Top 10 Lowest Valued World Currencies in 2026

Most people know about the strongest, most stable, and powerful world currencies. But what about the least valued world currencies? Who knows their names and what countries they are issued in?

For example, British Pound Sterling, Swiss Franc (Swissie), US Dollar, Euro – these currencies are the most stable, as well as the countries issuing them (see TOP 10 the strongest currencies).

But while making this list, we found it pretty hard to put the least valuable currencies in proper order, since the economic situation is changing rapidly in all these countries.

However, it is possible to identify certain devalued national currencies at the moment. Thus, let’s look at the 10 cheapest foreign currencies against the US Dollar and Euro.

The exchange rates of the least valued currencies were updated on 02 March 2024.

#1 – Iranian Rial (~514,000 IRR/USD)

Currency code – IRR.

Iranian rial rates:

1 USD = ~514,000 IRR (US dollar to Iranian rial – black market rate).

1 USD = 42,226 IRR (US dollar to Iranian rial – official rate).

1 EUR = ~561,000 IRR (Euro to Iranian rial – black market rate).

1 EUR = 46,275 IRR (Euro to Iranian rial).

The Iranian Rial is known as the world's least valuable currency. This began in 1979 following the Islamic Revolution, a time when numerous businesses abandoned Iran due to political instability. This situation worsened with the Iran-Iraq War and economic sanctions imposed due to Iran's nuclear activities. Additionally, the Iranian government limited its citizens' access to foreign currencies, resulting in a substantial black currency market. These factors collectively harmed the economy and led to an almost 400% devaluation of the Iranian Rial.

In 2015, Iran's government reached an agreement on nuclear issues with several countries, including the U.S., France, UK, China, Russia, and Germany. This agreement aimed to reduce sanctions on Iran. As a result, the situation improved, leading to the stabilization of Iran's local currency.

However, in 2018 the U.S. claimed that Iran proceeds its nuclear program. The sanctions were sharpened, restricting the country's access to the world commodity markets. Iran could no longer export its petroleum, which brought about 69% of income annually. It created a critical deficit in its national budget. The sanctions also covered other industries, including petrochemistry and metallurgy.

By May 2020, Iran was experiencing rapid inflation, and its currency had lost 600% of its value. To address this, the government chose to replace the Rial with the Toman, removing four zeros from its value. This means 10,000 old Rials are now equivalent to 1 Toman.

#2 – Vietnamese Dong (24,469 VND/USD)

Currency code – VND.

Vietnamese Dong rates:

1 USD = 24,469 VND (US dollar to Vietnamese Dong).

1 EUR = 26,793 VND (Euro to Vietnamese Dong).

The Vietnamese Dong is the world's second least valuable currency.

Vietnam is transitioning from a centralized economy to a market-based one. As a result, its currency, the Dong, is currently quite devalued. Presently, the Dong ranks second on the list of the world's weakest currencies.

However, experts insist that the Vietnamese government is going the right way and may soon catch up with its closer Asian neighbors.

#3 – Sierra Leonean Leone (22,418 SLL/USD)

Currency code – SLL.

Sierra Leonean Leone rates:

1 USD = 22,579 SLL (US dollar to Sierra Leonean Leone).

1 EUR = 24,731 SLL (Euro to Sierra Leonean Leone).

Sierra Leone is a very poor African country, which handled out many serious tests that caused the local money to devalue. Recently, a war took place there, and the deadly Ebola virus is recurrent.

In August 2021 the Bank of Sierra Leone has made a decision to redenominate the Sierra Leonean Leone. Old banknotes will be replaced with new ones called the New Leone with the rate of 1 New Leone to 1,000 old SLL.

#4 – Lao or Laotian Kip (20,594 LAK/USD)

Currency code – LAK.

Lao or Laotian Kip rates:

1 USD = 20,594 LAK (US dollar to Lao or Laotian Kip).

1 EUR = 22,556 LAK (Euro to Lao or Laotian Kip).

The Lao is the only currency on this list, which did not devalue but was originally issued with a very low rate. Besides, since its issue in 1952, the currency did strengthen against the US Dollar and continues to improve its value.

#5 – Indonesian Rupiah (15,502 IDR/USD)

Currency code – IDR.

Indonesian Rupiah rates:

1 USD = 15,502 IDR (US dollar to Indonesian Rupiah).

1 EUR = 16,975 IDR (Euro to Indonesian Rupiah).

Due to the low value of old-style banknotes, by presidential decree of September 5, 2016, 7 new banknotes were issued in denominations from 1 thousand to 100 thousand rupiahs.

Indonesia is an economically stable and quite developed country in Southeast Asia. However, its money has a very low exchange rate. The country’s regulatory authorities are taking all measures to strengthen the national currency, but all their efforts led only to insignificant changes.

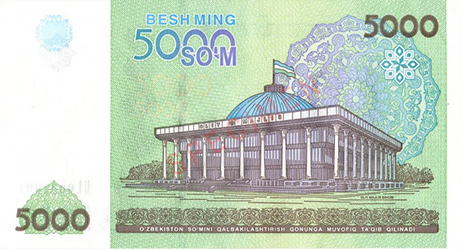

#6 – Uzbek Sum (12,335 UZS/USD)

Currency code – UZS.

Uzbek Sum rates:

1 USD = 12,335 UZS (US dollar to Uzbek Sum).

1 EUR = 13,510 UZS (Euro to Uzbek Sum).

The modern Sum was put into circulation with a ratio of 1 Sum equal to 1000 Sum-coupons from July 1, 1994, by Decree of the President of Uzbekistan.

As a result of the liberalization of their monetary policy from September 5, 2017, the exchange rate of the Sum against the US dollar was set at 1 USD = 8,100 UZS, with an estimated range of 8,000-8,150 UZS for 1 US dollar.

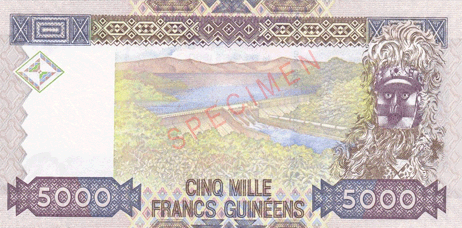

#7 – Guinean Franc (8,579 GNF/USD)

Currency code – GNF.

Guinean Franc rates:

1 USD = 8,579 GNF (US dollar to Guinean Franc).

1 EUR = 9,397 GNF (Euro to Guinean Franc).

A high inflation rate, progressing poverty, and prospering gangsters devalued the currency of Guinea – the African country with one of the most inflated currencies.

Considering its natural gifts like gold, diamonds, and aluminum, this country’s currency should be one of the most valuable.

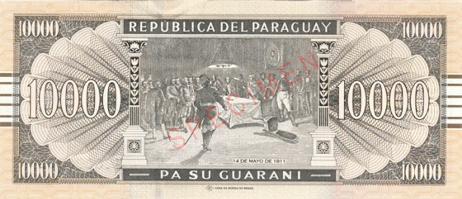

#8 – Paraguayan Guarani (7,280 PYG/USD)

Currency code – PYG.

Paraguayan Guarani rates:

1 USD = 7,280 PYG (US dollar to Paraguayan Guarani).

1 EUR = 7,974 PYG (Euro to Paraguayan Guarani).

Paraguay is the second poorest South American country. It suffered a disastrous economic downturn, combining inflation, corruption, low education quality, an enormous number of poor people, high unemployment, etc.

Paraguay exports cotton and soybeans, but this is hardly enough to cover its economic needs.

#9 – Cambodian Riel (4,086 KHR/USD)

Currency code – KHR.

Cambodian Riel rates:

1 USD = 4,086 KHR (US dollar to Cambodian Riel).

1 EUR = 4,476 KHR (Euro to Cambodian Riel).

In tenth place the weakest currency in the world is Cambodian Riel. The Cambodian Riel is the currency of this Monarch State in Southeast Asia.

This monetary unit was issued in 1995 to replace the Indochinese Piaster. Originally, the Riel had a low exchange rate and was not popular among locals who had decided to use foreign currencies.

Many Cambodians prefer to use the US dollar for payments now, which causes the local currency to devalue even more.

#10 – Colombian Peso (3,915 COP/USD)

Currency code – COP.

Colombian peso rates:

1 USD = 3,915 COP (US dollar to Colombian peso).

1 EUR = 4,289 COP (Euro to Colombian peso).

The Colombian peso is the national currency of the Republic of Colombia.

1 COP is equal to 100 centavos. However, due to inflation, centavos are now out of circulation.

This currency was first introduced in 1810, with the outbreak of the Colombian War of Independence from Spain, to replace the Spanish real that was in circulation until then.

At various times, the Colombian peso has been pegged to the French franc, the British pound sterling and the US dollar.

Devaluation has accelerated dramatically since 1980, when 1 USD equaled 50 COP. As of today, the Colombian peso has devalued about 3,000 times since its release.

Out of TOP 10 or redenominated (lowest/cheapest currency in past)

Denomination means a change in the nominal value of banknotes, usually after hyperinflation, to stabilize the currency and simplify calculations.

During a denomination, old banknotes are exchanged for new ones, which, as a rule, have a smaller denomination.

Due to this procedure, some of the currencies have left the above list.

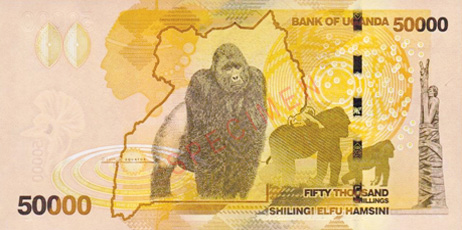

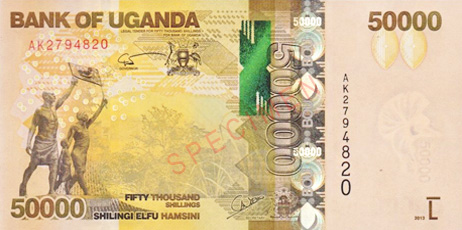

Ugandan shilling (3,806 UGX/USD)

Currency code – UGX.

Ugandan shilling rates:

1 USD = 3,806 UGX (US dollar to Ugandan shilling).

1 EUR = 4,169 UGX (Euro to Ugandan shilling).

In 1966, the Uganda Shilling first appeared, replacing the East African Shilling. The latter was the official means of payment in Kenya, Uganda, Tanganyika, and Zanzibar.

Banknotes with the following denominations are currently in circulation: 1,000, 2,000, 5,000, 10,000, 20,000, and 50,000.

The Uganda Shilling is a relatively stable currency. Over the past few years, its value hasn’t lost more than 5%.

Venezuelan Sovereign Bolívar (4,000,815 VES/USD)

Currency code – VES (Old VEF).

Venezuelan Sovereign Bolívar rates:

1 USD = 4,000,815 VES (US dollar to Venezuelan Sovereign Bolívar before denomination).

1 EUR = 4,745,513 VES (Euro to Venezuelan Sovereign Bolívar before denomination).

Venezuelan Sovereign Bolívar suffered significantly from inflation due to COVID19, so its value became record low in 2020.

And things kept getting even worse since then. In March 2021 the Central Bank of Venezuela introduced three new banknotes with the denominations of 200 thousand, 500 thousand and 1 million bolívars in their attempt to somehow stabilize the national economy. So, no wonder that this currency is considered the most inflated in the world.

The redenomination of the bolivar was carried out on October, 2021.

Sao Tomean Dobra

Currency code – STD.

Sao Tomean Dobra rate:

1 USD = 22,511 STD (US dollar to Sao Tomean Dobra before denomination).

The denomination was implemented on the 1st of January 2018. 1 new dobra (STN) equaled 1,000 (STD) of the previous dobras.

Two small islands in West Africa called St. Tome and Principe, are exporters of cacao, coffee, and coconuts. But this is not enough to support the local economy at an appropriate level.

Recently, oil fields were found on St. Tome Island, and, therefore, the Dobra is expected to increase its value soon.

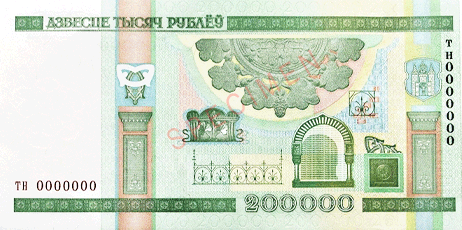

Belarusian Ruble

Currency code – BYR.

Belarusian Ruble rate:

1 USD = 24,155 BYR (US dollar to before Belarusian Ruble denomination).

The denomination was implemented on the 1st of July 2016. 1 new (BYN) equaled 10,000 old (BYR).

The Belarusian Republic appeared in 1992, after the USSR’s collapse. It created its national currency, the Belarusian Ruble, which exchange rate remained stable since 2016. High taxes, inflation, corruption, and political restrictions had led to a very low price for this currency on the global market.

Why do currencies devalue?

In most cases, a state’s currency devalues because of the economic downturn inside a country. This causes a balance of payments deficit and the inflation rate to grow.

This can be a consequence of different economic downturns such as war actions, GDP decreasing, falling prices of commodities that form a large part of exports, purchasing power falling, credit conditions tightening, political instability inside a country, etc.

Currency devaluation is often connected with badly organized monetary policy and relating to decisions of fiscal controls (Central Banking System).