Top 3 News Trading Strategies

One of the two approaches to trading Forex is fundamental analysis. It relies heavily on measuring the performance of the economies of currencies. And one way to go about this is through the news.

Technical analysis is another way of trading Forex, but we've covered this topic and the differences between the fundamental and technical analysis in another article. Today, we're focusing on news trading strategies in Forex.

But before you proceed, read our tips for trading on the news.

Here are some of the best news trading strategies in Forex.

The Classic Strategy

The classic news-based trading strategy involves an expert knowledge of the released economic data, and how it affects the market.

You have to understand the effect the news may have on the market when the forecasted value of the news report differs from the actual value by little or much. Knowing this helps you predict the effect of the news on the currency pairs you’re trading.

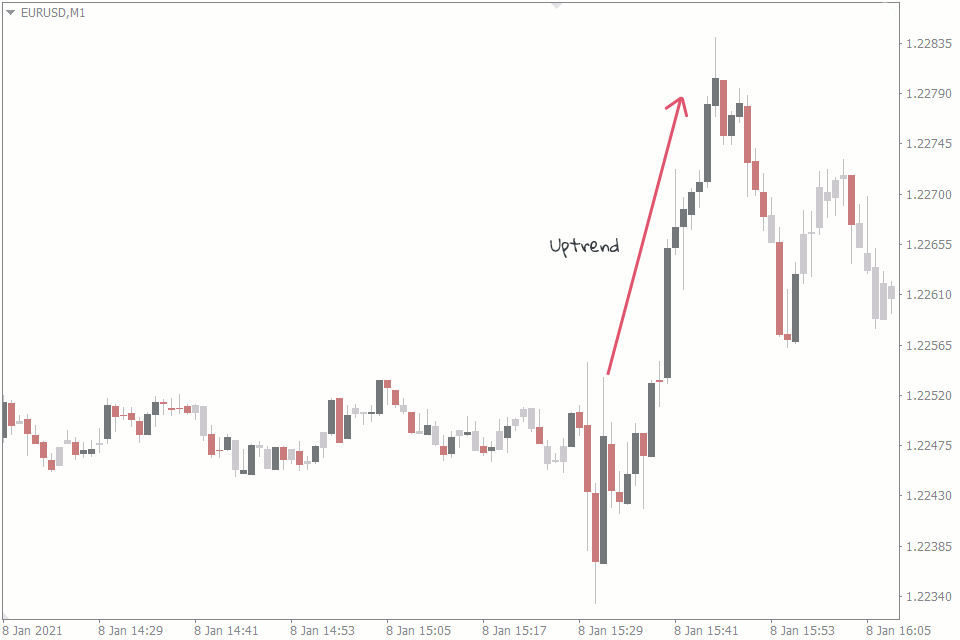

When the Non-Farm Payroll (NFP) was released on the 8th of January, 2021, for instance, the actual value fell short of the forecasted value by a lot. The economists forecasted an increase of the figures by 60 thousand. Instead, the actual figure was a decrease of 140 thousand.

The NFP is an economic data that represents the employment figures in the USA. As you might imagine, a fall in this figure is bad for the US economy because it means more people are unemployed.

This increased level of unemployment could dip the economy in many ways. One of them is that fewer people would pay taxes, and less income goes into the US Federal Reserve. So when the news was released, the USD weakened across many major currency pairs.

If the actual value was close to the forecasted value, the market might have been able to absorb the little gap and move on as if nothing happened.

Maybe a brief spike in volatility would be recorded across USD currency pairs. But the large difference meant things were worse than expected, so traders sold the USD. The effect is evident on the EURUSD chart above.

The Breakout (Straddle) Strategy

This might be the strategy for you if you know nothing about interpreting the news but hope to profit from trading it. The breakout forex news trading strategy allows you to prepare for a breakout in either direction without worrying about what the news says. Here is how you do it.

- Step 1. Open the lowest timeframe on the chart of the currency pair you wish to trade. Do this minutes before the release of the news.

