Classical “Pennant” Pattern in Forex

The “Pennant” pattern is a technical analysis tool; when the pattern is complete, trend continuation is expected. The pattern itself represents a temporary pause (retracement) in the actively developing trend.

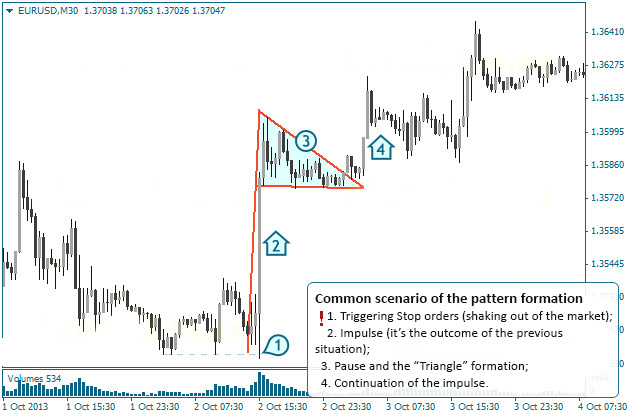

The “Pennant” pattern consists of two parts: the impulse (the so-called “flagpole”) and the base. At that, two other patterns – the “Wedge” and the “Triangle” – can play the role of the base of the “Pennant”. Here is an example.

“Pennant” with “Triangle” as its base

The assumption underlying the classical strategy is that when the pattern’s border is broken out, the price must cover the “distance” equal to the height of the “flagpole” in points.

Enter the market at the point (1) during breakout of the pattern’s border by the price;

Trading target is equal to the height of the “flagpole” (H) in points;

Stop order is set at the extreme level of the “Pennant” pattern’s base at the point (2).

Reasons Behind the “Pennant” Pattern Formation in Forex

The “Pennant” pattern forms and materializes very quickly and most often occurs on M5-M30 timeframes.

The most common scenario of the “Pennant” formation is as follows: trap (false move) (1) – impulse (2) – pause (3) – continuation (4).

The forming impulse (2) is the outcome of the exit from the previous market situation where various manipulations have been most likely involved and Stop orders (1) of market participants have been triggered in order to add to positions by large players. The impulse continuation (4) is initiated to close winning positions opened during the “flagpole” formation.

Alternative Strategies for the “Pennant” Pattern

The classical type of the “Pennant” pattern is recently rare, but this price model of the impulse -> slight pullback (1/3 of the impulse size) -> continuation is a typical situation in the market. The first impulse of the “Pennant” is often a response to the news release, so a candle or its shadow may be much larger than expected, and the first wave of the “Triangle”/”Wedge” is not clear. Therefore, the pattern’s border line should be drawn using the rest pivot points. Here is an example.

Alternatively, you can use the “Triangle” and the “Wedge” strategies depending on which of them is the base of the “Pennant”.

Sometimes it’s hard work setting Take Profit (TP), since the classical TP is abstract (it’s equal to H). Therefore, in practice it is better to set reasonable targets, for example, a higher high, a round-number level, etc. By the way, the article about how to properly set Take Profit describes a unified method for all occasions.

We don’t recommend you to trade with the “Pennant” using a classical strategy, because the odds of a successful market entry are unbelievably low. At that, there is a good sign that the pattern will materialize, namely – high volume spots at the classical breakout point.

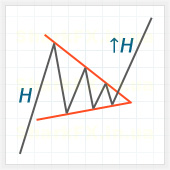

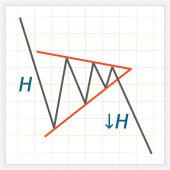

Pattern Types

| Pennant | Inverted Pennant |

The “Pennant” and the “Inverted Pennant” patterns are mirror of each other like a strategy of trading with them.

Due to the quick formation, the inner “Triangle”/”Wedge” might be shortened, i.e. breakout happens when a pattern can be drawn. Here is an example. In such cases, one can enter at the market price at the time of pattern drawing.

Examples of Trading With the “Pennant” Pattern in Forex

► Navigation: