High Risk, High Reward NFP Trading Strategy

If you’re a Forex news trader, then with no doubt you’ll understand that finding the right NFP trading strategy could well be considered the holy grail.

We have to make it clear that learning how to trade NFP is not for the faint hearted and should only be attempted by expert level traders with experience.

It’s for this reason that our NFP trading strategy shared below has been tagged as high risk, high reward and should be traded with extreme caution.

Before delving into the strategy itself, let's first go over what the NFP report actually entails and discuss why it’s so important.

Non-Farm Payrolls (NFP)

The Non-Farm Payroll (NFP) report is the most important US data release of the month.

The NFP report is published on the first Friday of the month at 8:30 AM EST by the US Bureau of Labor Statistics and represents the number of US jobs gained or lost over the previous month. As its name suggests, this number excludes agricultural employment such as farm labour.

Alongside the NFP release, traders are also delivered the US unemployment rate and the average hourly earnings number. This makes NFP Friday the most anticipated day of the month when it comes to news.

So, without further ado, let's delve into our high risk, high reward NFP trading strategy.

Our NFP Trading Strategy

Patience is key to our NFP trading strategy.

This strategy doesn’t rely on any predetermined directional biases when it comes to entering a trade. As you may already know, it’s extremely difficult as a retail forex trader to take advantage of the initial move instantly after any news release.

This is because liquidity thins out and it doesn’t matter whether you’re using a market maker or ECN broker, you’re still going to get your entry price slipped.

For this reason, our NFP trading strategy looks to take advantage of a continuation after any initial pullback, rather than watching the number and immediately buying or selling.

Forex News Indicator

That doesn’t mean however, that you should be going in blind.

The more information you have when it comes to trading NFP, the better off you’re going to be and when it comes to a news based strategy such as this one, it all starts with the numbers.

The first thing you’re going to want to do is consult your economic calendar for the expected number, used to compare with the actual release once that clock hits 8:30 EST.

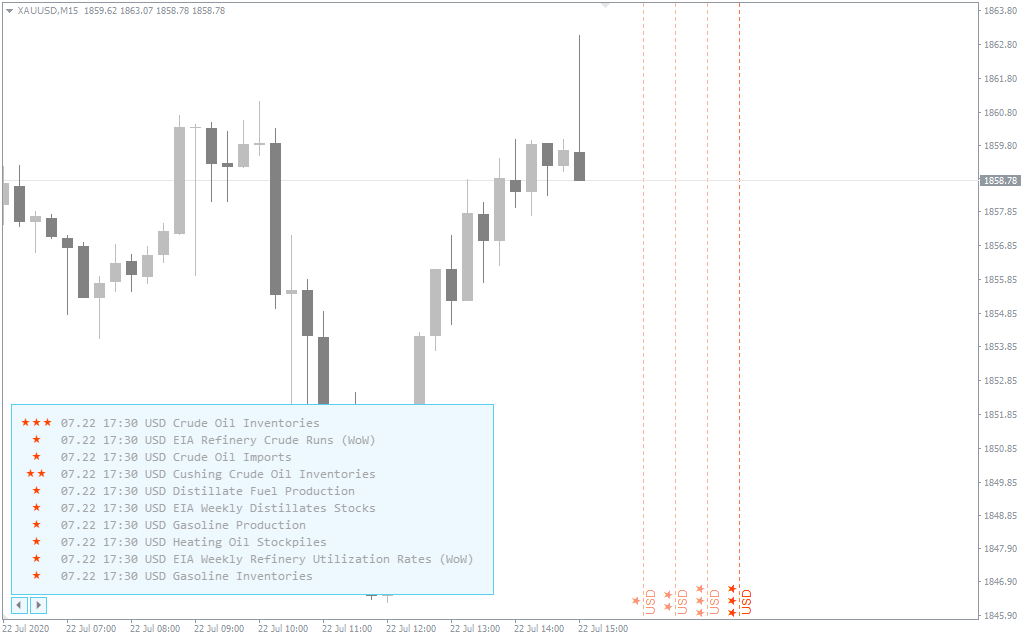

The easiest way to do this is to add Forex news indicator to your MT4 charts.

As you can see on the chart above, our MT4 indicator will display the date and time of upcoming news releases as vertical red lines directly onto your charts. This indicator is an extremely helpful asset to have installed when trading using our NFP strategy.

Now all that’s left to do is wait for the release and follow the steps in our high risk, high reward NFP trading strategy below.

Steps to Trade NFP

First step – wait for the NFP data release. Bring up a 1 minute chart on any of the Forex major currency pairs and wait for the 8.30 AM EST release.

Every Forex currency pair is going to behave differently and for that reason, everyone has their favourites to trade. Choosing a pair depends on personal taste and experience.

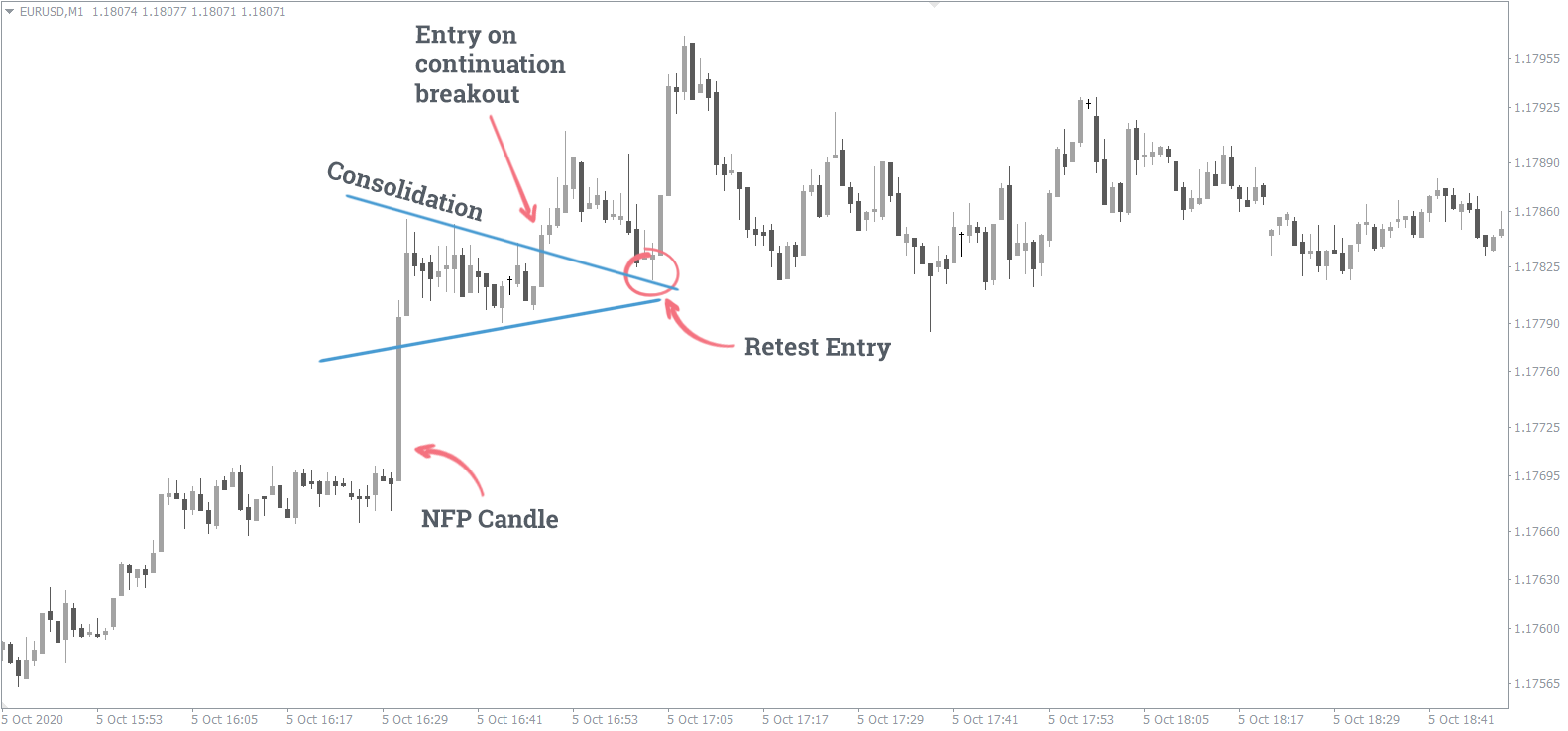

Second step – find the direction you’ll trade. Watch the initial momentum move on the 1 minute chart and wait for that first candle to close either bullish or bearish.

If the candle has closed bullish, then we’ll be looking for long trades. If the candle has closed bearish, then we’ll be looking for short trades.

Third step – wait for a price consolidation. Now that we have the direction we want to trade in, we have to wait for a price consolidation before we enter. We’re going to be waiting for multiple bars and for a trendline, flag or pennant to form.

Remember that as we’re on a 1 minute chart, the pattern doesn’t have to be perfect. It’s never going to be. We just need some sort of trend line that once broken, tells us that a continuation is likely.

Fourth step – trade the trend line breakout. When price breaks out of our short term consolidation and through the trend line in the direction of the initial 1 minute candle, then we immediately enter the trade in that direction.

That’s entering long on a trendline breakout if the initial 1 minute candle was bullish, or entering short on a trend line breakout if the initial 1 minute candle was bearish.

Fifth step – stop loss and profit target levels. Your stop loss placement will depend on how aggressive you are as a trader. With this strategy, it can be as low as 5 pips for aggressive traders, but again this is up to you.

When it comes to setting profit targets, always aim for a 1:3 risk:reward ratio in your trades and take into consideration any upcoming support/resistance levels on the daily chart.

Refining our NFP Trading Strategy

Now that you have the steps required to trade our high risk, high reward NFP trading strategy, there are a few more things that you need to consider.

By simply adding these refinements to our NFP trading strategy, with just a little experience, you’ll be able to significantly improve your winning rate.

NFP Strategy Refinements

- Consider the Actual vs Expected Number:

If the actual number is higher than the expected number, then we will be expecting USD strength. If the actual number is lower than the expected number, then we will be expecting USD weakness.

If the initial momentum move goes to the opposite direction, then consider not pulling the trigger at the first pause in momentum because this could be just the start of a full-blown retracement. There’s obviously bigger factors at play here.

- Choosing the Best Currency Pairs for Trading NFP:

You want to be trading our high risk, high reward NFP trading strategy on any of the majors. We want to see a sustained move following the initial pullback and the major currency pairs that are most likely to trend.

The most popular major currency pairs are EUR/USD, GBP/USD, USD/JPY and AUD/USD. The more you trade using this strategy, the more you’ll get a feel for each pair’s personality and be able to choose the right one for you.

Final Thoughts on Trading NFP

When it comes to trading NFP there are a few final thoughts that should be considered.

Always keep your total risk on any single position, to just 2% of your account. This can be achieved through changing your position size once you’ve identified your stop loss level.

As with any Forex trading strategy, this one shouldn’t be blindly followed no matter what. Every single NFP release is going to have a different set of circumstances surrounding it and price action will play out differently as a result.

If the setup doesn’t print in a way that looks like you can trade our NFP trading strategy in the way it's laid out above, then keep your powder dry.

Be patient and remember there’s always another trade just around the corner.