Low Spread Currency Pairs

In Forex, the spread is essentially one part of the cost for you as a trader to open any trades. It counts into the total price of trading.

In life, as with many things, the value of commonplace items tends to be lower compared to more exotic and sought-after counterparts. This principle also holds true in the Forex market, where currency pairs with lower spreads are commonly traded due to their ubiquity and stability, contrasting with less common pairs that command higher spreads due to their rarity and higher demand.

Low spread is very important for frequent traders for which every part of the pip movement makes a difference.

Let's start with the most commonly traded currency pair, EUR/USD.

EUR/USD pair, spreads from 0.1 pips!

Spread / Daily Range = 1.5% (the lower the better)

The most traded pair with around 20% of total trading volume on Forex. This also makes EUR/USD the pair with the lowest spread.

Variable spreads for this currency pair, in normal trading activity, range from 0.1 to 3 pips, depending on the broker. For fixed spreads, they go from 0.3 to 5 pips (excluding commission).

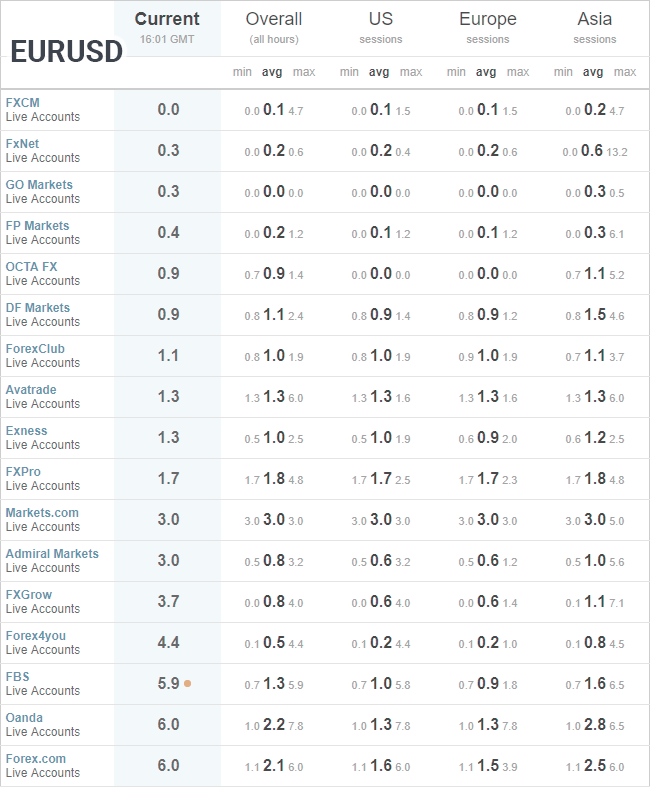

Table for Euro-Dollar spreads across different sessions (investing.com):

Volatility in this pair is known to spike during the news events, and EUR/USD is the most popular. News events, economic calendar, social media activity, and political events are frequent for the USD (United States). In addition, if we take that EUR (European Union) is composed of many countries, any crisis in one may affect the Euro.

Having this mix of trading sessions and volatility spikes makes this currency pair interesting to trade, even though it is the pair with typically the lowest spread.

If we compare the Daily Average Range (ADR), we can see if the spread is in line with the potential of the currency pair.

For the EUR/USD Daily Average Range (14) at the moment is around 58 pips. If we take an average 0.9 pips spread for EUR/USD pair it means (0.9/58=1.5%) spread takes 1.5% off our maximum potential profits in one trade.

USD/JPY, the second lowest spread pair

Spread/Daily Range = 2.1%

The two economies, one exporting type (Japan) and one big importer (US). Two distinct trading sessions. Combine this with typically low spreads and you have some trading opportunities here.

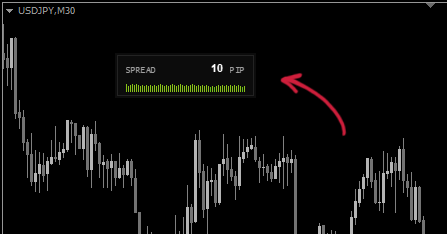

You can download the Spread Indicator to control the spread widening.

The variable spread for this currency pair is from 0.2 to 2 pips. Because of the big gap between trading sessions, it is great if you want to focus on one economy. A broker with three digits, average 1 pip spread accounts 2.1% off your maximum daily potential profit.

GBP/USD, a low spread pair that moves!

Spread/Daily Range = 2.0%

This pair is specific because of the big movements of the British pound. If you combine this with great liquidity and therefore low spreads, you get opportunities for low spread strategies that do not work on other pairs.

Nowadays if you follow the news, you will understand the obvious downfall of the GBP.

Variable spreads for this currency pair go from 0.3 to 2.7 pips excluding commissions. With high daily average range (68 pips) of the GBP/USD pair, the spread (1.4 pip) will eat your maximum potential profit by around 2.0% per trade, which is lower than USD/JPY pair.

USD/CHF, low spread – high stability

Spread/Daily Range = 2.6%

The Swiss Franc has close to zero inflation and the banking system is regarded as one of the best in the world for the investors. It is one of the most traded currency pairs on Forex with low spread.

Stability is one of the traits of the CHF but it does not mean that there are no opportunities for trading.

It is an easy-to-follow currency pair with low spreads that range from 0.5 to 5 pips. The average spread (1.2 pip) to profit ratio is 2.6% on the daily average range (45 pip).

EUR/JPY, non-USD pair with low spread

Spread/Daily Range = 1.9%

This currency pair is more sensitive and has big movements. Since the economies involved in this pair are smaller, one can expect bigger changes in the market caused by any events.

The spread may not be the lowest offered but low enough to boost the potential of this pair for frequent traders.

It is the perfect mix of low spread and opportunity. This can be seen by ADR (14) of 63 pips, spread range from 0.5 to 5.7 pips and average spread (1.2 pip) to potential profit ratio of 1.9%.

This currency pair is also interesting because it is rarely ranging, or moving sideways.

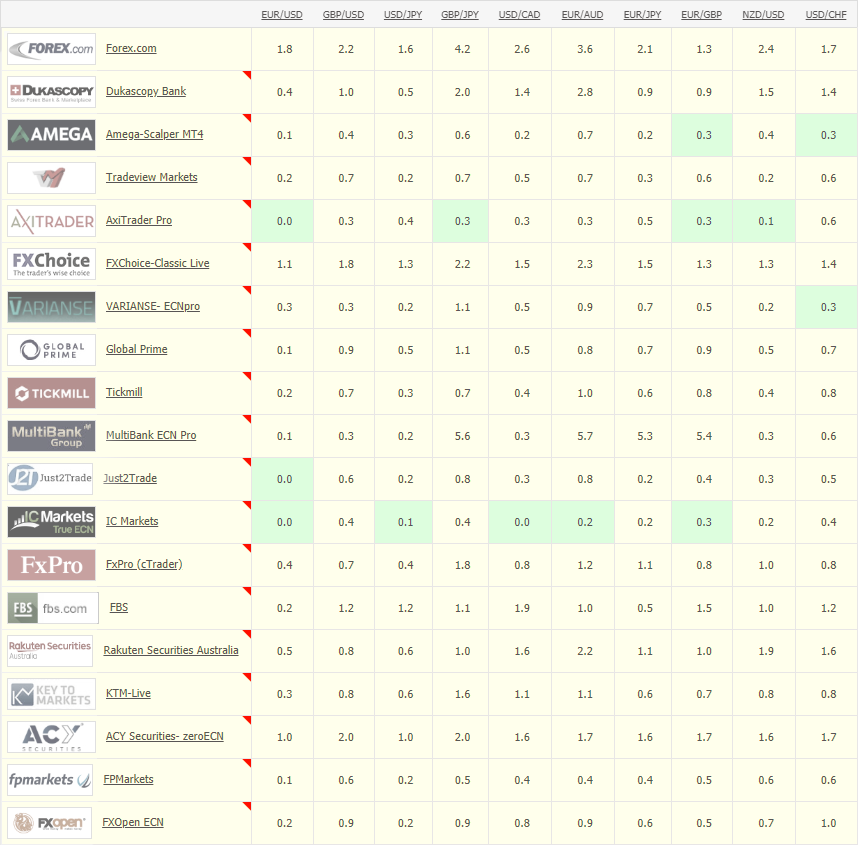

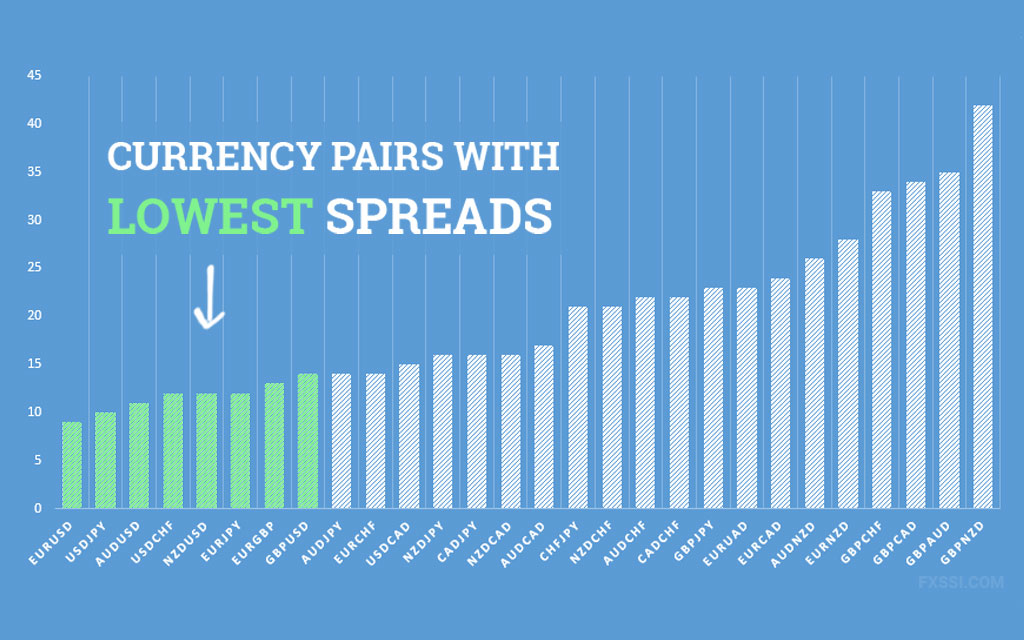

Even though the broker may offer low spreads, the commission may mask the total cost. If we take this into consideration, finding the broker with the right offer may be easier with this spreads table from Myfxbook:

Finally, you should understand that all the major 8 currency pairs combinations are liquid enough to have low spreads.