TOP 10 List of Major World Stock Indices | 2026 Edition

You’ve probably heard something along the lines of “the Dow gained 15 points today” or “NASDAQ index is down 40 points”. What does this mean, and what is an index?

Simply put, a stock market index is a relative term for a “basket” of securities combined together based on a specific criterion. For instance, some indices include shares of the largest companies trading in the United States.

Indices help track the behavior of the securities market. When some stocks increase in price and others come down, the index shows how much the stock market has gone up or down on average.

Rating or stock exchange agencies calculate the value of stock market indices. The name of the index mainly consists of an abbreviation and sometimes a number of companies constituting it.

There are over 3 million stock indices in the world, according to the Index Industry Association. Therefore, there are numerous ways of classifying stock indices, for example:

- geographically (this includes the shares lists of companies representing a specific country or a group of countries like the European Union, for instance);

- by the number of companies included in the index;

- by the method that provides the basis for calculating the value of the index;

- by industry (includes shares of various leading companies in different industries – manufacturing, transport, gas and electricity supply, etc.);

- and many others.

There’s also a set of criteria that each company has to meet before it can be added to an index. Some companies, however, might satisfy the requirements for multiple indices at the same time. Therefore, such companies can be included in several different indices simultaneously.

We've decided to put together our own list of the top 10 major world indices based on the average volume of shares traded within each index.

Presenting Top 10 Major World Indices in 2026

1. NASDAQ-100

Average volume: 5.737 bln.

Code: NDX

Country: USA

Weighting method: capitalization-weighted

National Association of Securities Dealers Automated Quotation or NASDAQ is one of the largest US indices. It was first calculated back in 1985. The index includes 103 shares of 100 high-tech US mid- and large-cap companies traded in the Nasdaq market system. These are mainly Internet holdings, electronics, and software manufacturers.

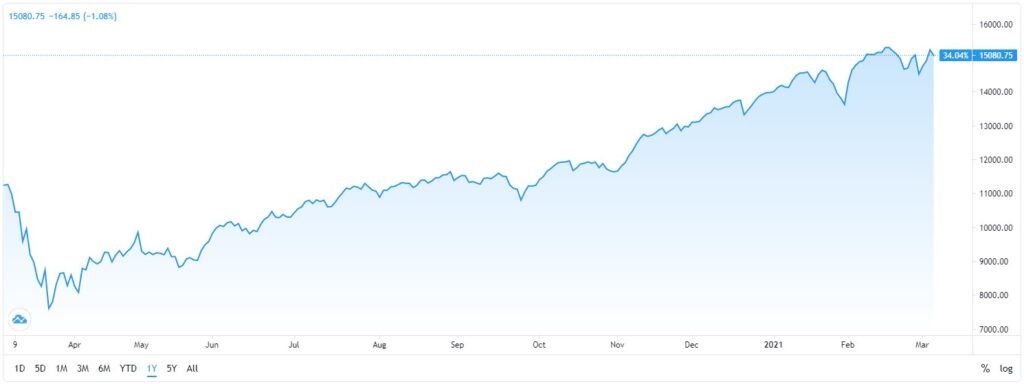

NASDAQ is the fastest developing index in the world, since it reflects the capitalization of stocks with potential to grow (also known as growth stocks). The market cap of NASDAQ-100 reached $9.8 trillion at the end of 2019.

Shares of such giant tech corporations as Apple, Microsoft, Amazon, Facebook, Alphabet (Google), and Tesla constitute the major part of the index.

2. S&P 500

Average volume: 4.996 bln.

Code: SPX

Country: USA

Weighting method: free-float capitalization-weighted

Standard and Poor's Composite 500 Index is one of the main American stock indices. It was first calculated in March 1957. The index consists of 505 shares of 500 largest companies in the USA. Together they account for about 80% of the capitalization of the entire US market.

S&P 500 can also be considered one of the major stock indices in the world, since its fluctuations significantly affect the share indices of other countries.

As of December 2020, the market cap of this index reached $33.4 trillion.

The IT giants like Microsoft and Apple make up the bulk of S&P 500. Other large corporations included in this index are Amazon, Facebook, Google, Berkshire Hathaway, Johnson&Johnson, and Visa.

3. Hang Seng Index

Average volume: 2.929 bln.

Code: HSI

Country: Hong Kong Special Administrative Region of the People's Republic of China

Weighting method: capitalization-weighted

The Hang Seng Index is the major index of the Hong Kong Stock Exchange – one of the most powerful in Southeast Asia. Hang Seng accounts for around 65% of this stock exchange’s total market cap.

The Hang Seng Index was first calculated in 1969.

To make the calculations easier, there are 4 sub-indices within this index:

- industrial Hang Seng Commerce & Industry,

- investment Hang Seng Properties,

- Hang Seng Utilities dealing with energy sector,

- financial Hang Seng Finance.

The index includes such huge corporations as HSBC, China Construction Bank, Industrial and Commercial Bank of China, and Bank of China. In total, they are the largest banks in the world.

4. FTSE 100

Average volume: 905.89 mln.

Code: FTSE

Country: UK

Weighting method: capitalization-weighted

The Financial Times Stock Exchange is the major index of the UK. It includes one hundred shares with the maximum capitalization on the London Stock Exchange. The index was first calculated in 1984.

FTSE 100, along with the Dow Jones Industrial Average, S&P 500, NASDAQ and Nikkei 225 indices, forms the "big five indicators" of the global economy.

The index includes companies operating in more than 150 countries around the world. As of May 2020 the market cap of FTSE 100 amounted to £1.814 trillion.

The capitalization of FTSE 100 accounts for 80% of the total value of the London Stock Exchange. In addition to this index, there are six main indices and a lot of industry ones. There are more than 200 indices in the world bearing the same name – FTSE – and using the same calculation formula.

HSBC, Royal Dutch Shell, and BP make up the bulk of this index.

5. Dow Jones Industrial Average

Average volume: 393.46 mln.

Code: DJI

Country: USA

Weighting method: price-weighted

Closing our top 5 major global indices is the well-known Dow Jones index, or simply called the Dow.

This index was first calculated in 1884 by Charles Dow, the publisher of the infamous financial newspaper The Wall Street Journal. Initially, the Dow index was based on the shares of 11 railway companies. The first Dow Jones Industrial Average index was put together in 1896 and included the shares of 12 companies.

The modern-day Dow includes 30 large companies (blue chips) listed on US stock exchange markets weighted by their prices: the value of each share is taken into account and the sum is divided by the number of companies constituting the index. The higher the value of one stock, the more the relative change in its value affects the index.

In December 2019 the total market cap of Dow Jones Industrial Average reached $8.33 trillion.

The Dow Jones index today is an indicator of the dynamics of the industrial sector in the United States. It’s also one of the most important benchmarks for the American economy. Some of the major companies constituting the index are Coca-Cola, IBM, Intel, Microsoft, and General Motors.

6. DAX 30

Average volume: 77.469 mln.

Code: DAX

Country: Germany

Weighting method: capitalization-weighted

The main German stock market index was first calculated in 1988. It includes 30 most liquid shares of the largest companies.

Like many other global indices, the DAX index characterizes the state of the economy of its region.

The index is calculated by Deutsche Börse AG. As of September 2020 the market cap of DAX 30 amounted to €1,017.7 billion.

Like with other major world indices, there are also sub-indices based on DAX 30, for example:

- CDAX includes all German listed companies.

- HDAX includes 110 largest corporations, similar to FTSE 100 and S&P 100.

- MDAX is the list of the TOP 50 companies following the ones included in DAX 30. This index focuses on mid-cap businesses.

- SDAX – includes the next TOP 50. SDAX focuses on companies with low capitalization.

- TECDAX is similar to NASDAQ and includes industrial mid-cap corporations. It represents 30 large technology companies in Germany that are not included in the DAX 30 index.

- OKODAX includes companies that deal with renewable energy sources.

DAX 30 includes such well-known companies as BMW, Deutsche Bank, Allianz, Deutsche Post, Henkel and others.

7. Russell 2000

Average volume: 49.965 mln.

Code: RUT

Country: USA

Weighting method: free-float capitalization-weighted

This index tracks the dynamics of small US companies. It accounts for about 90% of the total number of small-cap companies on the American stock market.

Russell 2000 is usually considered to be the opposite of the “elite” indices like the S&P 500 and Dow Jones. Since it shows a more in-depth analysis of the market, companies making up this index are rarely heard.

Broad diversification (there are more than 2,000 companies in the index) implies lower index returns but offers greater resistance to risk, making it a good investment opportunity.

Russell 2000 was first calculated in 1984.

8. CAC 40

Average volume: 47.827 mln.

Code: PX1

Country: France

Weighting method: capitalization-weighted

The major index of the French stock market was first calculated in 1987. As the name suggests, it includes the shares of 40 companies that trade on Europe's second-largest stock exchange – Euronext Paris.

The leading companies constituting CAC 40 deal with industrial goods and services, household goods, healthcare, and the oil and gas industry.

Unlike most world stock indices, where the constituents may stay the same for years, the CAC 40 index is a living and constantly changing organism. The list of companies is revised almost every quarter.

In January 2020 the market cap of CAC 40 reached €1.832 trillion.

The index includes such giants as L'Oreal, Renault, and Michelin.

9. Euro STOXX 50

Average volume: 39.468 mln.

Code: SX5E

Country: Eurozone

Weighting method: free-float market capitalization-weighted

This index includes fifty largest Eurozone companies from 19 economic sectors. France and Germany make up the bulk of Euro Stoxx 50 and account for almost 70% of the index's market capitalization.

The index has been calculated since February 1998, and its constituents are revised annually.

The Euro STOXX 50 index is calculated in five major EU currencies – Euro, US and Canadian dollars, British pound sterling, and Japanese yen.

In recent years a whole group of sub-indices has emerged, like Euro Stoxx SubIndex Italy, France, and Spain, for example. These indices display the general directions for national economic strategies of the above-mentioned countries. Among other important sub-indices based on Euro STOXX 50 are Stoxx Europe 600 and a number of industry indexes representing the overall market behavior in specific sectors.

The Euro STOXX 50 index includes such well-known companies as Deutsche Post, Deutsche Bank, AXA, BMW, Siemens, and Volkswagen Group.

10. Bovespa Index – Ibovespa (Índice Bovespa)

Average volume: 9.842 mln.

Code: BVSP

Country: Brazil

Weighting method: free-float capitalization-weighted

The BOVESPA Stock Index, also known as Ibovespa, is one of the major macroeconomic indicators in Latin America, traded on the B3 stock exchange in Sao Paulo.

The index includes the “blue chips” of the 50 largest companies in Brazil. Among them, there are only three financial companies, and eight represent the energy sector.

The index was first calculated in 1968.

Besides BOVESPA, there are also sub-indices:

- MLCX includes large and mid-cap companies,

- SMLL focuses on small-cap structures,

- IEE includes companies dealing with the energy sector,

- INDX focuses on companies in the industrial sector.

Some of the largest companies constituting the BOVESPA index are Petrobras, Itaú Unibanco, AmBev, Vale, Telefônica Brasil.

Major World Indices: Runners-up

The stock exchange market is very dynamic and naturally, some indices might replace one another on this list. The following indices have a great potential for growth and one day they might make even Dow Jones scooch over.

11. NIFTY 50

Average volume: 639.780

Code: NSEI

Country: India

Weighting method: capitalization-weighted

The National Stock Exchange of India is one of the fastest-growing in the world. One of its two main indices is NIFTY 50. It includes 50 companies with the largest capitalization. It was first introduced in April 1996.

In addition to NSE NIFTY 50, there are also NSE industry indices. They are formed to represent the main sectors of the Indian economy – automotive, IT, banks, media, etc. This makes it possible to determine the leading segments in real-time.

Some of the largest companies constituting the NSE NIFTY 50 index are Reliance Industries Ltd., HDFC Bank Ltd., Nestle India Ltd.

12. SSE Composite Index – Shanghai Stock Exchange Composite Index

Average volume: 294.812

Code: SHCOMP

Country: China

Weighting method: capitalization-weighted

This is one of the leading indices of the Shanghai Stock Exchange. It includes 1,075 “A” and “B” listed companies and has shown uneven growth for the past 24 years.

The index was first calculated in 1991.

Before the collapse of Chinese stock prices in 2015, the capitalization of the SSE Composite index reached $5.8 trillion.

Companies dealing with financial services and real estate make up the bulk of this index. The industry sector is a close second.

Besides the key Shanghai SE Composite index, there is a number of sub-indices like SSE 50; SE 180; SSE Dividend Index; SSE New Composite Index; SSE Government Bond Index; SSE Sector Indices; SSE Corporate Bond Index; SSE Fund Index, and many others.

