5 Tips on How to Trade Forex News With Confidence

In this article, we’re going to share some useful tips in case you decide to trade the news. Also, as a bonus, there’s a common news pattern example analysis at the end.

Trading the news has a number of advantages. First of all, you know in advance the exact time when you’re going to trade. Secondly, the price movement is almost always guaranteed. The latter, in fact, is the source of profit on the Forex market.

Naturally, a relevant question arises: why not trade Forex only on news releases? All you need to do is just look through a statistical report, compare the values, and if they are in favor of the currency – it’s time to buy, and if not – it’s time to sell.

However, despite the apparent simplicity, trading fundamental news is a very complex task.

Here are the 5 tips to help you feel more confident when trading news in Forex:

1. Select the most relevant news

Not all news is suitable for trading.

Some are important, some are not. The confusion is also caused by the news calendars, where some news are marked with the “three stars”, when, in fact, this news is not nearly volatile.

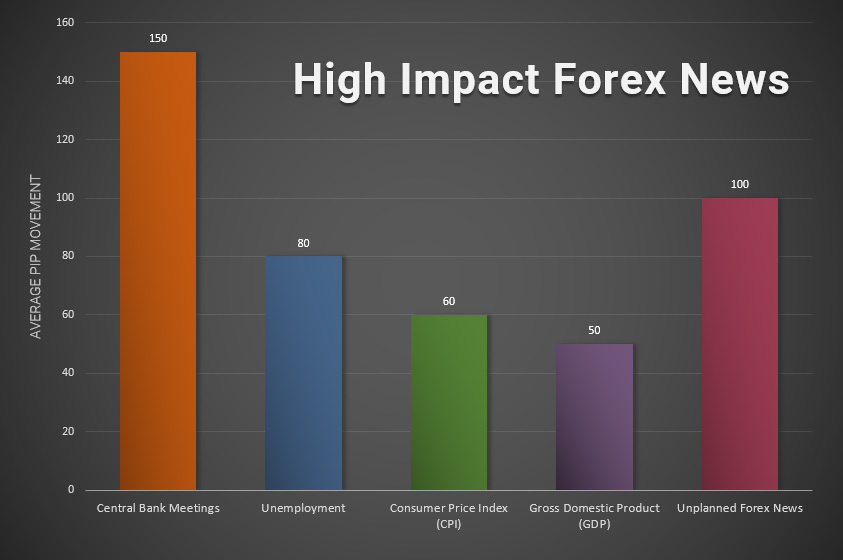

Volatility news. There are 4-5 high impact news events to consider when trading the news.

Black swan news can also be classified as volatile. But, most likely, such news will come in at probably the least convenient time for trading, so counting on it is far from reasonable.

News by country. The most important news comes from the USA. When the American statistics is published, it causes wide fluctuations in all currency pairs, even in those that do not include the US dollar. Therefore, it is crucial to pay attention to the news marked “USD”.

Other most traded currencies are also suitable for trading the news. But in this case, you should use pairs that already include these particular currencies. For example, when the data on British statistics is released, use GBPUSD pair to trade this event.

2. Prepare and analyse the chart in advance

Nobody likes homework, but if you are a news trader, you will have to do your homework.

Analyze the chart. How to trade the news if you don't know what preceded it? The thing is that the "fuel" for the price movement is often laid beforehand.

