Key Levels In Forex: What They Are, and How to Identify and Trade Them

In forex, there are always those key price levels that hugely affect market sentiments. What are they? And how do you identify and trade these key levels?

Key levels are psychological price levels on the forex chart where many traders base their technical analyses on. These traders are likely to place their bullish or bearish entries, and exit points around these levels. And as a result, key levels tend to be crowded with a high trading volume.

Key levels also attract so much trading volume because that is where institutional traders make their trades as well. And thanks to their big-money moves, key levels are often resilient and lasting.

How to Identify Key Levels in Forex

There are three main types of key levels, and you are most likely familiar with them all even if you’re a novice forex trader. So identifying them should be quite easy.

The Horizontal Key Level

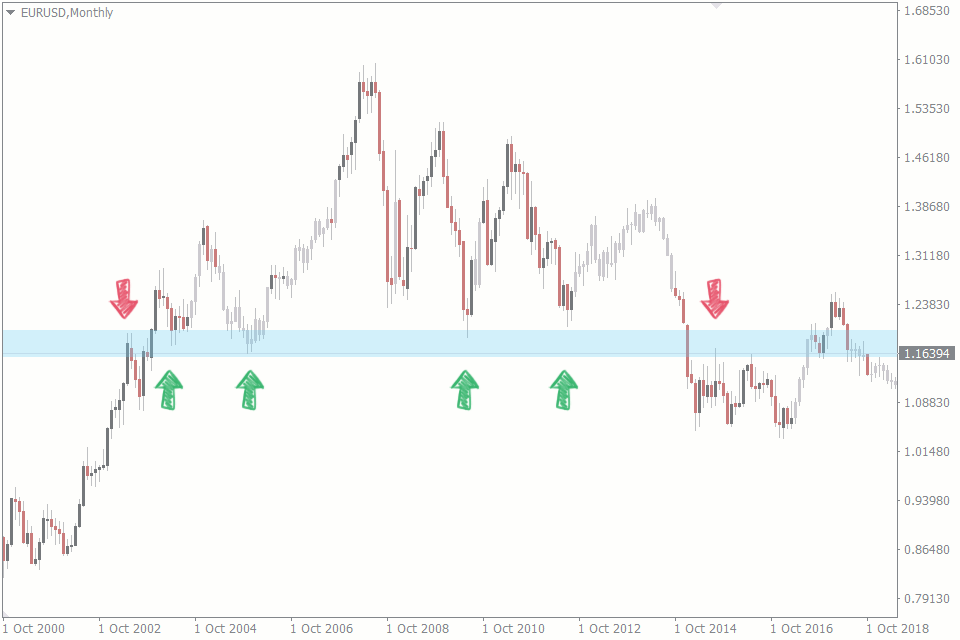

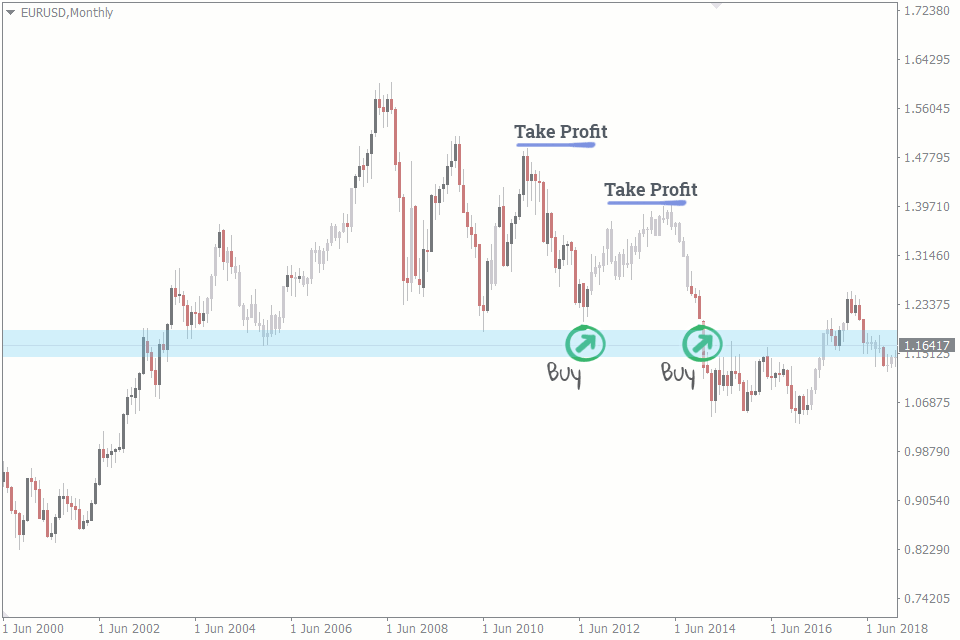

The horizontal key level is made up of forex support and resistance levels. But we aren’t talking about just any support and resistance level. We’re referring to those with lasting historical significance. You’ll find these horizontal key levels on the higher timeframes, such as the weekly and monthly timeframes.

