Inverted Hammer: A Method of Analysis in Forex

This article focuses on application and trading strategy of the inverted hammer candlestick pattern.

Candlestick patterns form an integral part of technical analysis and chart analysis. However, the important aspect of candlestick patterns is to help the trader identify reversal and continuation patterns.

The primary objective of the candlestick pattern is to identify the market trend. Most candlestick patterns reveal the direction of trend if the trader has the ability to identify and understand these patterns. Reversal and continuation candlestick patterns can be further looked into as bullish and bearish patterns.

The inverted hammer is a bullish reversal pattern that signals the trader that a trend reversal is imminent. By using this information the trader can easily prepare a trade plan and execute them accordingly.

In this article we will discuss the structure, formation and the underlying market dynamics of the inverted hammer candlestick pattern in detail. Furthermore, we will discuss the potential trading opportunity the pattern presents.

Inverted Hammer Candlestick Pattern Structure

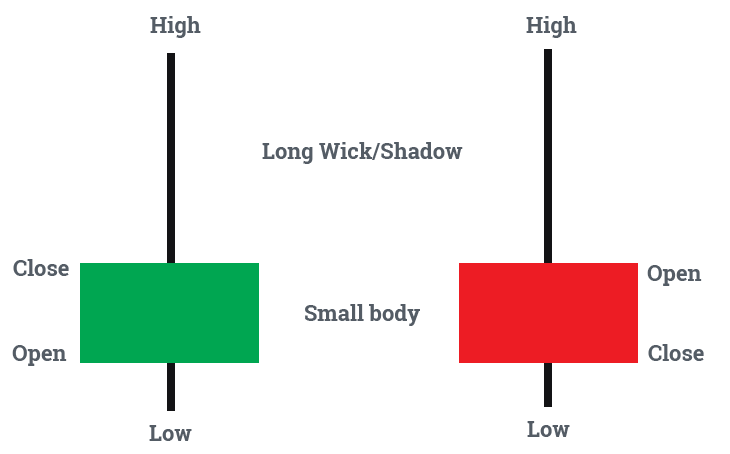

The above figure shows the inverted candlestick pattern labeled with open, high, low and close. We will now look closer and identify the important parts and structure of this pattern.

The inverted hammer candlestick can be easily identified by the forex trader because of its hammer like shape. This candlestick has a long wick or shadow. The body of the candle is very small compared to the length of the candle’s wick.

Generally, the length of the upper wick is at least double the length of the real body. However, the candle does not have a lower wick or may have a very small lower wick. The real body of the inverted hammer candle may be bullish or bearish in nature.

Simply put it can be an up or down candle. Both bullish inverted hammer or green inverted hammer and bearish inverted hammer or red inverted hammer have the same meaning.

The inverted hammer candlestick pattern must form in a downtrend; this is an important prerequisite for this candlestick pattern. The pattern is invalidated if it forms in an uptrend. In fact a similar pattern if formed during an uptrend is called a shooting star candlestick pattern.

The difference between hammer and inverted hammer candlestick pattern is just that they are upside down of each other.

What is the Meaning of Inverted Hammer Pattern?

As discussed earlier the candlestick should form during a downtrend. Traders can confirm that the market is in a downtrend, if the market makes a series of lower lows. Furthermore, the prices will be moving lower with many bearish down closing candles.

Once forex traders confirm the downtrend and the prerequisite is covered. We should now look into the size of the wick and body. If the wick’s length is at least double the size of the candle we can now confirm that the candlestick is indeed an inverted hammer pattern.

Let’s now look into the market sentiment during the formation of the inverted hammer candle. During the downtrend sellers are in control of the market and continue to lower the prices. But, during the inverted hammer candle the sellers seems to lose control.

The increase in buying activity or the entry of buyers indicate that the market participants now look at the lower prices as an opportunity to go long. The lower prices act as an incentive to buyers on the other hand influence traders holding sell positions to liquidate their positions.

Thus the market sentiment changes from bearish to bullish during this candle. To further reiterate this, let’s look at the candle’s wick. The long wick shows that buyers were able to take control of the market and increase the prices.

However, the longer wick also tells us that at the end the sellers were successful. But the buyers had already made a mark and that shows the intent of the market participants to go long. This intent forms the basis of market reversal.

What does the Inverted Hammer Pattern indicate?

The inverted hammer indicates that the market participants may be moving from a bearish bias to bullish bias. Viewing it in a different way, it indicates a waning seller interest and a potential entry to go long at the beginning of a new bullish trend.

The inverter hammer reflects the behavior of the market participants and in turn helps the trader to read the buyers and sellers intent.

In simple words forex traders should look at the formation of the inverted candle as a potential bullish reversal signal and prepare a trade plan to go long. Since the forex traders could enter in the beginning of a potential uptrend. This pattern provides a very good RR-Risk reward ratio.

How to trade the Inverted Hammer Pattern?

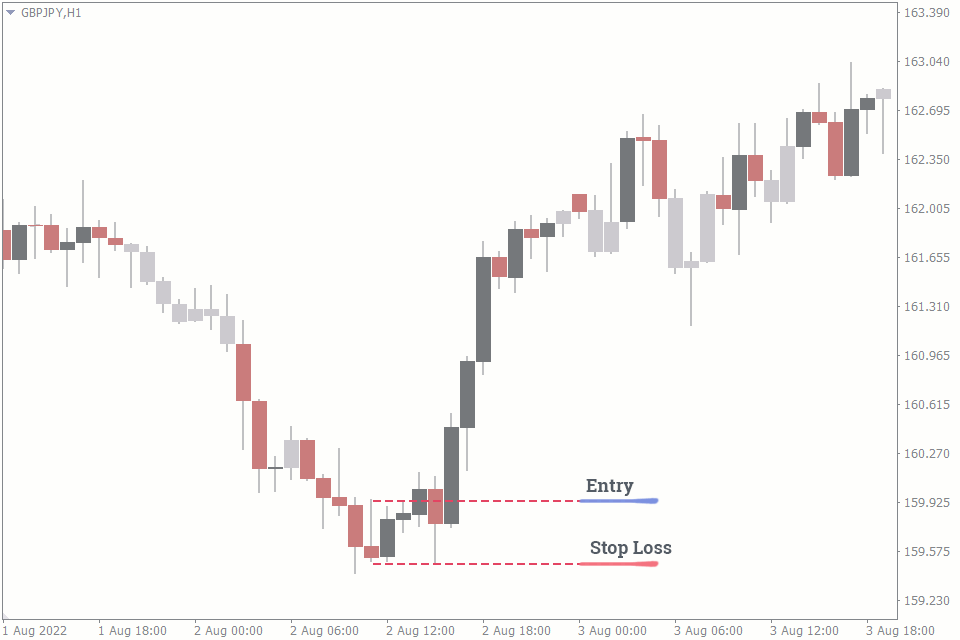

Trading the inverted hammer is pretty straight forward. Forex traders should place a buy trade above the high of the inverted hammer candle. At the same time, the pattern is invalidated of the price breaks the inverted hammer candle’s low. So a stop loss below the low is necessary for this trade.

To further confirm the pattern, forex traders can use the next candle of the inverted hammer. Generally, the candle subsequent to the pattern candle should not close lower than the inverted hammer candle.

Instead of entering the markets with a long trade after closing of the inverted hammer candle. Traders can wait for one more candle for confirmation of the reversal pattern. Effectively, traders go long once the candle next to pattern candle for additional confirmation.

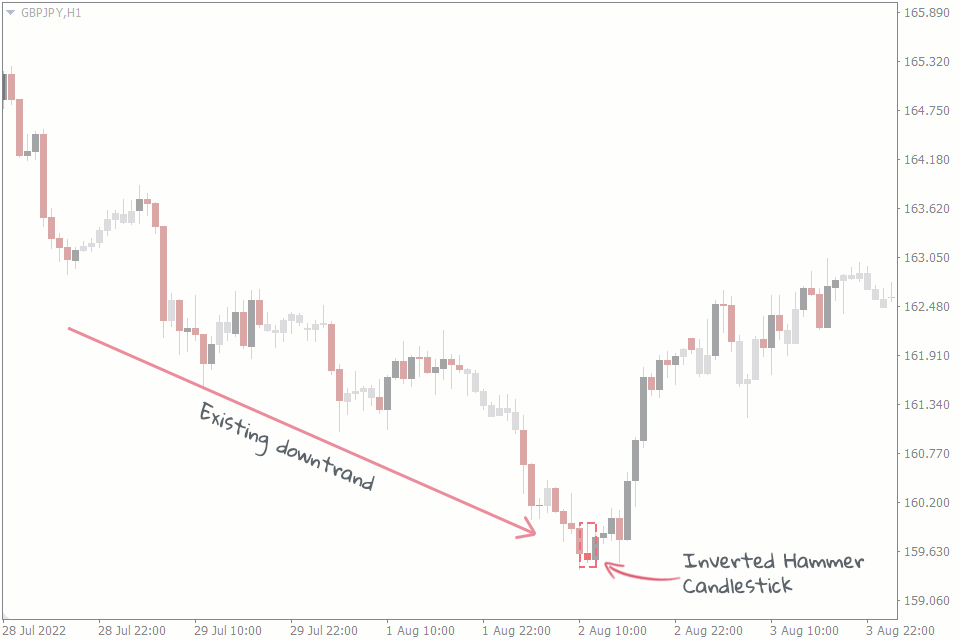

In the above chart GBPJPY H1 price chart, the market was in a downtrend making a series of lower lows. The price was moving lower and sellers were in control of the market. But during the inverted hammer candle we can identify the buyers entering the market.

Traders could wait for the pattern candle to close and enter the market with a buy trade. Similarly, they could wait for the pattern’s next candle to close and enter. The market reversed its direction after this bullish reversal pattern and provided a profitable position in both situations.

The Bottom Line

It is imperative that forex traders can use the inverted hammer candlestick pattern to identify bullish reversals. Another important feature of this pattern is possibility to enter a trade with good Risk reward ratio.