How To Trade Liquidity Voids Using Liquidity Zones

Liquidity voids happen all the time in forex. And when they happen, they hardly leave without creating trading opportunities. We discuss how to trade them in this article.

But first, what are liquidity voids?

Liquidity voids are sudden changes in price that occur in forex when the price jumps from one level to another, without enough liquidity between the originating price level and the final price level. They appear on the chart as physical voids in prices or abnormally long candlesticks.

The peculiar thing about liquidity voids is that they almost always fill up. And by “filling”, we mean the price returns to the origin of the gap. The reason for this is that during the gap, an imbalance is created on the pair that has to be made up for. The erasure of this gap is what we call the filling of the void. And while some voids waste no time in filling, some others take multiple periods before they get filled.

What causes these liquidity voids is a subject of argument for many forex professionals. But fortunately for us, we don’t need to know what causes them as long as we know how to trade them.

We will discuss how to trade liquidity voids using liquidity zones in a bit, but for now, let’s discuss the types of liquidity voids there are.

Types of Liquidity Voids

Liquidity voids fall into four major categories, depending on where they appear on the forex chart. And of the four, only two tend to get filled quickly. The others take some time to fill up.

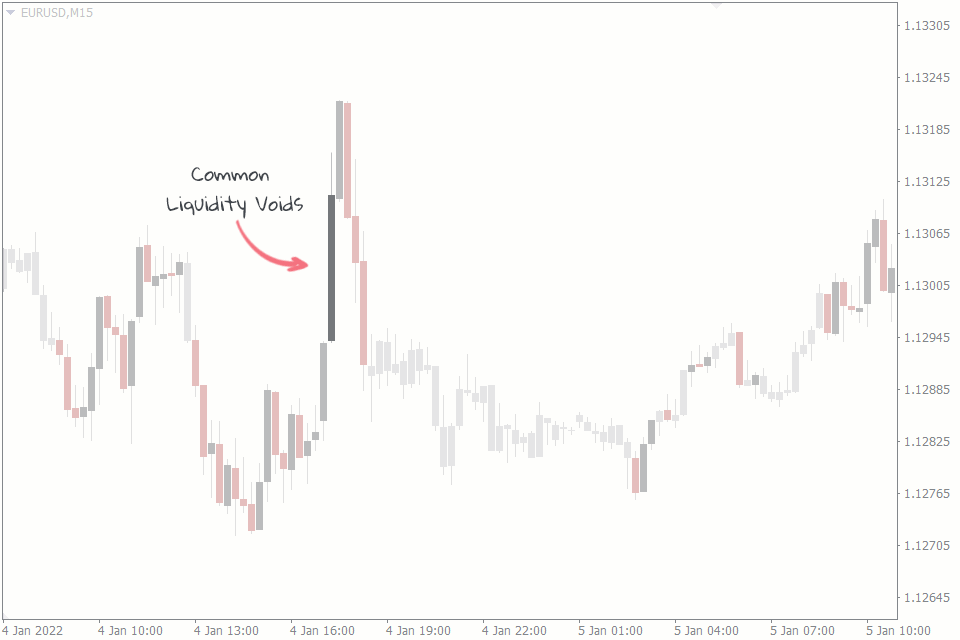

Common Liquidity Voids

Common liquidity voids appear randomly on the forex chart. Often, there is nothing more to their appearance on the chart beyond their mere appearance. In other words, they have no underlying price action meaning on the market.

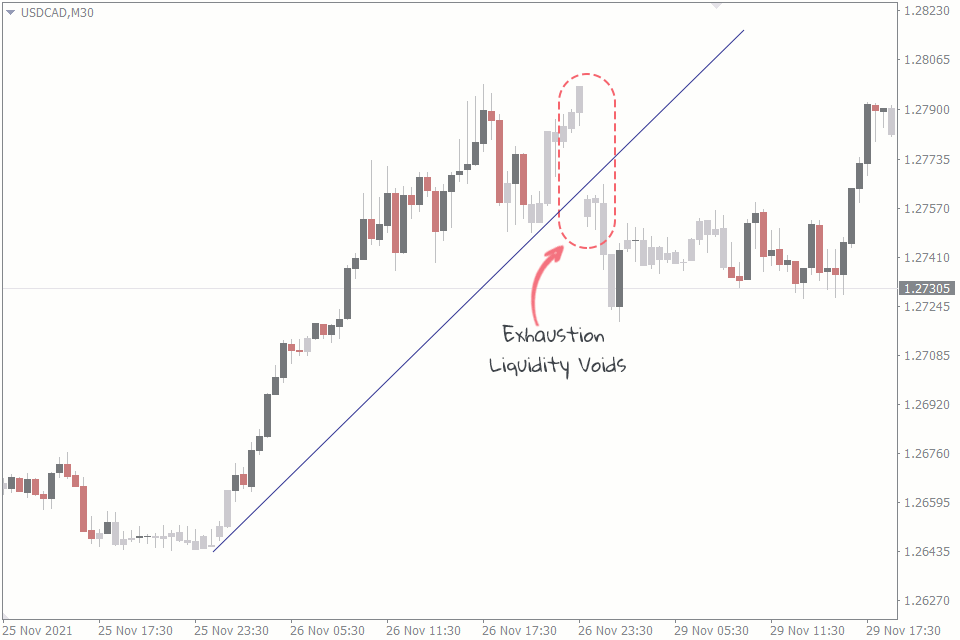

Exhaustion Liquidity Voids

Exhaustion liquidity voids happen at the end of trends. As the name suggests, they happen when the market gasses out at the end of a trend. And when this happens, the market releases the gap as its last gasp before reversal.

Exhaustion liquidity voids hardly ever get filled on time because they are markers of trend reversals.

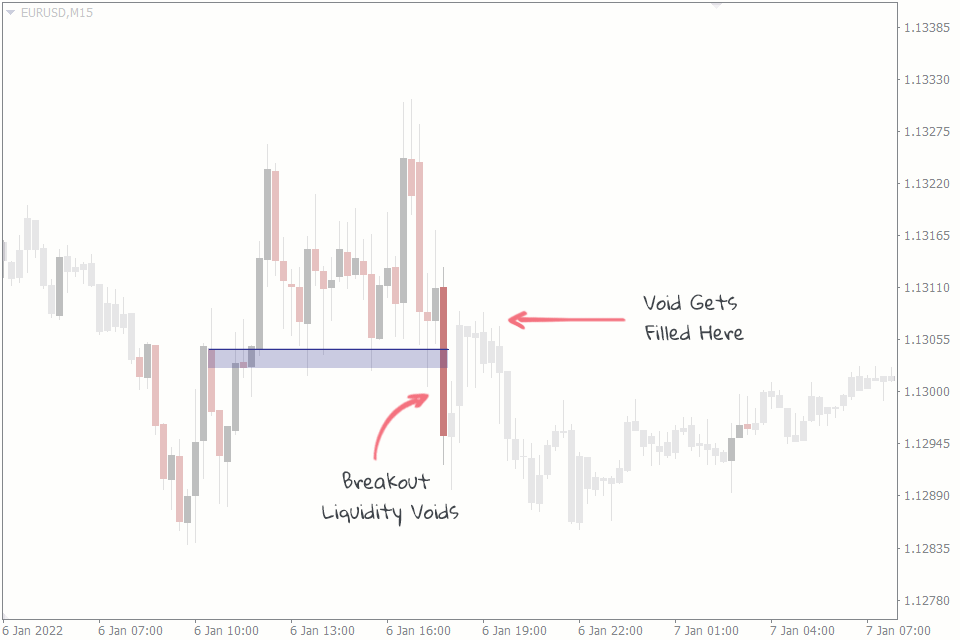

Breakout Liquidity Voids

Breakout liquidity voids happen when the price breaks out of support, resistance, or a liquidity zone. They often mark the beginning of a trend.

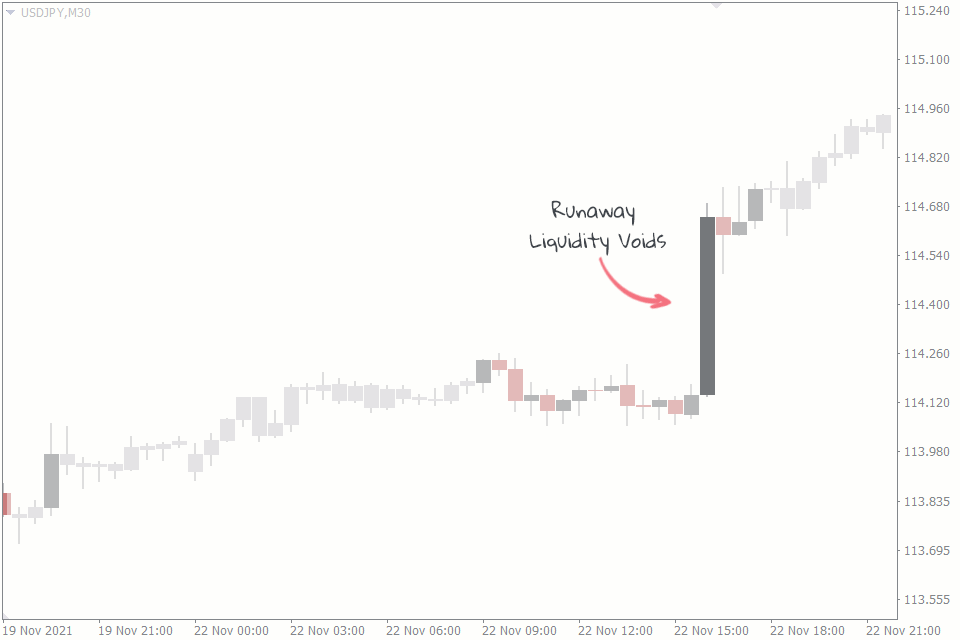

Runaway Liquidity Voids

Runaway liquidity voids are continuation voids because of where they appear on the chart. These liquidity voids happen in a market within an already established trend, and they appear in the direction of that trend.

Runaway liquidity voids don’t fill on time, as they often serve as the continuation of trends.

How To Trade Liquidity Voids In Forex

If you understand what liquidity voids are, you may already have an idea of how to trade them. You know that since the voids almost always get filled, your hope is in trading the fill. How do you trade the fill? Or how do you know when the price is about to reverse to fill the void?

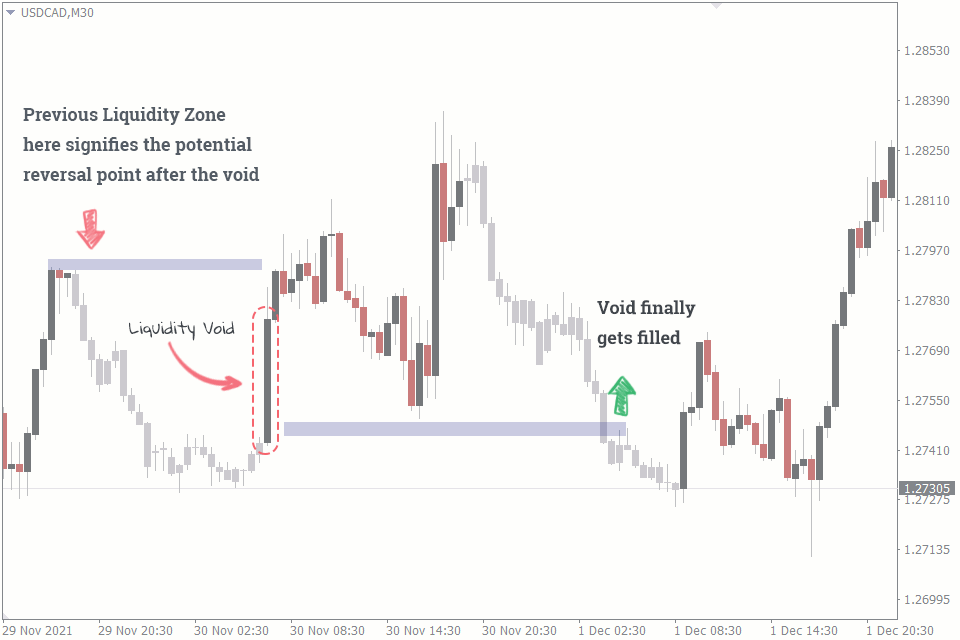

The first thing to look out for when attempting to predict where the price may start the void-filling reversal is to look for liquidity zones before the void.

These liquidity zones or pools are often in the forms of supports and resistances. This is where you expect the price to reverse from and fill the gap.

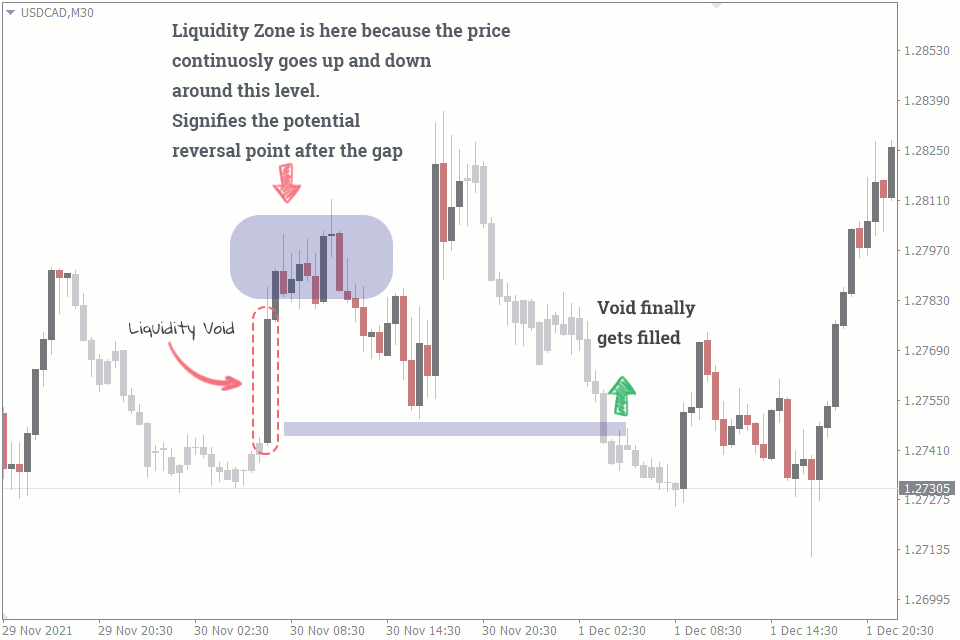

Another way to spot areas of potential reversal for the filling of the void is to look for liquidity zones that have developed after the void.

You’ll find the price going up and down around this zone. However, you can only use this method when the filling of the void doesn’t come abruptly.

Liquidity Voids Are Not Limited By Timeframes

The great thing about trading liquidity voids is that they are present across all timeframes, and so they can be used across these timeframes.

The implication of this is that traders of all trading styles can hope to benefit from it. Day traders can go down to the 30-minute chart to trade them. Scalpers can even go as far down as the 1-minute chart, and swing traders can also take advantage of the liquidity voids on the 4-hour and higher timeframes.

Summary

If you leave this page with nothing else, just know that liquidity voids occur when the price makes sudden jumps from one price level to another. They appear on the chart as physical voids in prices or abnormally long candlesticks.

Then you can top that information up with the fact that these voids tend to be filled, no matter how long it takes.

We also discussed how to trade liquidity voids in forex using liquidity zones, but it is important to note that you shouldn’t trade that strategy in isolation. Because if you do, you might be missing out on the bigger picture of the market that other strategies may offer you insights to.