Simple, Yet Effective Currency Pairs Correlation Strategy

Currency pairs correlation is usually the thing that everybody has heard about before but nobody really knows how to use it properly.

We’re going to tell you about a simple and sound strategy of practical application of the correlation that does work. First, let’s deal with terminology.

Understanding Currency Pairs Correlation

We’re not going to go into the details of correlation calculation theory – you can find the information online if you're interested.

Simply put, correlation in the Forex market is the measure of how synchronously currency pairs move. Meaning, the higher the value of correlation, the longer the pairs move together in unison.

There is an inverse correlation, where pairs move in unison, but in the opposite directions, for example, EUR/USD and USD/CHF.

Forex correlation occurs due to a small number of currencies that can make up a currency pair. Taking EUR/JPY and AUD/JPY as an example, we can see that the Japanese yen is included in both pairs and is the source of correlation. Therefore, if yen begins to strengthen, these two pairs will move in the same direction.

However, US dollar itself is even a greater source of correlation. Almost all pairs are dependent on it; if it starts to strengthen, other pairs (even those not including USD) will be directly or inversely correlated to it.

Currency pairs are correlated with:

- Each other due to a common currency that makes them up.

- Correlation of currencies and indexes, for example, the Dollar Index or the S&P 500 Index.

- Commodity assets. Correlation of the Canadian dollar with oil and the Australian dollar with gold is widely known.

Putting forward a logical argument, this correlation does nothing but interferes with trades and their activity, since it severely limits the number of financial instruments used for trading.

For example, you wouldn’t sell EUR/USD and buy GBP/USD at the same time.

Currency Pairs Forex Correlation Strategy

The strategy is easy to understand but not everyone can apply it in practice since it requires strong discipline and assiduity.

What do we need? Almost nothing except for realising that there is a correlation between currency pairs. We’re also not going to use correlation tables because it is obvious that AUD/USD, EUR/USD and GBP/USD correlate with each other.

The key to the Forex correlation trading strategy is: we must use currency pairs’ correlation as a source of cross currency signals. For example, if you've got a signal for EUR/USD, you should make a further analysis of GBP/USD (and other pairs) to check for any confirmation signals. If GBP/USD signals in the same direction, you can buy EUR/USD with greater confidence.

This strategy works even better as a signals filter: for example, you shouldn’t buy euro, no matter how strong signal you’ve got, if the pound has broken a major level, and it can now move only downwards.

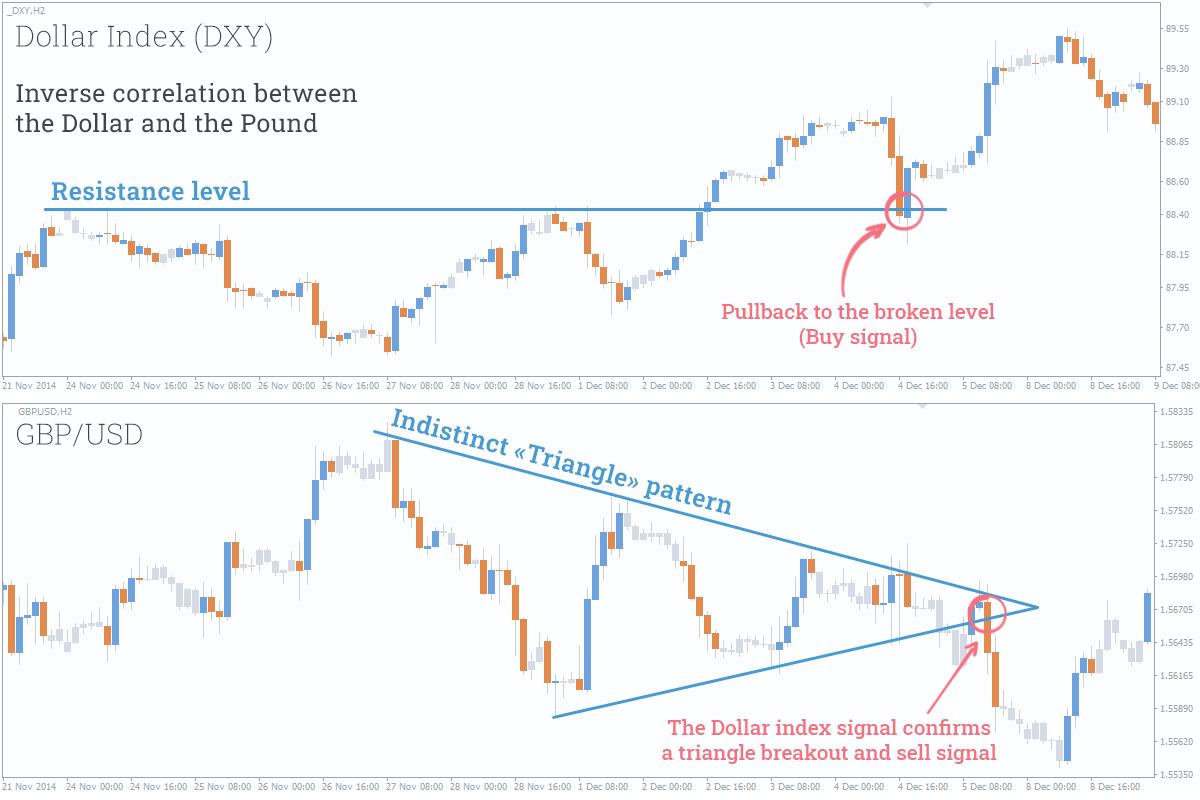

Example 1. Level

Analysing the pair that you typically trade, you’ll not always be able to determine a certain level, but you might find something interesting after analysing other correlation instruments.

Let’s examine this situation in more detail. The Dollar Index (DXY) has broken a major level and then pulled back to a level that is commonly known as a "retest". It’s a usual case in technical analysis and, as we know it, it signals a buying opportunity. Since the Dollar Index is inversely correlated with the pound, it’s a signal for us to sell the pound. As we can see, the pound responded accordingly.

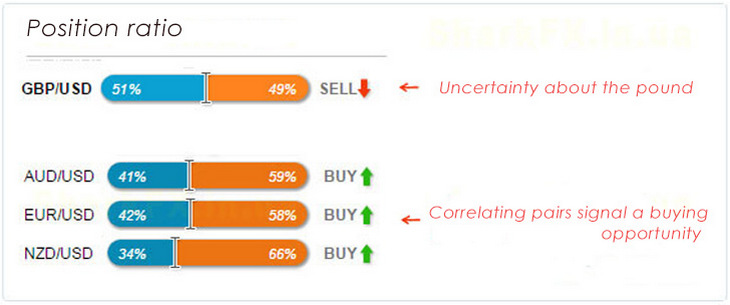

Example 2. Other

You can look for signals based on the currency pairs correlation strategy not only in the chart, but also in other sources.

This could be literally any signal for the financial instrument correlating with your pair. For example, while trading the euro, you should be careful during news releases for the pound since the volatility of GBP/USD directly affects EUR/USD.

You shouldn’t also sell the pound when 58% of traders are willing to sell the euro.

Let’s take a look at this example. Let's assume we trade GBP/USD and we've got a Buy signal. When analyzing the ratio of traders’ positions, we can see some "uncertainty" about the pound. If we look at correlating pairs, the situation changes dramatically. All the correlating pairs signal to buy, so the signal to buy the pound is confirmed.

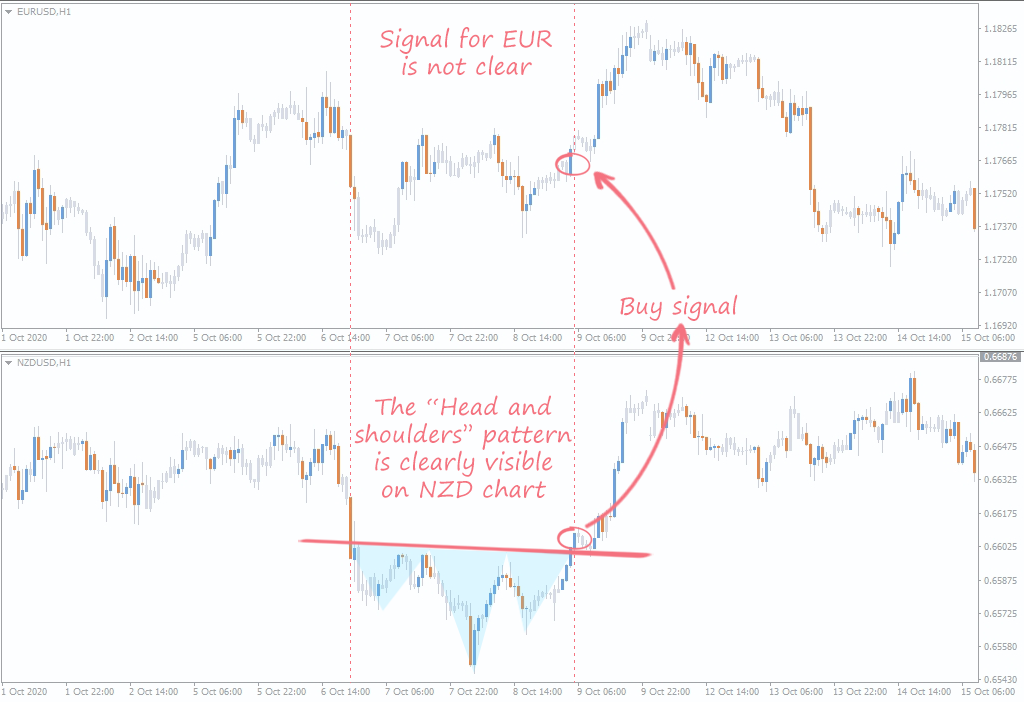

Example 3. Pattern

In this case, any market pattern serves as a source of the signal.

This is a very good example. Have you ever seen a pattern of questionable quality? So, checking other pairs is a great way to confirm the quality of the pattern you’ve identified; if the pattern is not reliable on all currency charts, it’s best not to trade it.

Let’s sum it up

This strategy provides an excellent opportunity to look at the market situation from different angles. For example, if something is not visible on EUR/USD, it can be clearly seen on the pound or the dollar index.

We recommend you an article on a similar topic: the domino effect in Forex.

Reading this article, you might have had the following question: why not to trade the instrument that generates a clearer signal?

- First of all, not all brokers enable trading indexes, oil, etc.

- Secondly, traders usually have their favorite financial instrument they got used to and feel uncomfortable trading other instruments.

- Finally, the signal might be generated by several correlating pairs. If this is the case, then which pair to choose?

This is why it’s best to trade the pair that you're most comfortable with and there's no need to switch between financial instruments; and as for correlation, it should be used as a signal confirmation.