Buying Gold in 2021: A Good or a Bad Investment?

2020 has been anything but a stable year. With the growing political and economic uncertainty, gold has become a popular investment option for many people looking for ways to reduce risks and diversify their portfolios.

The price of gold, as the main anti-crisis tool, has increased by 25% since the beginning of 2020. Overall, investment in this precious metal, which is usually put aside as insurance for a rainy day, has been on the rise since 2019.

Here’s a question for you: after an outstanding performance this year, will the gold prices continue to rise? Is it worth investing in this precious metal in the coming year? Let's figure it out together.

What makes gold a wise investment option?

Gold is an asset traditionally viewed as a good investment option. Is there any special reason behind this?

This noble metal has been valued at all times, and today its demand as a liquid and reliable asset remains relevant.

Buying gold as an investment is a stable option that helps to protect money against inflation and maintain its purchasing power. The production of this precious metal is getting more expensive every year, which directly affects its increase in value.

Gold deposits are rare all over the world. Most of them are already being developed, and the rest are located in hard-to-reach places. Gold mining is extremely labor-intensive and it’s a rather slow process, which makes this metal quite rare.

Gold also possesses unique physical and chemical properties. In addition to its durability, it is characterized by excellent electrical conductivity. Gold is actively used in the space and aviation industries, as well as in building computer components.

But note that investing in gold can both generate substantial profit and incur significant losses. Gaining the maximum advantage without unnecessary expenses is possible by thoroughly studying the ins and outs of this type of investment.

Is gold a good investment in 2021? What do experts say?

What can we expect from gold in the coming year? What’s the experts’ take on this precious metal?

Some analysts expect the price of gold to increase in the first half of 2021 followed by its decrease in the second half. The following factors might come into play in this case: accommodative monetary policy and a reduction in geopolitical risks. Therefore, they expect fewer risks, and as a result, gold rates will drop.

Other analysts are certain that the gold price will significantly increase next year, so now is the time to buy this precious metal.

Some experts are cautiously optimistic about gold's long-term potential. Analysts believe that due to the extremely unstable current situation in the world, the purchasing power of almost all official currencies will decrease. This is the scenario when gold is perceived as a good investment option.

It is believed that low-interest rates in the world and a weak US dollar will support gold in the first two quarters of the next year. However, the second half of the year is expected to see the global economy returning to normal, and this precious metal might face significant drops in price.

Still, most experts are optimistic about gold for the first half of the coming year. In addition, the market dynamics looks promising, so there is every reason for buying it for the coming year.

Investing in Gold: Good or Bad?

Gold has always been and remains one of the most popular investment options regardless of the economic situation, especially during a crisis. However, as with any investment, buying gold has its pros and cons.

| Why invest in gold | Why not invest in gold |

|---|---|

| It’s the perfect defensive asset that helps to protect investors' money against devaluation, inflation, and market crash. | At its core, investing in gold does not yield any profit. Its storage and insurance costs can produce negative returns. |

| The price of gold gradually rises over time. | There is a huge difference between the buying and selling price of physical gold. |

| Gold can also be considered a universal “currency”, i.e. it will have its own value in relation to national currency in any country in the world. | It's impossible to calculate the intrinsic value of gold. Its price is determined by supply and demand. |

| Gold itself is not subject to price fluctuations that are characteristic of stocks or securities. | It might take several years before you can enjoy the benefits of your investment in gold. |

What does it mean to “buy gold”?

A long time ago, buying gold was possible only in physical form, but investing in the metal today is even easier than it seems.

So let's take a look at various gold investment options that are available in this day and age.

Gold bars and coins

The first and easiest way of investing in gold that comes to mind. Bars can be purchased from banks.

Many investors consider investing in gold bars to be one of the easiest and most profitable options. However, it’s worth mentioning that purchasing physical gold makes you face a number of issues: you’d need to store it somewhere, take care of the insurance for it, and there’s also a big difference between the buying and selling price.

Investing in gold coins is almost the same, except that there are increased demands on the quality of the coins. Any physical impact, even opening the container, reduces their value.

As with the gold bars, coins can also be purchased from a bank. You can also buy them at numismatic stores and auctions.