The horizontal key levels remain active for months and years, and the price mostly never gets across them without strong opposition. In the chart above, notice how the level keeps getting a lot of reactions from the price before it finally breaks.

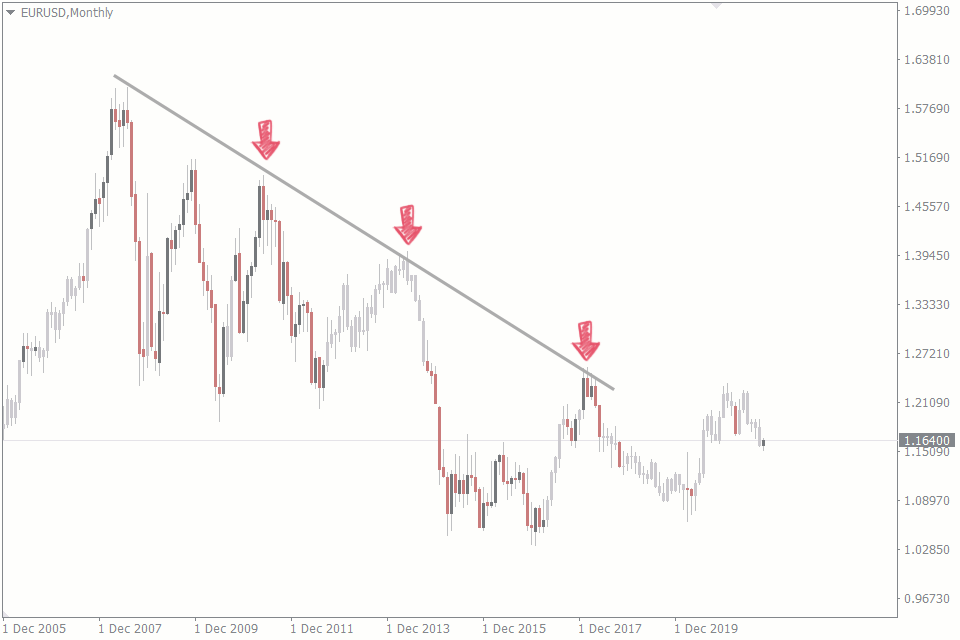

The Slanting Key Level

The slanting key level forms on trends. It appears as a trendline on the chart. And just like their horizontal counterparts, slanting key levels mostly form on the weekly and monthly charts.

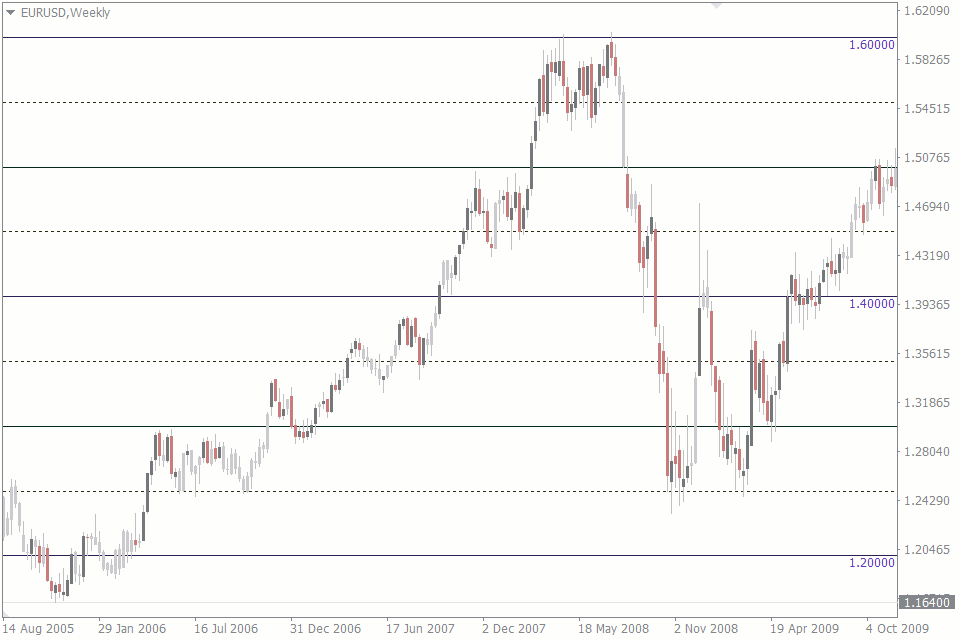

The Rounded Key Level

Rounded levels on the charts also form key levels. Our article on rounded levels tells you everything you need to know about rounded levels. But for the sake of this article, rounded levels are those price levels that are easily divisible by 100. They often end with two or more zeroes.

