Fixed Spread vs Floating Spread: Which one is better?

First you need to understand what does the spread mean in Forex and to be honest, it's not that difficult.

Spread in the Forex market is a difference between the buy (ask) and sell (bid) prices that a broker receives as a commission for participating in trades. In case of sell trades, the spread is taken after the trade is closed, and for buy trades – at the beginning.

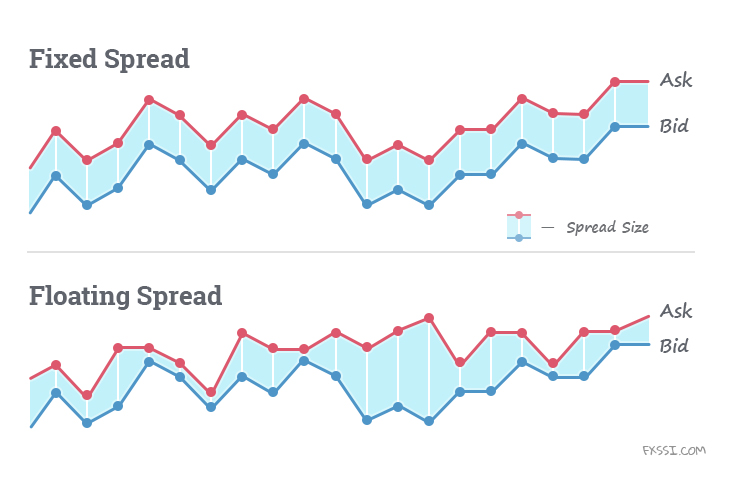

For a start, let’s look at the difference between a fixed and a floating spread in Forex on the image above.

It’s hard to determine with just one look which kind of spread is better.

It seems that the fixed spread size is constant while the floating spread can be smaller in size than the fixed one. Regardless of which spread you have chosen, it is very convenient to track live floating spread using the Spead.Warner indicator.

Let’s name the pros and cons of each of them for more accurate comparison.

Fixed spread

Fixed Spread is a broker's set income from any of your trade.

Pros and cons of Fixed Spread:

+ Commission size you must pay is known in advance;

− Trading limits are often common during news releases;

− In most cases, you’ll be offered 4-digit pricing along with the fixed spread;

Floating spread

Floating Spread is a broker's volatile income from each of your trades. It can be minimal during quiet trading and can rise sharply during market turbulence.

Pros and cons of Floating Spread:

+ For the most part, it is less in size than the fixed spread;

− Significant spread widening is possible during news releases and holidays.

Which One to Choose?

Our personal opinion is that: if you trade profitably you’ll be able to trade in profit no matter what kind of spread you choose (if only your broker lets you withdraw the money you’ve made).

Your aim is to reduce trading costs, and these are our recommendations on how you can do it:

Your aim is to reduce trading costs. Trading currency pairs with low spreads will also increase your profits. Below are a few more recommendations.

Choose the fixed spread

- If its size for the selected instrument is less than that of the floating one;

- If you’re planning to activate a rebate service on your account;

Choose the floating spread

- In all other cases.

We would add that in our practice the costs of trading on account with the floating spread are always far less than that with the fixed one.

This is why we strongly recommend the floating spread for manual trading.

We want you to remember that the fixed spread is an artificial concept created by brokers as an advertising trick. However, it shouldn’t be any concern of yours if your broker faithfully lets you withdraw your profits.

So, it’s up to you to decide.