The spread on gold coins is also high and can sometimes reach 8-10%.

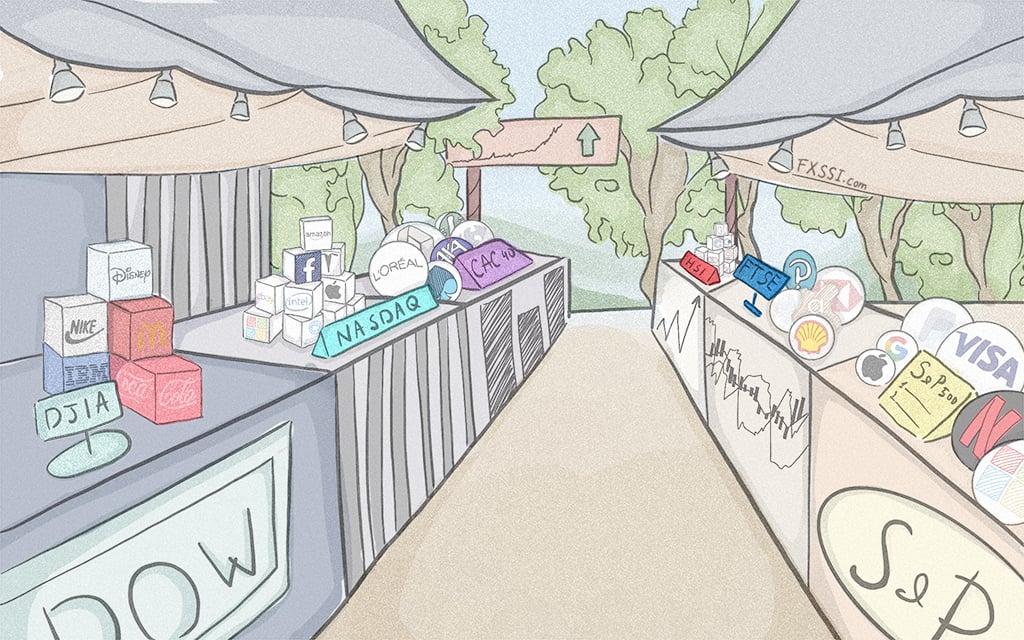

Gold mining stocks

Another way to invest in gold is to buy shares of gold mining companies.

However, investing in stocks is not the same thing as purchasing precious metals.

The fact is that the share price depends on various factors: the level of competition, taxes, the business processes, the volume of supply / demand, etc.

One of the advantages of investing in stocks, however, is the ability to receive dividends. Since dividends are a part of the company's profit, the investor can count on additional income even when the gold prices drop.

This type of investment works for both long-term and short-term investors. The main thing is to remember that the prices of gold mining stocks depend not only on the price of this precious metal itself.

Exchange Traded Funds

ETF or Exchange Traded Fund is a publicly traded investment fund. Its quotes are linked to the assets in the portfolio. Gold ETFs have gold as their only asset, so their stocks follow the movement of the metal's market price.

ETFs are traded on the exchange market in lots.

The advantage of this type of investment is that you can easily invest in gold without the need to buy it physically or worry about storing it. ETFs can be traded the same way as regular stocks.

In general, the overall cost is significantly lower than when buying physical gold. The disadvantage of investing in ETFs, however, is that it’s still "paper" gold. There are also other risks to consider, such as the management company itself, a broker, and exchange markets.

Investing in ETFs has both long-term and short-term potential. It works for both small and large investment. Although, bear in mind that it depends directly on the price of gold and low costs.

Alternatives to gold investment

What about other precious metals? Is it worth investing in them?

In general, the most popular alternatives to investing in gold are silver, platinum and palladium.

