Gap Trading Strategies: How To Trade Forex Gaps

Forex gaps, when they occur, can offer you trading opportunities. This article focuses on the most common forex gap trading strategies.

There are many forex gap trading strategies, some being more common than others. Let's take a look at some of the most useful ones.

Gap Trading Strategy 1: Trading the fill

Trading the fill is the most common forex gap trading strategy, and it's based on the tendency of the price to fill after a gap.

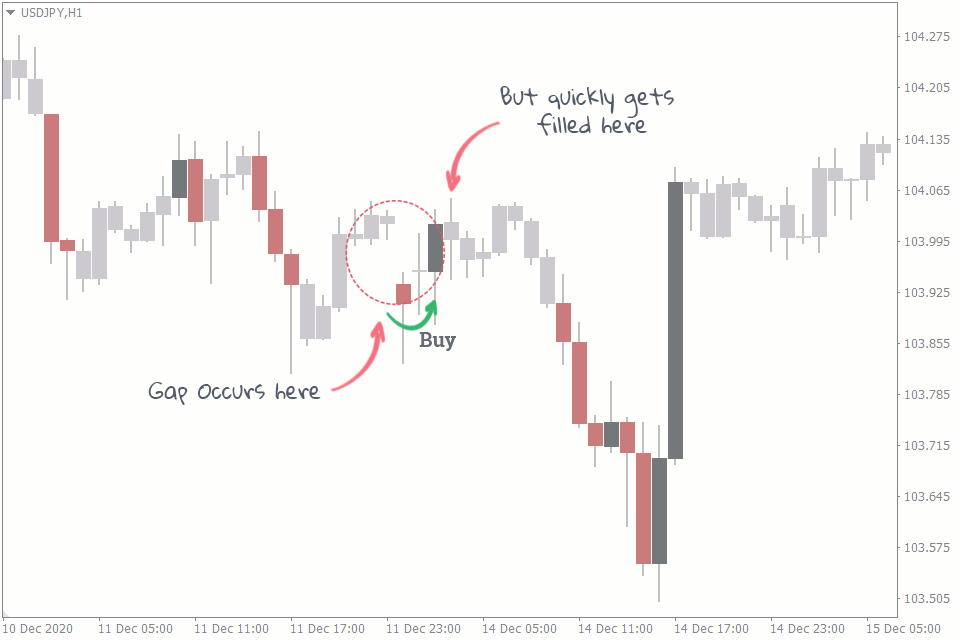

Forex gaps often get filled over 60% of the time. So when you see a currency pair gapping, you can trade it by entering a position in the direction opposite to the gap. For instance, go short when the price gaps up, and buy when the price gaps down.

Place your stop loss some pips above or below a gap up or a gap down, respectively, and place your take profit at the level where the gap gets filled. However, it's better to ignore this strategy when there are really small gaps that are less than 10 pips. The reason is that the profit could be negligible when you factor in the spreads of your broker and the volatility of the currency pair.

Speaking of volatility, a gap should fill within the next 24 hours on most volatile currency pairs. This is the time to take your profit. However, sometimes the reversals from the gaps keep going on for a while, turning gaps into exhaustion gaps.

So, to help you prepare for such situations, take half of your profit off the trade and move the stop loss to break even after the price completely fills.

Gap Trading Strategy 2: Trading the gap as a support and resistance level

This is another forex gap trading strategy that's based on the filling tendencies of the forex chart. And it is also one of the many effective ways of trading support and resistance.

Quite often, you’ll find that after the price fills up and returns to the level before the gap, this level becomes a support or a resistance level, where the price further reverses from.

When exploiting this gap trading strategy, mark the level where the gap has begun. After the gap fills and the price falls back to the level you have marked, buy or sell in the direction of the gap. Place your stop loss level somewhere below the candlestick that initiated the gap. You can rely on any take-profit strategy to cash in your profits if the trade goes in your favor.

Gap Trading Strategy 3: Trading the breakout of a gap

Trading the breakout of a gap is very similar to trading the support and resistance strategy that we've mentioned above. They both rely on the tendency of a gap to form a support or resistance zone, which the price may retest. However, these two strategies focus on two different directions the price moves in, when it hits this support or resistance zone.

In the previous strategy, the price reverses from the support/resistance level. In trading the breakout of a gap strategy, however, it breaks out of the support/resistance level. These two trading strategies are the possible scenarios that could occur when the price fills up the gap and uses the same gap as a support and resistance level.

You can try out this technique using one of these effective breakout trading strategies. But the most common approach is to wait for the price to breakout out and retest the level before entering a position.

You could also trade the immediate breakout, but this may increase your risk, since the support/resistance level has not been tested yet.

Gap Trading Strategy 4: Trading the gap and go

Up untill now, the strategies we’ve discussed have all been based on the tendency of the price to fill the gap it has created. But this isn’t always the case.

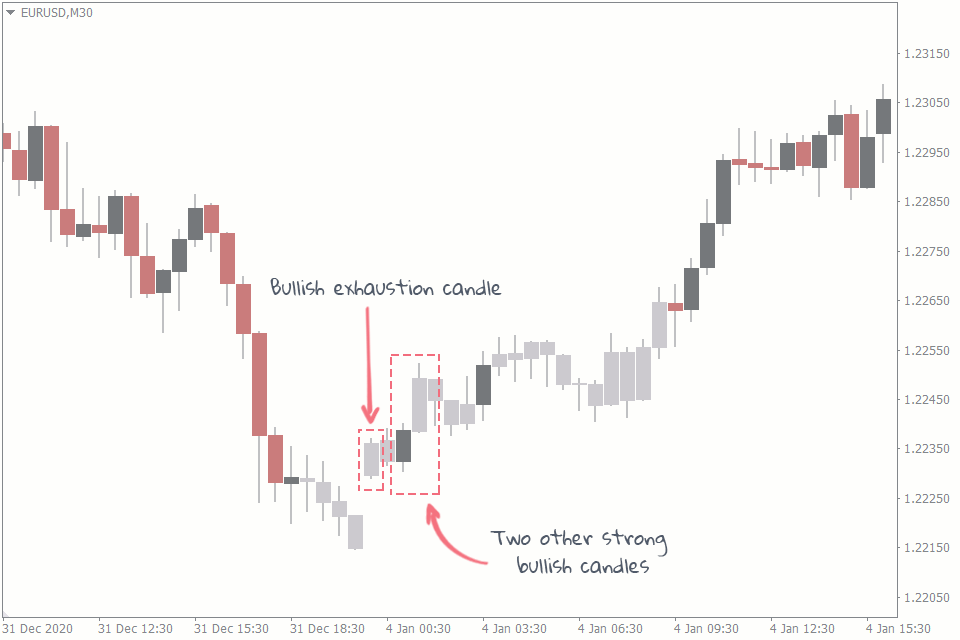

Sometimes, the price gaps in one direction and just keeps following the same direction without filling up within the next 24 hours. This is exactly what has happened on the EURUSD between the last day of 2020 and the first trading day of 2021.

There are many ways to trade the Gap and Go strategy, and most of them involve combining the strategy with another forex technical trading tool. You could use a volume indicator, such as the FXSSI Better volume indicator, to determine the amount of momentum behind the gap.

You could also use the price action of candlesticks to complement this Gap and Go strategy, which is what we’ll be using in our case.

As soon as you notice the gap, read the bias and strength of the candlesticks to help you predict the potential bias of the price. In the chart above, for instance, you’ll notice that the first candlestick after the gap is a strong bullish exhaustion candle.

And although the candlestick after that is a bearish candle, the next two candlesticks are going to be strong bullish ones.

More experienced traders might have picked this out as a bullish bias, and they would have been right. But in case you haven’t, you’ll also notice that the price retests the newly formed support level twice. This is another strong bullish sign, and you should make the trade.

Tips on Trading the Gap

Keep these tips in mind as you implement the gap trading strategies:

- Don’t assume the gap will always fill. As you might have noticed from the fourth strategy we've mentioned, the gap doesn’t always fill. So, don’t make a trade setup based on your assumption that the gap will fill.

- Don’t trade the strategies in isolation. This could lead to wrong conclusions. But use other forex technical tools to confirm your gap trading strategy. In the Gap and Go strategy, for instance, we used forex candlestick patterns to help us predict the potential bias of the price.

Conclusion

Forex gaps do not happen very often, but they are worth trading using these strategies when they appear. And because of their scarcity, you might need to scan through a lot of currency pairs at the resumption of the forex market after the weekend to spot a gap.

However, remember that not all gaps are to be traded. Some gaps are too small. Ignore such gaps, especially if your broker imposes huge spreads.