Trading With a “Wedge” Pattern Using a Classical Strategy

The “Wedge” pattern is a technical analysis tool in the Forex that predicts the approaching market tendency (trend) change.

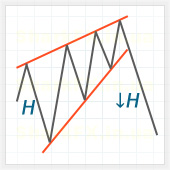

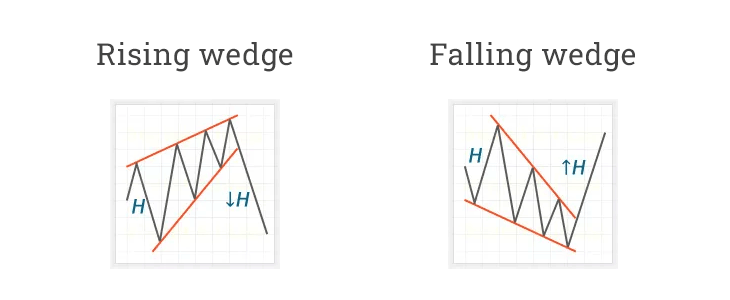

The “Wedge” is visually similar to the “Triangle” pattern and only different in the way that both of its forming lines are facing in the same direction. Here is an example:

It is this feature that makes it a reversal pattern, but we’ll talk about it when we consider the reasons behind the pattern formation.

Classic Trading Strategy

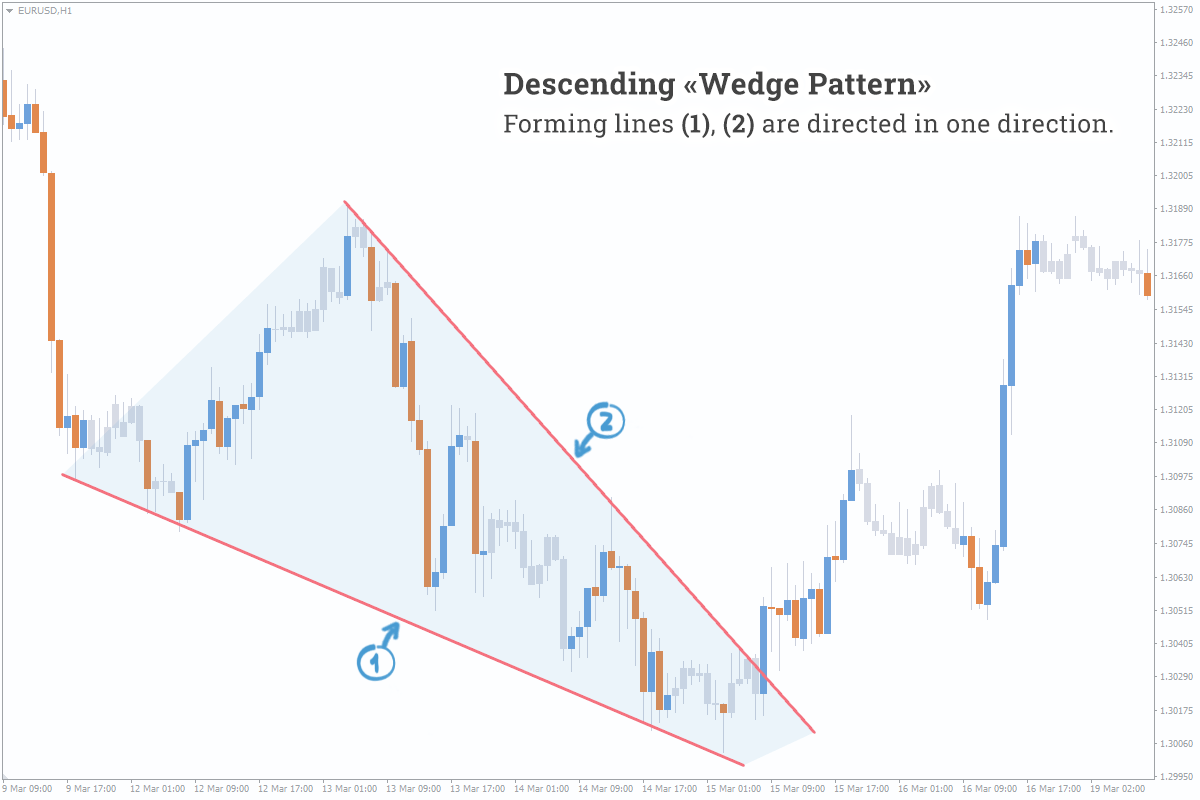

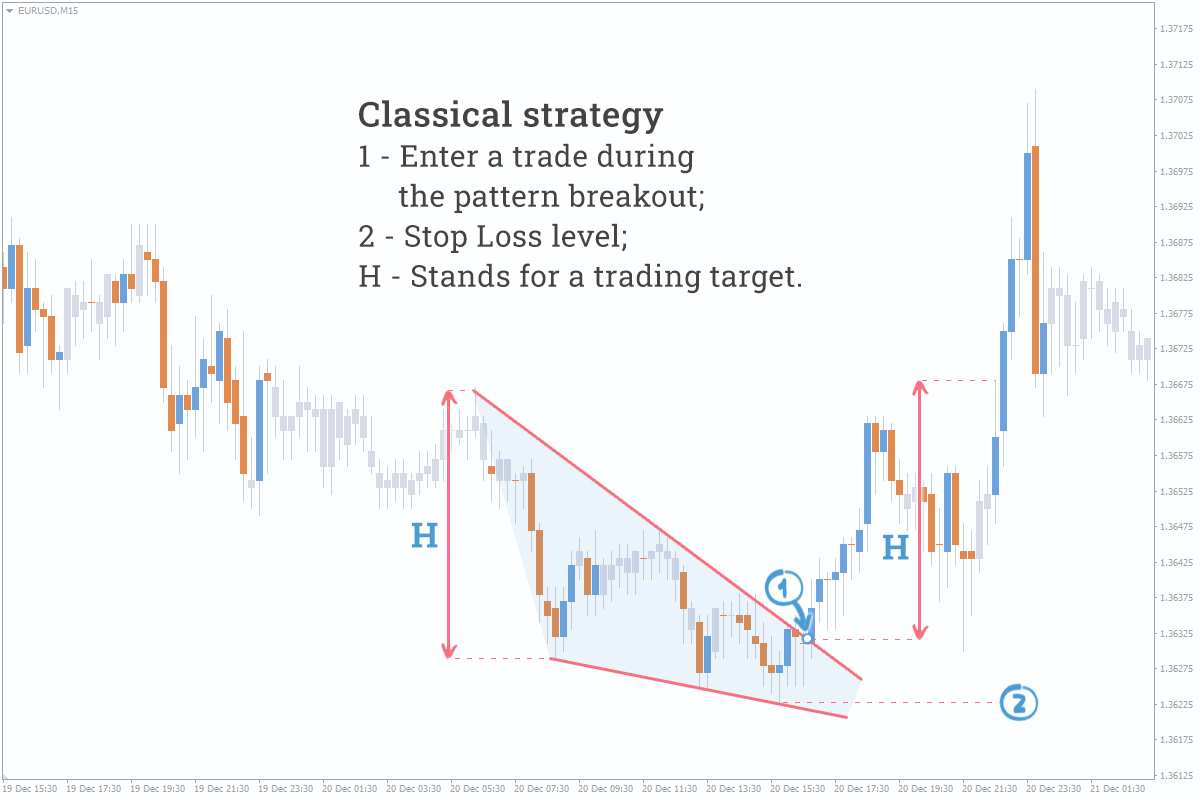

It is believed that the “Wedge” pattern, like other reversal patterns, occurs at the end of trend, but in practice it can often be seen in the middle of trend and even as a trend continuation pattern. Now we’re going to describe a classical trading strategy based on the “Wedge” pattern:

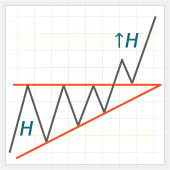

Enter the market at the point (1), when the price moves outside the pattern’s border;

Trading target is equal to the height of the first wave of the pattern (H);

Stop order is set outside the pattern’s extreme at the level (2).