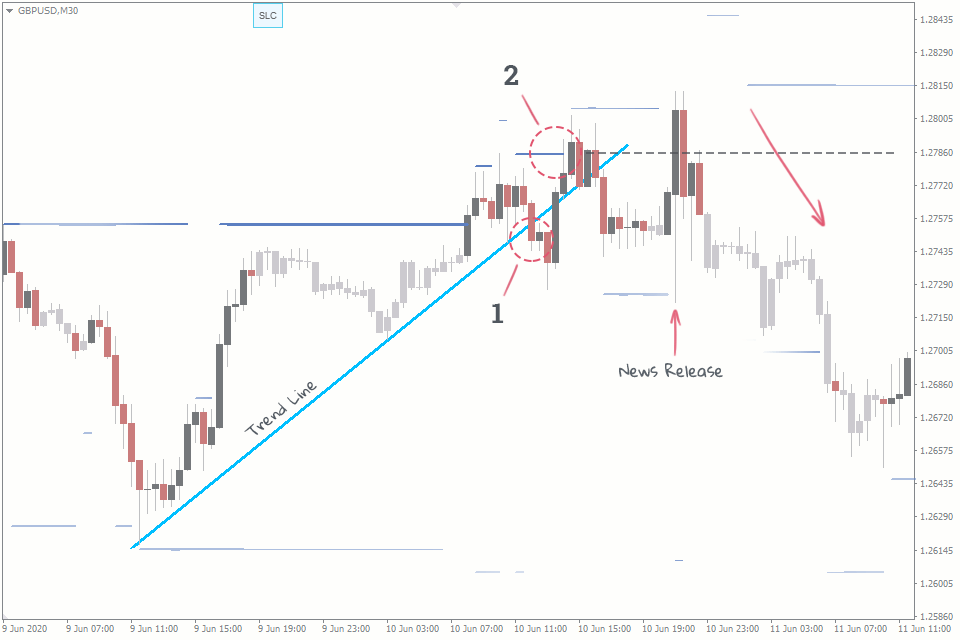

Analysing the previous few days helps you find the levels at which the smart money has gained their position or notice some bull or bear traps. Such findings alone might indicate the direction of the upcoming movement. Let's take a look at an example:

Point (1) displays a false breakout of the trend line. It's a trap for bears. Later, they are knocked out of the market by the stop loss at point (2), which is the position filled by a big player.

With this information, it’s possible to exclude one of the directions and, after the data is released, you have a chance to look for the most convenient entry point.

Plan your actions. Usually it’s enough to just mark several levels on the chart and come up with scenarios of behaviour when the price touches them. You’d also need to plan your actions if the price stays within a specific range.

Assess the potential sizes of stop loss and take profit in advance, and adjust the volume of your trades, so that the risks wouldn't exceed your operating percentage.

3. Do not rush into opening a trade

One of the major mistakes made when trading the news is the desire to open a position as quickly as possible. What’s worse, opening a trade immediately after the news release, making your decision based only on the analysis of the data in the report, without taking into account what is happening on the chart.

Wait at least 10 minutes. Remember, you have 1 hour after the news release to open a trade. The effect of the released report lasts approximately this long. Moreover, the second half of the hour is usually more predictable.

It is not necessary to open a trade. Opening a position makes sense only if you are absolutely sure of the analysis performed. Even if you are in the mood for trading, there’s no reason to open a trade after each news release.

4. Switch to a smaller scale

This is where all the fun usually takes place – during short-term volatility. By observing price movements in real time, you’ll start feeling the pulse of the market at some point.

Switch the main chart to the M1 timeframe. Since the situation is developing rather rapidly, this will help you notice more details. A trading robot, script or a panel allowing you to quickly manage trades will also be quite helpful in this case.

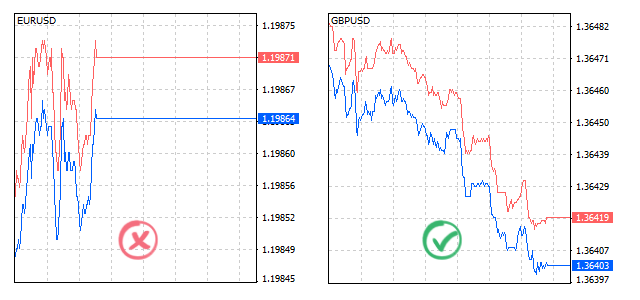

Analyze the tick chart. It will help you get an even better feel for the market.

When trading news volatility, it’s best to open a trade when the tick chart becomes less “jittery” and the price movement becomes smoother.

5. Control the risks

Easier said than done.

Every trader is familiar with the concept of money management, but sometimes it’s rather difficult to follow the rules, even if you’re an experienced trader.

First of all, calculate how much you are ready to lose. Trading the news in a volatile environment is the easiest way to forget about all your rules or even turn it into a gamble. The biggest losses usually occur when you open a new trade right after losing the first one, in an attempt to recover from loss. Determine the maximum amount or percentage of the deposit, upon losing which you will stop trading, and not only in terms of volatile news, but in general, for today.

Reduce the lot size. News movement can be unpredictable. To guard yourself from unplanned loss, reduce the lot size of your trades by an order of magnitude.

Consider slippage and requotes. Slippage is common for the news, especially in the first few minutes after the release. Such a mishap can significantly change the final result, in most cases, for the worse.

Slippage is typical for market and stop orders. However, the slippage of the stop loss order closing the position is the one that occurs rather frequently.

In theory, a limit order should have protected you from slippage. However, this is not how it works. When the price is reached, a limit order in the most popular MT4 terminal turns into a regular market order and is executed at the worst price.

The optimal solution, as we’ve already mentioned above, is to delay trading for 10 minutes.

Consider possible spread widening. Check your order execution with your broker. Some brokers restrict trading the news or significantly widen the spreads, so it’s better to know about this in advance.

In order to monitor spread widening in real time, install the SpreadWarner indicator.

The spread size can also be seen on the tick chart.

What to do if you have an open trade and news is coming in

Is it better to close it or leave it as it is?

When you find yourself in such a situation, it's almost always the right decision to close the trade. The only exception is when you're trading H4 or higher timeframes.

Yes, this is frustrating, especially if the trade has a floating loss, but it's not worth the risk. At the time of the news release, a whipsaw occurs, and the price shoots out in both directions, so by leaving the trade open, you're simply leaving it to chance.

Use the news indicator. Installing a simple news indicator will help you to always be aware of upcoming news releases and you will be able to plan your trading properly.

It will help you avoid situations when a recently opened trade is knocked out by an unexpected movement. A quick Google search would tell you that a famous political leader was giving a speech on something.

Tricks to be aware of

The price rarely moves in just one direction immediately after the news release. The only option for this to happen is if the released data turned out to be unpredictable and under the pressure of the ongoing chaos the price shoots out in one direction.

In the rest of the cases, there are 2 – 4 oppositely directed spikes before the price chooses the direction.

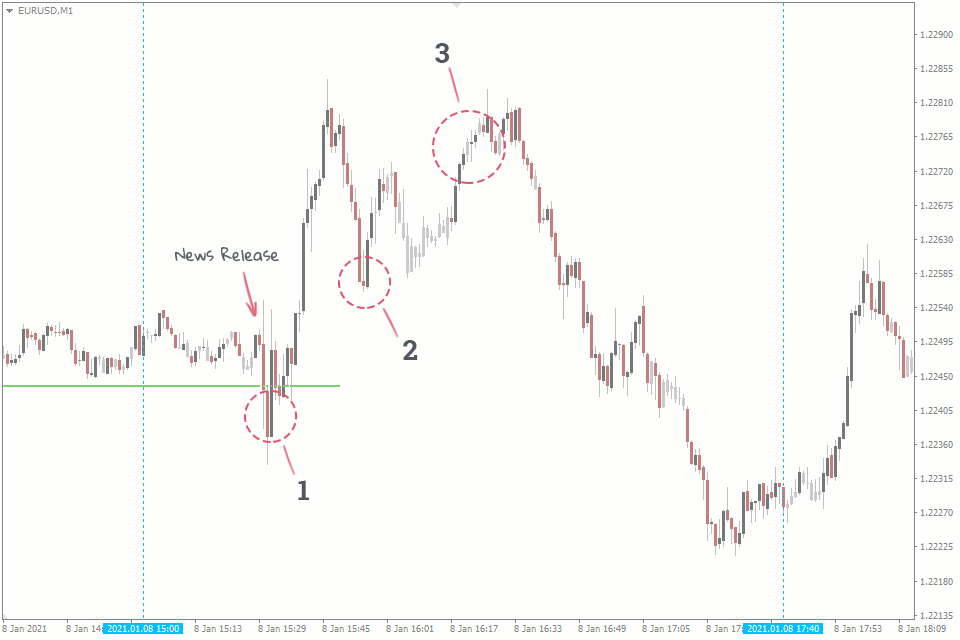

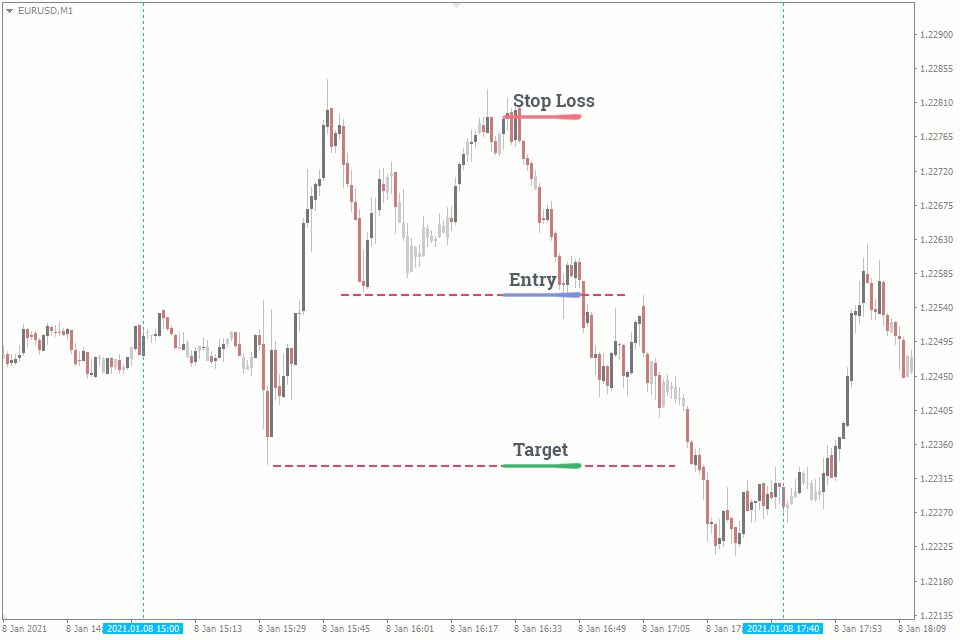

Let's take a closer look at a news pattern that can be commonly seen in the market:

False "Pennant". The trick here is to knock out of the market all the participants who have chosen the right direction (1), and then make others believe in a false trend (3). Visually, it looks like a pennant pattern, which at first seems to unfold, but then it breaks down and the price moves in the opposite direction.

The optimal entry point will be the level of the base of the pennant (2), and the target will be the extremum formed by the initial impulse (1). It's better not to place the stop loss beyond the top of the pennant, because once this point is passed, there will be no other barriers to the price.

Once you recognise the manoeuvre (the trick), trading becomes a lot easier. You clearly understand the price level, above/below which it will not move, and you can draw up your strategy based on this.

The example above shows the exact moment where the catch took place, and we could have been convinced for quite some time that there's a downward movement.

The article on news trading strategies deals with even more practical examples.

Final thoughts

Despite the fact that the idea of trading the news seems very promising, there are many pitfalls that you will have to overcome.

For instance, the need to react quickly to every change or poor execution of orders during the news release.

Therefore, it's important to properly control the risks when trading the news, and always remember that “there always has to be a tomorrow for a trader”.