The SSE Composite index is an excellent indicator for the Chinese economy in general and an important statistical indicator for the overall state of the Chinese stock market. It is widely used by both Chinese and foreign investors.

Some of the largest companies included in the SSE Composite index are ICBC, Bank of China, Sinopec, SAIC Motor.

13. Nikkei 225

Average volume: 72.438

Code: N225

Country: Japan

Weighting method: price-weighted

This stock market index for the Tokyo Stock Exchange was first calculated in 1950. Today it includes 225 companies, and the constituents are reviewed annually.

Even though Nikkei 225 takes the last place in our current list of indices, it is one of the most important indicators of Japan’s economy.

As of the beginning of 2016, the capitalization of this stock index amounted to $4.5 trillion. This accounted for 2/3 of the total capitalization of the Tokyo Stock Exchange.

Some of the most famous companies included in this index are Sony, Canon, Nissan, and Honda Motor Company. Technology and consumer sectors make up the largest section of Nikkei 225.

When did the first stock index appear?

The first and most famous index in the world – the Dow Jones index – originally consisted of only 12 shares. This was back in 1896. The index was calculated based on the arithmetic mean of these 12 stocks (i.e., prices were simply added up and the sum was divided by 12). This primitive way of calculating the index was very convenient at a time when there were no calculators or computers.

Interesting fact: only one company has remained on the market since then and is included in the index to this day. It's General Electric.

What does a stock market index show?

A stock index is an indicator of the state and dynamics of the securities market. By comparing the current value of the index with the previous data, it is possible to assess the market behavior, its reaction to certain changes in the macroeconomic situation and various corporate events (company mergers, acquisitions, stock splits).

Depending on which securities make up the bulk of the index, it can characterize the market as a whole, the market of a certain securities class (corporate bonds, stocks), or the industry market (i.e., securities of companies of the same industry: telecommunications, transport, insurance, Internet sector, etc.).

Comparing the dynamics of various indices can show which sectors of the economy are developing faster.

Besides, indices can be a benchmark for assessing investment returns. For example, if your portfolio of stocks on a particular stock exchange showed a 10% return over the year, and an index of all shares on the same stock exchange grew 30%, then you might have made a mistake choosing your shares.

How is a stock index calculated?

In order for the stock market index to adequately reflect the processes in the securities market, it is necessary to apply correct and reasonable methods for calculating stock indices. In addition, understanding the methodology behind these calculations can help correctly interpret its changes.

The main methods for calculating stock indices:

- Price-weighted method is based on a simple arithmetic mean.

The market prices of the shares included in the index are added up, and the resulting amount is divided by the number of all these shares.

This formula is used to calculate the Dow Jones Industrial Average. However, it is not very effective as the number of shares issued by companies can differ greatly – one company can issue a million shares, and the other – just several tens of thousands.

- Method of calculating the weighted arithmetic mean using various weighing methods.

The price of each stock included in the index is multiplied by a coefficient corresponding to its amount in the share capital of the company that issued it (the so-called "weight").

This technique is used to calculate the average index of the rating agency Standard&Poor's (S&P 500 index).

- Method of calculating the geometric mean.

This formula is used to calculate the oldest UK stock index FT-30, which was first published in 1935.

The index calculation method may change from time to time. This is mainly associated with various corporate events experienced by the companies whose securities are included in the index.

How to invest in share indices?

You cannot buy an index itself because an index is basically just a concept. But you can make an investment based on the index. This is easier than picking individual stocks, and the risk is mitigated by diversification, since there are many shares in one index.

You can buy all the stocks from the index you’re interested in according to their weight. However, this is usually a very expensive way, and it’s not very convenient either.

Another option of investing in a stock index is to buy a share in an investment fund (either an exchange-traded fund – ETF, or a mutual fund) that tracks the index. It contains the index stocks in correct proportions. If an investor has a share in a fund, they have a share in all the fund assets.

Shares of investment funds can be bought and sold on the stock exchange in the same way as ordinary shares.

In conclusion…

There’s a huge variety of indices in the world. Each index contains an enormous pool of information that can be useful. The most important thing to know when using indices is which stocks they are based on. This way, it’s easier to analyze the market dynamics, and interpret the data of the specific index. You can check out our article Big Mac Index.