“Three-Drive” Pattern (“Three Indians”)

“Three-Drive” is one of the simplest, but effective patterns of classical technical analysis, also known as “Three Indians”.

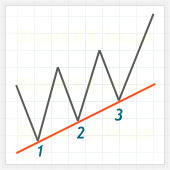

Its name suggests that the Three-Drive strategy involves the identification of three points. These points should be on the same straight line, that is, the trendline.

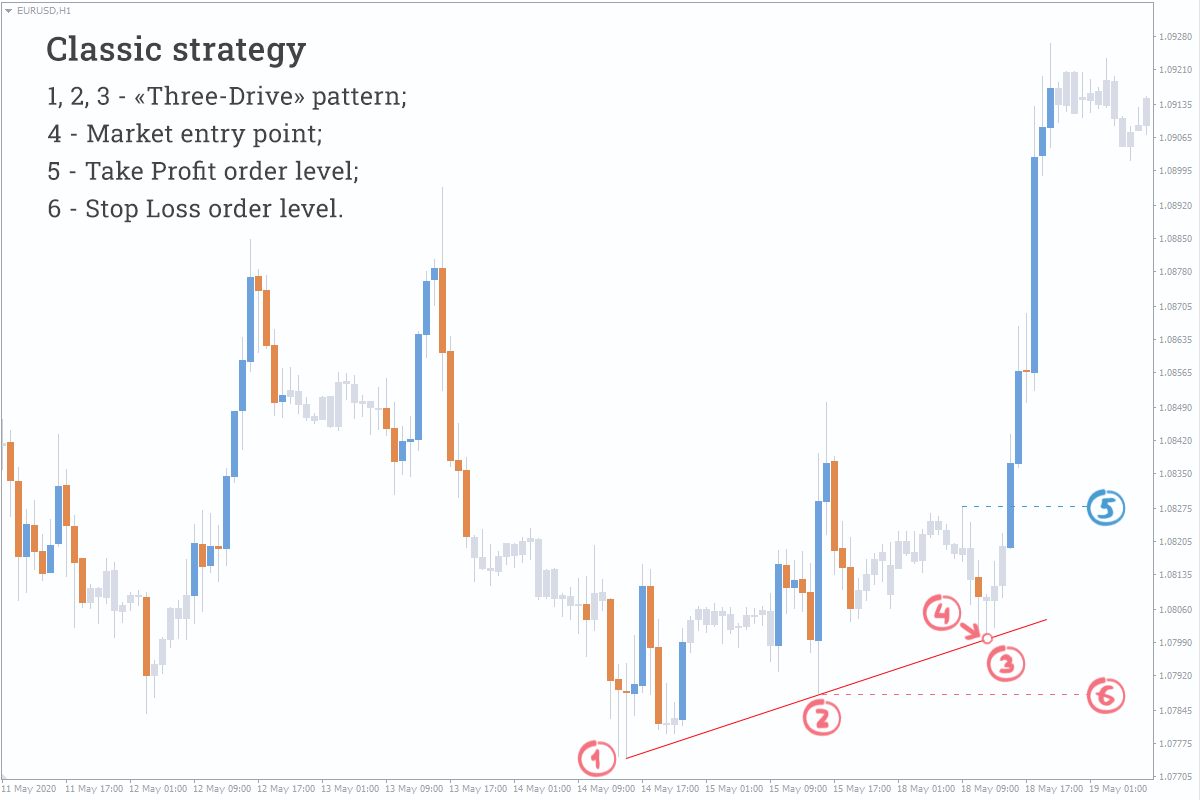

Classic Strategy

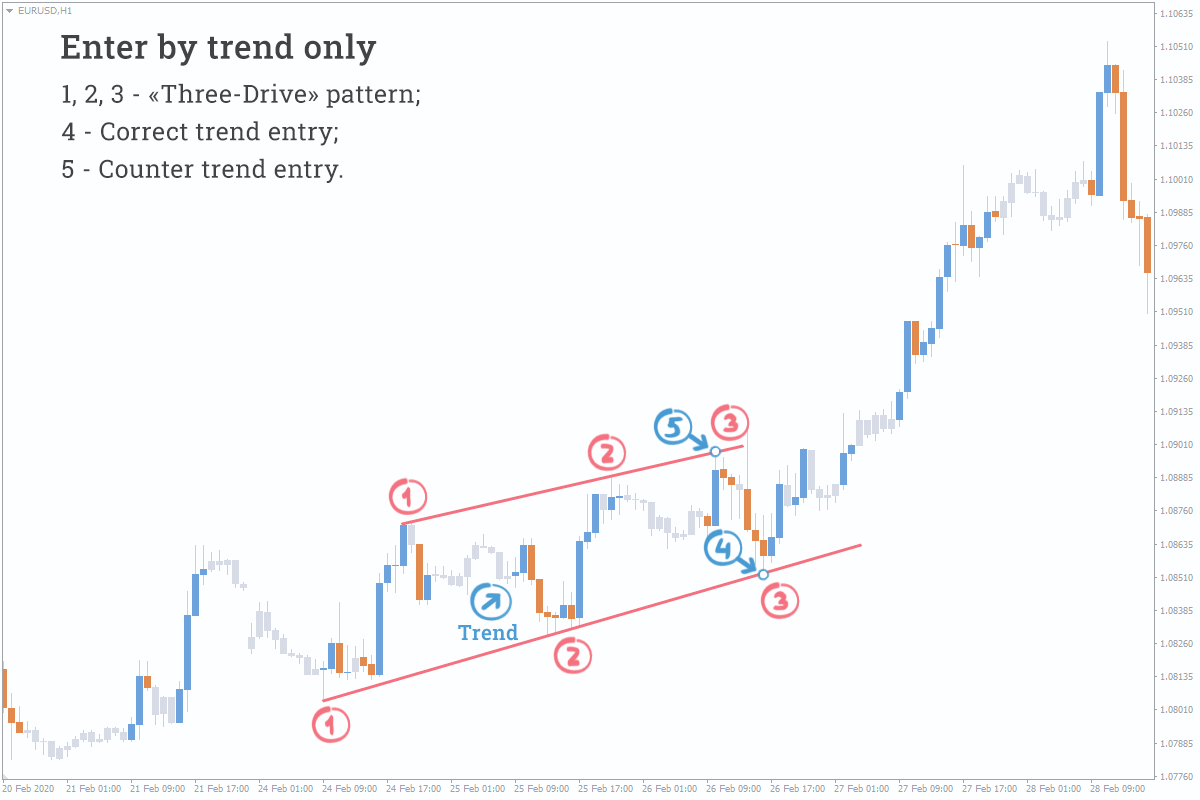

The key to the classic strategy is to draw a trendline using two points, this way you can safely make a trade towards a trend at the point where the price touches this line for the 3rd time. More details in the picture below:

- Enter the market at the point where the price touches a trendline for the third time – see point (4) on the chart above.

- Take Profit is set where the price is expected to make a new high within the pattern – see level (5).

- Stop Loss is set at level (6) of the second low.

The nice thing about this strategy is that we open trades exclusively towards a trend, but it has a few nuances that we’re going to talk about further.

