Trading the Outside Bar Candlestick Pattern

Candlestick patterns are great tools to improve your forex trading experience.

One of the most commonly used among them is the outside bar candlestick pattern. In this article you’ll learn everything you need to know about the powerful outside bar candlestick pattern and how to use it in your forex trading.

What is the Outside Bar Candlestick Pattern?

The outside bar candlestick pattern makes use of the bullish and bearish engulfing candlesticks, two of the most powerful candlestick patterns in forex. This pattern usually involves a small-sized candlestick beside a big-sized one. And as you’ll soon learn, this pattern is often signifying a trend continuation or a reversal.

A bullish outside bar pattern forms when a little bearish candle precedes a large bullish one. Sometimes, the opening price of the bullish candlestick is lower than that of the previous bearish candlestick. In some other cases, the opening prices of the two candlesticks are at the same level.

What matters most, however, is that the closing price of the bullish candlestick is way higher than the closing price of the previous bearish candlestick. This is when one can say that the bullish outside bar candlestick pattern has formed.

The bearish outside bar pattern follows the same steps of formation as its bullish counterpart, only in reverse. This means that the bearish pattern has a large bearish candlestick engulfing a small bullish one.

Identifying the Outside Bar Candlestick Pattern

The formation of the outside bar candlestick pattern is simple: a small candlestick precedes a large one in opposite directions. However, there’s one trap that a trader can fall into, when they try to trade the pattern before it has fully formed.

The reason this is a trap is that there are times when the price shoots up instantly, only to slump down just as rapidly within a short period of time. What we have in the end is a candlestick with a very long wick. And this isn’t what an outside bar candlestick is. It’s not an outside bar candlestick pattern if the engulfing candlestick has not been closed.

Outside Bar Candlestick Pattern Trading Strategy

There are two major ways to trade the outside bar candlestick pattern. The first one is reversal trading, and the other one is trend continuation trading.

Reversal Trading Strategy With the Outside Bar Pattern

The outside bar candlestick pattern can be used to spot potential trend reversals on the chart, since the engulfing candle is merely a graphical representation of the bias of traders. For instance, if the price was in a recent downtrend and a bullish outside bar pattern showed up, it suggests that the bulls are trying to change the direction of the market trend to an uptrend.

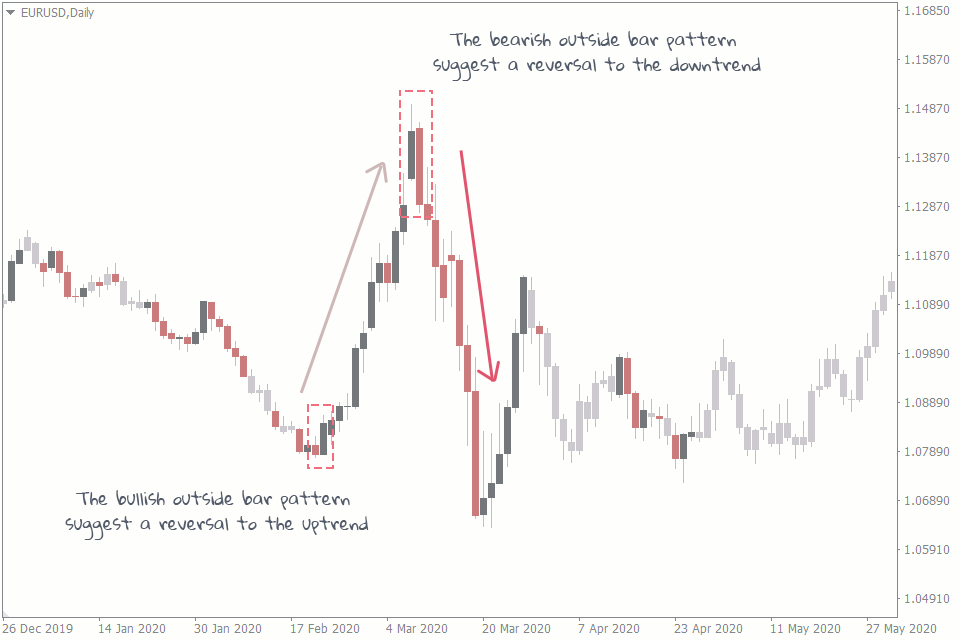

In the EURUSD daily chart above, notice how the price was previously in a downtrend until the bullish outside bar candlestick pattern showed up. This is the point where the price makes a reversal that is going to last for the next few days. Similarly, when the bearish outside bar candlestick pattern shows up, the price reverses towards the downtrend.

Trends that have been going on for long are more likely to have a reversal than new trends. And the longer a trend lasts, the bigger the potential reversal. So, it might be a good idea to try and trade this strategy on extended trends.

Trend Continuation Strategy With the Outside Bar Pattern

The outside bar candlestick pattern can also be used to trade trend continuations. This happens when the trend bias of the engulfing candlestick correlates with the trend the price is currently on. For instance, a bearish outside bar pattern appearing on a bearish trend is suggesting that the bearish trend continues.

Traders who use this strategy hope to take advantage of an already established trend. These could be the traders who want to add to their trades or those who try to get in on the trend after missing out on the trend breakout.

It’s always a good idea to use this strategy in combination with other forex trading tools if you want to reduce your risks. For instance, the FXSSI auto trendline indicator can be very helpful when trying to identify the current trend on the chart.

This way, you can be sure you’re trading a trend continuation when the bias of the outside bar pattern correlates with the bias of the auto trendline indicator.

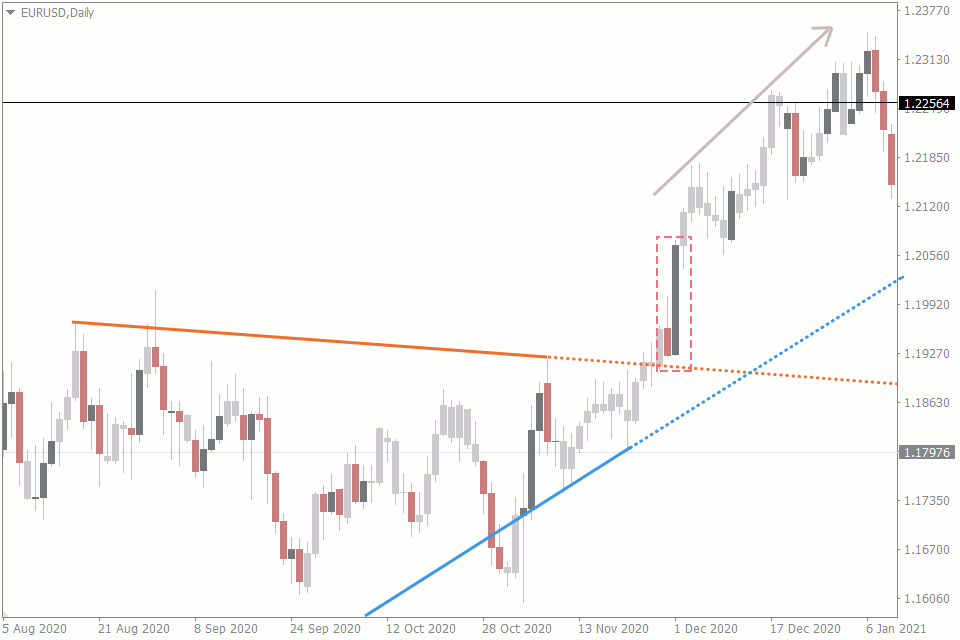

The chart above shows the EURUSD on a daily chart.

The blue line confirms the market is in a major uptrend, while the orange line shows there is a minor rerversal uptrend opposing the major one.

The bullish outside bar pattern appearing on a major uptrend suggest a trend continuation on the uptrend. Also, the pattern appearing right after the breakout from the minor downtrend further suggest a trend continuation. All this suggests that it's a good time to buy.

Notice how the price was on an uptrend before the bullish outside pattern appeared. And after the formation of the pattern, the price has moved up even further.

Trade Entry Tips When Using the Outside Bar Candlestick Pattern

- Always wait for the closing of engulfing candlestick before you enter a position. You’re putting yourself at risk of encountering a fakeout otherwise.

- Set your entry point above the close of the engulfing candlestick in case of a bullish outside bar pattern. If you’ve taken the first tip we’ve mentioned, that means you would be trading soon after the opening of the candlestick that follows the pattern.

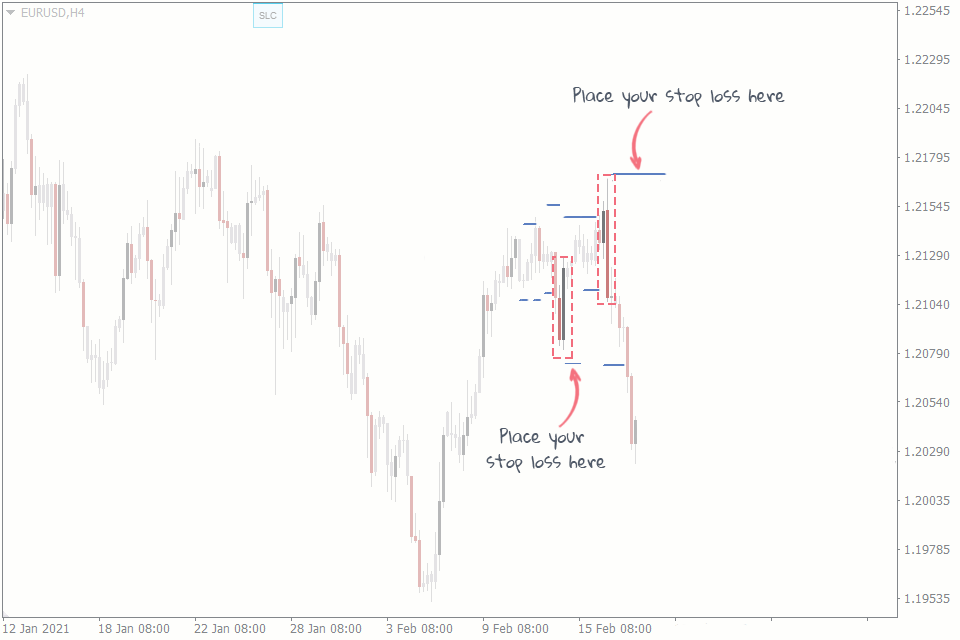

- You can place your stop loss below the opening price of the engulfing candlestick for a bullish scenario. But we recommend doing so while using the Stop Loss Clusters indicator. This indicator shows you where the stop losses of most traders have clustered. The big banks and other forex whales often force the price to temporarily fall to these stop-loss levels to take out the stop losses of retail traders. So you can use the indicator to plan your stop losses properly. See an example in the image above.

The Bottom Line

The outside bar candlestick pattern is a price action tool you can use to spot potential trend continuations or reversals. It’s based on the bullish or bearish engulfing candlestick pattern. And it can prove to be a powerful tool in the arsenal of a forex trader who uses it in combination with other forex trading tools.