Difference Between Fundamental and Technical Analysis

Are you just starting on your Forex trading journey? Are you unsure as to the difference between fundamental and technical analysis? Perhaps you’re wondering which trading approach is right for you?

Then you’ve come to the right place.

Read on as we discuss the basics of both technical and fundamental analysis in Forex trading and the pros and cons of each strategy when applied in isolation.

Technical Analysis Explained

Put simply, technical analysis is the study of past and present price action.

A technical analyst looks at the way the price of a Forex pair has behaved in the past and uses this data in an attempt to determine what will happen next.

It all Begins with the Chart

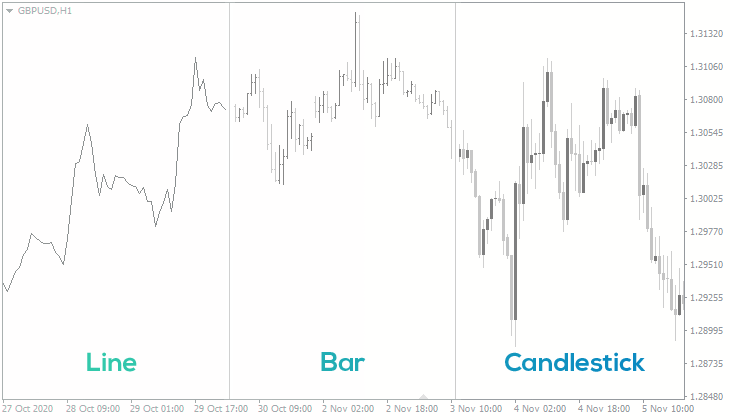

The favoured weapon of the technical analyst is the trusty Japanese candlestick chart.

Unlike a simple line chart, candlestick charts tell traders and analysts an abundance of information at a glance.

Where a line chart is built only from the closing price of an asset, a candlestick chart is built from the open, high, low and closing price (OHLC) values.

Traders and analysts look at historically significant OHLC values and use this data to determine potential inflection levels known as support and resistance.

Chart Art: Trend Lines

Another simple yet highly effective method of technical analysis involves connecting historical highs or lows to form a trend-line.

Unlike basic OHLC horizontal levels, trend-lines are a dynamic form of support/resistance in that their value is not fixed – it rises or falls over time.

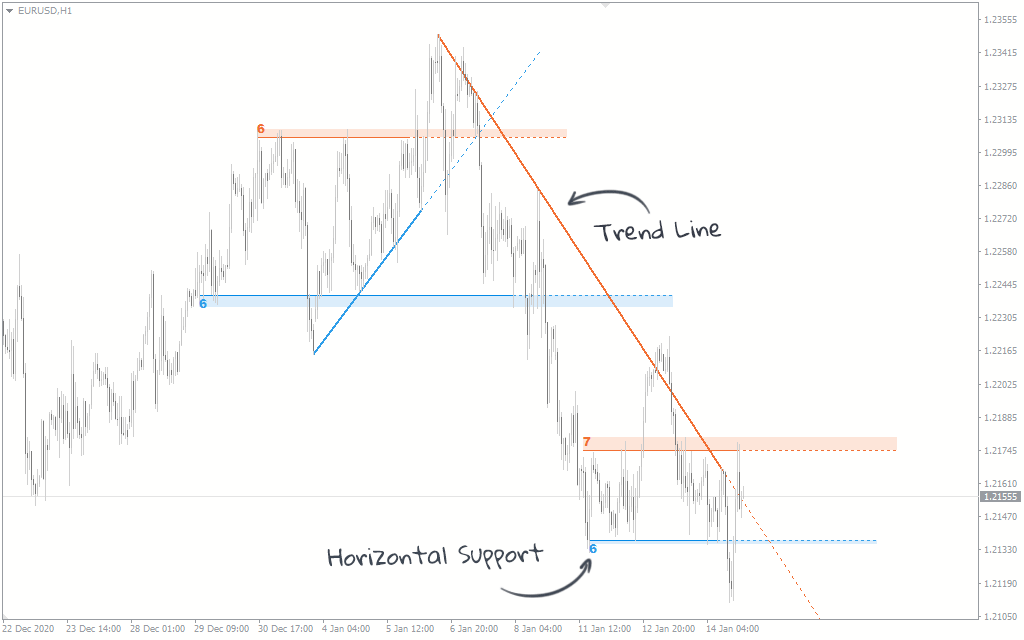

Take a look at the following EUR/USD hourly chart, featuring both horizontal and trend line support/resistance lines:

Trend-lines can help you determine what the current trend is, when to trade it and even when to fade it.

Technical Indicators

Another handy set of tools in the technical trader’s arsenal are technical indicators.

Though some technical indicators can be quite complex, popular ones such as RSI simplify price action into just a single line, allowing you to readily make trading decisions based on a simple set of rules.

For example, a basic RSI strategy is to buy when the indicator crosses above 30, and sell when the indicator crosses below 70.

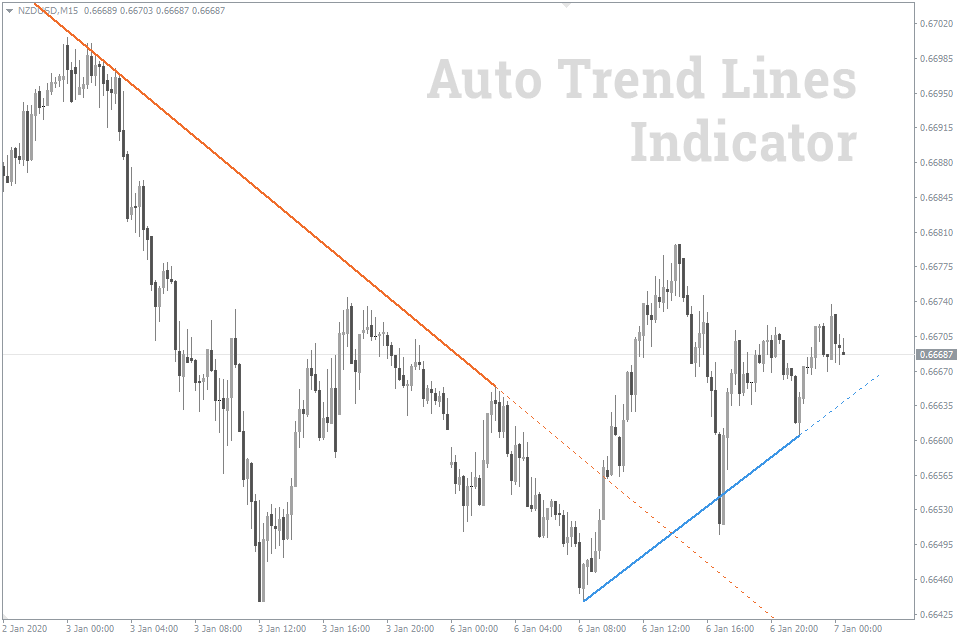

FXSSI offers a range of powerful custom technical indicators for you to employ in your trading, including the powerful auto trend line indicator seen below.

Pros and Cons of Technical Analysis

Technical analysis is great as it’s a standalone analysis method that works for both short term and long term trading.

On the other hand, sometimes technical traders can develop “analysis paralysis”, where your indicators and lines are telling you different stories and you’re not sure how to act.

Another issue is tunnel vision, where you get too caught up in your own analysis and fail to consider other possibilities, combined with poor money management practices, this can lead to serious losses.

| Pros | Cons |

|---|---|

| Works for both short and long term trading | Analysis paralysis |

| Standalone analysis method | False sense of confidence / tunnel vision |

Fundamental Analysis

Fundamental analysis is the study of economic factors that drive price action.

Fundamental analysts make trading decisions based on economic drivers such as interest rate changes and inflation expectations, as well as data points such as monthly trade balance and quarterly gross domestic product data.

Though this can seem rather intimidating at first, you don’t really need an economics degree to incorporate fundamental analysis into your trading strategy.

Interest Rates and Risk-On

All else being equal, a currency with a higher interest rate is a more attractive investment than a currency with a lower one.

This is because you will earn more yield holding the first currency than you will holding the second.

When the global economy is strong and markets have an appetite for risk, investors will seek out high yielding currencies to park their cash in and these same currencies will generally trend upwards.

Inflation and Risk-Off

Conversely, when there’s uncertainty in markets, investors will look to park their cash in low inflation or safe haven currencies.

The idea here is that when the current panic eventually passes, the relative value of your cash will not have been eroded by inflation.

Despite giant easing programs, the Swiss Franc (CHF) and Japanese Yen (JPY) are the go to safe haven currencies and will nearly always catch a bid in times of crisis.

The US Dollar also often catches a bid due to its position as the world’s reserve currency, but this behaviour is not nearly as reliable when compared with the Frank or Yen.