Quality Criteria for the Three-Drive Pattern

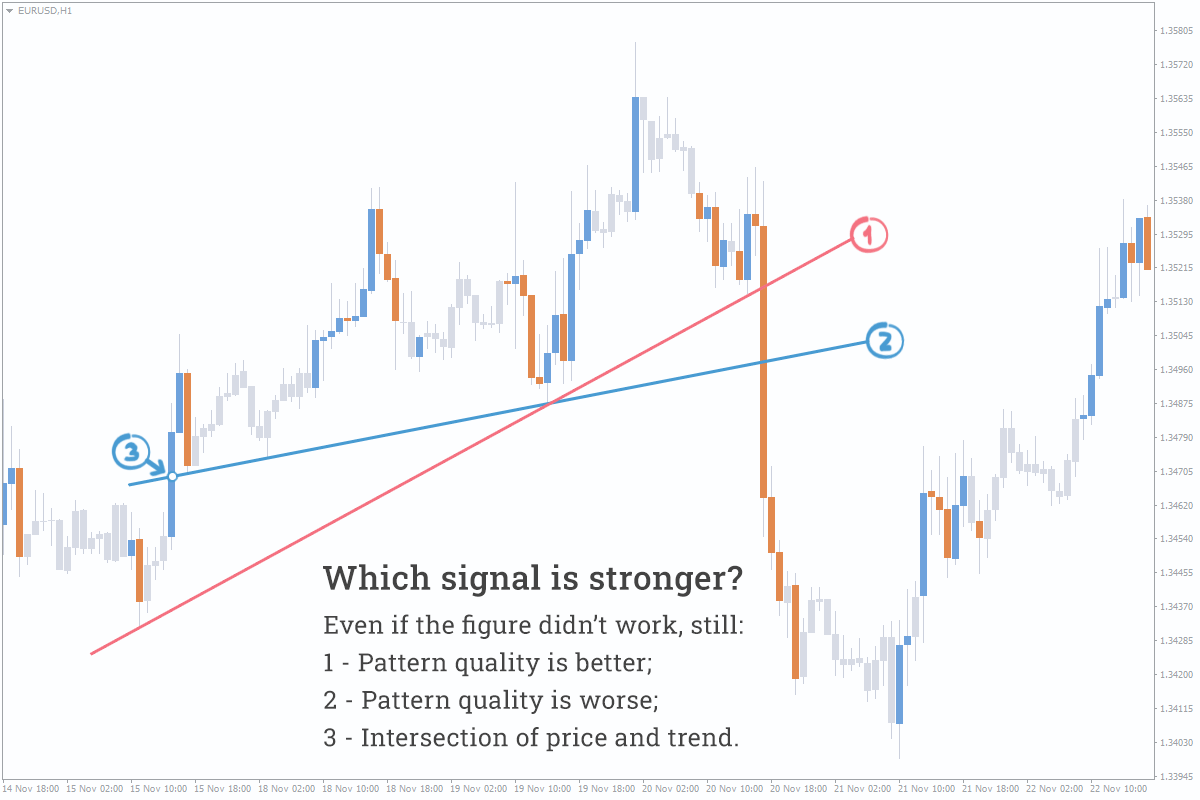

You will agree that if you draw all possible lines using two highs, there will be too many of them and too many potential points of the third touch. This is why they need to be filtered out somehow. You can use the list of features of the ~standard Three-Drive pattern as a filter:

- Timeframe. The Three-Drive pattern generates very weak signals on M30 and lower timeframes. The reason is simple – not all market participants have time to notice it. This means that the higher the timeframe, the better. However, you shouldn’t “go overboard” in this case: people can easily forget about the third touch with the weekly interval (W1).

- The Three-Drive pattern implies entering the market only towards a trend, so you shouldn’t make a mistake of looking for a counter-trend entry.

- It’s best when each of the touches resembles a hairpin as if the price gently pierces a trendline and immediately comes back. In addition, the pattern itself should resemble a tier of arches. The point is that the pattern needs to be defined as clearly as possible, so that the probability of its development could be higher.

- Another important nuance: a trendline should be drawn from the outside of the price, so that they do not intersect. If the trendline were an infinite straight line, it wouldn’t have to intersect with the price in the recent past.

Tips for Trading With the “Three Indians” Pattern

We will give you some recommendations in order to help you avoid common mistakes when trading using this strategy:

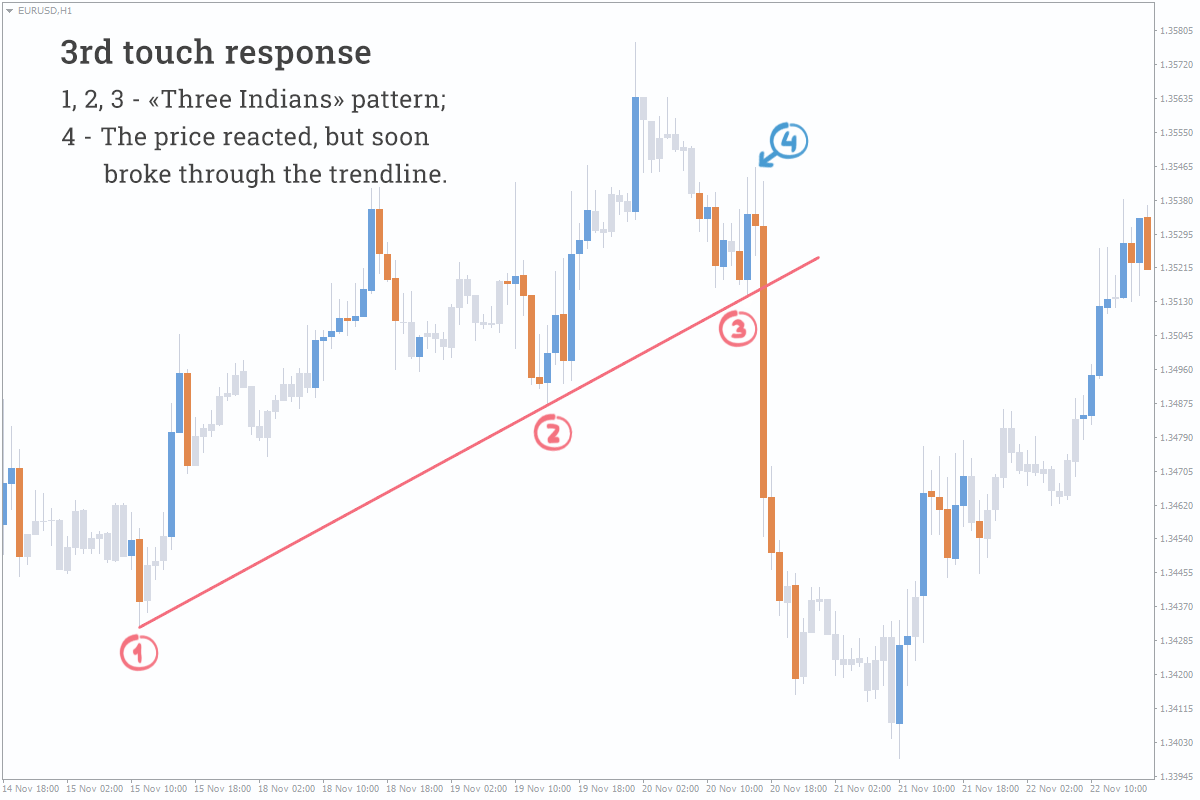

- Don’t mindlessly open a trade shortly after the price touches a trendline for the third time assuming that the price is definitely going to rebound from it. This pattern can act as a signal confirmation or a favorable point of entry, but not as an entry signal. Therefore, it is necessary to have a main signal, if you want to avoid such situations.

- Contrary to the previous paragraph, the price does frequently respond to the third touch, even if it’s not going to follow this trading scenario, meaning that a small rebound does take place in this case. We're talking about such a situation where the price bounces off a trendline, doesn’t go far away from it, and breaks out through it. Perhaps, it's some sort of a diversion. In such cases, it makes sense to properly assess the situation and move Stop Loss to breakeven, if events are expected to unfold this way.

- Be careful when placing a Limit order according to this strategy. Given that the trendline is askew and we cannot know the exact time when the price touches this line for the 3rd time, we have to constantly move the Limit order. This is why it is better to open a trade manually, at the time of the third touch to control the situation.

