The Largest Currency Redenominations in History

Throughout history, a lot of countries suffered from severe inflation, which usually caused a depreciation of local currencies. In some cases, the ridiculously enormous number of zeroes could barely fit on the banknotes.

That's when the redenomination helped to fix the situation. Redenomination implies changing the face value of banknotes and coins. It is one of the few ways to regulate currency circulation so that people don't have to deal with millions and billions in their daily transactions.

Some countries use redenomination, for example, to adopt a new currency like the euro. But most commonly, it is a result of a crisis in the state or the world. So here, we are going to talk about the redenominations aimed to slash some zeroes from the notes.

And so, we give you the top 10 most significant redenominations in the world's history:

#1 – Hungary, 1946

Old Currency: Hungarian pengő

New Currency: Hungarian forint

Exchange Rate: 4×1029∶1

The most significant redenomination in the world's history occurred in Hungary in 1946, when pengő was changed to forint with the exchange rate of 400 octillion to 1. The highest denominated banknote back then had a value of 20 octillion (2×1027) pengős, and its exchange rate was only $0.0435. It was the most severe case of hyperinflation ever recorded so far.

But it wasn't the first redenomination in the country. After WWI, the Hungarian krona, which was the national currency at that time, suffered from very high inflation. So, with the loan from League of Nations, the government replaced it with pengő at the rate of 12,500∶1. The new currency was pegged to the gold standard, and for some time, was the most stable in the region.

But the high expenditures of WWII and the Great Depression in the 30s have depreciated the currency. The reserves were almost empty. So when the war has ended, hyperinflation was out of control. The pengő had devalued by 400% every day, and the prices increased five times daily.

The new denominations of milpengő (million pengő) and b.-pengő (trillion pengő) were issued to make the calculations easier. By May 1946, the exchange rate of the 100 b.-milpengő (100 quintillions or 1020) banknote was only $0.024.

In 1946, the adopengő (tax pengő) was issued. At first, it was an accounting unit used only by the government and major banks. But as it was somewhat more stable, it became a legal tender and replaced pengő at the rate of 1:200,000,000.

As the hyperinflation continued, the Hungarian government decided to replace the depreciated currency with forint in August 1946.

Today, Hungarian forint remains the national currency of the country and is considered a relatively stable one.

#2 – Zimbabwe, 2009

Old Currency: 3d Zimbabwe dollar

New Currency: 4th Zimbabwe dollar

Exchange Rate: 1×1012∶1

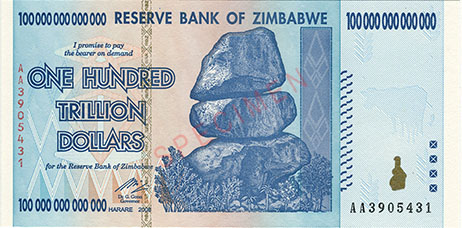

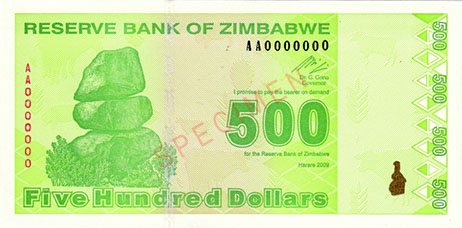

Zimbabwe could take the 2nd and 3d places on our list of grand redenominations ever, as, in 2006-2009, there were three significant cases in the country and four editions of local dollars. Due to severe hyperinflation, in 2009, one 4th Zimbabwe dollar equaled 10 septillions (1×1025) 1st dollars.

Zimbabwe dollar was introduced when the country gained its independence in 1980. At that time, 1 ZWD was worth 1.47 USD in the official market. But over time, it went rapidly down.

By 2006, the unsustainable hyperinflation reached 1,730%. At first, the government planned to introduce an entirely new currency instead of the depreciated one. But without achieving macro-economic stability, it did not make sense. So, the first dollar was simply replaced with the second one at the rate of 1,000:1.

At first, the official rate of the second Zimbabwe dollar was 250 ZWN to 1 USD. But when inflation exceeded 1,000%, it reached 30,000 ZWN to 1 USD in 2007.

In 2008, the currency was redenominated again, with a rate of 10 billion ZWN (2nd dollar) to 1 new ZWR (3d dollar). By that time, the value of ZWN fell to approximately 688 billion per 1 USD.

In November 2008, hyperinflation reached a monthly rate of 79.6 billion %. So, in 2009, the third redenomination cut 12 zeros off the ZWR face value. The exchange rate was 1,000,000,000,000 ZWR to 1 new fourth dollar (ZWL).

In April 2009, the government decided to demonetize the Zimbabwe dollar and legalized some foreign currencies, such as South African rand, the U.S. dollar, Euro, Chinese yuan, and others.

In 2019 Zimbabwe returned to the national currency. The same year inflation increased to 175% and then to 676% in 2020 due to drought and the COVID-19.

#3 – Greece, 1944

Old Currency: 1st Greek drachma

New Currency: 2nd Greek drachma

Exchange Rate: 50,000,000,000∶1

Another grand redenomination happened in Greece in 1944, right after the country was liberated from the Axis invaders. Due to hyperinflation, Greek drachma was redenominated by 50 billion times.

A sharp abrupt in prices started in April 1941, when German troops invaded Greece. During the occupation period, most of the goods from the agricultural, mineral, and industrial sectors were used to support the Axis forces and to provide provisions for the Afrika Korps. Therefore, the products were sold at very low prices, and the value of the export fell significantly. Not to mention looting of the Greek treasury and naval blockades.

With the prices increase, the occupational forces demanded more and more drachmas to cover it. By 1944, the country faced the highest inflation rate of 3×1010% resulting in the issuance of 100,000,000,000-drachma banknotes.

Immediately after the Axis troops left the country, inflation slowed down. The old drachmas were exchanged for new ones at the rate of 50,000,000,000 to 1. But the country still suffered from inflation. It took several years for the rate to fall below 50%.

In May 1954, the currency was redenominated again at the rate of 1,000:1. In 2001, the drachma was replaced with the euro at the rate of 340.75 to 1.

#4 – Germany (Weimar Republic), 1923

Old Currency: Papiermark

New Currency: Rentenmark

Exchange Rate: 1,000,000,000∶1

One of the most significant redenominations occurred in Germany after the WWI. Before 1914, the national currency here was Goldmark linked to the gold standard. But after the war started, there was no precious metal left to back the currency. Goldmark has devalued and gained a new name – Papiermark. It was backed by the land used for agriculture and business purposes.

After WWI, the country had to pay reparations according to the Versailles Treaty. Having no gold or currency reserves, the government issued unlimited new banknotes to pay the debt, causing the Papiermark to collapse.

The inflation reached its culmination of 29,500% in 1923. Back then, the highest denomination of 100 trillion marks was equal to $24.

In November 1923, the worthless Papiermark was replaced with a Rentenmark at the rate of 1 trillion (1012) to 1. Though a year later, this new unit was replaced with the Reichsmark at par, it helped to stabilize the situation and returned the country to a gold-backed currency.

#5 – Yugoslavia, 1994

Old Currency: 1993 dinar

New Currency: 1994 dinar

Exchange Rate: 1,000,000,000∶1

Yugoslavia could also appear several times on our list. As, in 1992-1994, the country faced the third-longest hyperinflation period in world history, there were at least four grand redenominations during this time.

In 1990, Yugoslavia implemented a currency reform, which implied the exchange of 10,000 old dinars to one new convertible dinar. At that time, four states left the Federal Republic and started issuing their own currencies.

In 1992, the reformed dinar replaced the convertible one at the rate of 1:10. It was the period when hyperinflation started rising, reaching 1 million percent by 1993. One of the reasons for this was the Bosnian War, which resulted in the United Nations boycott. This significantly damaged the economy weakened by military operations.

In 1993, the government introduced the new dinar at the exchange rate of 1 to 1,000,000 old ones. This currency unit lasted only three months.