Traders often place their trades around the rounded key levels because it is psychologically easier and simpler to trade at 120.00 as opposed to 119.97 The same way you would say you bought an item for $100 when you actually bought it for $99.99.

The image above shows how round levels automatically drawn by the Round Level indicator are forming key levels on the weekly USDJPY chart.

How To Trade Forex Key Levels

There are three methods to trade the key levels.

The Key Level Approach

Key levels are like price magnets. The price is always moving towards them. And this presents a trading opportunity for you.

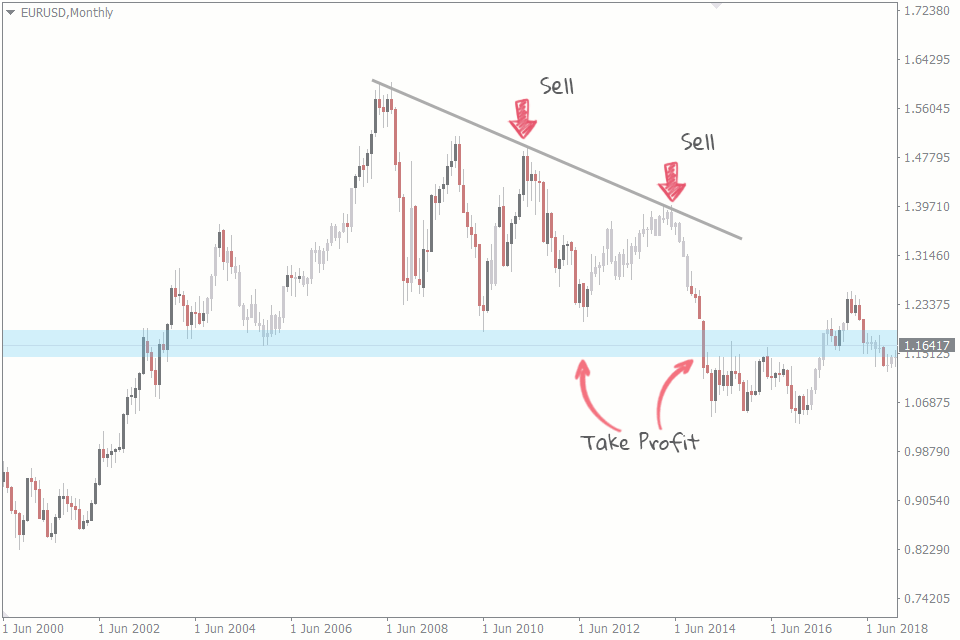

The key level approach trading strategy involves buying or selling in the direction of the key level. For instance, if there is a horizontal key level that serves as a support, you could enter a sell trade and set your take profit on the key level. This way, you’re riding on the magnetism of the level.

However, this level is best traded on horizontal and rounded key levels. Trading it on a slanting key level would mean buying in a downtrend. To put it simply, you would be going against the trend, which is a very risky approach to forex trading. This is a trade setup only contrarian traders would trade. But if you’re a trend trader, steer clear of this strategy on slanting key levels.

The Key Level Bounce

Key levels in forex are tough to break. Very often, you’ll find the price bouncing off the levels. The price level would approach a key level serving as a resistance, for instance, hit the level, and bounce back in the direction it was initially coming from.

The key level bounce strategy exploits this price behavior. In this strategy, you’ll buy at a key support level and sell at a key resistance level.

The Key Level Breakout

Despite the resilience of key levels, they don’t last forever. They break, and the price crosses over them. This strategy helps you make the best of the breakouts from these key levels.

When price approaches a key resistance level, for instance, place your buy orders on the other side of the level. And when the price is descending into a key support level, place your sell order on the other side of the level.

There are two ways to trade this strategy. You could wait for the initial breakout candle before you make the trade, or you could wait for a retracement to the level after the initial breakout. The first is riskier, as the first breakout candle could be a false breakout.

However, the method has its own disadvantage, as the price may never retest the level.

Tips on Trading Key Levels

Here are some tips have at the back of your mind when trading the key levels:

- Pick your key levels from higher time frames. The key levels on the higher timeframes tend to be stronger than those on the lower timeframes. The reason is that this is where the market movers, big banks, and other institutional traders make their trades. Any level below the 4-hour chart could easily falter and is prone to false breakouts. But to be on the safe side, use the key levels on the timeframes higher than the daily chart.

- Set your stop losses wisely. Where you place your stop losses could make or break your forex account. There are many schools of thought when it comes to setting stop losses, and each one is perfect for varying trade scenarios. But one objective method of setting stop losses that works for most trading scenarios is using the Stop Loss Cluster indicator.

The Stop Loss Cluster indicator tells you where most traders have placed their stop losses. And these are the levels the price is most likely to hit during a false breakout.

Conclusion

You too can base your trades on these key levels. But make sure you follow the strategies and tips we have discussed to help you make the best of the key levels.