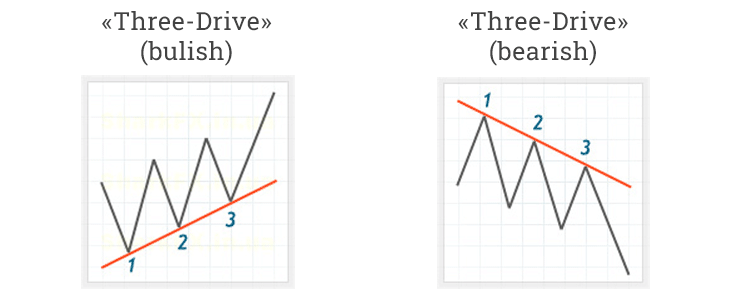

Pattern Types

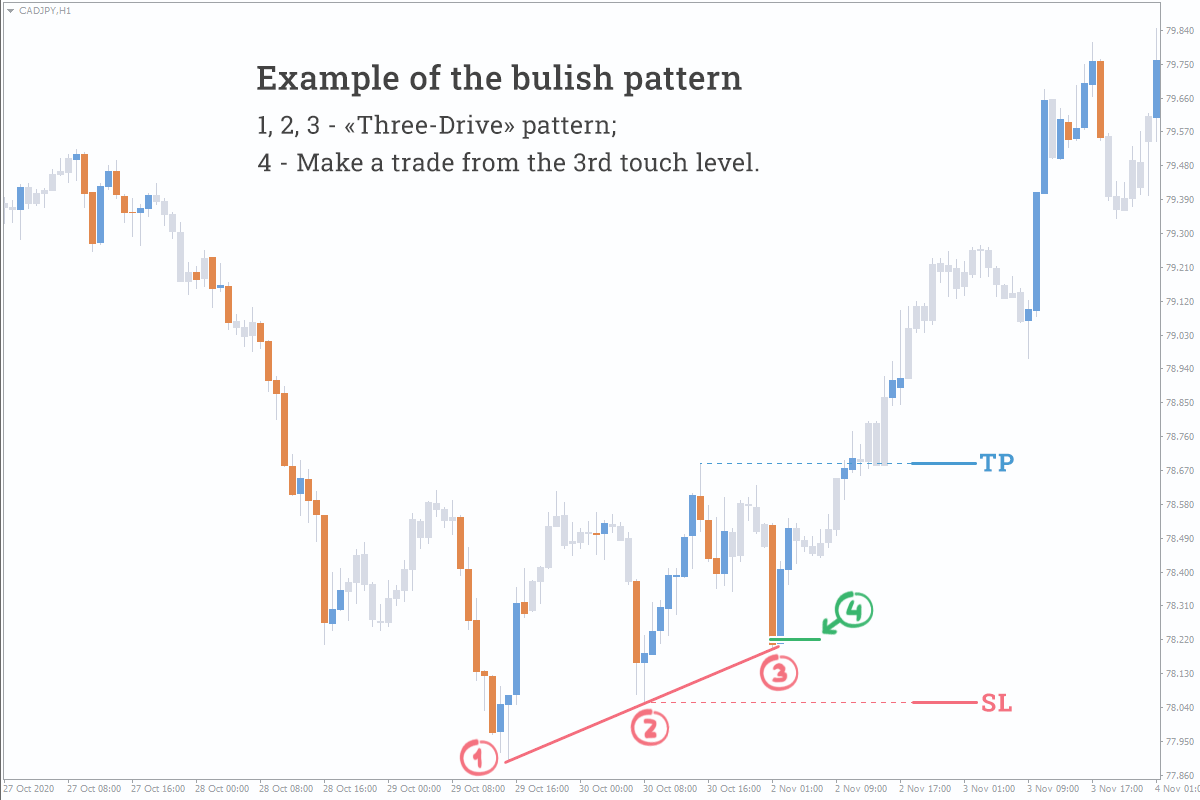

Bullish Three-Drive pattern – enter the market towards an upward trend to buy. The trendline is drawn below the price.

