Spread.Warner

Spread.Warner Screenshots (8)

Spread.Warner - Overview

There are several types of trading costs, among them we have: the commission for opening a transaction, swap cost and, of course, the spread. And if the value of the first two depends exclusively on the selected broker, then the spread can be controlled.

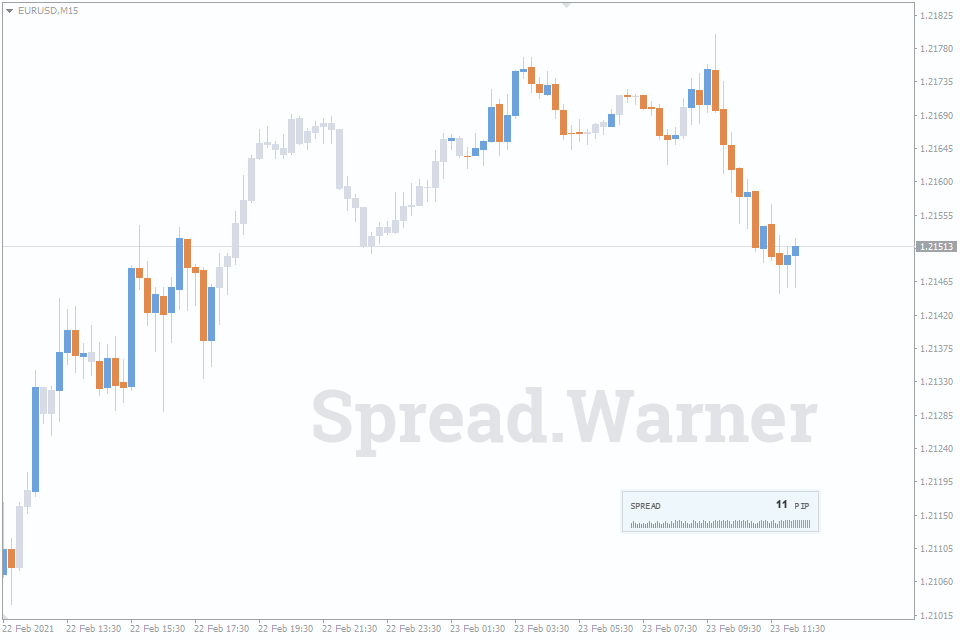

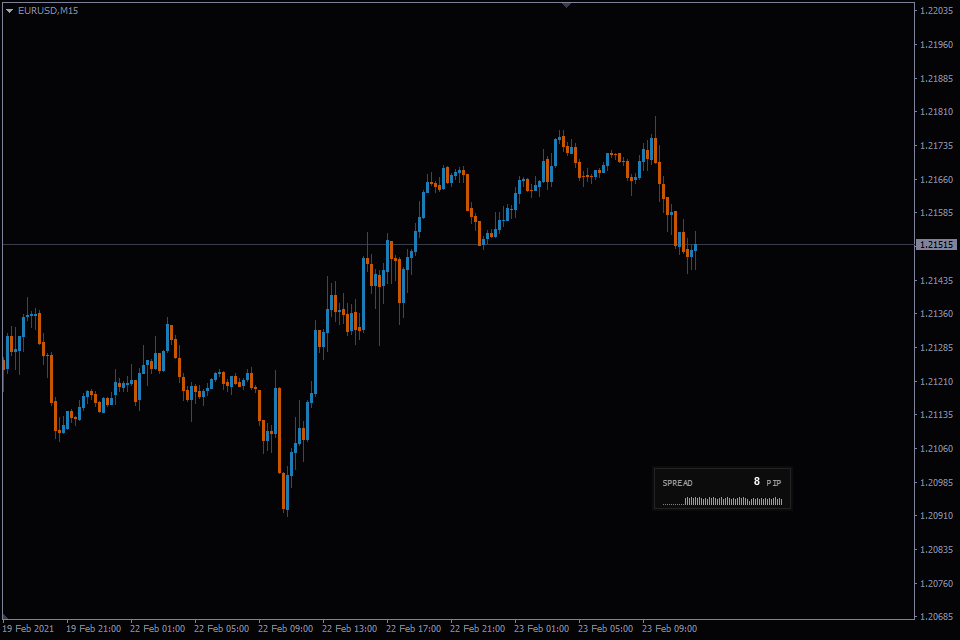

This indicator for MetaTrade 4 and MetaTrade 5 was created for the purpose of monitoring the value of the current spread.

The sudden widening of spread

It is common for a trader to open a trade and see a loss that is much higher than usual. This is a result of spread widening.

Spread may widen (increase):

- due to increased volatility at the time of publication of economic news;

- on low liquid instrument;

- when the price reaches important levels.

The Spread.Warner indicator will help to avoid such situations by warning you in time about an abnormal spread value.

Your task, having seen the warning signal from the indicator, is to not open a trade at the moment, but to wait for the spread value to normalize.