- Step 2. Usually, there is a brief period of consolidation and low volatility before the release of important news. Set buy and sell stop orders at about 10-15 pips above and below the support and resistance levels bounding the consolidation.

- Step 3. Protect both orders with stop losses placed about 15 pips off your entry points.

- Step 4. The moment the breakout triggers one of your orders after the release of the news, cancel the second order. And as the price goes in your speculated direction, pursue it with a trailing stop loss placed a few pips away, to claim the pips you’ve gained.

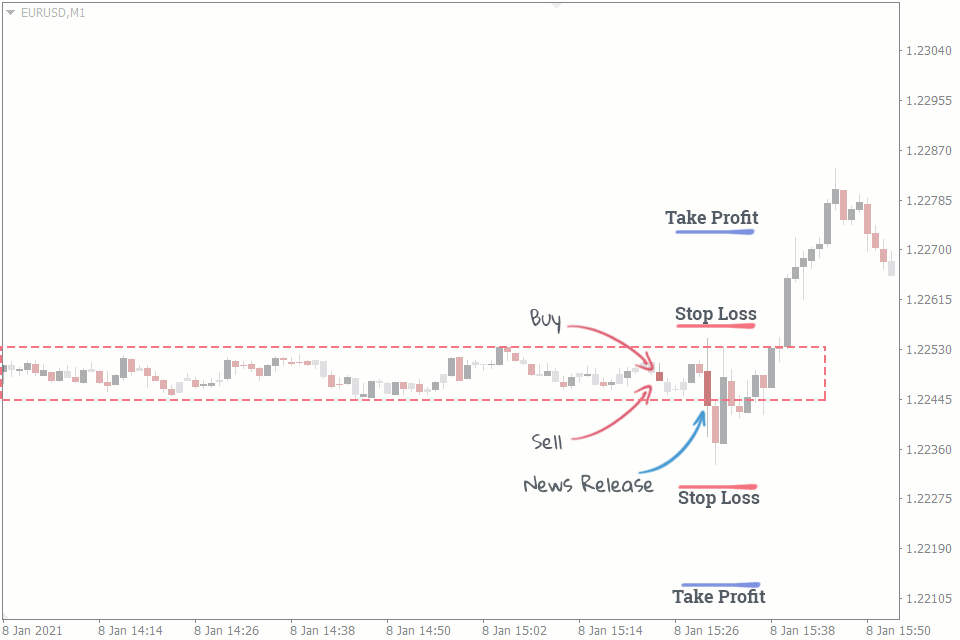

Look at the chart below for a more practical view of this strategy.

A possible outcome is that the price goes in one direction, triggers one of your orders, and reverses to trigger your second order.

That is why you need to set stop losses to protect your account. This scenario is what we have up there on the chart where price made a false breakout to the downside before reversing direction.

Hedging Strategy

This strategy is like the straddle news trading strategy. Both have no care for what direction the news would drive the market. You only look to profit from the pair, irrespective of what the news says.

But unlike in the straddle strategy, you don’t set stop orders above and beneath support and resistance levels. Instead, you open instant buy and sell positions on the currency pair where you expect to profit from the news.

Follow the steps to trade the news using the hedging strategy:

- Step 1. Open buy and sell orders about two minutes before the scheduled release of the news.

- Step 2. Set your stop losses at about 15 to 20 pips away from each position. This way, some false low volatility breakouts will not take out one of your stop losses before price changes direction and takes out your other stop loss.

- Step 3. Set your take profit levels to about 3 times your stop loss.

- Step 4. When the news drops and the price responds with increased volatility, move your winning trade to break even and trail your stop loss by a few pips. Your other trade would have automatically closed by then.

Conclusion

There is no strategy in forex that wins all the time. That is why you have to be good at risk management, especially when you are dealing with the sudden spikes in volatility that forex news trading involves.

Finally, you can use the FXSSI calendar indicator to keep track of important news releases right there on your MT4 charts.