In 1994, another revaluation implied exchanging 1 new dinar for 1,000,000,000 old ones. It was the shortest-lived currency unit of all. Less than a month later, the government introduced the Novi dinar replacing the old one at the rate of 13 million to 1. This time, the currency was pegged to the Deutsche Mark.

Eventually, 1 Novi dinar was equal to about 2.4×1030 pre-war dinars.

#6 – Republic of China, 1949

Old Currency: "gold" yuan

New Currency: "silver" yuan

Exchange Rate: 500,000,000∶1

In 1948-1949, the Republic of China was experiencing lasting hyperinflation because of the Sino-Japanese and civil wars. The old yuan depreciated severely, as the notes were printed in large amounts to cover the increased military expenditures.

In 1948, the golden yuan (golden round) was introduced to replace the old currency at the rate of 3,000,000:1. The government forced people to exchange their gold, silver, and foreign currency for the new unit. The losses of the middle class were so high that the government lost its major support in the civil war.

Golden yuan was very vulnerable to hyperinflation due to inadequate print preparations and failure to enforce issuance limits. The prices continued rapidly growing, though the government tried to freeze them, prohibiting rises and hoarding. Eventually, hyperinflation reached a rate of over 1.1 million percent per year.

In the final days of civil war, the ROC government introduced the silver yuan, which should have replaced golden yuan at the rate of 1:500,000,000. But the new currency circulated only in some parts of the country and was suspended a few months later with the change of the political situation.

In mid-1949, the new government instituted renminbi as the new national currency. And when the hyperinflation ceased, 10,000 old yuans were exchanged for 1 modern yuan in 1955. Today it is one of the world's major reserve currencies.

#7 – Nicaragua, 1991

Old Currency: 2nd Nicaraguan cordoba

New Currency: 3d Nicaraguan cordoba (oro)

Exchange Rate: 5,000,000∶1

Cordoba was introduced in 1912 as a replacement for the peso. Initially, it was nearly equal to the US dollar due to industrialization and some economic growth of the country.

But in the 1960s, the situation started to decline due to flaws in the economic system. To that, in 1972, an earthquake destroyed much of the industrial infrastructure. Budget deficits, foreign loans, and inflation started rapidly growing as a lot of money was spent on reconstructions. In 1977, Nicaragua faced the civil war, which resulted in a sharp drop in foreign investments. And though the conflict stopped in 1979, the cost of the revolution was tremendous.

The government decided to fill the gap between decreasing revenues and growing expenses by issuing large amounts of money. This led to a sharp inflation rise, which by 1987, reached more than 13,109% annually.

In 1989, the country implemented an austerity program, which included a tight price control and also a redenominated currency. The second cordoba was introduced at the rate of 1 to 1,000 old cordobas. As a result, inflation had dropped to an annual rate of 240%. The same year Hurricane Joan caused extensive damage destroying all the anti-inflation measures.

In 1990, the new government started to implement radical changes aimed to stimulate the export of agricultural products and reactivate the private sector. One of the measures was also the redenomination, which took place in 1991. The 3d córdoba oro (gold) was introduced at the rate of 1 to 5,000,000 2nd córdobas.

#8 – Republic of Zaire (Congo), 1993

Old Currency: 1st zaïre

New Currency: nouveau zaïre

Exchange Rate: 3,000,000∶1

Zaire currency was introduced in 1960 when the country became independent. It replaced the Congolese franc at the rate of 1 to 1,000. In 1967, the exchange rate was 2 zaïres to 1 USD. But as the currency was overvalued, so there was a dramatic decline in the following years.

Lack of experienced human resources led the country to inflation. The consistent shortages of hard currency at the official rate strengthened the black market. Access to limited foreign currency was mostly the privilege of the political elite. All of this was accompanied by a series of civil wars called the Congo Crisis. In 1965 the new government somehow stabilized the country politically. But the economic situation continued declining due to poor infrastructure, uncertain legal framework, and corruption.

In 1991, to match the official exchange rate with the black-market, zaire was devalued to 15,300 per 1 USD. By 1992, it was already 1,990,000 zaires to $1.