Beat or Miss

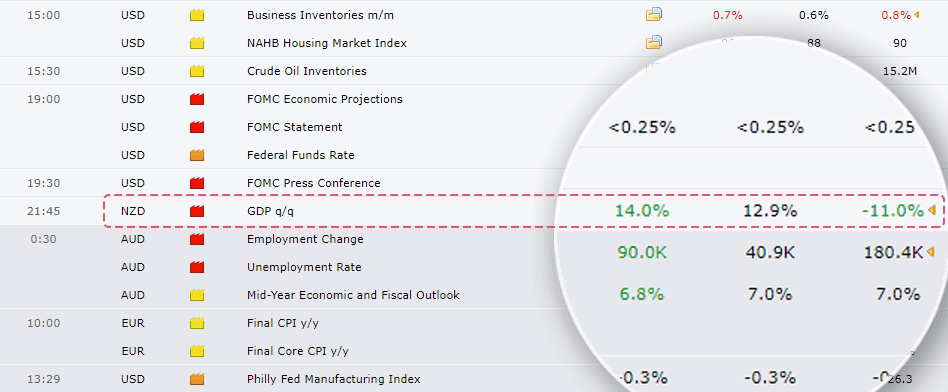

Economic data points such as terms of trade or quarterly GDP releases give a snapshot of a nation’s economic health and also move currency markets.

When a nation’s GDP comes out better than expected, traders will move to buy that nation’s currency.

Similarly if a nation delivers a trade surplus by exporting more than it imports, this is a sign of economic health and may suggest ongoing trade demand for that nation’s currency.

On the other hand, if GDP or trade data is expected to come out strong, but misses, the market reaction can be fierce.

This is why you don’t really need an economics degree to trade fundamentals – you just need to know what the market is expecting and what the economic reality is – Forex economic calendars update in near real time when economic data is released.

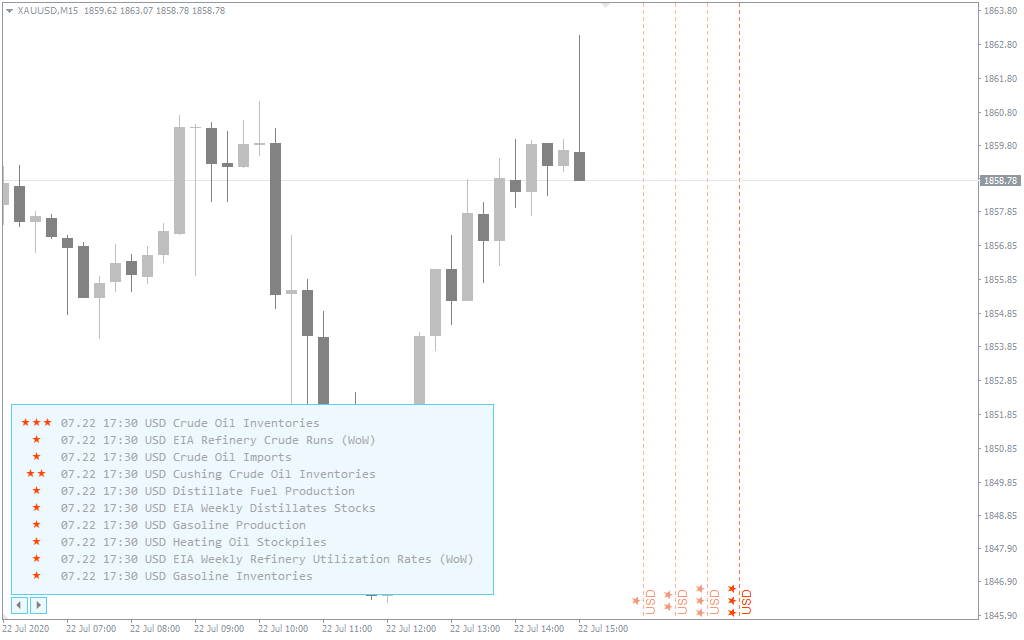

Used in conjunction with the FXSSI news trading indicator, having access to a detailed economic calendar will ensure you’re up to date when it comes to market fundamentals.

Pros and Cons of Fundamental Analysis

One of the biggest advantages of fundamental analysis is that you can ride a major move with confidence – with the right fundamental drivers, currency pairs can trend for months or even years – if you understand why this is happening, you will have no trouble holding.

On the other hand, markets can often move against all logic for months at a time – if you stubbornly keep trying to trade your sound logic in a market like this, you will only last so long.

Another issue is that fundamental trading is not really standalone, especially not on shorter horizons, if your buying data beats at the top when the market is overbought and selling misses at the lows when it’s due for a bounce, you probably would have been better off tossing a coin.

| Pros | Cons |

|---|---|

| Trade with confidence | Counter-logic moves |

| Big sustained moves | Short term relies on techs |

Don’t be Ignorant

Efficient markets require perfect knowledge.

We’ve never met a successful trader who completely ignores technical trading.

We’ve also never met a successful trader who completely ignores the fundamental trading.

The most successful traders use a combination of both, as well as sentiment analysis, to gain an edge over the market.