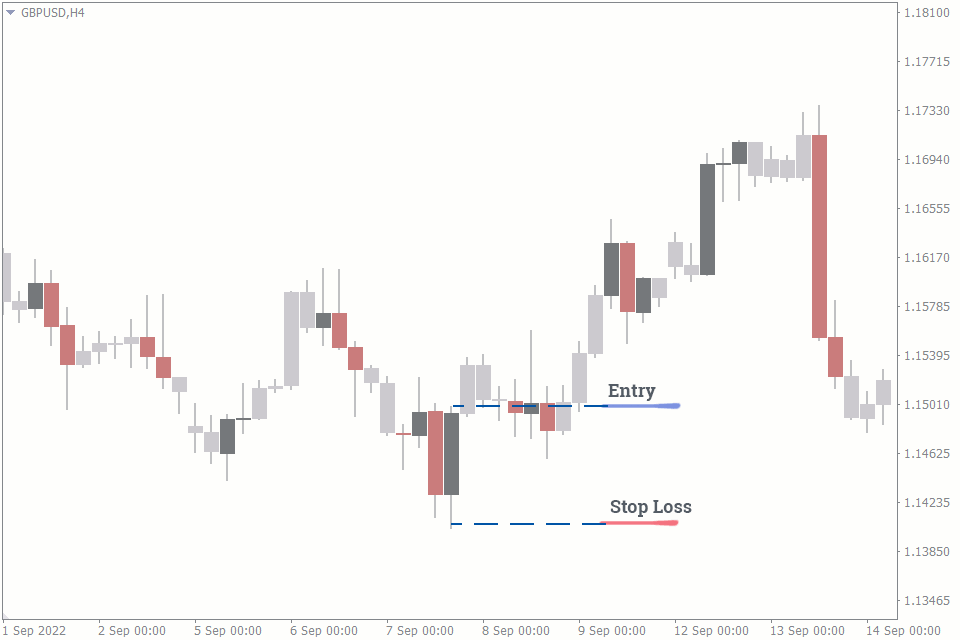

The above GBPUSD H4 candlestick price chart shows the entry and exit method you could follow for the inside bar candle trading strategy.

As mentioned earlier, this candle pattern has a very low risk. Since the entry and stop loss are based on the high and low of the second candle, the stop loss is very minimal. This results in a trade with a very good risk reward ratio.

As the trades result with a good risk reward ratio, trading losses due to false signals are lower. The reward offsets the risk significantly and enhances the end result in this trading strategy.

During a bullish inside bar candle pattern the entry is above the high of the second candle. You can place the stop loss below the second candle’s low.

Similarly, during a bearish inside bar trading strategy the entry point is at the low of the second candle. A stop loss above the second candle’s high is optimal.

A word of caution, most traders rush into the marker before the closing of the second candle. Sometimes, the second candle may stretch a bit longer and invalidate the pattern during its closing. So, traders should wait for the closing of the second candle and validate the inside bar candle pattern.

The Bottom Line

The inside bar candle trading strategy is an excellent pattern with a good risk reward and is very effective. However, technical forex traders can amplify the results if you can validate the pattern near established support and resistance zones.