List of Correlated Currency Pairs In Forex

Currency pair correlations are some of the last things you’ll likely learn in a forex academy, but they’re by no means the least important. How many of them do you know?

After trading forex for a while, you may realize that those currency pairs are interconnected somehow. One of them goes up and the others follow in the same or opposite direction. News that should affect one affects a couple more pairs. So you can expect another currency pair to do the same thing one currency pair does.

This is the beauty of correlating forex currency pairs.

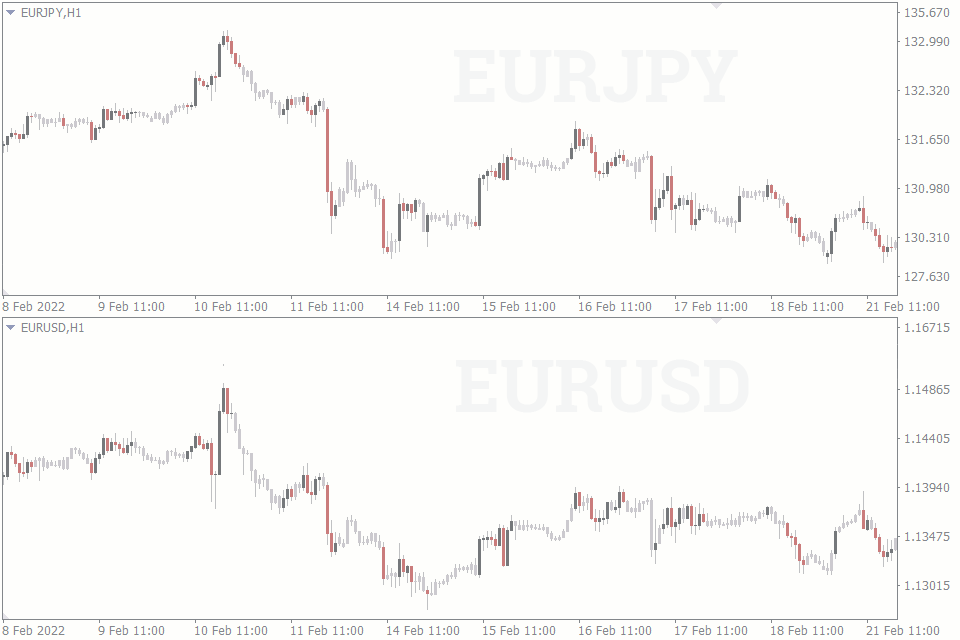

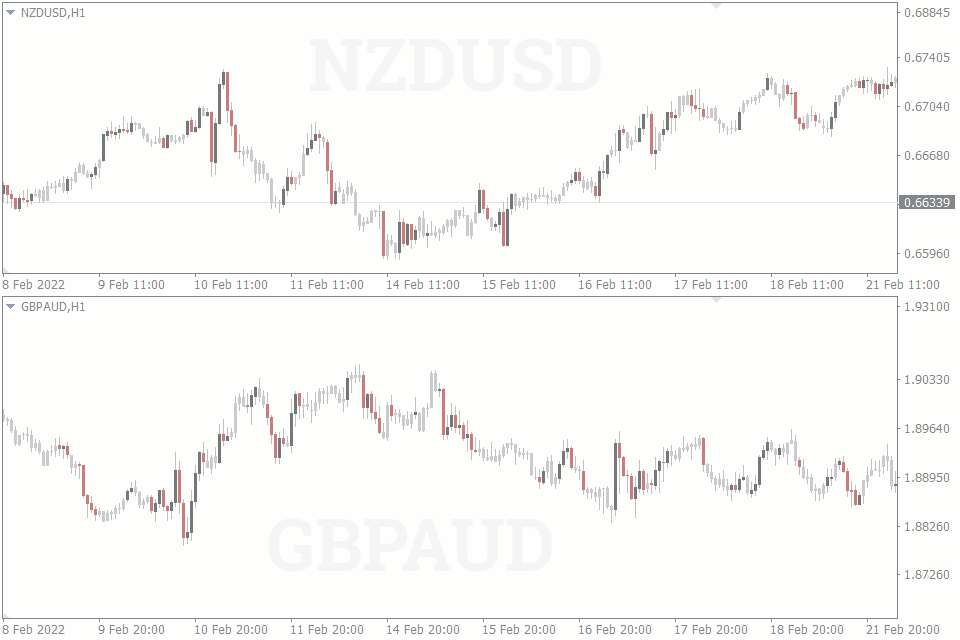

In fact, if you place some two currency pair charts side by side, you’ll see how they look alike. Some are highly correlated. The image below is a perfect example.

We say these are positively correlated because they move in the same direction. But there are negatively correlated pairs too, which move in opposite directions to each other. The image below is an example of such.

But whether they are negatively or positively correlated, the benefits remain the same. You can do your analysis on one and carry it on to another for the most part. You can also let your sentiment on one pair guide your sentiment on another correlated pair.

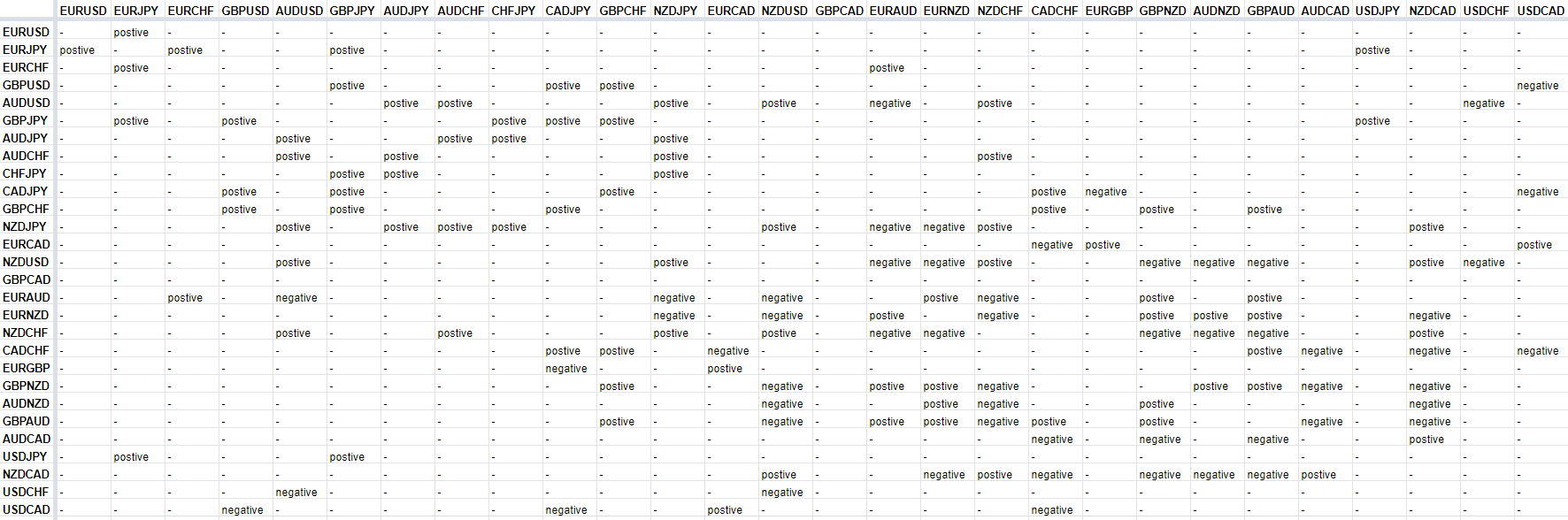

We’ll discuss more benefits soon. But first, we have for you a table containing the list of all the correlating currency pairs in forex and how they correlate. The table includes all the minor and major currency pairs in forex.

Benefits of Trading Correlated Pairs In Forex

There are some helpful benefits to that list of correlated currency pairs above.

Makes analysis easier

If there’s any reason many professional forex traders enjoy using pair correlations, it is because it makes their analyses easier.

For instance, you can make an analysis of the EURUSD pair. And because it positively correlates with the EURJPY, your technical analysis becomes a little easier for EURJPY. This is because you know what to expect, and you only need the analysis of the EURJPY to confirm that of the EURUSD.

For an easier way to monitor the correlation between currency pairs in MetaTrader 4, you can use this helpful indicator. This indicator allows you to track how different currency pairs relate to each other, providing valuable insights for your trading strategy.

PS: Correlation is not an excuse to be lazy. Because two pairs have a positive correlation doesn’t mean you can do your analysis on one and neglect the other. What correlation merely does is that it helps you to know what you expect from both pairs.

Confirm your trades

Another great thing about forex currency pair correlations is that you can use your sentiment on one to confirm the other.

If, for instance, you’re about to go bullish USDCAD and GBPUSD after analyzing them in the same timeframe, you know that there’s likely to be a problem somewhere. Because if they’re negatively correlated, you should be buying one when you’re selling the other.

PS: This is not to say, however, that you should always buy one currency pair while you sell another one simply because they’re negatively correlated. You still have to make a careful analysis of each pair and time your entries based on the data of each pair.

Reduce risks of overexposure

Overexposure in the forex marketis when you have too many active trades involving a particular currency.

The problem with overexposure is that news that negatively affects the currency you’re overexposed to could pose danger to your forex trading account. This is especially if you don’t practice good money management.

Here’s how correlation helps you reduce this risk of overexposure:

Instead of making trading your third pair, for instance, involving USD, you can trade another pair that doesn’t involve USD but correlates with your currency pair. An example is trading NZDJPY instead of AUDUSD. These two correlate positively.

You may then wonder, “if they’re positively correlated, won’t one mirror the movements of the other?”

The answer to that is that both pairs do not perfectly correlate. They might mirror each other, but only to some extent. And the currencies involved are different, which means different countries, central banks, and monetary policies. All these help to reduce the risk of overexposure.

Conclusion

Before we close the curtain on the list of correlated currency pairs in forex, note that correlations change. They change over time and they vary depending on your timeframe. Currency pairs that correlated 50 years ago may be uncorrelated 50 years from now.

So when you’re trading with correlations, make sure you are on the same timeframe for both pairs and that you have the latest correlation data.

This can be a lot of information to take in, especially if you’re a novice forex trader. So, in case you don’t yet know how to make trades using this information, check out our article on forex currency pair correlation trading strategy to help you out.