In 1993, the government tried to stop inflation by introducing the new currency – Nouveau zaire. The redenomination took place with a rate of 3 million old zaires to 1 new unit. But the new currency suffered from high inflation as well.

As the attempts to stop the inflation were ineffective, in 1997, the country re-established the Congolese franc at the rate of 1 to 100,000 new zaïres.

#9 – Bolivia, 1987

Old Currency: peso boliviano

New Currency: boliviano

Exchange Rate: 1,000,000∶1

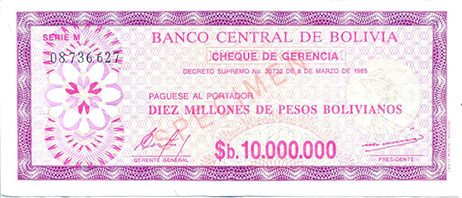

The grand redenomination took place in Bolivia in 1987, when peso boliviano was replaced with boliviano at a rate of 1,000,000:1. The value of the new currency unit was equal to 1 USD.

Boliviano was the national currency of Bolivia since 1864. But in 1963, due to rising inflation, it was replaced with the peso boliviano at a rate of 1,000:1. The new exchange rate was 11.875 peso per 1 USD. Yet, by 1985, one US dollar was equal to about a million pesos bolivianos on the black market. The currency has devalued by 95%.

In 1982, as there was insufficient time to print regular banknotes, the Banco Central introduced much simpler cheques de gerencia (bank drafts) ranging from 5,000 to 10 million pesos bolivianos. By 1986, they almost replaced the ordinary banknotes in circulation. Inflation reached its culmination in 1985 when the annual rate was more than 20,000%. The prices grew by approximately one million times.

In 1987, the government implemented fiscal and monetary reforms, which included the transition to the new boliviano at the rate of 1,000,000:1. By that time, 1 USD was worth 1.8-1.9 million pesos. In the early-90s, the measures implemented by the government reduced inflation, bringing it to the manageable level.

#10 – Peru, 1991

Old Currency: Peruvian inti

New Currency: Peruvian nuevo sol

Exchange Rate: 1,000,000∶1

Since 1863, sol was the national currency in Peru. But the chronic inflation due to the bad-state forced the government to replace it with inti at the rate of 1,000:1 in 1985. By that time, 1 USD was equal to over 3,210,000,000 soles.

This redenomination turned inflation into hyperinflation, which rose effectively to the early 1990s. Before the second currency revaluation in 1991, the "inti millón" note was commonly used to make the calculations easier.

The switch to the nuevo (new) sol in 1991 stabilized the economy of Peru. The new currency was adopted at the rate of 1 new sol to 1,000,000 inti (1,000,000,000 old soles). In 2015 the government refused from the label "nuevo" and renamed the currency to simply "sol."

Since the nuevo sol was introduced, its inflation rate remains 1.5%, which is considered the lowest in South and Latin America.

#10 – Angola, 1999

Old Currency: kwanza reajustado

New Currency: 2nd kwanza

Exchange Rate: 1,000,000∶1

Another significant redenomination case took place in Angola in 1999 when kwanza reajustado was replaced with (second) kwanza at the rate of 1,000,000∶1.

In the 1920-1960s, the country experienced strong economic growth mostly due to abundant natural resources, such as petroleum. The downturn started in 1974 when a military coup happened in Lisbon. Angola gained its independence from Portugal, and the Portuguese left the country in 1977. That year, the kwanza replaced escudo at par. Since then, four different kwanzas were circulating in Angola.

Independence resulted in a crisis, as the Angolans had no skills or knowledge for running the country and maintain the infrastructure. The violent civil wars in 1975-2002 also accelerated inflation. Several times during the 90s, Angola's currency was the least valuable in the world.

In 1990, the government introduced the novo kwanza, which replaced the previous one at par. But people could exchange only 5% of the old banknotes; the rest had to be changed for government securities.

The novo kwanza lasted until 1995 when it was replaced by kwanza reajustado at the rate of 1,000 to 1. As the inflation continued, the smallest note denomination of the new currency soon was 1,000 kwanzas reajustados.

