“Dragon” Pattern in Forex

The “Dragon” pattern is a simple pattern of technical analysis that refers to reversal price models and its occurrence predicts the future change in the market tendency (trend).

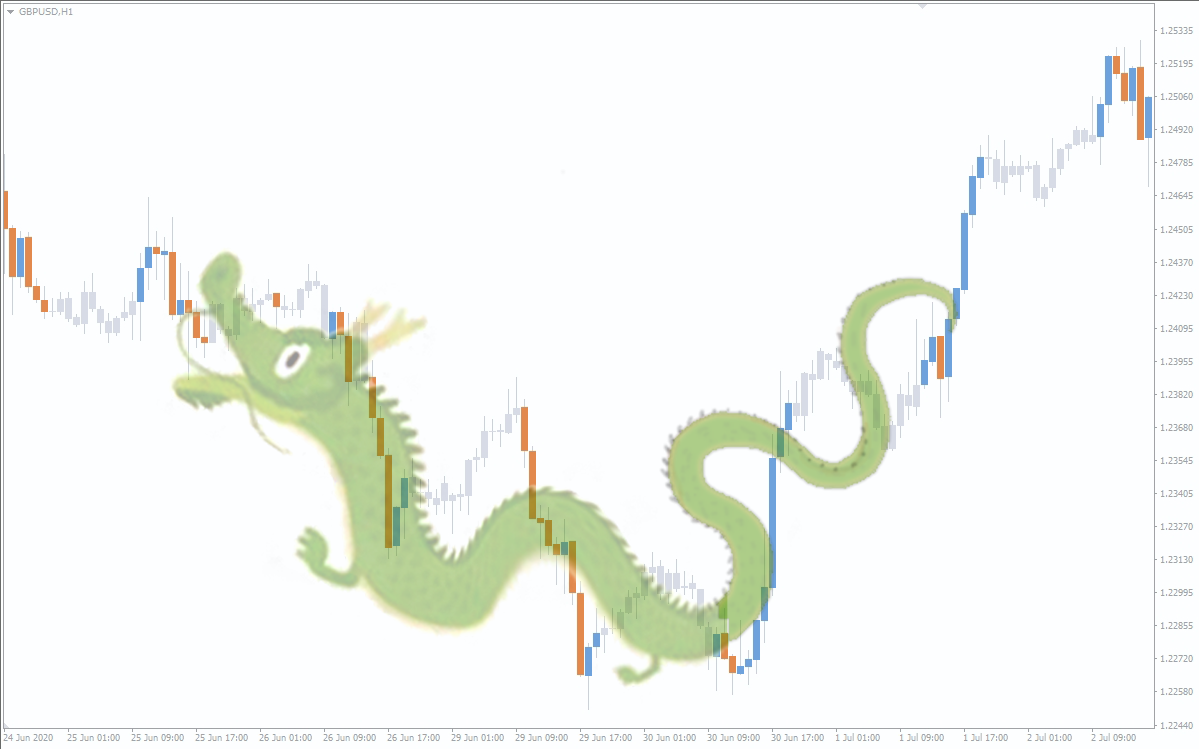

It visually resembles the Chinese dragon.

The Dragon pattern consists of five elements, namely: a head, two feet, a hump between the feet and a tail. With that, one should be able to draw a trend line from the pattern’s head to the highest point of its hump.

Classic Strategy

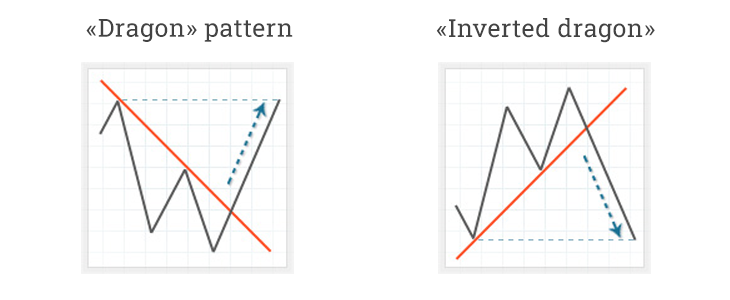

The “Dragon” can be both bullish and bearish, and the rules of trading with them mirror each other. Therefore, in order to save time, we’re going to give a description of the strategy only for the bullish pattern.

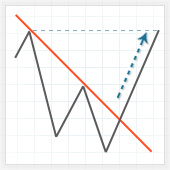

According to the classic strategy, a trend line should be drawn from the pattern‘s head to its hump. You may enter the market at the point where the price crosses this line. See the example in the picture below:

- Enter the market at the point where the price crosses the trend line.

- Take Profit 1 is our first target. Place a Take Profit order at the hump’s highest point level.

- Take Profit 2 is our second target which is at the level of the pattern’s head.

- Stop Loss is set beyond the level of a larger foot of the “Dragon”.

When you trade with this strategy, you might have questions, so we’re going to try to answer some of them.

Nuances of Trading With the Forex Dragon Pattern

- The “Dragon” feet length. Different sources state that the first foot must be definitely longer than the second one, but we believe the opposite is true: while the pattern is forming with the second foot being longer, the market movement has a higher potential;

- Trend line (from the head to the hump of the pattern) should be clearly visible, otherwise it makes no sense to continue the pattern analysis.

- The “Dragon” has two conflicting patterns. This is clearly shown in the pictures:

- Example for the “Flag” pattern;

- Example for the “Three-Drive” (“Three Indians”) pattern.

- Example for the “Flag” pattern;

We have already mentioned in the article on patterns, that you shouldn’t use them as a signal to enter the market.

The pattern should be used as a good entry point if there is a main signal, so the conflict of patterns is not a problem.

Alternative Strategies for Trading With the Dragon Pattern

There are also alternative strategies in addition to the classic one, and it’s up to you whether to put them into practice or not, but knowing about them won’t hurt you.

If you take a closer look, you’ll notice that the “Dragon” price model consists of two other ones: “Double top/bottom” and a usual trend line. Let's make it clear: the strategy of trading with a trend line is used as a classical one (which is described above). The entry/exit points are also borrowed from these patterns.

Now let’s consider an alternative “Double top/bottom” strategy. See the following picture for more details:

- We enter the market when the price breaks the support line – see point (1).

- Take Profit (TP) is set at the level of the initial point of the pattern’s first impulse.

- Stop Loss (SL) is set a few points below the top of the pattern.

Pattern Types

Dragon pattern is a bullish pattern which signals buying. “Inverted Dragon” is a bearish pattern which signals possible sales.

The trading strategy with the Dragon pattern is described above, it can also be used for the Inverted Dragon pattern, but only in a mirror-like manner.

Examples of Trading With the Dragon Pattern in Forex

For better understanding, let’s take a look at a few more examples of Dragon patterns, where we use some of our best practices, for example, a Stop Loss is different from the classic one. Read more about this technique in this article.

Other patterns in our blog: