The Problem of Trading Discipline + Infographics

Surprisingly, the main reason behind destroyed deposits is not an ill-designed strategy or a harmful money management method, but a trivial lack of discipline among traders themselves.

But why don't we follow our own rules? After all, most of us are tech-savvy people who should be very good at it.

Reasons for Trading Discipline Violation

As for us, the key reason for this is market misperception. We don't take it seriously enough, it's even a slightly “careless” attitude. Therefore, looking at the rules of our own strategy, we allow ourselves to change them “on the fly”.

Besides, many of us are simply not used to work for and report to ourselves. We don't know how to be a strict judge to ourselves.

On the other hand, this is a problem of our mentality. Two obsessions, that we don't always recognise, are found deep in our consciousness. These are: the thirst for freebies and the “I'm smarter than other people”, “I don’t make mistakes”, “I’ll get lucky”, and “It won't happen to me” ideas.

We'd like to tell you a little bit about one trader. After a month of training in trading, he already believed that he could make money since he had read a lot and always stood out from all the rest – at least, he thought he did. He was sure that others didn’t understand something, and that he already knew all about trading.

The phrase itself – “All traders destroy their first deposit” – encourages you to do everything to prevent this from happening particularly to you. Therefore, when you incur your first loss, you're engulfed in fear, and then you say: “Discipline? Nope, haven't heard of it”.

It's rather obvious that discipline is essential. For example, traders are also rated for their achievements in sports when they are hired in some companies. This is an excellent criterion of their discipline and competitiveness.

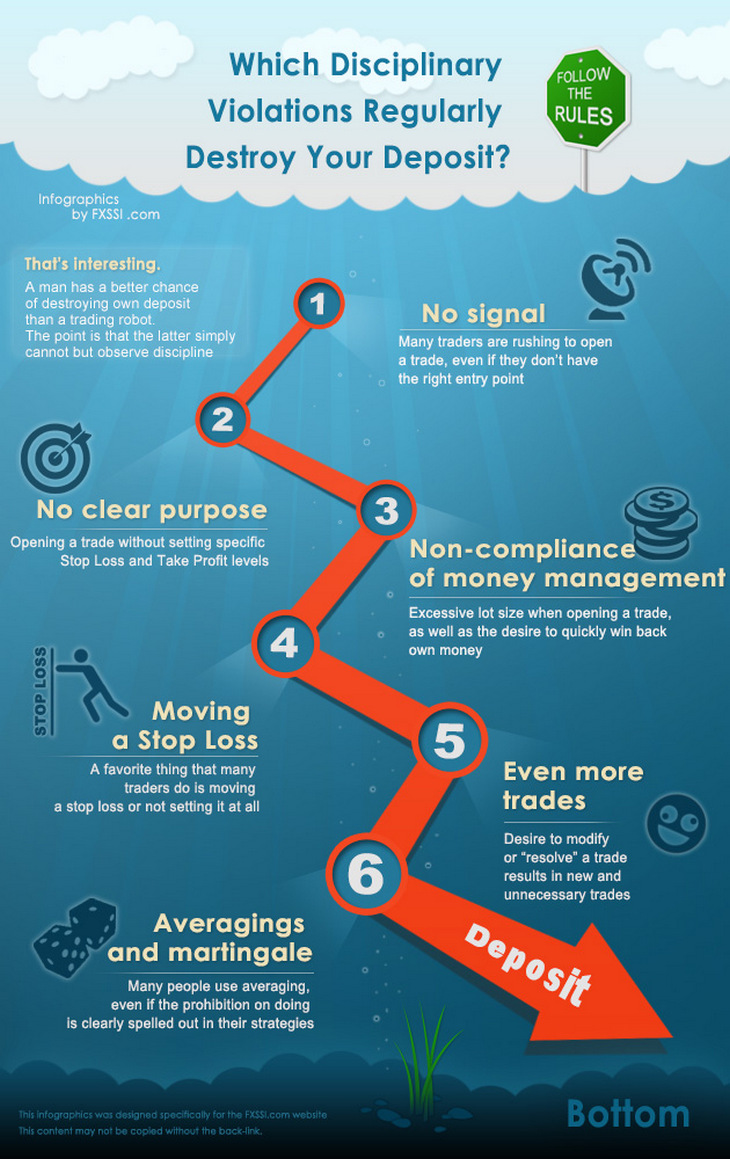

To know your enemy, let's consider the most common disciplinary violations in trading.

Disciplinary Violations are Inherent in any Strategy

If you don’t make these mistakes in trading, we can guarantee you that it will take you a long time to “kill” your deposit, no matter which it is in succession.

How to Solve the Problem of Indiscipline

Observance of discipline is strongly influenced by fear and other emotions – most often, by the fear of making a losing trade which entails “awkward body movements” in front of a trading terminal. One needs to be cool-headed to harness their own emotions, and it is also important to realise the following:

Think carefully about the words written above. When we realised this, we were able to overcome all fears related to trading.

Here are a few more recommendations to help you become a disciplined trader:

- Enter the market only when you have got a signal and have set a specific SL/TP (they should be set immediately).

- If something went wrong, close a trade and don’t open an additional one – it will prevent you from being held hostage by a losing trade.

- In the rest of cases, “hands off the terminal”. Let the market decide for itself on whether your forecast was correct, stay out of the trading process, let a trade be closed by SL or TP, and only then work on your errors.

In addition, observance of discipline is strongly influenced by publicity. When a person understands that his/her results are watched by others, he/she begins to behave in a more calm and rational manner. For example, one can post public reports on some online forums for traders or, alternatively, print the following sentence on an A4 size paper: “I don’t observe discipline”. Every time you don’t observe it, mark it on the paper. Sooner or later you will feel ashamed that you’re so irresponsible and can't cope with such a simple task. It might sound ridiculous, but sometimes these simple methods yield good results.

And the last thing: if you don't observe discipline, you'll end up leaving the market and hating yourself for not being able to cope even with yourself, let alone the market.

If your deposit suddenly gets destroyed while you are observing discipline, it will only make you stronger and will add to your confidence.