In 1999, when the exchange rate of kwanza reajusado reached 5,400,000 to 1 USD, the government replaced it with the new kwanza at the rate of 1,000,000 to 1. And though at the beginning the new currency has also suffered from high inflation, now it has stabilized.

#10 – Turkey, 2005

Old Currency: Turkish lira

New Currency: Turkish new lira

Exchange Rate: 1,000,000∶1

Since 1946 Turkish lira was pegged to the U.S. dollar at the rate of 2.8 liras to 1 USD. But in 1970 the currency started falling. The chronic high inflation during 1970-2005 resulted in severe depreciation of the national currency. In 1990, 1 USD was equal to 2,500 liras. And by 2005, one USD was worth 1,350,000 liras.

The highest annual inflation rate in Turkey reached about 38%, making lira the least valuable currency in 1995-96 and 1999-2004.

This eventually led to the 2005 redenomination when the old currency unit was changed to the new lira at the rate of 1,000,000 to 1. In 2009, it was decided to refuse from the "new" label.

In 2017, Turkey experienced an inflation rise again. The currency devaluation, increasing borrowing costs, large amounts of private foreign-currency-denominated debt, and Erdoğan's decision to prevent the Central Bank from making the interest rate adjustments caused the currency and debt crisis. Some also say that one of the reasons for this was the geopolitical conflicts with the United States and the enforced tariffs on some Turkish products such as steel and aluminum.

#10 – Georgia, 1996

Old Currency: kuponi (coupons)

New Currency: Georgian lari

Exchange Rate: 1,000,000∶1

Georgia started its way to the free-market economy in 1991. Two years later, the government replaced the Russian ruble, which was used as the national currency back then, with the kuponi (provisional coupons) at par.

But like many post-soviet countries, the economy of Georgia faced a collapse, as the restructuring of the whole system required a lot of effort and resources. The budget deficit continued growing. To that, civil war in South Ossetia and Abkhazia aggravated the situation. The new currency suffered from severe hyperinflation.

Interestingly, the banknotes here included some unusual denominations like 3,000, 30,000, and 150,000 coupons.

In 1995, the World Bank and International Monetary Fund granted Georgia a credit to stabilize the situation. The next year the new lari replaced the coupons at the rate of 1:1,000,000. Since then, lari was considered one of the most stable among the post-soviet currencies until 2019 when it faced another depreciation.

A few more redenomination cases

Here is the short information on some other countries that have redenominated their currencies, slashing at least four zeroes from the notes:

| Country | Year | Old Currency | New Currency | Rate |

|---|---|---|---|---|

| Ukraine | 1996 | Karbovanets | Hryvnia | 100,000∶1 |

| Venezuela | 2018 | Bolivar Fuerte | Bolívar Soberano | 100,000∶1 |

| Taiwan | 1949 | Taiwan Dollar | New Taiwan Dollar | 40,000∶1 |

| Ecuador | 2000 | Sucre | U.S. Dollar | 25,000∶1 |

| Austria | 1925 | Austrian Krone | Austrian Schilling | 10,000∶1 |

| Argentina | 1983 | Peso Ley | Peso Argentino | 10,000∶1 |

| Argentina | 1992 | Austral | Peso | 10,000∶1 |

| Poland | 1995 | 2nd Polish Złoty | 3d Polish Złoty | 10,000∶1 |

| Romania | 2005 | 3d Romanian Leu | 4th Romanian Leu | 10,000∶1 |

| Ghana | 2007 | Cedi | New Ghanaian Cedi | 10,000∶1 |

| Belarus | 2016 | 2nd Belarusian Ruble | 3d Belarusian Ruble | 10,000∶1 |

And soon, Iran may join the list above. In 2019, the government announced their plan to replace the depreciated rial with the new toman at the are of 10,000:1. This process is likely to last about 2-5 years. The reason for such a change is that the Iranian rial devalued by approximately 600% due to the galloping inflation. Today it is considered the weakest currency in the world.