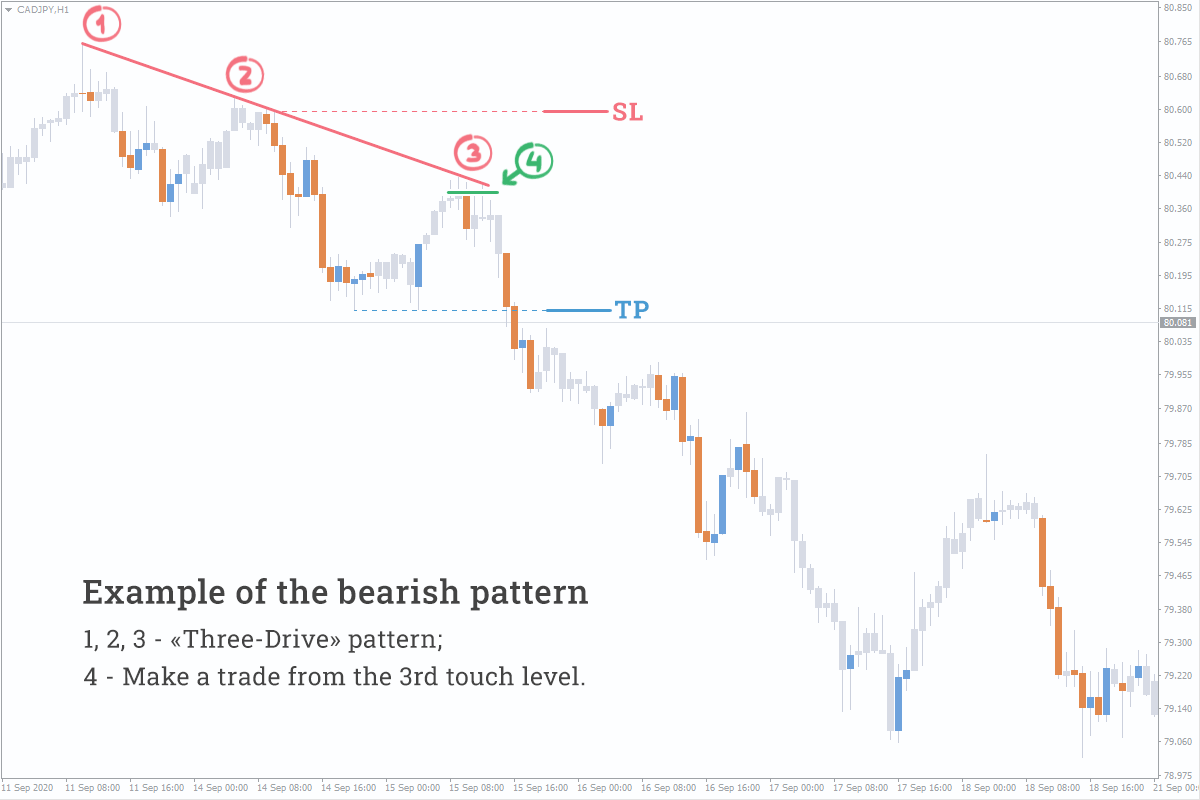

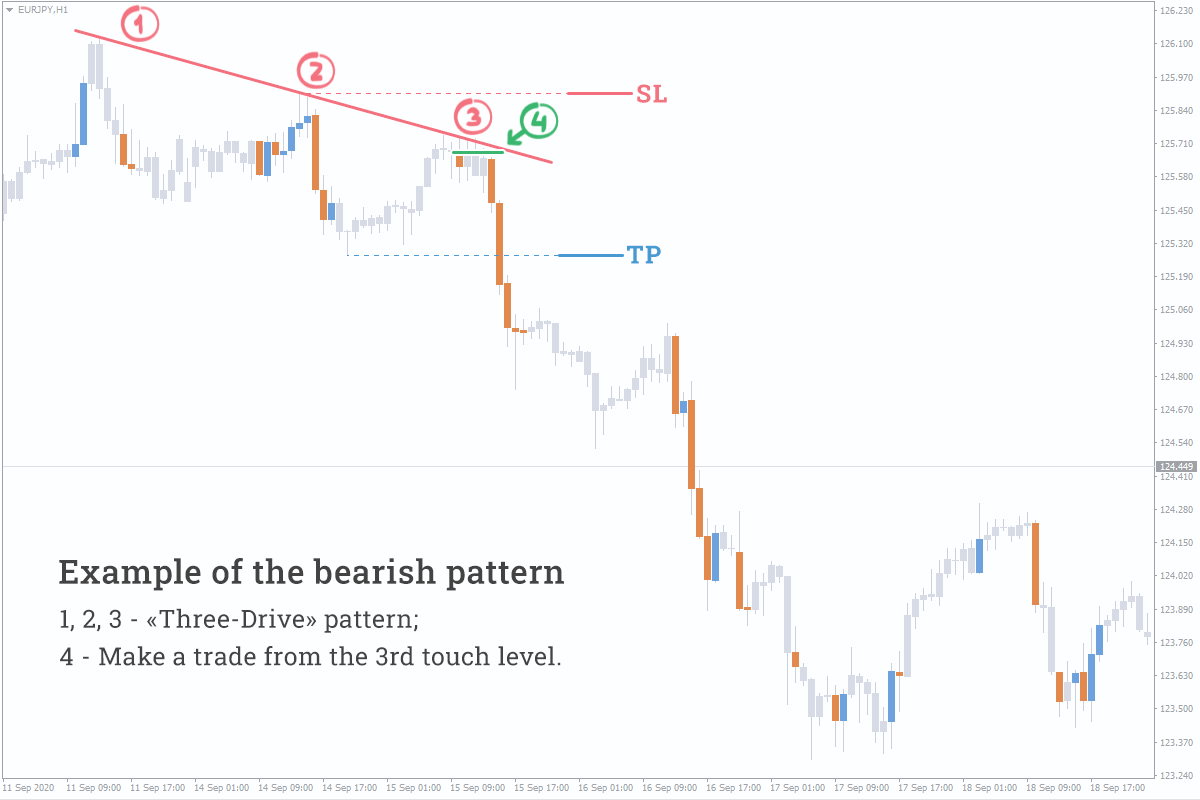

Bearish Three-Drive pattern – enter the market towards a downward trend to sell. The trendline is drawn above the price.

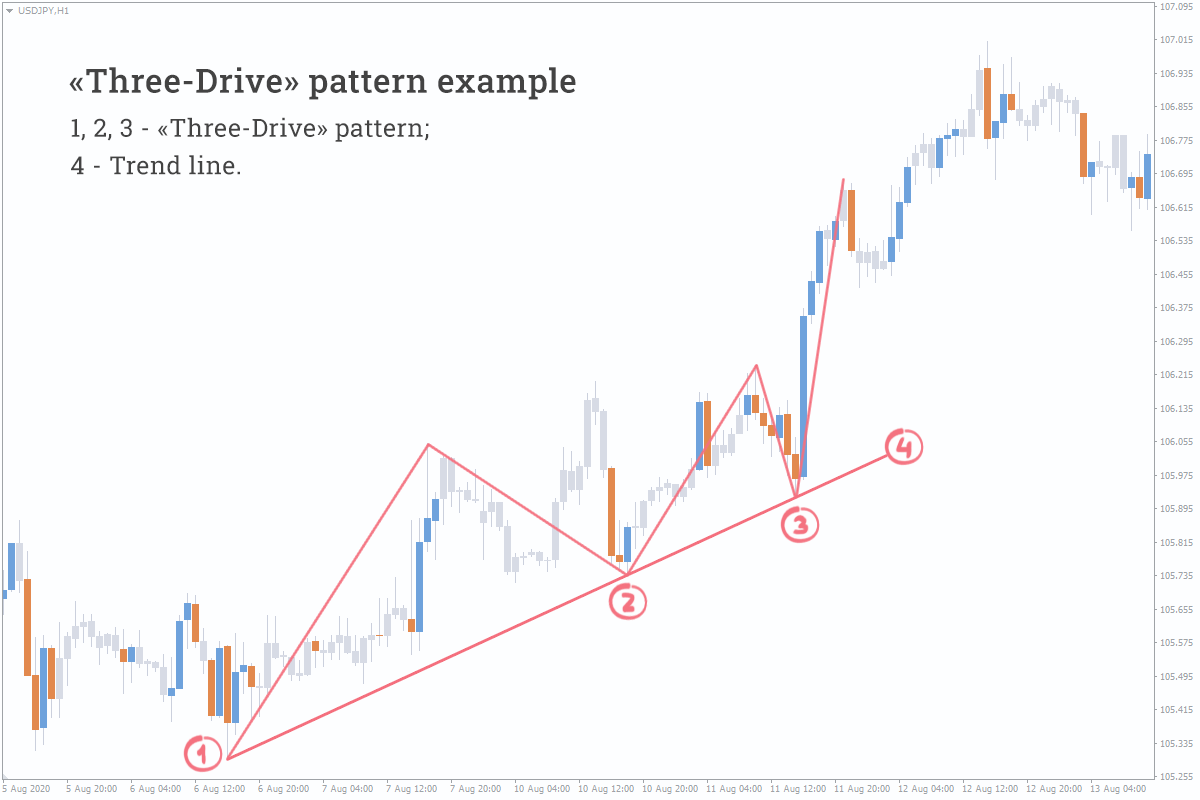

Examples of Trading With the Three-Drive Pattern in Forex

Other patterns in our blog: