Channel Trading Strategies: How to Trade Price Channels in Forex

Price channels are useful technical analysis tools that help you tell the market trend.

Besides that, they also offer you a foundation to build your other technical analysis tools. And with the right strategies, you can squeeze out some valuable trading opportunities from them.

In this article, you'll learn some effective price channel trading strategies and find some handy tips to help you maximize your advantage.

3 Price Channel Trading Strategies

When you come across those channels, there are some strategies to assist you in trading them:

1. Trend Channel Trading Strategy

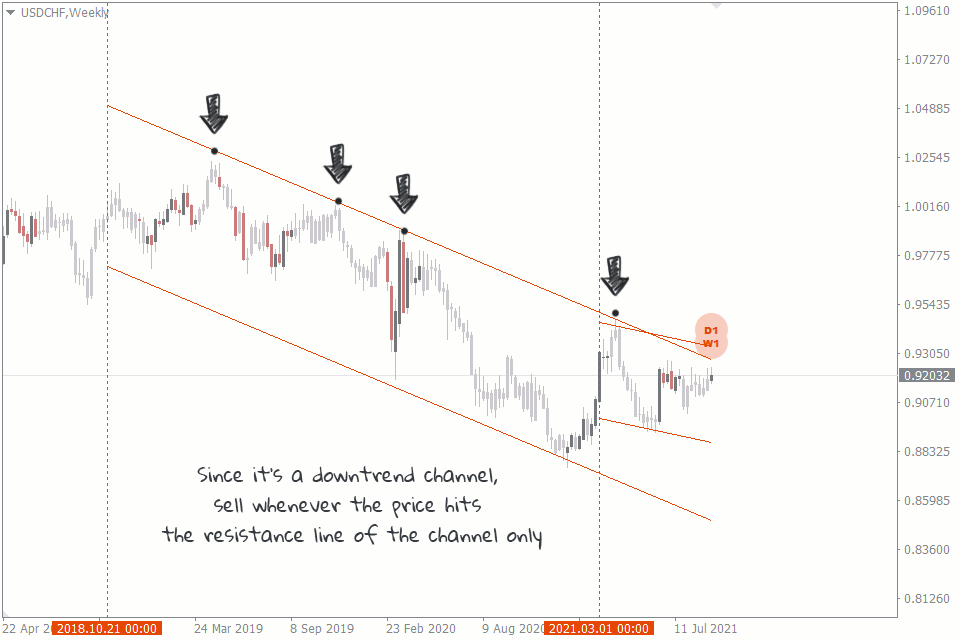

The first, and possibly the most popular, way to trade channels is during trending markets. It is the preferred strategy for many forex traders because of its simplicity. This strategy helps you take advantage of a trending market by telling you the best positions to get in on the trend.

You can trade this strategy by scouting for trade opportunities in the direction the channel slopes. You buy when the channel slopes upwards and sell when the channel slopes downwards.

You wait until the price sinks to the channel's support line in an uptrend setup before making your order. And when in a downtrend setup, you wait till the price floats to the channel's resistance line before making your order.

Because you never know when the price might break out of the channel, it is best to combine this trading strategy with other forex trading tools. For instance, you could use the volume indicator to measure how much buying or selling pressure is on the market before you trade. You could also use confirmation candles to verify the direction of the price.

2. Price Channel Breakout Trading Strategy

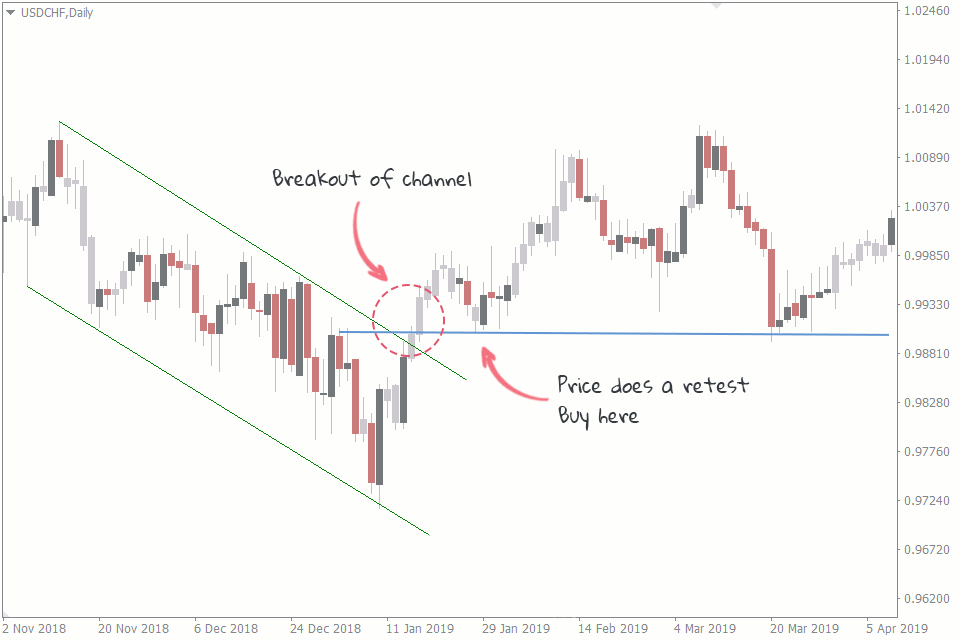

This channel trading strategy helps you take advantage of a breakout when the volatility of the forex market makes the price break out of a channel.

