Most Trendy Currency Pairs

The most popular way to make money from Forex trading is to exploit strong trends. However, your favorite currency pair(s) will not always deliver the persistent moves you’re looking for.

Let’s see which currency pairs are most suitable for trend following at the moment.

Although trend identification has quite a bit of subjectivity to it, there are concrete methods to spot good trending behavior. Of course, the time frames you trade on will influence your opinion on the direction of the prevailing trend (if there is an existing trend).

A trader who only studies 5-minute charts will often disagree with someone who looks at daily and 4-hour charts. Different methods and indicators are also used to establish whether currency pairs are trending.

Then, there are different types of trends. Some are volatile (jagged) and some are smooth. Some are forceful and some are weak.

Trending currency pairs study

In this article, we study the daily time frames of 10 different currency pairs.

We also look at certain exponential moving averages and measure price fluctuations over 4 different time periods.

We also take note of swing points as we expect to see higher highs and higher lows in an uptrend and lower lows and lower highs in a downtrend.

To give you relevant information that applies to the current market conditions, we mostly look at data and price action for the last 12 months.

TOP Currency Pairs and Price Movements in Percentage

| Currency Pair | % Change Last 2 Weeks | % Change Last 3 Months | % Change Last 6 Months | % Change Last 12 Months |

| GBP/JPY | -0.87 | 0.65 | -3.18 | -3.32 |

| EUR/JPY | -0.76 | -0.54 | -4.24 | -5.25 |

| NZD/USD | -0.96 | -2.13 | -2.08 | -5.24 |

| EUR/USD | 0.78 | -0.76 | -0.89 | -5.71 |

| GBP/USD | 0.65 | 0.56 | 0.21 | -3.82 |

| USD/JPY | -1.47 | 0.21 | -3.38 | 0.53 |

| AUD/USD | -0.64 | -1.25 | -3.16 | -7.08 |

| USD/CAD | -0.29 | 1.14 | 1.67 | 5.12 |

| USD/ZAR | -1.40 | 4.14 | -0.96 | 15.28 |

| USD/MXN | 0.86 | 0.19 | -5.18 | -0.59 |

This table contains some of the most important and liquid currency pairs you can trade, plus two exotic pairs. You can check out our article The Most Liquid Currency Pairs.

You will not find the USD/CHF major pair in this table because it has been trading in a range for several years and is generally inclined to being range-bound. The retail sentiment is also ‘flat’ on the USD/CHF, which tells us that a really strong trend will probably not be seen for this pair soon. So we didn’t even bother looking at the USD/CHF.

Certainly, we can not use this table as a stand-alone indicator to gauge the trend strength of these currency pairs. However, if we notice that a specific currency pair has made a substantial move during a certain time period, we have a reason to investigate that pair in more detail. Furthermore, if the direction of that substantial move agrees with the market direction of the previous periods, there is a pretty good chance that a healthy trend is in play.

In our table, there are 3 pairs (marked in red) that have moved in the same direction in all 4 time periods. They are:

- EUR/JPY;

- NZD/USD;

- AUD/USD.

By briefly scanning through this table, an experienced trader will notice that market volatility has generally been low over the last year. Many of these pairs are also relatively close to where they were a year ago. So, when we look at the charts of these pairs, we shouldn’t expect to see the massive trends that many Forex traders dream of. Nevertheless, let’s analyze the daily time frames of these 3 trending currency pairs to gauge the quality of their move.

