The Most Liquid Currency Pairs

Liquidity is the ability of assets to be sold quickly and closest to the market price. However, one definition is not enough to answer the question, what currency pair is the most liquid, since such liquidity must somehow be measured.

Ideally, we calculate the total volume of all pending orders for a specific currency pair and compare it to the volume of the other pairs. We can rank the currency pairs from the most to the least liquid by doing so.

However, we cannot calculate these volumes since the Forex market has no single-center, and God knows how many open orders there are.

On the other hand, we have some data on the activity of various currency pairs, namely, every pair’s share of the total volume.

Thus, if we take the entire volume of transactions in the Forex market as 100%, each pair will constitute a particular share in the total volume.

The Most Liquid Currency Pairs

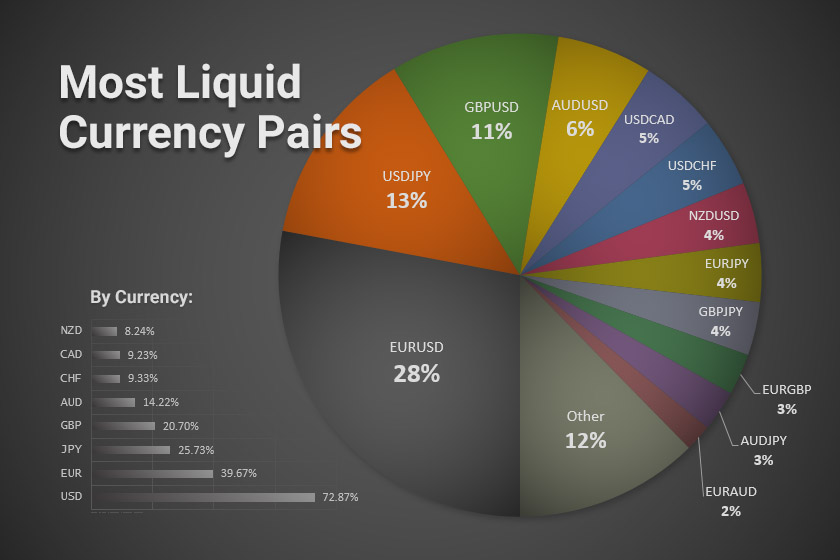

We obtained a chart displaying the share of each currency pair as of March 2023:

Note: We cannot guarantee that this chart reflects the current market situation for 100%, but the error margin does not exceed 5-10%.

So, the most liquid currency pair is EUR/USD, which accounts for 28% of the total transaction volume in the Forex market.

The second most liquid forex pair is USD/JPY, with a share of 13%.

The third most liquid pair is GBP/USD (11%).

You can find the information on other currency pairs in the chart above.

Of course, there are a lot of other pairs, mainly exotic ones, but nobody knows which of them is the least liquid. They probably have no liquidity at all compared to major pairs.

What makes liquid pairs interesting for us?

If you are interested in the most liquid currencies, it matters to you. Indeed, the quality of order execution is highly dependent on liquidity and commission costs.

More highest volume forex pairs are characterized by:

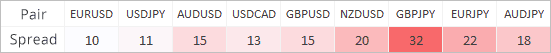

- rare slippage;

- lower spread;

- fast execution of orders.

This is why many traders prefer trading more liquid currency pairs only, and some of them "get stuck on" EUR/USD and don’t even consider other pairs for trading.

To tell the truth, the difference in liquidity among the seven major pairs is not substantial enough to limit your trading with one of them only.

We should also mention that not the pairs themselves have the liquidity, but the currencies constituting them.

Put the phrase "currency pair" in the above definition of liquidity, and you'll get: "Liquidity is the ability of a currency pair to be sold quickly…". However, we don't sell a currency pair itself but sell/buy a specific currency. So, the liquidity of a currency pair derives from the liquidity of its constitutive currencies.

Now that you've read to the end, maybe you will be interested in looking at the most expensive currencies in the world or The Lowest World Currencies?