Often, you'll see a strong candle that crosses to the other side of your channel, signifying its potential end. And the longer a channel lasts, the higher the chance of a potential breakout. So, how do you trade the channel breakout strategy?

When trading this strategy, the first thing to look out for is the breakout candle. If you're an aggressive forex trader, this is a clear signal to trade the breakout. You buy or sell at the closing of the breakout candlestick.

However, the risk attached to trading the first breakout candle is very high, as there's no way to be certain it isn't a false breakout. And if you absolutely must make a trade, learn how to deal with false breakouts first.

The next trading opportunity comes when the price retests the channel after the breakout. This is a more conservative and less risky approach since waiting for the retest helps you confirm that the price has fully broken out of the channel.

Llike in the chart above, there are times where the price doesn't retrace back to the channel. Instead, it forms a support level from which it retraces. You can also make your orders on that level. You can check out our article that teaches you how to trade breakouts and retests.

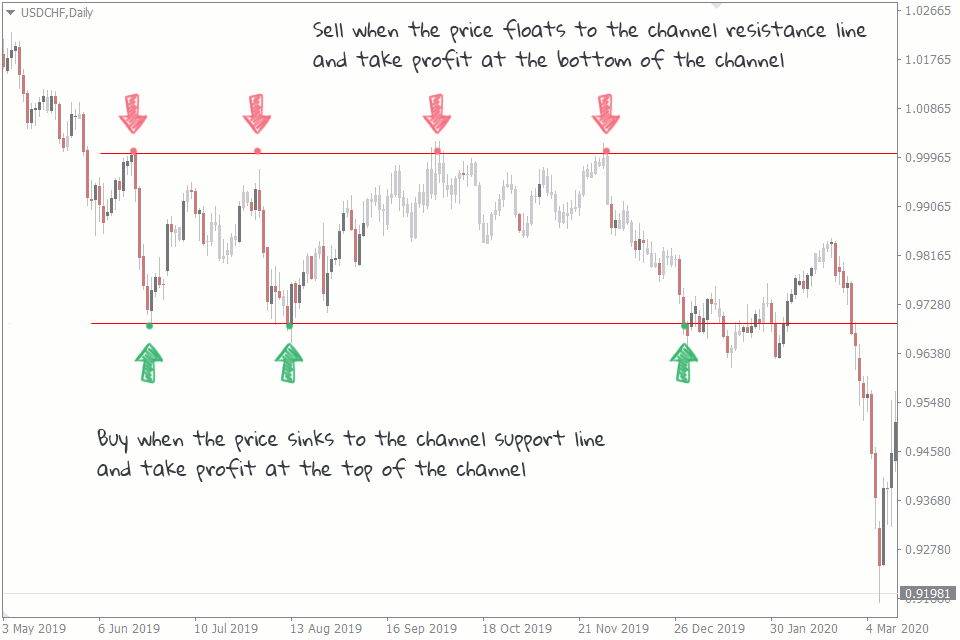

3. Price Channel Consolidation Trading Strategy

Channels form not only in trending markets. They also form in ranging markets, thereby offering you more trading opportunities. The interesting thing about this channel consolidation trading strategy is that you can buy or sell without fear of going against a major trend.

However, this advantage makes trading riskier and less profitable because there are rarely any big movements within consolidations compared to trends.

You can easily trade this strategy by buying when the price sinks to the bottom of the channel and selling when the price floats to the top.

Tips on Trading Channels in Forex

It is easy to get it wrong with channels even after you master these strategies. This is often because a trader fails to follow some basic rules such as these:

1. Draw your channels properly

Correctly drawing your channel is the first and most important key to getting the price channels trading strategies right. Otherwise, your channel could tell you that the price is still within it when a breakout is actually happening.

When drawing your channels, make sure you're not forcing the lines of your channel to touch any candlesticks. Also, make sure your channels are not squeezing the candlesticks too tightly either. The FXSSI auto trend channels indicator can come in handy when you're marking out forex channels.

2. Don't wait for perfect setups

A mistake many novice traders make is waiting for perfect channel setups before making trades. But ideal channels where all the lines touch the candlesticks at the tips rarely happen. Instead, what you'll most often see is the price getting very close to the lines of the channel but not touching them.

You may also find a candlestick or two slightly shooting out of the channel. In situations like these, any of the channel trading strategies we've mentioned above are still relevant.

3. Never trade without proper risk management

The usual risk management tips apply here. Never risk more than you're willing to lose. Always use stop losses even if you forget to take profits. Don't get greedy. Eliminate emotions from your trading.

Summary

By now, we hope you're familiar with the channel trading strategies enough to try them out on your demo account. You can also combine any of the strategies mentioned in this article with others in your trading system and see how it affects your results. But remember to not implement the strategies on a live trading account until you are sure you've got the hang of it.