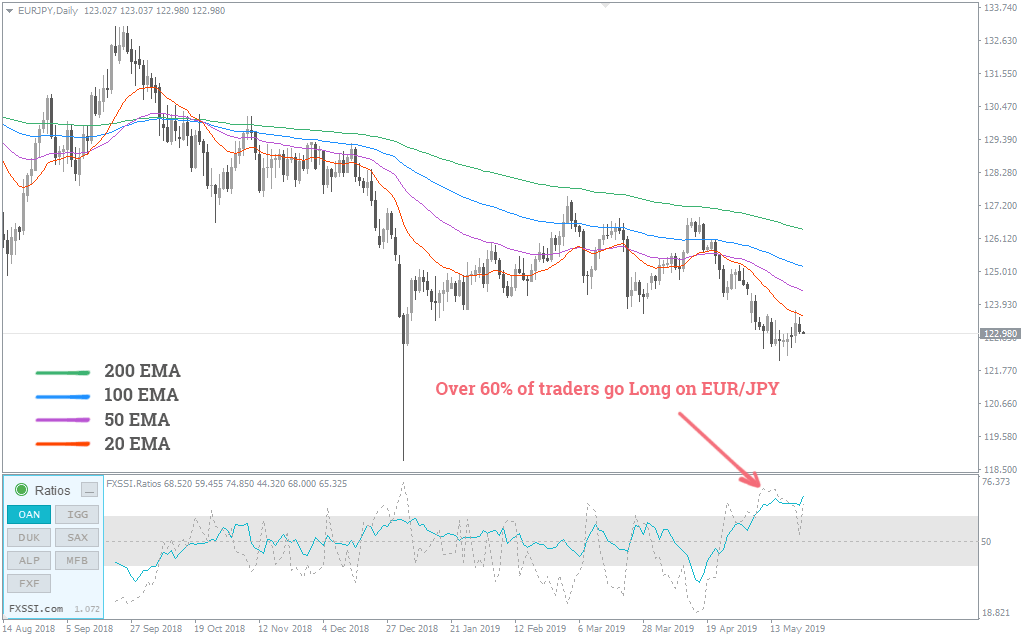

EUR/JPY

In this daily chart of the EUR/JPY, the four exponential moving averages testify of a decent bearish trend. However, the trend is very jagged, with steep pullbacks having occurred regularly. During the last 12 months, there have been some really good opportunities to short this pair, despite a few periods of sideways consolidation.

Pay attention to the Ratios indicator where we can see prevailing Long positions by retail traders. So we can expect a downtrend in the near future.

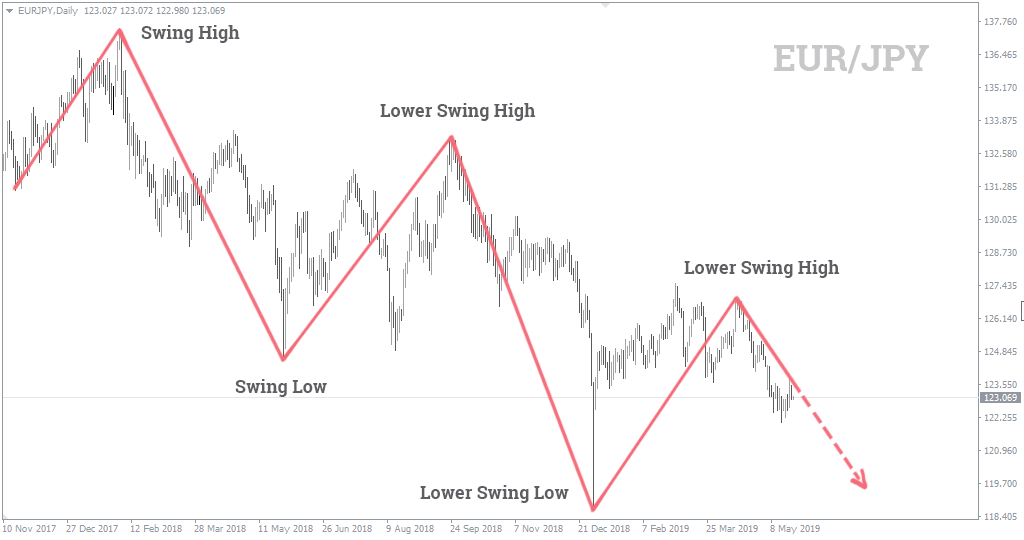

When we analyze the recent price waves and swings of the EUR/JPY, we find lower swing highs and lower swing lows. Of course, we need to use some discretion here because the trend is pretty rough and bumpy. Here is the same chart that illustrates the price swings:

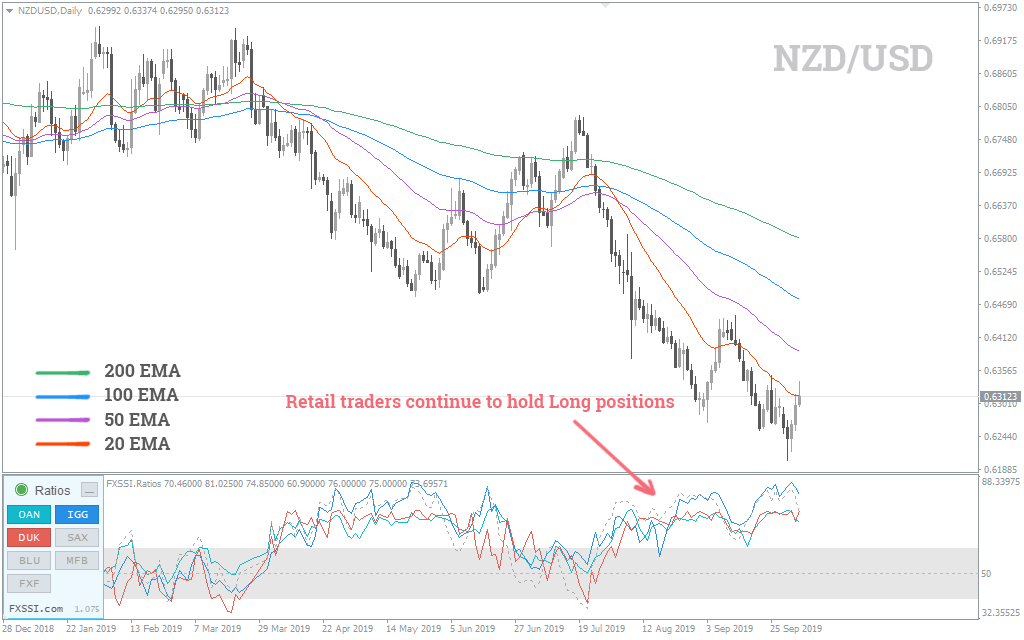

NZD/USD

The NZD/USD is also pretty bearish. Our 4 exponential moving averages are perfectly aligned, with the 20-EMA being the nearest to the price, followed by the 50, 100, and 200. The NZD/USD has been one the best movers (percentage-wise) during the last two weeks, so the predominant bearish trend is still pretty vigorous.

Just like the EUR/JPY, the NZD/USD has also printed some jagged price action over the last year or so. Periods of consolidation and counter-trend moves have often interrupted the move lower. Once again, there were numerous opportunities to successfully short this pair.

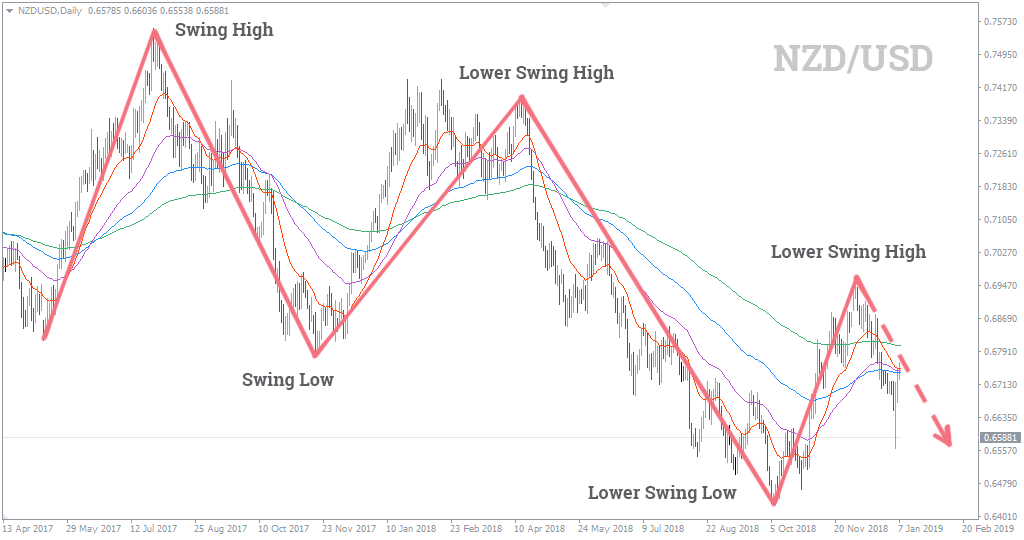

An analysis of the recent price swings of the NZD/USD reveals the characteristics of a healthy downtrend – lower highs and lower lows. Take a look at this chart:

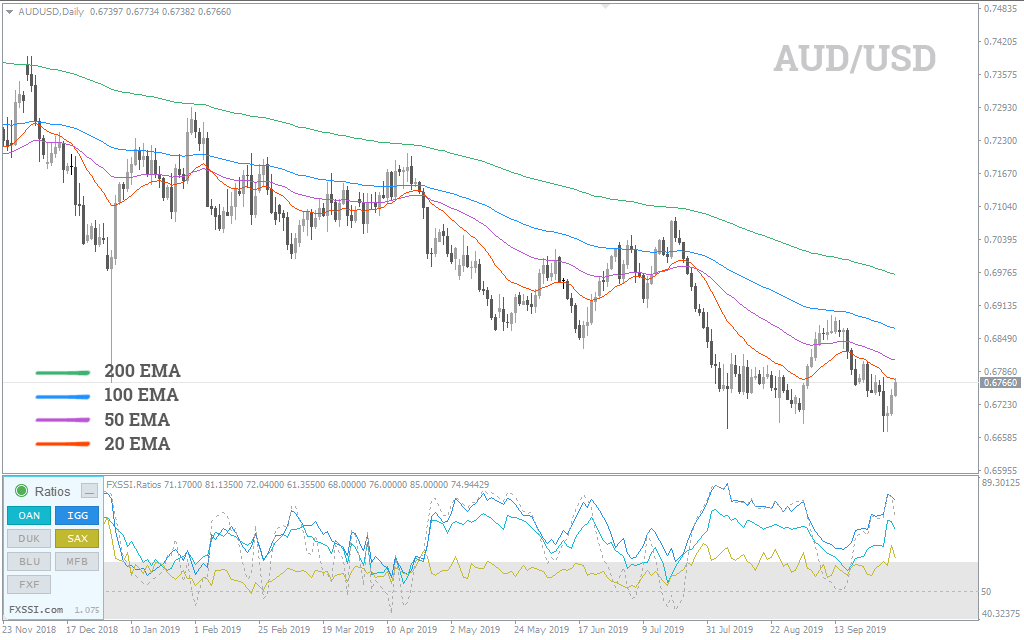

AUD/USD

During the last 12 months, the AUD/USD has declined more than 7%, which is more than most of the other pairs in our table. It is easy to see that the pullbacks against the predominant downtrend were generally less aggressive than those on the EUR/JPY and NZD/USD.

Just like with the two other pairs we looked at, the 4 exponential moving averages are also aligned on this daily chart of the AUD/USD. This indicates that a strong selling pressure is still prevalent in this pair.

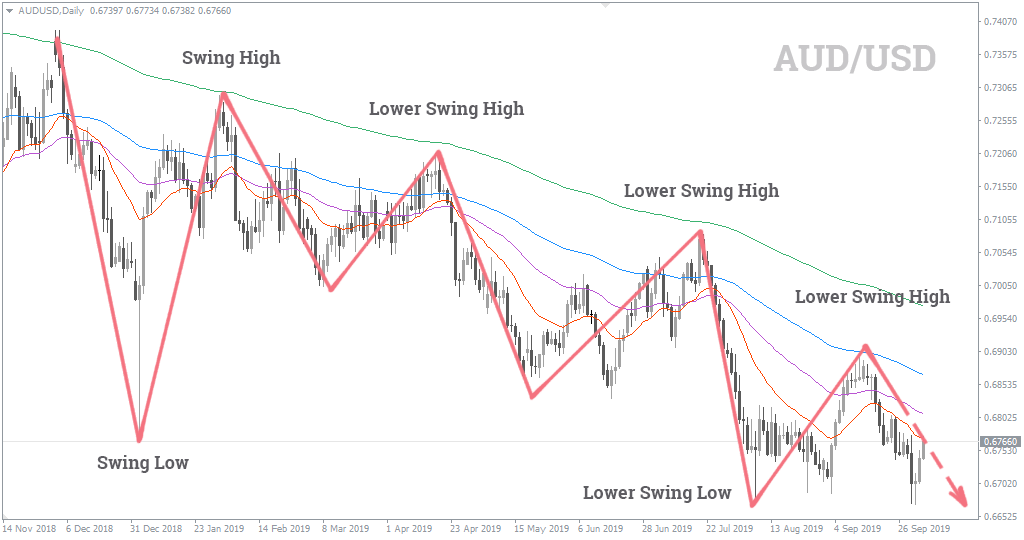

Let’s take a look at how the price swing points have unfolded on the AUD/USD over the last year or so:

Once again, the characteristics of a downtrend are seen in this chart – lower highs and lower lows.

Conclusion

Of all the pairs listed in our table, the EUR/JPY, NZD/USD, and AUD/USD are the most trending currency pairs at the moment. Although these trends are not extremely forceful, they have produced numerous trading opportunities during the last 12 months.

But What About the Other Pairs? Are there any other pairs good for trend following?

Of the other pairs in our table, the EUR/USD is also trending lower, although at a very slow pace.

The GBP/USD is heading lower but is still caught in a wide range on the daily time frame.

The USD/JPY also lost some ground lately but the overall picture remains sideways.

The USD/CAD is struggling to reach the high that was set at the beginning of 2019. Although the 20, 50, 100, and 200 EMAs are aligned and sloping upwards, the pair is just inching higher. Nothing spectacular.

The GBP/JPY is moving lower but is still caught in a wide range.

Although the USD/ZAR is 15.28% higher than 12 months ago, the pair is in the middle of a wide range that has contained the price for several months.

As you may have noticed from the numbers in our table, the USD/MXN is caught in consolidation and is not suitable for trend traders at the moment.