How to use the indicator

There are several typical situations when this indicator will be extremely useful to you.

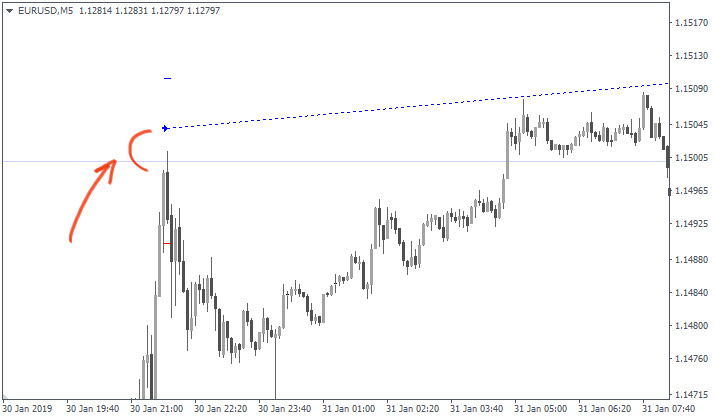

Situation #1. You are expecting a speech by the President of the ECB and are planning to open a long trade. After waiting for the right moment, you enter the market and see that the trade has opened at a price that is not even on the chart.

The problem is that at the time of the speech, the spread has greatly increased. And since the BUY is made at the ASK price, and the chart is based on the BID price, we see that the trade opened at a price that was allegedly not there.

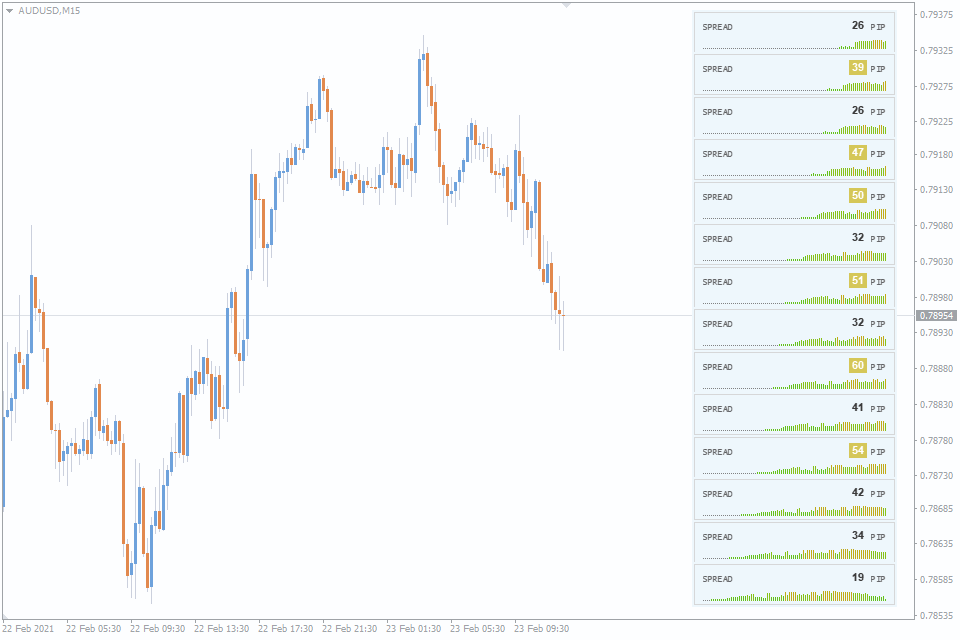

Situation #2. Suppose you are used to trade the EUR/USD currency pair and at the time of opening a transaction you know that the loss caused by the difference between the BID and ASK is $10 per 1 lot. And then at some point you decide to open a trade on EUR/AUD, but unfortunately, instead of the usual $10, you see a loss of $37.

The problem is that you have not controlled the spread for the EUR/AUD currency pair or perhaps your broker does not have very favorable trading conditions for this pair.

Situation #3. You are trading breakout strategies. Seeing that the price comes to an important level and is about to break through it, you open a trade. Again, the loss at the time of opening the transaction exceeds the standard.

The problem is that during the breakdown volatility increases and, as a result, liquidity decreases. And low liquidity means 100% widened spread.

In addition, indicator can be configured in such a way that it will absolutely not occupy space on the chart and you will see it only at the moment of spread expansion.

Indicator Settings (MT4 and MT5)

This type of indicator does not need a lot of settings, but you will probably want to customize some things for yourself.

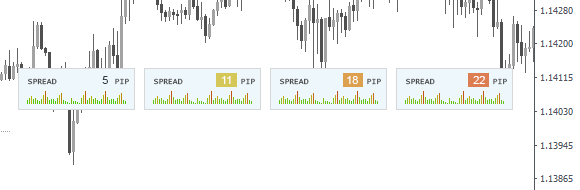

4 stages of the spread value. The indicator determines the spread deviation from the normal value and color indicates the deviation value:

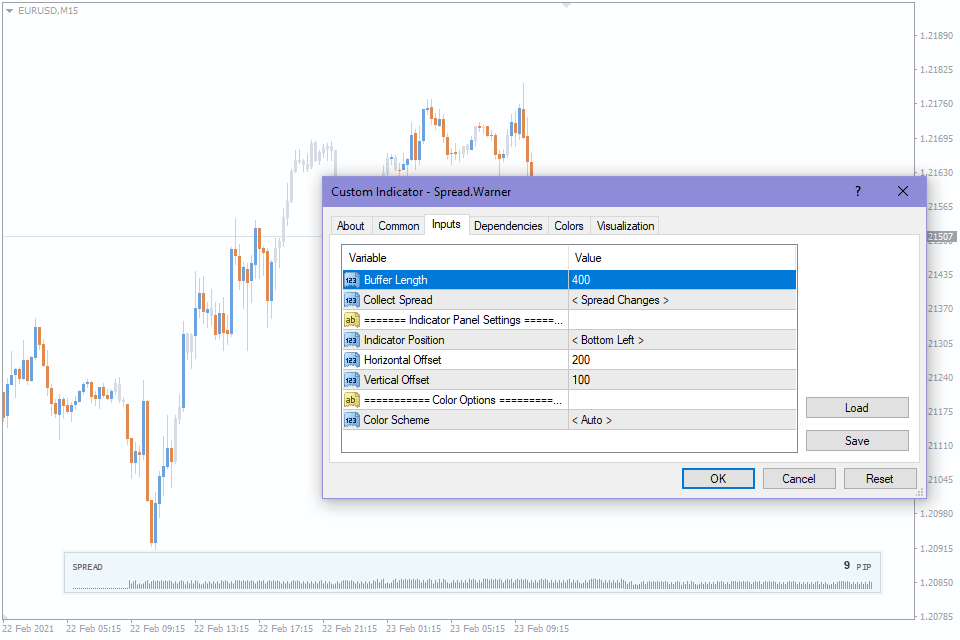

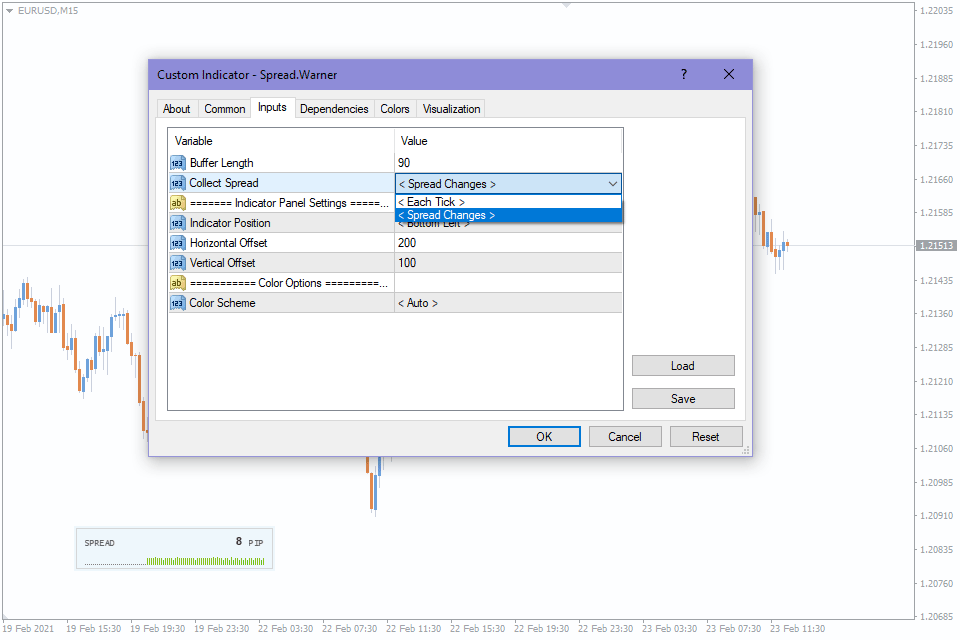

Buffer Length – this is the number of bars in the histogram displaying the spread.

Collect Spread – draw a new bar at the moment of changing the spread value or for each tick.

Indicator Position – setting the default position of the indicator panel

Color Scheme – chose the color scheme or its automatic determination.

How to add Spread.Warner in MT4/MT5

Follow the instructions below to install the Indicator to your MT4 or MT5 terminal:

- Download the ZIP-archive with Spread.Warner indicator file by clicking the link at the top of the page;

- Unzip the file into the MQL4/5 indicators folder of your terminal;

- Restart the MT4/MT5 terminal;

- Run the indicator by double clicking the indicator name in the MT4/5 Navigator;

- Check the "Allow DLL imports" box and click "OK";

- The indicator will be displayed on the chart;

- Adjust the indicator’s settings according to your needs: press CTRL+I, select the indicator from the list, and switch to the "Inputs" tab.

If you have any difficulties while installing the indicator, please view the detailed instruction.