What Are the Major Currency Pairs in Forex?

Forex is an extensive market with an endless list of currency pairs to trade. But some of them take the lead when it comes to trading volume. We call them major currency pairs or FX majors.

These major currency pairs are the most heavily traded currencies in the forex market.

Your forex major pairs list might vary depending on your resource. However, the four main pairs you’ll always find on any of these lists are:

- EURUSD

- USDJPY

- USDCHF

- GBPUSD

These four make up the top forex majors. If you take a second look at those pairs, you’ll notice that the currency that’s always present in each pair is the USD. This is because at the moment the United States Dollar is the most widely traded currency in the world (as of June 2021).

You’ll also notice that the remaining currencies making up those pairs are all majors. And apart from those currency pairs, others ride on the USD’s wave of popularity. You may consider them to be FX majors too, but they aren’t as heavily traded as the 4 mentioned above. These currency pairs consist of the USD and the remaining major currencies, such as AUD, NZD, and CAD:

- USDCAD

- NZDUSD

- AUDUSD

These other three currency pairs are also called commodity pairs because their values are strongly attached to commodities, such as natural resources. For instance, the value of the AUDUSD is strongly correlated to the value of gold, since Australia is the second-largest producer of gold in the world.

Other Forex Currency Pairs That May Be Considered Majors

Apart from the 7 major currency pairs mentioned above, additional ones might end up on some traders’ list of major currency pairs. They are known as forex cross pairs.

Forex cross pairs are currency pairs that include any of the previously mentioned currencies constituting the 7 majors, apart from the USD. Of all the cross pairs, these are the most heavily traded ones:

- GBPEUR

- EURJPY

- EURCHF

Unlike the USD pairs, most of the cross pairs don’t command as much trading volume. In fact, these pairs are regarded as minor currency pairs. But they do end up on the trading lists of many traders. They are of great interest especially to those, who don’t want to risk too much when trading USD. This way, if a major incident adversely affected the USD, they would have non-USD pairs to fall back on.

| EUR/USD | Euro and US dollar |

| USD/JPY | US dollar and Japanese yen |

| GBP/USD | British pound and US dollar |

| USD/CHF | US dollar and Swiss franc |

| AUD/USD | Australian dollar and US dollar |

| USD/CAD | US dollar and Canadian dollar |

| NZD/USD | New Zealand dollar and Canadian dollar |

| GBP/EUR | British pound and euro |

| EUR/CHF | Euro and Swiss franc |

| EUR/JPY | Euro and Japanese yen |

Above you can see the currency pairs and their full names.

Why Trade Major Pairs at All?

Major currency pairs wouldn’t be major if no one traded them. And no one would trade them if there was nothing appealing about them. So, what exactly makes traders trade these major pairs?

It’s All About Volumes

The more volume a currency pair has, the more volume it attracts. To put it simply, volume attracts more volume. These are the possible outcomes of high trading volumes and how they might affect major currency pairs.

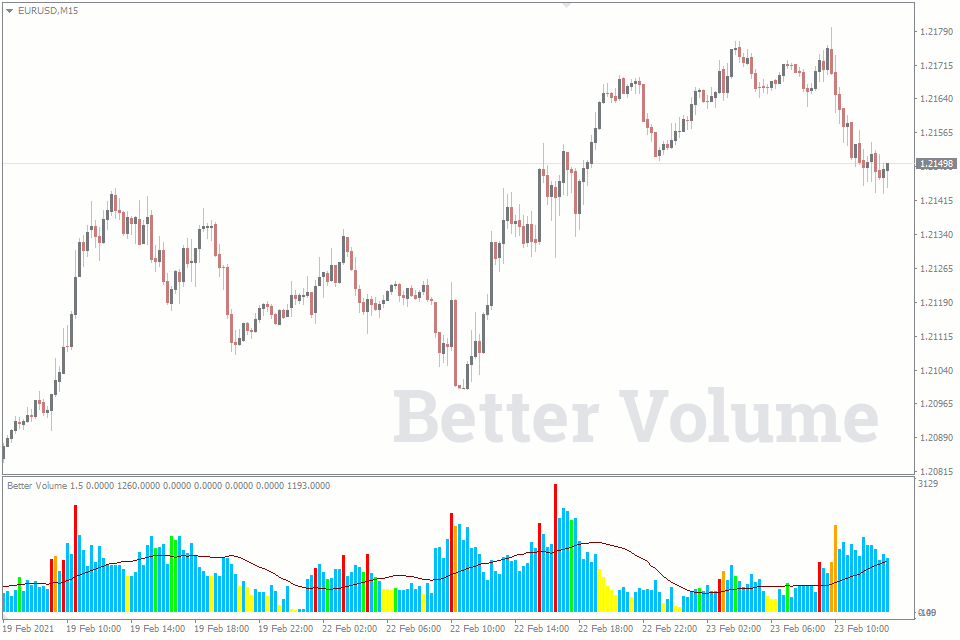

We have a great free indicator – Better Volume – for your advanced trading.

High liquidity

Because of the high trading volumes of the major currency pairs, it is easy for traders to get in and out of positions, irrespective of their position sizes. This is because, at every point in time, there are always traders who are willing to buy or sell major currency pairs. This ease of buying and selling makes major currency pairs the most liquid currency pairs in the world.

Tighter spreads

The use of spreads is one of the many ways brokers claim their commissions, and their values vary from broker to broker. But one thing you’ll find common to various brokers is that major currency pairs have very tight spreads. Some can even be as low as 0.3 pips. As a result, traders have a higher profit margin than they would have when trading other currency pairs, like exotic or minor pairs.

Stability

The stability of major currency pairs is another reason traders turn to them. These pairs are made up of currencies that are relatively strong and stable on their own. Pairs involving these major currencies are not expected to be volatile.

What Affects the Values of Major Currency Pairs

The fundamental factor that affects the values of major currency pairs in forex is the simple law of supply and demand. Every other factor, such as interest rates, politics, or economic rates, can be related to the fundamental one.

For instance, interest rates are peculiar to each currency, and they are calculated by the central bank governing that currency. An increase in the interest rate of a currency is regarded as a sign of a booming economy and investors who aim at generating larger profit, try to acquire this currency. And when that happens, it increases the demand for the currency.

Similarly, politics could affect a country’s currency negatively, as some news might make anyone holding those currencies sell them. This then leads to a larger supply than demand.

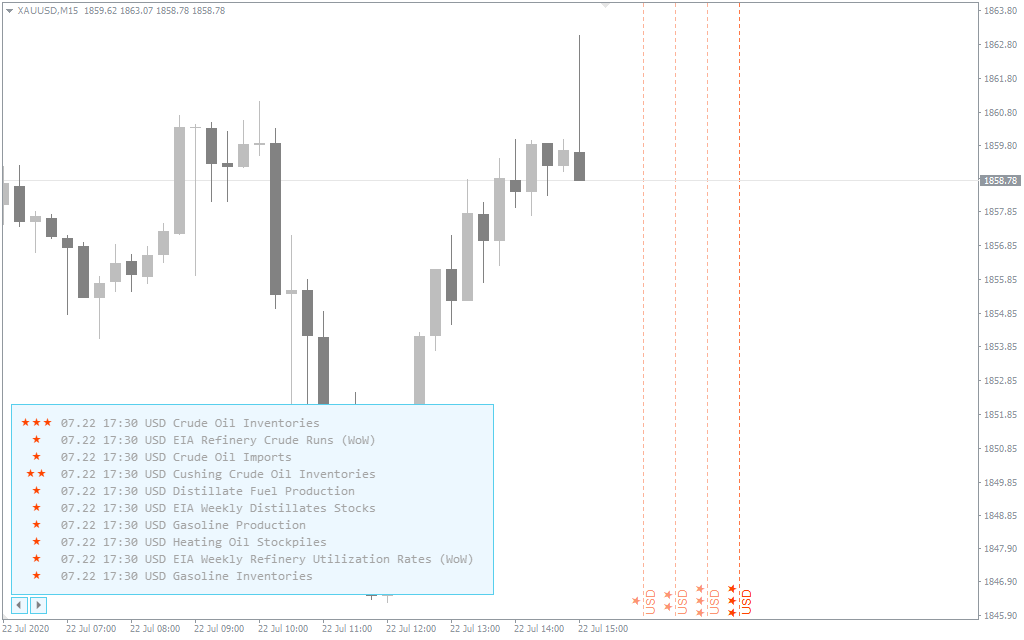

By the way, there are some powerful indicators that tell you in real-time when important news updates that concern your major currency pair trades are coming up. For example, the FXSSI Calendar Indicator. And if you need even more powerful indicators to help you improve your trading, FXSSI’s extensive indicator resource is where to get them.

Conclusion

If you take nothing else from this piece, just remember that major currency pairs are the most heavily traded pairs in the world. And the popularity of these currency pairs is partly because they contain USD, the single most traded currency in the world.

By the way, if you find that understanding top forex majors seems a bit complicated, since you don’t feel like you’ve fully grasped the concept of currency pairs, don’t panic. You’re probably a beginner, and you need to first learn how to read forex currency pairs.