MACD vs Stochastic Indicator: Which Is the Best for Successful Forex Trading?

This article will pitch MACD against Stochastic indicators to identify the best among these two, by looking at differences and the best forex trading methods.

The quest to identify the best forex trading indicators is ongoing and a continuous process among most forex traders. This time consuming process is enjoyable and frustrating. But, it provides fruitful trading results and improves the trader’s psychology.

Rather looking at something new, it’s always better to apply tried and tested indicators in forex trading. The subject matter of this article, both MACD and Stochastic oscillators are proven technical trading indicators.

We will ignore the formulae and calculation methodology of the indicators and dive in into the application part. On the other hand, we will focus on the differences between MACD and Stochastic and the outcome they present to the forex trader. Most importantly, we will look at the best trading practices using these indicators.

Moving Average Convergence Divergence

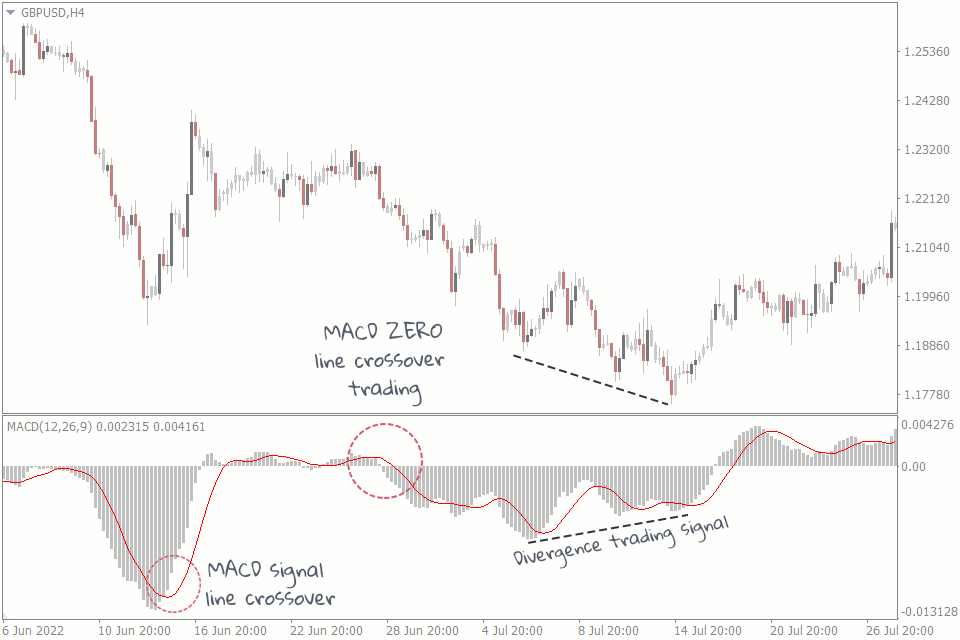

MACD – Moving Average Convergence Divergence measures the trend strength of a given trading instrument. The main component behind the MACD is the moving average, in particular the exponential moving average. The MACD combines two EMAs, 9 period and a 26 period to form a line called the MACD line.

The MACD line is combined with a 9 period EMA, called the signal line. The combination of these MACD line and the signal line provides buy and sell forex trading signals. The crossovers of these lines provide a bullish or bearish trading signal based on the crossover direction.

MACD indicator consists of a Zero line. This line is indicates the direction of momentum. A value higher than Zero indicates the prevalence of bullish price momentum. On the other hand, values lower than Zero a bearish in nature.

Another important feature of the MACD is the ability to identify divergence and convergences. Since the divergence provides an early trading signal, the indicator is considered a leading indicator in terms of divergence and convergence.

Stochastic

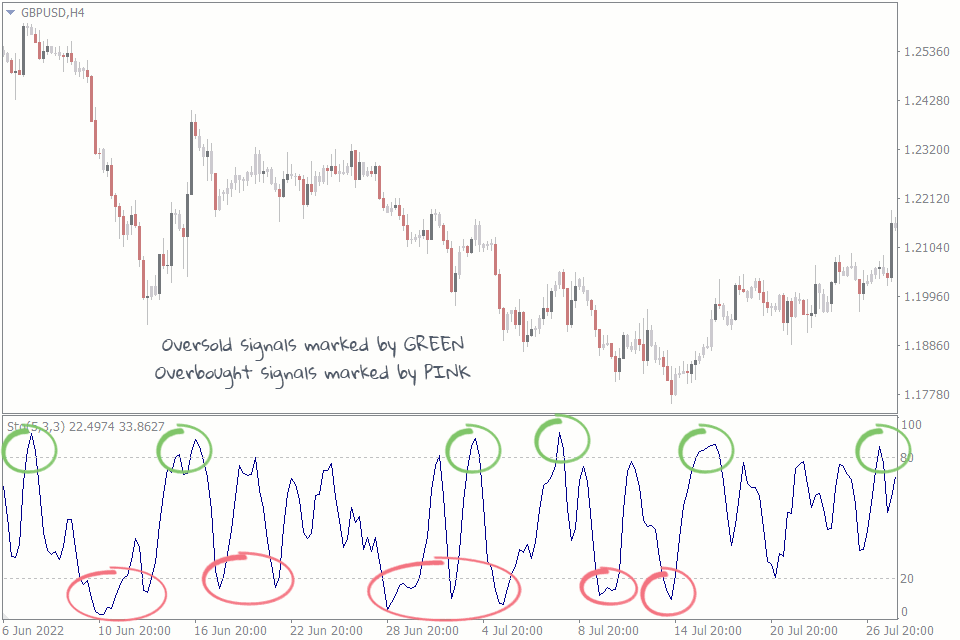

The Stochastic oscillator helps the technical forex traders to identify the trend reversal points. As an oscillator the value of this indicator tends to float between 0 to 100. The important application of this indicator is to detect if the forex currency pair is oversold or overbought.

Indicator values higher than 80 represent an overbought condition of the pair. Similarly, values lower than 20 makes the pair enter into an oversold condition. Traders anticipate a trend reversal once an overbought or oversold condition occurs.

The %K and %D lines are the integral components of Stochastic indicator. The crossover of these lines trigger and entry signal, if the crossover occurs above 80 or below 20 indicator value.

The Differences Between MACD and Stochastic

As we have a better understanding of these indicators. We will now dive deeper into the differences between them

| MACD | Stochastic |

|---|---|

| Momentum indicator uses Exponential Moving averages | Momentum indicator uses highs and lows of recent previous price periods. |

| Measures trend strength and signals reversals | Anticipates trend reversals |

| Generates buy and sell signals using trend strength, MACD Zero line, Divergences | Generates buy and sell forex trading signals using overbought and oversold conditions |

| Trend following is the main purpose | Predicting of price reversal is the main purpose |

| Leading indicator in terms of divergence trading | Leading indicator in terms of overbought and oversold conditions |

| Provides relatively higher number of trading signals than Stochastic | Provides lower number of trading signals than MACD |

Which is Better MACD vs Stochastic?

Addressing this major question and understanding it will provide much better clarity to a forex trader. However, the fact is MACD is not better than Stochastic and vice versa. There are certain market conditions where each one of the produces better trading results.

MACD has its own advantages over Stochastic in some ways. So, the trading results depend upon the way you apply them. The Stochastic may not produce frequent trading signals. But, the trading signals once appear may provide you with a good risk reward ratio with a good success rate.

On the other hand, MACD may produce multiple trading opportunities during a trend. As a result, forex traders may enter and exit the market successfully multiple times within a single trend wave.

We should agree and note that both MACD and Stochastic indicator produce lower trading results during market consolidation.

Where to apply MACD or Stochastic?

As we discussed earlier the application of MACD or Stochastic indicator depends upon you trading style. For trend followers the best suitable indicator is the MACD. However, if you are a traders looking for trend reversals, then Stochastic should be your best indicator. Now, let’s discuss some tips on the application of MACD and Stochastic.

Tips On Trading With MACD

- MACD is a trend follower and produces trend following trading signals. Trend reversal trading signals appear based on divergence.

- MACD does not perform well during market consolidation and may result in losses.

- Crossover trading signals are often associated with lag as the calculations are based on moving averages.

- Traders should confirm the divergence trading signals using price action as the price momentum may not have exhausted completely. There are instances where price makes additional attempts to breach the established highs or lows before a reversal.

Tips On Trading With Stochastic

- The main purpose of Stochastic is to signal overbought and oversold trading conditions.

- All oscillations and crossover of %K and %D between 20 and 80 has no meaning. However, the crossover of these two lines below 20 or above 80 provides reversal signals.

- A crossover of the %K and %D at oversold or overbought levels doesn’t warrant an entry immediately. Traders should confirm these signals using price action before entering the markets.

The Bottom Line

MACD and Stochastic indicators help the forex trader to generate trading signals in different methods. However, like all technical indicators they tend to produce false trading signals. The best way is to have a solid money management strategy.

You can use the Stop Loss Clusters Indicator to identify the areas where other traders have placed their stops. As a result, it helps you to place you stop loss at the best possible stop in tandem with others.

As we conclude this comparison on MACD vs Stochastic, we encourage you to have a look at our other article on MACD vs RSI.