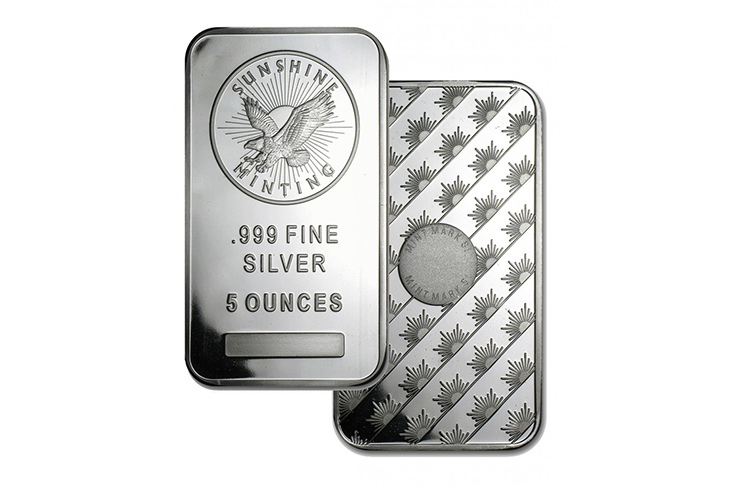

Silver

It is not a very expensive metal, since its deposits are much larger. And the price, respectively, is ten times lower than the price of gold. However, the cost of silver is growing steadily and, according to a number of experts, this precious metal can significantly increase in price within 20 years.

The thing is that the price of silver is undervalued since it is actively being used in various types of industries. And this may lead to the depletion of its reserves and an increase in its value in the foreseeable future.

Platinum

One of the largest suppliers of platinum is South Africa. This country accounts for the bulk of the world's supply of this metal. As a result, the exchange rate of the South African currency as well as the intensity of mining in this region may influence the price of platinum.

Platinum is actively used in the automotive industry. This precious metal is used in the manufacturing of catalytic converters, which help reduce the toxicity of vehicle exhaust gases.

Just like gold, platinum is also used in jewellery manufacturing. If you’re looking for ways to invest in platinum, you might get interested in ETFs that, for example, support the physical supply of this precious metal.

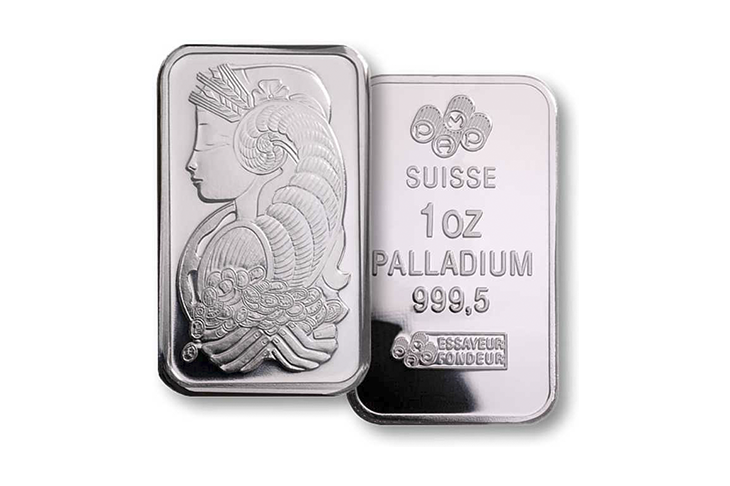

Palladium

Palladium is similar to platinum, since it also belongs to the platinum group metals and it’s also used in the manufacturing of catalytic converters for vehicles.

Since the automotive industry accounts for the bulk of the industrial use of palladium, increased vehicle sales could increase the demand for palladium.

Russia is the world's largest producer of palladium, which is often a by-product of nickel mining.

If you are interested in other precious metals and their investment potential, we have prepared for you a list of the Top Rarest and Most Expensive Metals in the World.

So, is investing in gold a good idea?

The coming year suggests investing in gold as the main defensive asset during a recession.

However, this precious metal does not bring immediate benefits. It does not pay dividends. And one can expect a substantial profit only in the long run. If you are not ready to wait for several years, then it is better to pay attention to the stocks of gold mining companies, for instance.

So, is it worth buying gold in 2021? Unfortunately, there’s no straight answer to this question. Most projections currently point to a consistently good performance of gold in 2021. However, it is important to remember that global financial markets remain extremely volatile. Therefore, it’s rather difficult to predict how the price of gold is going to behave in a few hours, and it’s even more problematic to provide long-term estimates. It is important to implement technical analysis, consider the latest market trends and news before making any investment decisions.