Reasons for the “Wedge” Pattern Formation

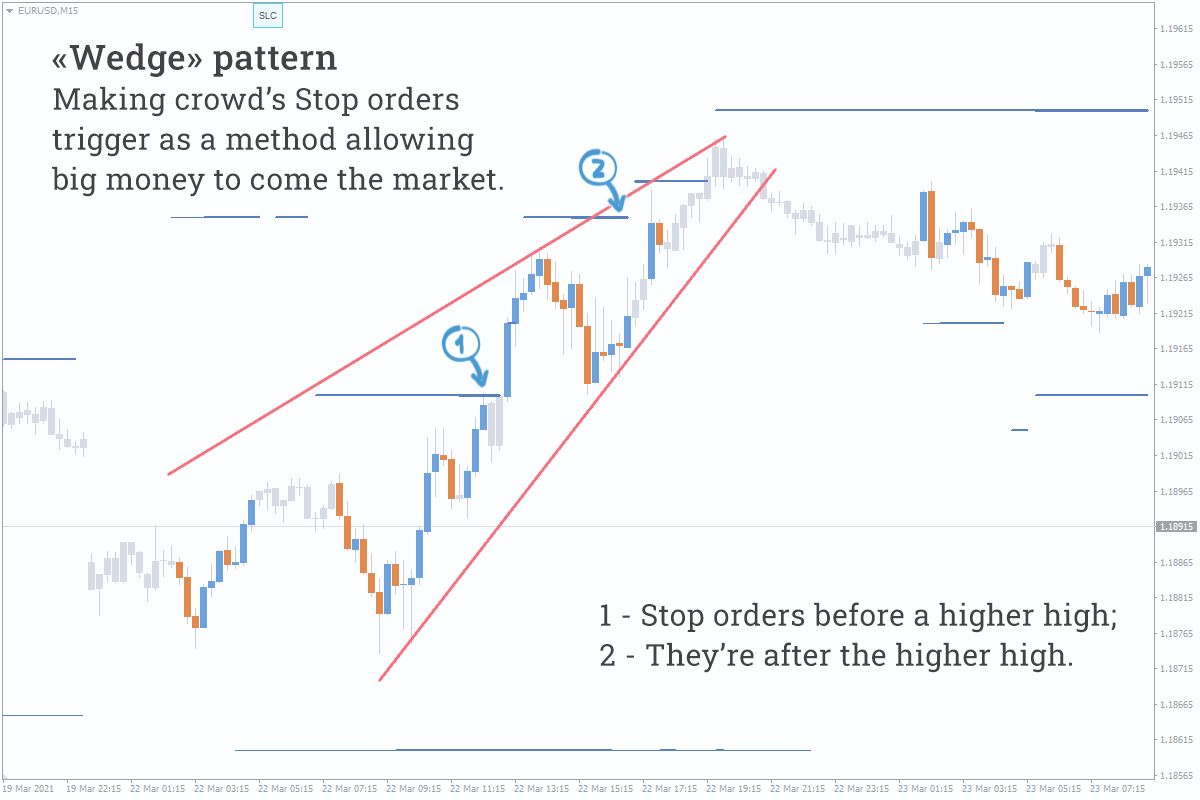

Being a reversal pattern, the “Wedge” pattern implies manipulations during its completion. The purpose of these manipulations is simple – knocking extra “passengers” out of the market or adding to positions by a large participant.

The “Wedge” is often similar to a “Triangle” pattern having a horizontal flat side. However, if conditions for clustering of orders are specially created for the “Triangle”, these orders (1) are constantly triggered in case of the “Wedge”.

The “Wedge” is often similar to a “Triangle” pattern having a horizontal flat side. However, if conditions for clustering of orders are specially created for the “Triangle”, these orders (1) are constantly triggered in case of the “Wedge”.

Let’s clarify: as a rule, when the impulse is expected to make a new high, the price waits out while Stop Loss/Take Profit orders cluster on both sides of the pattern’s range. In our case, the price constantly makes a new high on one side and comes back abruptly inside the pattern’s range – thus, the impulse in this direction is not of interest to us. This may indicate adding to positions by a major player and preparation for the price reversal. By the way, a snapshot of the order book (2) indicates that it is the last time when the price has made a new high.

Alternative Strategies for the “Wedge” Pattern

“Wedge” is the pattern of average complexity within which the price makes abrupt moves followed by false breakouts due to constant making of new highs; at that, the steeper the slope of the pattern, the harder it is to trade with the pattern successfully.

Alternative strategy of market entry and exit points.

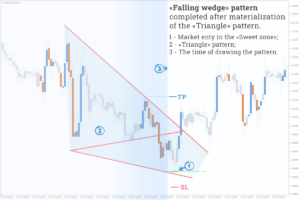

Strategy of market entry in the “sweet zone”*:

*“Sweet zone” is the conditional name of the favorable range for the market entry that refers to the zone from the previous extreme to the pattern’s border (it is marked in green on the chart on the right side).

Enter the market (1) when the price is in the “sweet zone” (2);

Set a trading target (Take Profit, TP) at the level of one of the internal tops of the descending “Wedge” – they might be points (3, 4);

Stop order (Stop Loss, SL) is set outside the pattern’s border.

Sometimes it’s hard work setting Stop Loss according to this strategy, since the pattern occurs at the end of the trend. You can experiment with it, but most of all, you must observe the rule of SL < TP.

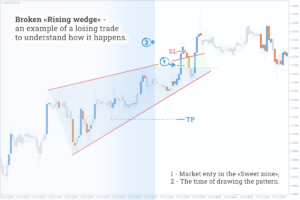

We don’t advise you to trade based on a classical strategy, because you’ll experience difficulties with setting and subsequent execution of Limit order, namely: the price can trigger the Limit order and come back inside the range.

Due to the really steep slope of the pattern’s side broken out, the price very rarely pulls back to it, but slight price move towards the side happens quite often.

Pattern Types

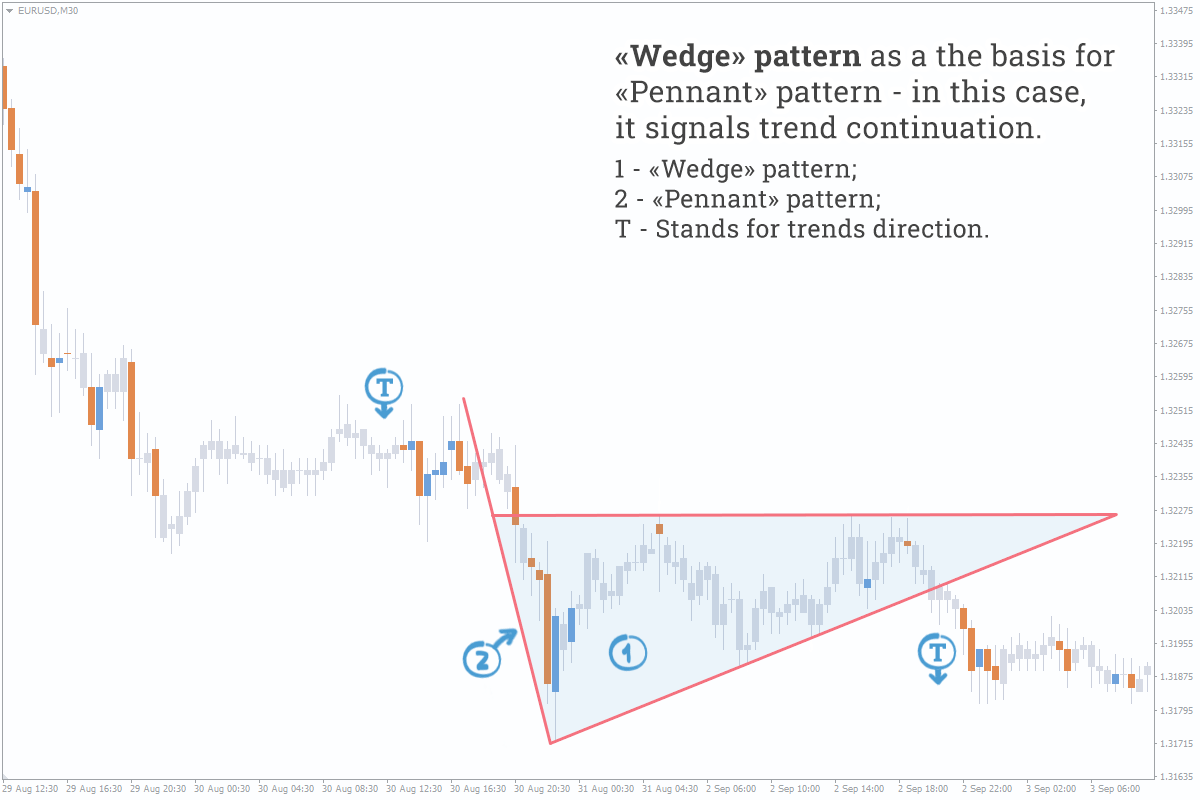

Many traders link the “Wedge” pattern only to the previous trend reversal (although it does often occur before a trend reversal). However, we consider it separately from a trend – it means that the “Wedge” has its own direction, and trend reversal happens against this direction. In addition, it is often the basis for the “Pennant” pattern, where it indicates trend continuation in the big picture. Look at the picture below:

Many traders link the “Wedge” pattern only to the previous trend reversal (although it does often occur before a trend reversal). However, we consider it separately from a trend – it means that the “Wedge” has its own direction, and trend reversal happens against this direction. In addition, it is often the basis for the “Pennant” pattern, where it indicates trend continuation in the big picture. Look at the picture below:

Options for entering the market and placing Stop orders are the same for “Rising wedge” and “Falling wedge”, as described above.

Examples of Trading With the “Wedge” in Forex

Other patterns in our blog: